Scalper1 News

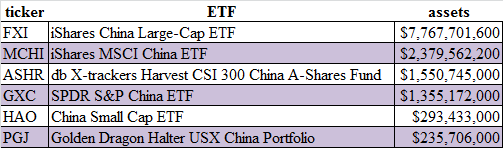

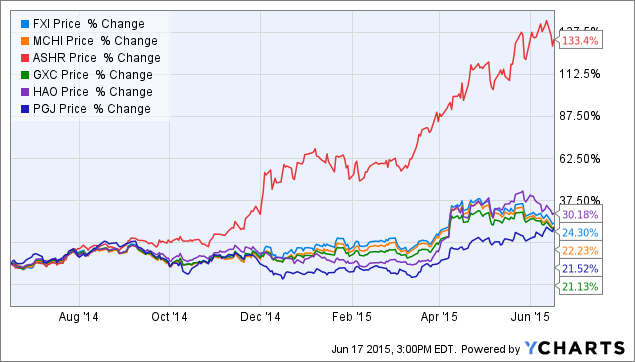

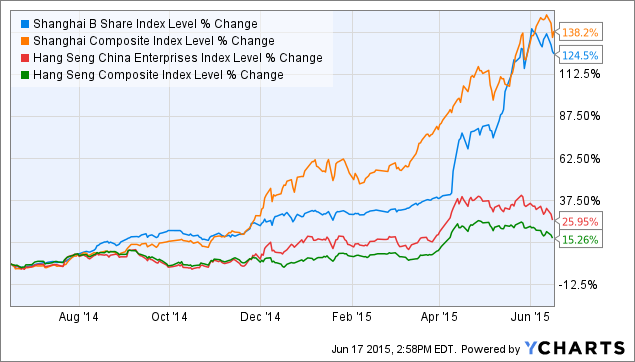

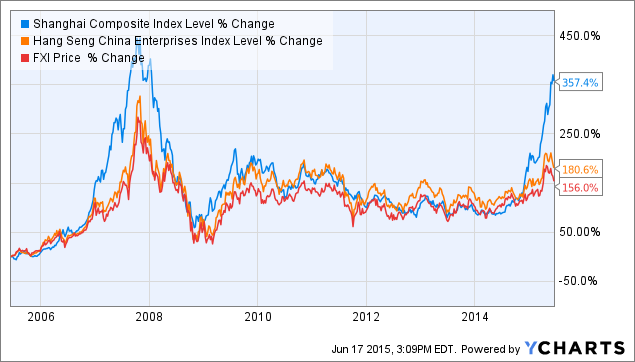

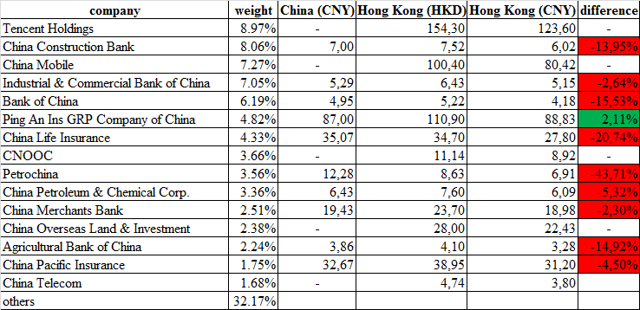

Summary There is a stock market bubble growing in China. Although the share markets in mainland China have grown furiously, the Hong Kong share market has lagged significantly. The iShares China Large-Cap ETF share price hasn’t been affected by the mainland bubble too much as it invests in Hong Kong listed shares. If the current bubble is similar to the 2006/2007 one, FXI should start to grow rapidly in the coming months, with a 50-100% upside potential. If the current bubble turns out to be different and it starts to collapse soon, FXI has only a limited downside of 20-25%. As I wrote in my article last week, there is a bubble underway in China. The Chinese share market has experienced incredible growth in the last 12 months. The main Chinese share indices are up by more than 130%. As I stated earlier, if the current bubble turns out to be similar to the 2006/2007 Chinese share market bubble, it should start to burst sometime in November. In this article, I focus on the performance and perspectives of the iShares China Large-Cap ETF (NYSEARCA: FXI ) – the largest China focused ETF. China focused ETFs There are many ETFs that invest in Chinese shares, but only 6 of them have asset value of over $200 million (table below). By far the biggest is the iShares China Large-Cap ETF with assets of over $7.7 billion, followed by iShares MSCI China ETF (NYSEARCA: MCHI ) ($2.38 billion). Source: ETFdb.com The chart below shows that there are huge differences between performances of these ETFs. 5 of the 6 biggest China focused ETFs grew only by 20-30% over the last 12 months. On the other hand, share price of the db X-Trackers Harvest CSI 300 China A-Shares Fund (NYSEARCA: ASHR ) grew by 133%. The reason is simple. While ASHR invests in A-Shares traded in Chinese mainland, the other ETFs invest in shares of Chinese companies traded in Hong Kong. As we can see, there is a huge difference between the growth of Chinese mainland share markets and the Hong Kong share market (chart below). While Chinese A-shares and B-shares are up by 138% and 125%, respectively, the Hang Seng indices are up only by 15-30%. The Chinese bubble and FXI As shown in the chart below, FXI’s share price is much more related to the Hang Seng China Enterprises Index than to the Shanghai Composite Index. Although FXI experienced huge losses during the collapse of the 2006/2007 bubble, it is important to notice that there was a bubble in Hong Kong as well as in mainland China back then. Today, we can hardly talk about a bubble in Hong Kong as the gap between share valuations in Shanghai and in Hong Kong is huge. FXI recorded its biggest gains during the last growth phase back in 2007. If history should repeat itself, FXI’s share price must start to grow rapidly before it collapses. If the Chinese mainland share bubble starts to burst right now, FXI’s share price will be impacted, but the decline will be only limited. It won’t be comparable to the 2008 one. The table below shows the 15 biggest holdings of FXI. 10 out of the 15 companies are dual listed in Chinese mainland and in Hong Kong. The table shows actual share prices in mainland (in CNY), actual share prices in Hong Kong (in HKD) and Hong Kong share prices converted to CNY using the current exchange rate of HKD/CNY = 0.801016. As the calculations show, 9 out of the 10 dual-listed companies are cheaper in Hong Kong than in mainland China. Only the shares of Ping An Insurance Group (OTCPK: PIAIF ) (OTCPK: PNGAY ) are more expensive in Hong Kong. Some of the differences are really huge. For example, shares of China Life Insurance (NYSE: LFC ) (OTCPK: CILJF ) are 21% cheaper, shares of Bank of China (OTCPK: BACHF ) (OTCPK: BACHY ) are 16% cheaper and shares of PetroChina (NYSE: PTR ) (OTCPK: PCCYF ) are 4% cheaper in Hong Kong than in mainland China. (click to enlarge) Source: own processing, using data of ishares.com and Bloomberg Conclusion Although there is a share market bubble in mainland China, the Hong Kong share market hasn’t inflated yet. The shares of most of the dual-listed companies are much cheaper in Hong Kong than in mainland China. There are only two ways how the valuation gap may be eliminated. The Hong Kong share price must grow or the Chinese mainland share prices must decline (or a combination of both). The first option is favorable for FXI shareholders and the second one is relatively neutral for them. There is a bubble on the Chinese share market, but Hong Kong has been impacted only slightly. FXI shareholders don’t have to fear a bubble burst right now. If the Chinese bubble starts to collapse, FXI shares should experience only a limited impact. During the 2006-2007 bubble, the Hong Kong share market lagged behind the mainland market significantly, only to start to grow furiously during the last phase of the mainland bubble. If history repeats itself, FXI has 50-100% upside potential. If the history doesn’t repeat itself and the mainland share market starts to collapse before the Hong Kong share market inflates, there is only a limited downside of 20-25%. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in FXI over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary There is a stock market bubble growing in China. Although the share markets in mainland China have grown furiously, the Hong Kong share market has lagged significantly. The iShares China Large-Cap ETF share price hasn’t been affected by the mainland bubble too much as it invests in Hong Kong listed shares. If the current bubble is similar to the 2006/2007 one, FXI should start to grow rapidly in the coming months, with a 50-100% upside potential. If the current bubble turns out to be different and it starts to collapse soon, FXI has only a limited downside of 20-25%. As I wrote in my article last week, there is a bubble underway in China. The Chinese share market has experienced incredible growth in the last 12 months. The main Chinese share indices are up by more than 130%. As I stated earlier, if the current bubble turns out to be similar to the 2006/2007 Chinese share market bubble, it should start to burst sometime in November. In this article, I focus on the performance and perspectives of the iShares China Large-Cap ETF (NYSEARCA: FXI ) – the largest China focused ETF. China focused ETFs There are many ETFs that invest in Chinese shares, but only 6 of them have asset value of over $200 million (table below). By far the biggest is the iShares China Large-Cap ETF with assets of over $7.7 billion, followed by iShares MSCI China ETF (NYSEARCA: MCHI ) ($2.38 billion). Source: ETFdb.com The chart below shows that there are huge differences between performances of these ETFs. 5 of the 6 biggest China focused ETFs grew only by 20-30% over the last 12 months. On the other hand, share price of the db X-Trackers Harvest CSI 300 China A-Shares Fund (NYSEARCA: ASHR ) grew by 133%. The reason is simple. While ASHR invests in A-Shares traded in Chinese mainland, the other ETFs invest in shares of Chinese companies traded in Hong Kong. As we can see, there is a huge difference between the growth of Chinese mainland share markets and the Hong Kong share market (chart below). While Chinese A-shares and B-shares are up by 138% and 125%, respectively, the Hang Seng indices are up only by 15-30%. The Chinese bubble and FXI As shown in the chart below, FXI’s share price is much more related to the Hang Seng China Enterprises Index than to the Shanghai Composite Index. Although FXI experienced huge losses during the collapse of the 2006/2007 bubble, it is important to notice that there was a bubble in Hong Kong as well as in mainland China back then. Today, we can hardly talk about a bubble in Hong Kong as the gap between share valuations in Shanghai and in Hong Kong is huge. FXI recorded its biggest gains during the last growth phase back in 2007. If history should repeat itself, FXI’s share price must start to grow rapidly before it collapses. If the Chinese mainland share bubble starts to burst right now, FXI’s share price will be impacted, but the decline will be only limited. It won’t be comparable to the 2008 one. The table below shows the 15 biggest holdings of FXI. 10 out of the 15 companies are dual listed in Chinese mainland and in Hong Kong. The table shows actual share prices in mainland (in CNY), actual share prices in Hong Kong (in HKD) and Hong Kong share prices converted to CNY using the current exchange rate of HKD/CNY = 0.801016. As the calculations show, 9 out of the 10 dual-listed companies are cheaper in Hong Kong than in mainland China. Only the shares of Ping An Insurance Group (OTCPK: PIAIF ) (OTCPK: PNGAY ) are more expensive in Hong Kong. Some of the differences are really huge. For example, shares of China Life Insurance (NYSE: LFC ) (OTCPK: CILJF ) are 21% cheaper, shares of Bank of China (OTCPK: BACHF ) (OTCPK: BACHY ) are 16% cheaper and shares of PetroChina (NYSE: PTR ) (OTCPK: PCCYF ) are 4% cheaper in Hong Kong than in mainland China. (click to enlarge) Source: own processing, using data of ishares.com and Bloomberg Conclusion Although there is a share market bubble in mainland China, the Hong Kong share market hasn’t inflated yet. The shares of most of the dual-listed companies are much cheaper in Hong Kong than in mainland China. There are only two ways how the valuation gap may be eliminated. The Hong Kong share price must grow or the Chinese mainland share prices must decline (or a combination of both). The first option is favorable for FXI shareholders and the second one is relatively neutral for them. There is a bubble on the Chinese share market, but Hong Kong has been impacted only slightly. FXI shareholders don’t have to fear a bubble burst right now. If the Chinese bubble starts to collapse, FXI shares should experience only a limited impact. During the 2006-2007 bubble, the Hong Kong share market lagged behind the mainland market significantly, only to start to grow furiously during the last phase of the mainland bubble. If history repeats itself, FXI has 50-100% upside potential. If the history doesn’t repeat itself and the mainland share market starts to collapse before the Hong Kong share market inflates, there is only a limited downside of 20-25%. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in FXI over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News