Scalper1 News

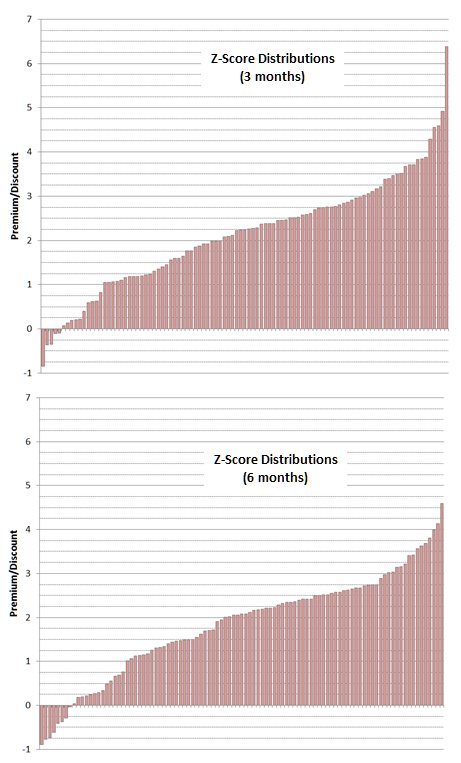

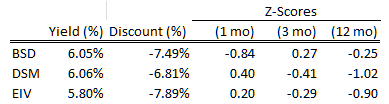

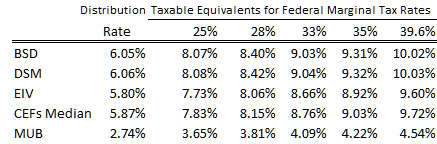

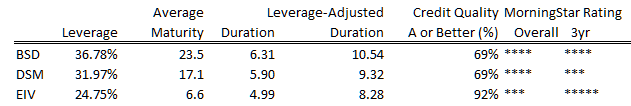

Summary Municipal bonds are coming off one of their best years in a long time. Most municipal bond, closed-end funds are selling well above their usual discount/premium status, a situation nearly exactly opposite that of a few months past. In this article I consider three funds that still present attractive valuations and propose one as my top choice. Few Bargains in Tax-Free Income. Here’s Three. After a dismal 2013, municipal-bond closed-end funds turned in a strong showing in 2014. Let’s start by looking at the largest and most liquid municipal bond ETF as a benchmark. iShares S&P National AMT-Free Muni Bond ETF (NYSEARCA: MUB ) is up 5.42% for the past 12 months and has a 12 month tax-free yield of 2.74%. Not bad for muni bonds, but it doesn’t sound all that terrific, does it? Now, compare that to the median national municipal-bond closed-end fund: 12 month price return of 17.09% coupled with a current, tax-free yield of 5.87%. That’s a total return difference of nearly three fold. How is it that closed-end funds outperformed the benchmark ETF to such an extent? First is their use of leverage: the median muni-bond CEF is leveraged at 34.9%. This can provide a substantial boost in a year such as 2014 but will, of course, drag a fund’s performance down in a less favorable year such as 2013. A second factor is credit quality. Many CEFs will delve more deeply into the credit risk pool than MUB which holds 83% of its portfolio in bonds rated A and above compared to the category average of 74%. Here again, when things go well taking on credit risk can pay off. But in 2013 exaggerated fears of credit risk, driven largely by sentsationalist media coverage of the municipal bond market, proved costly to investors in this asset class. Finally, there’s the factor unique to CEFs: most sell at a discount to their NAVs. This cuts two ways: A discount pumps up the yield on NAV; buying a fund that pays, say, 6% on NAV at a 10% discount turns that 6% into 6.67% at market price. Plus, if a discount compresses, the holder of the fund enjoys capital appreciation unrelated to the price movements of the underlying assets. The first two factors, leverage and portfolio quality, tend to be stable for any given fund. The third, premium/discount status, tends to be quite volatile for municipal bond CEFs, and will often offer attractive buying opportunities. The strong showing for municipal bond CEFs over the last year, and the past few months in particular, has been driven in considerable part by discount compression. This has left few bargains for the tax-free income shopper. The median discount for national municipal-bond CEFs stands at -6.81%. Nearly -7% may look good at first glance but it compares poorly with recent history for the category. How poorly? That -6.81% is more than 2 standard deviations higher (i.e. less discounted) than the median discounts of 3 or 6 months ago. Such numbers do not offer much of an attractive market for buyers. Recent Changes in Premium/Discount Status in Municipal Bond CEFs The metric used to measure how a closed-end fund’s current premium/discount relates to its recent history is the Z-score which indicates how far from the average discount or premium a fund’s current discount or premium is. A fund with a positive Z-score is currently trading at discount or premium higher than its average. Negative Z-scores indicate distance below the average (deeper discounts). Only 4 months ago, when I last wrote about muni-bond CEFs, negative Z-scores were overwhelmingly the rule. That’s now turned around completely with the median Z-scores for 3, 6 and 12 months standing at 2.26, 2.17 and 0.97, respectively. This chart shows distributions of Z-scores for 3 and 6 month periods for 99 national municipal-bond closed-end funds. To see mean reversion in action, it’s worth comparing these to charts of the same metric in Figure 2 from October 2014 which present nearly exact mirror images of these charts in shape if not scale. Figure 1. Z-score distributions for national municipal-bond closed-end funds. In the entire universe of municipal-bond closed-end funds 5% have discounts deeper than their average for the last 3 months and only 8% for the 6 month average. A Moderate Fund-Trading Strategy for Muni-Bond CEFs That Combines Tax-Free Income and Periodic Capital Profits I consider closed-end funds to provide the best choice for exposure to tax-free income. I would argue that the municipal bond arena is the space where CEFs are the clear investment option of choice. They return consistently high-distribution yields on an absolute measure, and very high yields on a tax-adjusted basis in an investment category typified by low yield for essentially every other investment vehicle. Because CEFs often use high leverage and credit-risk as mechanisms to achieve those high returns they tend to be riskier alternatives in comparison with municipal-bond ETFs or holding individual bonds. To moderate some of that risk, I buy muni-bond closed-end funds when they are priced attractively relative to their typical discounts/premiums. To this end I rely on Z-scores to provide a measure of that relationship. I base this on an assumption that the funds with outsized Z-scores will tend to revert to their means over time. Some readers object to this emphasis on Z-scores, which I can appreciate. For the buy-and-hold investor they may be a relatively minor factor in an investment decision. But, I have been able to identify appealing opportunities by including this metric along with the more important considerations of yield and portfolio quality. Understand, as well, that I am always prepared to trade out of a fund if that carefully selected extreme discount reverts to the fund’s less deeply discounted mean, which is, in fact, what I expect to happen most of the time. An investor less inclined to trade funds will, of course, be less inclined to value this metric. Over the past few years I have purchased funds at outsized discounts and sold them at a profit as they reverted to something closer to their mean discounts, using the proceeds to purchase other funds with attractive entry points. With about 100 national muni-bond CEFs and another couple of dozen funds from my home state of California to select from there is always a lot of choice. This approach has provided steady, tax-free income in the 6 to 7% range and modest profits as I traded into new funds. By following this strategy, I presently hold muni-bond funds purchased when they had deeply negative Z-scores. Riding the rising tide in the asset class, they have logged substantial capital appreciation, a fair portion of which is attributable to mean reversion of their discounts. In fact they presently have Z-scores well over 2, so I would like to trade out of them and capture those profits. But there are precious few funds that meet the standards I’m looking for in a replacement. Screen Criteria and Results Can we find some reasonable buys in spite of the clear lack of the sorts of bargains that were available in the recent past? To find out, I downloaded the full list of national muni-bond CEFs from cefanlayzer.com and screened them using the following criteria: Market price yield at or above the median of 5.87%. Discount at or below the median of -6.81%. Z-score for 1, 6 and 12 months being negative for at least 2 of the 3 periods. These are pretty open filters. A few months ago they would have returned dozens of selections to explore. Today the screen passed only two funds: BlackRock Strategic Municipal Trust (NYSE: BSD ) and Dreyfus Strategic Municipal Bond Fund (NYSE: DSM ). With so few candidates, I opened the filter a bit more, stretching the market-price yield down to 5.80%, a bit below the median yield of 5.87%. This added a third candidate, Eaton Vance Municipal Bond Fund II (NYSEMKT: EIV ). This table summarizes yield on market-price, discount and Z-score values for the three funds. Figure 2. Yield, Discount and Z-Scores (Source: cefanlayzer.com ). When I write about tax-free municipal bond funds I like to show the equivalent tax-free yields for investors at a range of marginal tax rates, which I feel gives a better sense of how appropriate a yield point may be in for any individual’s case. Here’s the table. Figure 3. Taxable equivalents for Federal Marginal Tax Rates. As you can see, for an investor in the mid to upper tax brackets, the CEFs are providing extremely attractive tax-adjusted yields compared to what’s available in today’s fixed-income environment. Even at the lowest tax brackets one would be hard pressed to find fixed-income investments with comparable yield and safety. The Funds This next table summarizes some key features of each of the three closed-end funds under consideration. Figure 4. Leverage, Maturity, Duration, Credit Quality and Morningstar Ratings (Sources: cefanalyzer.com and Morningstar). BlackRock Strategic Municipal Trust has been selling at a discount between -4 and -8% since mid-2013. It’s current discount reflects a move upward from a low of -9.84% in August 2014. Distributions are paid monthly and have been steady at $0.074/share since 2010. The fund has not paid out return of capital since its inception. The top 5 states represented are Texas (13.3%), Illinois (11.2%), New York (9.2%), California (8.7%), New Jersey (6.1%). Tobacco bonds, generally considered the riskiest of muni bond categories, are not included in the top 5 sectors held in the portfolio. Morningstar rates the fund as having high to above average risk. The fund has a Sharpe ratio of 1.63 relative to the benchmark Barclays Index of 1.14. Dreyfus Strategic Municipal Bond Fund has been selling at a discount near -5% since early in 2013. Its present discount of -6.8% is marginally lower than its recent history and a full standard deviation below its one year average discount. Distributions are paid monthly. They were cut from $0.0475 to $0.0415/share in November 2014. The fund does not pay any return of capital in its distributions. Top five states are Texas (15.2%), California (12.6%), New York (11.8%), Massachusetts (8.1%), and Arizona ((4.5%). Morningstar rates the fund as having average risk. The fund’s Sharpe ratio is 1.09 relative to the benchmark’s 1.14. Some might express concern about the lead role of Texas in these two portfolios in light of the possible negative impacts of the oil crash on local municipal revenues. It’s just about impossible to sort out how much or little of a factor this may be. My inclination is to dismiss this as an immediate worry. Municipal bond default rates are so low relative to essentially all other bond categories, that I consider this risk exceptionally low on the list of possible risks for the funds. Eaton Vance Municipal Bond Fund II is the final of the three funds. It has seen its discount move to -8.1% at present which is above the -9% range it fell to during November and December 2014. Otherwise it’s about as low as it has been since late 2013. This is just short of one standard deviation below its 12 month average discount. The fund’s monthly $0.0631/share distribution has held steady since a drop in 2012. The fund does not pay return of capital in its distributions. The top holdings in the portfolio comprise bonds from New York (10.3%), Florida (7.5%), Pennsylvania (7.5%), New Jersey (7.1%) and Massachusetts (5.8%). Morningstar rates the fund as having above average risk metrics. Its Sharpe ratio is 1.21 compared to the benchmark’s 1.14. Most notable about EIV is that it has excellent credit quality. Recall that the category average for bonds rated A and above is 74% and for MUB, the benchmark ETF, it’s 83%. Compare EIV: With 92% of its bond portfolio rated A or better, credit risk becomes a near insignificant factor. Finally, EIV outperformed its category in 2014 on a NAV and market price basis despite having not suffered the significant discount compression along the way that its peer funds did. Summary and My Top Choice Any of the three I’ve listed here are, in my view, worthy of a hard, close look for those exploring an investment in tax-free high-yield. My top choice would be the Eaton Vance offering, EIV, but my enthusiasm for it as top choice is somewhat tempered. On the plus side is its portfolio characteristics (credit quality, maturity and duration) which are clearly the best of the three. At Scalper1 News

Summary Municipal bonds are coming off one of their best years in a long time. Most municipal bond, closed-end funds are selling well above their usual discount/premium status, a situation nearly exactly opposite that of a few months past. In this article I consider three funds that still present attractive valuations and propose one as my top choice. Few Bargains in Tax-Free Income. Here’s Three. After a dismal 2013, municipal-bond closed-end funds turned in a strong showing in 2014. Let’s start by looking at the largest and most liquid municipal bond ETF as a benchmark. iShares S&P National AMT-Free Muni Bond ETF (NYSEARCA: MUB ) is up 5.42% for the past 12 months and has a 12 month tax-free yield of 2.74%. Not bad for muni bonds, but it doesn’t sound all that terrific, does it? Now, compare that to the median national municipal-bond closed-end fund: 12 month price return of 17.09% coupled with a current, tax-free yield of 5.87%. That’s a total return difference of nearly three fold. How is it that closed-end funds outperformed the benchmark ETF to such an extent? First is their use of leverage: the median muni-bond CEF is leveraged at 34.9%. This can provide a substantial boost in a year such as 2014 but will, of course, drag a fund’s performance down in a less favorable year such as 2013. A second factor is credit quality. Many CEFs will delve more deeply into the credit risk pool than MUB which holds 83% of its portfolio in bonds rated A and above compared to the category average of 74%. Here again, when things go well taking on credit risk can pay off. But in 2013 exaggerated fears of credit risk, driven largely by sentsationalist media coverage of the municipal bond market, proved costly to investors in this asset class. Finally, there’s the factor unique to CEFs: most sell at a discount to their NAVs. This cuts two ways: A discount pumps up the yield on NAV; buying a fund that pays, say, 6% on NAV at a 10% discount turns that 6% into 6.67% at market price. Plus, if a discount compresses, the holder of the fund enjoys capital appreciation unrelated to the price movements of the underlying assets. The first two factors, leverage and portfolio quality, tend to be stable for any given fund. The third, premium/discount status, tends to be quite volatile for municipal bond CEFs, and will often offer attractive buying opportunities. The strong showing for municipal bond CEFs over the last year, and the past few months in particular, has been driven in considerable part by discount compression. This has left few bargains for the tax-free income shopper. The median discount for national municipal-bond CEFs stands at -6.81%. Nearly -7% may look good at first glance but it compares poorly with recent history for the category. How poorly? That -6.81% is more than 2 standard deviations higher (i.e. less discounted) than the median discounts of 3 or 6 months ago. Such numbers do not offer much of an attractive market for buyers. Recent Changes in Premium/Discount Status in Municipal Bond CEFs The metric used to measure how a closed-end fund’s current premium/discount relates to its recent history is the Z-score which indicates how far from the average discount or premium a fund’s current discount or premium is. A fund with a positive Z-score is currently trading at discount or premium higher than its average. Negative Z-scores indicate distance below the average (deeper discounts). Only 4 months ago, when I last wrote about muni-bond CEFs, negative Z-scores were overwhelmingly the rule. That’s now turned around completely with the median Z-scores for 3, 6 and 12 months standing at 2.26, 2.17 and 0.97, respectively. This chart shows distributions of Z-scores for 3 and 6 month periods for 99 national municipal-bond closed-end funds. To see mean reversion in action, it’s worth comparing these to charts of the same metric in Figure 2 from October 2014 which present nearly exact mirror images of these charts in shape if not scale. Figure 1. Z-score distributions for national municipal-bond closed-end funds. In the entire universe of municipal-bond closed-end funds 5% have discounts deeper than their average for the last 3 months and only 8% for the 6 month average. A Moderate Fund-Trading Strategy for Muni-Bond CEFs That Combines Tax-Free Income and Periodic Capital Profits I consider closed-end funds to provide the best choice for exposure to tax-free income. I would argue that the municipal bond arena is the space where CEFs are the clear investment option of choice. They return consistently high-distribution yields on an absolute measure, and very high yields on a tax-adjusted basis in an investment category typified by low yield for essentially every other investment vehicle. Because CEFs often use high leverage and credit-risk as mechanisms to achieve those high returns they tend to be riskier alternatives in comparison with municipal-bond ETFs or holding individual bonds. To moderate some of that risk, I buy muni-bond closed-end funds when they are priced attractively relative to their typical discounts/premiums. To this end I rely on Z-scores to provide a measure of that relationship. I base this on an assumption that the funds with outsized Z-scores will tend to revert to their means over time. Some readers object to this emphasis on Z-scores, which I can appreciate. For the buy-and-hold investor they may be a relatively minor factor in an investment decision. But, I have been able to identify appealing opportunities by including this metric along with the more important considerations of yield and portfolio quality. Understand, as well, that I am always prepared to trade out of a fund if that carefully selected extreme discount reverts to the fund’s less deeply discounted mean, which is, in fact, what I expect to happen most of the time. An investor less inclined to trade funds will, of course, be less inclined to value this metric. Over the past few years I have purchased funds at outsized discounts and sold them at a profit as they reverted to something closer to their mean discounts, using the proceeds to purchase other funds with attractive entry points. With about 100 national muni-bond CEFs and another couple of dozen funds from my home state of California to select from there is always a lot of choice. This approach has provided steady, tax-free income in the 6 to 7% range and modest profits as I traded into new funds. By following this strategy, I presently hold muni-bond funds purchased when they had deeply negative Z-scores. Riding the rising tide in the asset class, they have logged substantial capital appreciation, a fair portion of which is attributable to mean reversion of their discounts. In fact they presently have Z-scores well over 2, so I would like to trade out of them and capture those profits. But there are precious few funds that meet the standards I’m looking for in a replacement. Screen Criteria and Results Can we find some reasonable buys in spite of the clear lack of the sorts of bargains that were available in the recent past? To find out, I downloaded the full list of national muni-bond CEFs from cefanlayzer.com and screened them using the following criteria: Market price yield at or above the median of 5.87%. Discount at or below the median of -6.81%. Z-score for 1, 6 and 12 months being negative for at least 2 of the 3 periods. These are pretty open filters. A few months ago they would have returned dozens of selections to explore. Today the screen passed only two funds: BlackRock Strategic Municipal Trust (NYSE: BSD ) and Dreyfus Strategic Municipal Bond Fund (NYSE: DSM ). With so few candidates, I opened the filter a bit more, stretching the market-price yield down to 5.80%, a bit below the median yield of 5.87%. This added a third candidate, Eaton Vance Municipal Bond Fund II (NYSEMKT: EIV ). This table summarizes yield on market-price, discount and Z-score values for the three funds. Figure 2. Yield, Discount and Z-Scores (Source: cefanlayzer.com ). When I write about tax-free municipal bond funds I like to show the equivalent tax-free yields for investors at a range of marginal tax rates, which I feel gives a better sense of how appropriate a yield point may be in for any individual’s case. Here’s the table. Figure 3. Taxable equivalents for Federal Marginal Tax Rates. As you can see, for an investor in the mid to upper tax brackets, the CEFs are providing extremely attractive tax-adjusted yields compared to what’s available in today’s fixed-income environment. Even at the lowest tax brackets one would be hard pressed to find fixed-income investments with comparable yield and safety. The Funds This next table summarizes some key features of each of the three closed-end funds under consideration. Figure 4. Leverage, Maturity, Duration, Credit Quality and Morningstar Ratings (Sources: cefanalyzer.com and Morningstar). BlackRock Strategic Municipal Trust has been selling at a discount between -4 and -8% since mid-2013. It’s current discount reflects a move upward from a low of -9.84% in August 2014. Distributions are paid monthly and have been steady at $0.074/share since 2010. The fund has not paid out return of capital since its inception. The top 5 states represented are Texas (13.3%), Illinois (11.2%), New York (9.2%), California (8.7%), New Jersey (6.1%). Tobacco bonds, generally considered the riskiest of muni bond categories, are not included in the top 5 sectors held in the portfolio. Morningstar rates the fund as having high to above average risk. The fund has a Sharpe ratio of 1.63 relative to the benchmark Barclays Index of 1.14. Dreyfus Strategic Municipal Bond Fund has been selling at a discount near -5% since early in 2013. Its present discount of -6.8% is marginally lower than its recent history and a full standard deviation below its one year average discount. Distributions are paid monthly. They were cut from $0.0475 to $0.0415/share in November 2014. The fund does not pay any return of capital in its distributions. Top five states are Texas (15.2%), California (12.6%), New York (11.8%), Massachusetts (8.1%), and Arizona ((4.5%). Morningstar rates the fund as having average risk. The fund’s Sharpe ratio is 1.09 relative to the benchmark’s 1.14. Some might express concern about the lead role of Texas in these two portfolios in light of the possible negative impacts of the oil crash on local municipal revenues. It’s just about impossible to sort out how much or little of a factor this may be. My inclination is to dismiss this as an immediate worry. Municipal bond default rates are so low relative to essentially all other bond categories, that I consider this risk exceptionally low on the list of possible risks for the funds. Eaton Vance Municipal Bond Fund II is the final of the three funds. It has seen its discount move to -8.1% at present which is above the -9% range it fell to during November and December 2014. Otherwise it’s about as low as it has been since late 2013. This is just short of one standard deviation below its 12 month average discount. The fund’s monthly $0.0631/share distribution has held steady since a drop in 2012. The fund does not pay return of capital in its distributions. The top holdings in the portfolio comprise bonds from New York (10.3%), Florida (7.5%), Pennsylvania (7.5%), New Jersey (7.1%) and Massachusetts (5.8%). Morningstar rates the fund as having above average risk metrics. Its Sharpe ratio is 1.21 compared to the benchmark’s 1.14. Most notable about EIV is that it has excellent credit quality. Recall that the category average for bonds rated A and above is 74% and for MUB, the benchmark ETF, it’s 83%. Compare EIV: With 92% of its bond portfolio rated A or better, credit risk becomes a near insignificant factor. Finally, EIV outperformed its category in 2014 on a NAV and market price basis despite having not suffered the significant discount compression along the way that its peer funds did. Summary and My Top Choice Any of the three I’ve listed here are, in my view, worthy of a hard, close look for those exploring an investment in tax-free high-yield. My top choice would be the Eaton Vance offering, EIV, but my enthusiasm for it as top choice is somewhat tempered. On the plus side is its portfolio characteristics (credit quality, maturity and duration) which are clearly the best of the three. At Scalper1 News

Scalper1 News