Scalper1 News

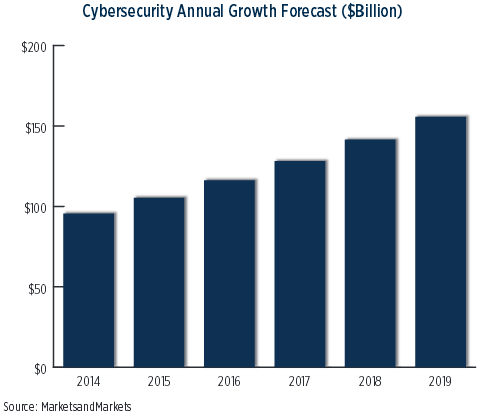

Summary Cyber security stocks have been a popular technology play this year. First Trust comes out with new cyber security ETF, the second offering in the space. Focus on the First Trust NASDAQ CEA Cybersecurity ETF. By Todd Shriber & Tom Lydon Confirming that cyber security is one of this year’s hottest investment themes, First Trust, the sixth-largest U.S. issuer of exchange traded funds, introduced on July 7th, the First Trust NASDAQ CEA Cybersecurity ETF (NasdaqGM: CIBR ) , the second cyber security ETF to come to market since November. The first is the well-entrenched, fast-growing PureFunds ISE Cyber Security ETF (NYSEArca: HACK ) , an ETF that needed less than eight months of trading to eclipse $1 billion in assets under management. HACK, the household name among cyber security ETFs, entered trading Tuesday with nearly $1.2 billion in assets under management . CIBR will track the Nasdaq CEA Cybersecurity Index, which “is designed to track the performance of companies engaged in the cybersecurity segment of the technology and industrials sectors. It includes companies primarily involved in the building, implementation, and management of security protocols applied to private and public networks, computers, and mobile devices in order to provide protection of the integrity of data and network operations,” according to a statement issued by First Trust. Amid a spate of public and private sector data breaches, the most recent afflicting personal data of federal employees, cyber security stocks are getting increased attention and, more importantly, are surging. Although it has given back some gains in recent weeks, HACK is up 12.4% year-to-date, more than triple the 3.9% gained by the Nasdaq Composite. “Cybersecurity is gaining global attention following recent high profile security breaches,” notes First Trust . “The opportunity for cybercrime is expected to grow and may cost the global economy as much as $575 billion annually. As cybercrimes continue to increase, the global cybersecurity market is forecast to grow at a compound annual growth rate (CAGR) of 10.3% from $95.6 billion in 2014 to $155.74 billion in 2019.” CIBR’s underlying index, which began trading on June 23, is home to 34 companies, including AhnLab, Akamai (NASDAQGS: AKAM ), Check Point Software (NASDAQGS: CHKP ), Cisco Systems (NASDAQGS: CSCO ), CyberArk (NASDAQGS: CYBR ) and FireEye (NASDAQGS: FEYE ), according to Nasdaq data . Companies must have a minimum market value of $250 million, a minimum three-month daily dollar trading volume of $1 million and a minimum free float of 20% to be eligible for the index. CIBR and HACK may not be alone in the cyber security ETF space for long as Direxion has plans to introduce leveraged bearish and bullish versions of HACK . Cyber Security Estimated Spending Growth Chart Courtesy: First Trust Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Cyber security stocks have been a popular technology play this year. First Trust comes out with new cyber security ETF, the second offering in the space. Focus on the First Trust NASDAQ CEA Cybersecurity ETF. By Todd Shriber & Tom Lydon Confirming that cyber security is one of this year’s hottest investment themes, First Trust, the sixth-largest U.S. issuer of exchange traded funds, introduced on July 7th, the First Trust NASDAQ CEA Cybersecurity ETF (NasdaqGM: CIBR ) , the second cyber security ETF to come to market since November. The first is the well-entrenched, fast-growing PureFunds ISE Cyber Security ETF (NYSEArca: HACK ) , an ETF that needed less than eight months of trading to eclipse $1 billion in assets under management. HACK, the household name among cyber security ETFs, entered trading Tuesday with nearly $1.2 billion in assets under management . CIBR will track the Nasdaq CEA Cybersecurity Index, which “is designed to track the performance of companies engaged in the cybersecurity segment of the technology and industrials sectors. It includes companies primarily involved in the building, implementation, and management of security protocols applied to private and public networks, computers, and mobile devices in order to provide protection of the integrity of data and network operations,” according to a statement issued by First Trust. Amid a spate of public and private sector data breaches, the most recent afflicting personal data of federal employees, cyber security stocks are getting increased attention and, more importantly, are surging. Although it has given back some gains in recent weeks, HACK is up 12.4% year-to-date, more than triple the 3.9% gained by the Nasdaq Composite. “Cybersecurity is gaining global attention following recent high profile security breaches,” notes First Trust . “The opportunity for cybercrime is expected to grow and may cost the global economy as much as $575 billion annually. As cybercrimes continue to increase, the global cybersecurity market is forecast to grow at a compound annual growth rate (CAGR) of 10.3% from $95.6 billion in 2014 to $155.74 billion in 2019.” CIBR’s underlying index, which began trading on June 23, is home to 34 companies, including AhnLab, Akamai (NASDAQGS: AKAM ), Check Point Software (NASDAQGS: CHKP ), Cisco Systems (NASDAQGS: CSCO ), CyberArk (NASDAQGS: CYBR ) and FireEye (NASDAQGS: FEYE ), according to Nasdaq data . Companies must have a minimum market value of $250 million, a minimum three-month daily dollar trading volume of $1 million and a minimum free float of 20% to be eligible for the index. CIBR and HACK may not be alone in the cyber security ETF space for long as Direxion has plans to introduce leveraged bearish and bullish versions of HACK . Cyber Security Estimated Spending Growth Chart Courtesy: First Trust Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News