Scalper1 News

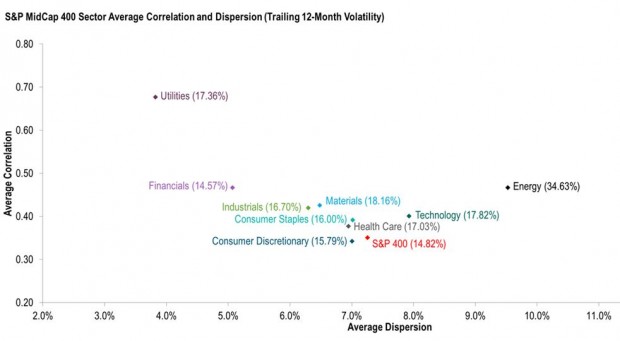

By Craig Lazzara, Global Head of Index Investment Strategy If we needed a reminder of the continuing volatility of the world’s financial markets, the first weeks of 2016 obliged us by providing one. What’s often overlooked, especially when volatility spikes, is that there are two distinct sources of volatility . Understanding them can not only enhance our appreciation of market dynamics, but also provides some important insights for portfolio managers. The two components are correlation and dispersion . Correlation, the more familiar of the two, is a measure of timing . Correlations within an equity market are, in our experience, invariably positive , indicating that stocks tend to move up and down together. As correlations rise and diversification effects diminish, the co-movement of index components is heightened, and market volatility increases. Dispersion, on the other hand, is a measure of magnitude : it tells us by how much the return of the average stock differs from the market average. In a high dispersion environment, the gap between the market’s winners and losers is relatively large. Given positive correlations, as dispersion rises, the market’s gyrations will take place within wider bands – and volatility will increase. The chart below illustrates the cross-sectional interaction of dispersion, correlation, and volatility using the sectors of the S&P 400 . The numbers in parentheses show the last 12 months’ volatility for each sector. Energy, unsurprisingly, was the most volatile sector, driven largely by its very wide dispersion. The Financials sector was the index’s least volatile. Notice that the volatility of Utilities (17.4%) and Health Care (17.0%) were more or less the same. Yet their volatility came from different sources . Utility volatility is correlation-driven; the gap between the sector’s winners and losers is low, producing low dispersion, but the winners and losers are highly likely to move together, producing high correlation. Health Care’s volatility comes from the opposite direction – from low correlation, meaning that the sector’s components tend to move more independently, but with higher dispersion, indicating a bigger gap between winners and losers. The sources of sector volatility have important implications for active managers: For a sector like Utilities, stock selection should be a relatively low priority. Low dispersion means that the gap between winners and losers is relatively low; this reduces the value of an analyst’s skill . For Health Care (and other high-dispersion sectors), the situation is different – the opportunity to add (or to lose) value by stock selection is relatively large. If research resources are constrained, this is where they should be concentrated. The nature of the research question is fundamentally different for these two sector types. For Utilities, the sector call is important, the stock selection decision much less so. For Health Care, the stock selection decision is more critical. An investor who understands the sources of volatility is more likely to be successful at managing and exploiting it. Disclosure: © S&P Dow Jones Indices LLC 2015. Indexology® is a trademark of S&P Dow Jones Indices LLC (SPDJI). S&P® is a trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC, and those marks have been licensed to S&P DJI. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI and to see our full disclaimer, visit www.spdji.com/terms-of-use . Scalper1 News

By Craig Lazzara, Global Head of Index Investment Strategy If we needed a reminder of the continuing volatility of the world’s financial markets, the first weeks of 2016 obliged us by providing one. What’s often overlooked, especially when volatility spikes, is that there are two distinct sources of volatility . Understanding them can not only enhance our appreciation of market dynamics, but also provides some important insights for portfolio managers. The two components are correlation and dispersion . Correlation, the more familiar of the two, is a measure of timing . Correlations within an equity market are, in our experience, invariably positive , indicating that stocks tend to move up and down together. As correlations rise and diversification effects diminish, the co-movement of index components is heightened, and market volatility increases. Dispersion, on the other hand, is a measure of magnitude : it tells us by how much the return of the average stock differs from the market average. In a high dispersion environment, the gap between the market’s winners and losers is relatively large. Given positive correlations, as dispersion rises, the market’s gyrations will take place within wider bands – and volatility will increase. The chart below illustrates the cross-sectional interaction of dispersion, correlation, and volatility using the sectors of the S&P 400 . The numbers in parentheses show the last 12 months’ volatility for each sector. Energy, unsurprisingly, was the most volatile sector, driven largely by its very wide dispersion. The Financials sector was the index’s least volatile. Notice that the volatility of Utilities (17.4%) and Health Care (17.0%) were more or less the same. Yet their volatility came from different sources . Utility volatility is correlation-driven; the gap between the sector’s winners and losers is low, producing low dispersion, but the winners and losers are highly likely to move together, producing high correlation. Health Care’s volatility comes from the opposite direction – from low correlation, meaning that the sector’s components tend to move more independently, but with higher dispersion, indicating a bigger gap between winners and losers. The sources of sector volatility have important implications for active managers: For a sector like Utilities, stock selection should be a relatively low priority. Low dispersion means that the gap between winners and losers is relatively low; this reduces the value of an analyst’s skill . For Health Care (and other high-dispersion sectors), the situation is different – the opportunity to add (or to lose) value by stock selection is relatively large. If research resources are constrained, this is where they should be concentrated. The nature of the research question is fundamentally different for these two sector types. For Utilities, the sector call is important, the stock selection decision much less so. For Health Care, the stock selection decision is more critical. An investor who understands the sources of volatility is more likely to be successful at managing and exploiting it. Disclosure: © S&P Dow Jones Indices LLC 2015. Indexology® is a trademark of S&P Dow Jones Indices LLC (SPDJI). S&P® is a trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC, and those marks have been licensed to S&P DJI. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI and to see our full disclaimer, visit www.spdji.com/terms-of-use . Scalper1 News

Scalper1 News