Scalper1 News

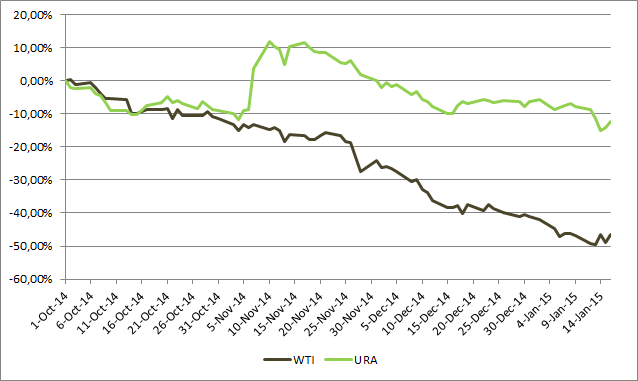

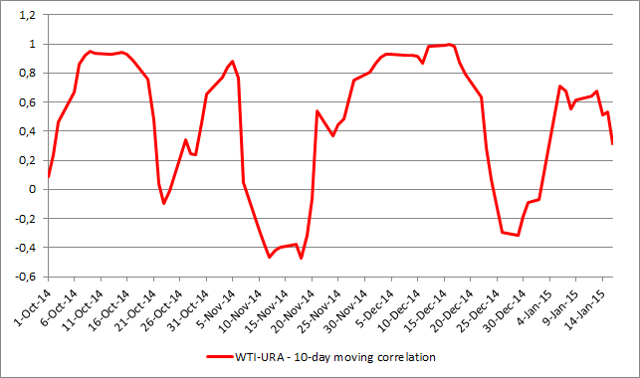

Summary The uranium sector was negatively impacted by the oil price collapse. The Global X Uranium ETF has recorded a new historical low. The decline is exaggerated and panic driven. Japan announced that it will restart its nuclear reactors, uranium price started to grow and the Global X Uranium ETF (NYSEARCA: URA ) rebounded strongly from its historical lows. It was early November and it seemed that the uranium sector found its bottom and the bright future is finally on the horizon. Then the URA price started to tank again and it has created new historical lows in January 2015 (chart below). But the uranium bull isn’t dead. The bull was just temporarily paralyzed by the collapse of oil prices. (click to enlarge) Source: own processing The most important thing that happened in the energy markets during the last quarter was the collapse of oil prices. The WTI price declined from $90.74 on October 1 to $48.5 on January 16. It represents a 46% decline. It had a negative effect on the whole energy sector, uranium companies including. The chart below shows the development of WTI and URA prices. The URA share price was declining along with the WTI price back in October. The relation changed in early November when the Japanese decision to restart its nuclear reactors spurred a short-lived rally of uranium prices and the whole uranium sector represented by URA as well. But the impact of collapsing oil prices proved out to be too strong. The URA share price started to decline again although the decline started to slow down slightly in December. Source: own processing The URA share price is strongly correlated with the WTI price most of the time. The chart below shows that there were time periods of almost perfect positive correlation during the last quarter. Some short periods of weak negative correlation were recorded only during the first half of November and in the end of December. (click to enlarge) Source: own processing Although URA has created a historical low in the beginning of 2015, the uranium price is still significantly above its summer lows (chart below). The current uranium price of $36.5 per pound is on the December 2013 levels. The URA share price was approximately $14 back then. It means that the current decline of URA is exaggerated and panic driven. Source: futures.tradingcharts.com Conclusion The decline of the Global X Uranium ETF share price seems to be exaggerated and panic driven. The uranium sector was significantly affected by the oil price collapse but the favorable uranium market fundamentals remain. Oil and uranium are not direct substitutes. Oil is mainly used for production of fuels and plastics while the main usage of uranium is to produce electricity. As soon as the markets realize that the bullish uranium fundamentals are still at play, the price of uranium and related securities including the Global X Uranium ETF will start to grow regardless of the oil price development. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Summary The uranium sector was negatively impacted by the oil price collapse. The Global X Uranium ETF has recorded a new historical low. The decline is exaggerated and panic driven. Japan announced that it will restart its nuclear reactors, uranium price started to grow and the Global X Uranium ETF (NYSEARCA: URA ) rebounded strongly from its historical lows. It was early November and it seemed that the uranium sector found its bottom and the bright future is finally on the horizon. Then the URA price started to tank again and it has created new historical lows in January 2015 (chart below). But the uranium bull isn’t dead. The bull was just temporarily paralyzed by the collapse of oil prices. (click to enlarge) Source: own processing The most important thing that happened in the energy markets during the last quarter was the collapse of oil prices. The WTI price declined from $90.74 on October 1 to $48.5 on January 16. It represents a 46% decline. It had a negative effect on the whole energy sector, uranium companies including. The chart below shows the development of WTI and URA prices. The URA share price was declining along with the WTI price back in October. The relation changed in early November when the Japanese decision to restart its nuclear reactors spurred a short-lived rally of uranium prices and the whole uranium sector represented by URA as well. But the impact of collapsing oil prices proved out to be too strong. The URA share price started to decline again although the decline started to slow down slightly in December. Source: own processing The URA share price is strongly correlated with the WTI price most of the time. The chart below shows that there were time periods of almost perfect positive correlation during the last quarter. Some short periods of weak negative correlation were recorded only during the first half of November and in the end of December. (click to enlarge) Source: own processing Although URA has created a historical low in the beginning of 2015, the uranium price is still significantly above its summer lows (chart below). The current uranium price of $36.5 per pound is on the December 2013 levels. The URA share price was approximately $14 back then. It means that the current decline of URA is exaggerated and panic driven. Source: futures.tradingcharts.com Conclusion The decline of the Global X Uranium ETF share price seems to be exaggerated and panic driven. The uranium sector was significantly affected by the oil price collapse but the favorable uranium market fundamentals remain. Oil and uranium are not direct substitutes. Oil is mainly used for production of fuels and plastics while the main usage of uranium is to produce electricity. As soon as the markets realize that the bullish uranium fundamentals are still at play, the price of uranium and related securities including the Global X Uranium ETF will start to grow regardless of the oil price development. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News