Scalper1 News

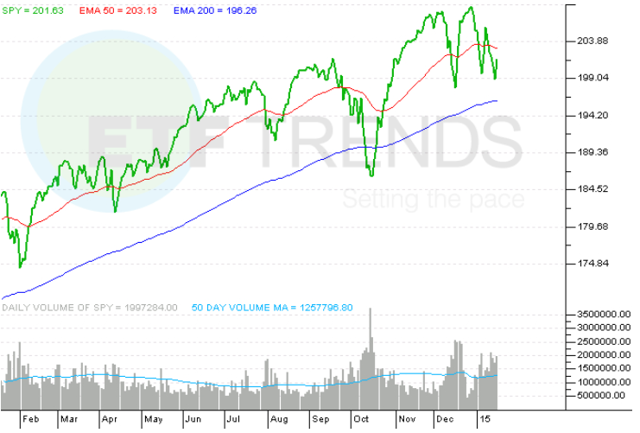

Summary U.S. dollar is strengthening against a basket of foreign currencies. How a stronger dollar could affect S&P 500 company earnings. Sectors that are exposed to foreign exchange currency risks. The quickly appreciating U.S. dollar could begin to weigh on corporate earnings, especially among large-cap S&P 500 stocks and related exchange traded funds with significant overseas exposure. The SPDR S&P 500 ETF (NYSEArca: SPY ) , which tries to reflect the performance of the S&P 500 index, has increased 11.5% over the past year but is down 1.9% year-to-date. The stronger USD is expected to diminish profits for large companies that do business overseas, and some strategists contend that the strengthening currency and low energy prices could constrain quarterly S&P 500 earnings growth to just 3%, compared to previous calls for a 7% rise at the start of October, reports Eric Platt for Financial Times . The PowerShares DB U.S. Dollar Index Bullish Fund (NYSEArca: UUP ) has increased 13.1% over the past year and rose 2.6% year-to-date. The appreciating greenback, which has been rallying against a basket of foreign currencies since July, could pressure the S&P 500 where foreign sales make up over two-fifths of total turnover, with 261 companies in the index generating over 15% of revenues overseas. Deutsche Bank calculates that for every 10% increase in the USD against major currency baskets, the S&P 500 earnings face a potential decline of “slightly over $2,” or each 10 cent drop in the euro from about $1.2 could cut $1 from S&P 500 earnings. “The uncertainty in commodities, foreign exchange and interest rates across the curve is high, confounded by uncertainty in quantifying their influence on earnings per share and price-earnings,” David Bianco, strategist at Deutsche, said in the FT article. “We expect more cuts during fourth-quarter earnings season, especially for those with FX exposure.” For instance, GameStop (NYSE: GME ) has already blamed the “strength of the US dollar” for part of its slide in holiday same-store sales. On a sector-by-sector basis, observers believe the technology, materials and energy sectors will likely be the most affected by a stronger dollar as each sector generates over half of revenues abroad. Year-to-date, the Technology Select Sector SPDR (NYSEArca: XLK ) fell 5.0%, Materials Select Sector SPDR (NYSEArca: XLB ) decreased 1.5% and Energy Select Sector SPDR (NYSEArca: XLE ) dipped 2.4%. Cantor Fitzgerald analysts have warned that companies with “material international exposure,” such as Google (NASDAQGM: GOOG ), Facebook (NASDAQGM: FB ), Amazon (NASDAQGM: AMZN ) and eBay (NASDAQGM: EBAY ), could report reduced earnings forecasts if the “trend is sustained.” XLK includes GOOG 6.4%, FB 4.0% and EBAY 1.6%. SPY holds GOOG 1.6%, FB 0.9%, AMZN 0.6% and EBAY 0.3%. SPDR S&P 500 ETF (click to enlarge) Max Chen contributed to this article . Scalper1 News

Summary U.S. dollar is strengthening against a basket of foreign currencies. How a stronger dollar could affect S&P 500 company earnings. Sectors that are exposed to foreign exchange currency risks. The quickly appreciating U.S. dollar could begin to weigh on corporate earnings, especially among large-cap S&P 500 stocks and related exchange traded funds with significant overseas exposure. The SPDR S&P 500 ETF (NYSEArca: SPY ) , which tries to reflect the performance of the S&P 500 index, has increased 11.5% over the past year but is down 1.9% year-to-date. The stronger USD is expected to diminish profits for large companies that do business overseas, and some strategists contend that the strengthening currency and low energy prices could constrain quarterly S&P 500 earnings growth to just 3%, compared to previous calls for a 7% rise at the start of October, reports Eric Platt for Financial Times . The PowerShares DB U.S. Dollar Index Bullish Fund (NYSEArca: UUP ) has increased 13.1% over the past year and rose 2.6% year-to-date. The appreciating greenback, which has been rallying against a basket of foreign currencies since July, could pressure the S&P 500 where foreign sales make up over two-fifths of total turnover, with 261 companies in the index generating over 15% of revenues overseas. Deutsche Bank calculates that for every 10% increase in the USD against major currency baskets, the S&P 500 earnings face a potential decline of “slightly over $2,” or each 10 cent drop in the euro from about $1.2 could cut $1 from S&P 500 earnings. “The uncertainty in commodities, foreign exchange and interest rates across the curve is high, confounded by uncertainty in quantifying their influence on earnings per share and price-earnings,” David Bianco, strategist at Deutsche, said in the FT article. “We expect more cuts during fourth-quarter earnings season, especially for those with FX exposure.” For instance, GameStop (NYSE: GME ) has already blamed the “strength of the US dollar” for part of its slide in holiday same-store sales. On a sector-by-sector basis, observers believe the technology, materials and energy sectors will likely be the most affected by a stronger dollar as each sector generates over half of revenues abroad. Year-to-date, the Technology Select Sector SPDR (NYSEArca: XLK ) fell 5.0%, Materials Select Sector SPDR (NYSEArca: XLB ) decreased 1.5% and Energy Select Sector SPDR (NYSEArca: XLE ) dipped 2.4%. Cantor Fitzgerald analysts have warned that companies with “material international exposure,” such as Google (NASDAQGM: GOOG ), Facebook (NASDAQGM: FB ), Amazon (NASDAQGM: AMZN ) and eBay (NASDAQGM: EBAY ), could report reduced earnings forecasts if the “trend is sustained.” XLK includes GOOG 6.4%, FB 4.0% and EBAY 1.6%. SPY holds GOOG 1.6%, FB 0.9%, AMZN 0.6% and EBAY 0.3%. SPDR S&P 500 ETF (click to enlarge) Max Chen contributed to this article . Scalper1 News

Scalper1 News