Scalper1 News

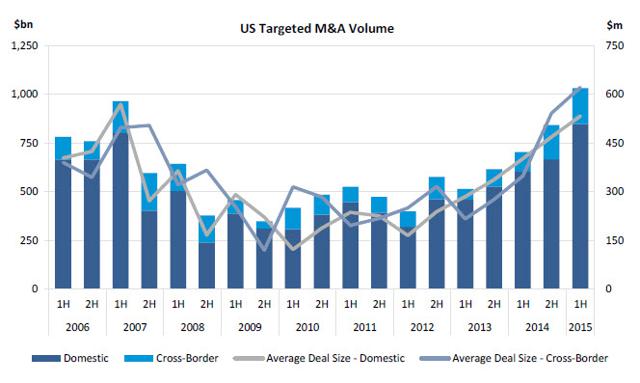

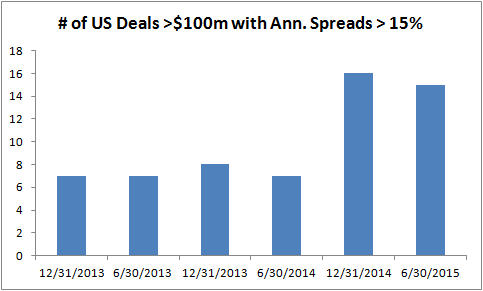

Summary The ongoing boom in M&A activity is creating a more robust opportunity set in merger arbitrage. Importantly, this is occurring at the same time that most other strategies (and general equity market exposure) are becoming increasing overvalued/unattractive. From a risk standpoint, merger arbitrage also appears to be becoming more compelling given its relatively low beta, and the plethora of risks building for general equity market exposure. A Little Background For those new to the strategy, generally when a merger is announced, the stock price of the target immediately jumps toward (but not fully to) the offer price. The remaining gap exists for two primary reasons: 1) there is a possibility (typically small) that the deal could fail to be consummated, and 2) legacy holders of the target’s stock that have typically just experienced a large windfall gain are sometimes willing to forgo the relatively smaller amount of remaining alpha due to their lack of experience in merger arb (and consequent limited ability to underwrite the risks). Merger arbitrage specialists attempt to capture this alpha by buying the target’s stock (and shorting the acquirer’s in cases where part of the consideration offered is stock). They then seek to profit as the spread compresses, with the deal moving to completion. Merger arb is most commonly pursued by hedge funds. However, in recent years ETFs have also emerged to pursue the strategy passively (the largest of which being the IQ Merger Arbitrage ETF (NYSEARCA: MNA )), and there are a handful of Seeking Alpha contributors focusing on it as well. Increasingly Attractive when Other Strategies are Least Attractive Like most strategies, the general attractiveness of merger arb varies over time based on fluctuations in supply (in this case of M&A deal volume) and demand. As mentioned, demand comes mostly from hedge funds and tends to be reasonably sticky, as it takes time for the funds to raise capital from their underlying investors (or for investors to take back capital) based on changes in the attractiveness of the opportunity set. The result is that when there are big changes in deal volume, this supply can temporarily overwhelm (or underwhelm) demand, leading to higher (or lower) risk-adjusted returns. From 2010 through 2013, deal-flow was limited as corporate managements were reluctant to make bold moves toward expansion with fresh memories of the 2008-2009 disaster in mind. As a result, merger arb players struggled to perform, and the HFR merger arb index posted very modest single-digit returns annually. However, since 2014 there has been a substantial pick-up in M&A activity as the financial crisis has fallen farther from mind, many corporate balance sheets have become increasingly bloated with cash, and tightened credit spreads have enabled companies to raise capital very cheaply. (click to enlarge) Source: Dealogic Though many hedge funds have been seeking to deploy additional capital in the space, demand has still been slow to catch up with supply. The result is that merger arb has been becoming more interesting at the same time that most other strategies and equity beta have become less attractive. One illustrative data point is that the number of $100m+ deals with annualized spreads over 15% ballooned from late 2014 to now, as shown below. Source: SINLetter Less Beta when Beta is Most Overvalued In the current environment with high equity valuations and abundant macro dangers, another potential attraction of merger arb is its risk profile, as noted above. For each deal, the main sources of risk are idiosyncratic/company-specific (e.g., antitrust investigations, unwieldy regulatory reviews, loss of financing). It is true that merger arb still retains some exposure to general risk premiums, or the tendency of market participants to require higher returns to hold any investments during times of fear. Further, the probability of deals breaking does increase somewhat when market is stressed, particularly for deals with financing contingencies (e.g., LBOs). However, the recent M&A boom has predominately represented strategic deals with relatively few LBOs. Also, the level of exposure to general risk premiums is lessened due to the short duration, self-realizing nature of the strategy. Accordingly, the strategy has tended to produce much lower drawdowns than the overall equity market during past market shocks. For instance, in 2008-2009, the CSFB risk arbitrage index posted a maximum drawdown of roughly 20% vs. roughly 50% for the S&P 500. In 2000-2001, the risk arb index posted a max drawdown under 10% vs. ~40% for the S&P 500. Conclusion For those with interest/experience in event-driven investing, this is a good time in the cycle to explore opportunities in merger arb. For those with less experience or time to underwrite the risks of individual deals, a diversified approach may be worthy of consideration, for instance through one of the ETFs that exist today. Disclosure: I am/we are long DTV, MEA, OVTI, OWW, DARA, PNK, ODP. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The ongoing boom in M&A activity is creating a more robust opportunity set in merger arbitrage. Importantly, this is occurring at the same time that most other strategies (and general equity market exposure) are becoming increasing overvalued/unattractive. From a risk standpoint, merger arbitrage also appears to be becoming more compelling given its relatively low beta, and the plethora of risks building for general equity market exposure. A Little Background For those new to the strategy, generally when a merger is announced, the stock price of the target immediately jumps toward (but not fully to) the offer price. The remaining gap exists for two primary reasons: 1) there is a possibility (typically small) that the deal could fail to be consummated, and 2) legacy holders of the target’s stock that have typically just experienced a large windfall gain are sometimes willing to forgo the relatively smaller amount of remaining alpha due to their lack of experience in merger arb (and consequent limited ability to underwrite the risks). Merger arbitrage specialists attempt to capture this alpha by buying the target’s stock (and shorting the acquirer’s in cases where part of the consideration offered is stock). They then seek to profit as the spread compresses, with the deal moving to completion. Merger arb is most commonly pursued by hedge funds. However, in recent years ETFs have also emerged to pursue the strategy passively (the largest of which being the IQ Merger Arbitrage ETF (NYSEARCA: MNA )), and there are a handful of Seeking Alpha contributors focusing on it as well. Increasingly Attractive when Other Strategies are Least Attractive Like most strategies, the general attractiveness of merger arb varies over time based on fluctuations in supply (in this case of M&A deal volume) and demand. As mentioned, demand comes mostly from hedge funds and tends to be reasonably sticky, as it takes time for the funds to raise capital from their underlying investors (or for investors to take back capital) based on changes in the attractiveness of the opportunity set. The result is that when there are big changes in deal volume, this supply can temporarily overwhelm (or underwhelm) demand, leading to higher (or lower) risk-adjusted returns. From 2010 through 2013, deal-flow was limited as corporate managements were reluctant to make bold moves toward expansion with fresh memories of the 2008-2009 disaster in mind. As a result, merger arb players struggled to perform, and the HFR merger arb index posted very modest single-digit returns annually. However, since 2014 there has been a substantial pick-up in M&A activity as the financial crisis has fallen farther from mind, many corporate balance sheets have become increasingly bloated with cash, and tightened credit spreads have enabled companies to raise capital very cheaply. (click to enlarge) Source: Dealogic Though many hedge funds have been seeking to deploy additional capital in the space, demand has still been slow to catch up with supply. The result is that merger arb has been becoming more interesting at the same time that most other strategies and equity beta have become less attractive. One illustrative data point is that the number of $100m+ deals with annualized spreads over 15% ballooned from late 2014 to now, as shown below. Source: SINLetter Less Beta when Beta is Most Overvalued In the current environment with high equity valuations and abundant macro dangers, another potential attraction of merger arb is its risk profile, as noted above. For each deal, the main sources of risk are idiosyncratic/company-specific (e.g., antitrust investigations, unwieldy regulatory reviews, loss of financing). It is true that merger arb still retains some exposure to general risk premiums, or the tendency of market participants to require higher returns to hold any investments during times of fear. Further, the probability of deals breaking does increase somewhat when market is stressed, particularly for deals with financing contingencies (e.g., LBOs). However, the recent M&A boom has predominately represented strategic deals with relatively few LBOs. Also, the level of exposure to general risk premiums is lessened due to the short duration, self-realizing nature of the strategy. Accordingly, the strategy has tended to produce much lower drawdowns than the overall equity market during past market shocks. For instance, in 2008-2009, the CSFB risk arbitrage index posted a maximum drawdown of roughly 20% vs. roughly 50% for the S&P 500. In 2000-2001, the risk arb index posted a max drawdown under 10% vs. ~40% for the S&P 500. Conclusion For those with interest/experience in event-driven investing, this is a good time in the cycle to explore opportunities in merger arb. For those with less experience or time to underwrite the risks of individual deals, a diversified approach may be worthy of consideration, for instance through one of the ETFs that exist today. Disclosure: I am/we are long DTV, MEA, OVTI, OWW, DARA, PNK, ODP. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News