Scalper1 News

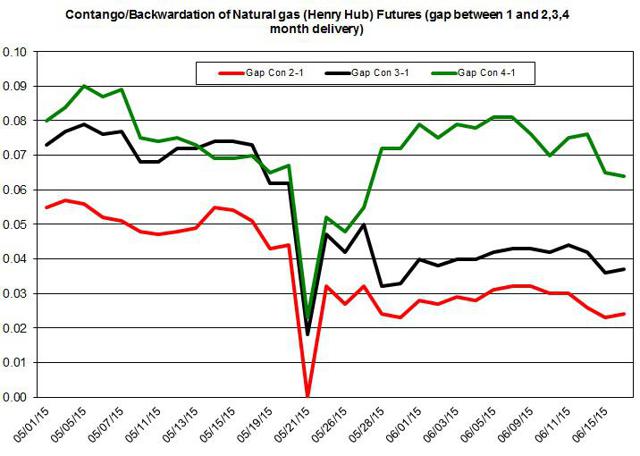

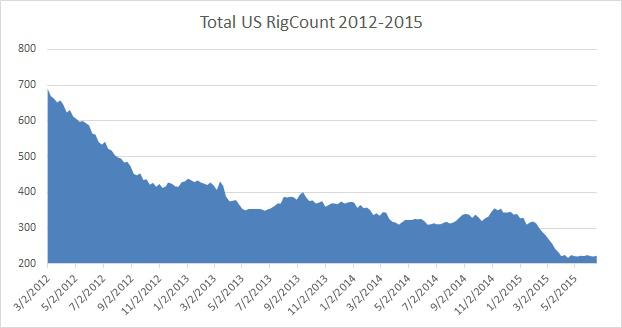

Summary The production in natural gas is higher than last year, despite the drop in natural gas rigs. Warmer weather is projected to keep the consumption of natural gas in the power sector high. The Contango in the future markets is likely to keep UNG underperforming natural gas prices. Even though the demand for natural gas in the power sector continues to rise, the price of The United States Natural Gas ETF (NYSEARCA: UNG ) has only slightly increased during the past week. The recent natural gas storage report showed an 89 Bcf injection – a bit lower than expected. Looking forward, the Energy Information Administration still expects the storage to reach higher than normal levels by the end of the injection season on account of higher production. For UNG investors, the ongoing Contango in the future markets is likely to keep the price of UNG below the price of natural gas due to roll decay. But will natural gas pick up again? (click to enlarge) Source of data taken from EIA Over the short term, we could keep seeing modest gains in the price of UNG due to higher demand for natural gas in the power sector. Albeit the impact of the changes in the weather on the price of UNG and the injections to storage play a smaller role this time of the year relative to the winter time. Baker Hughes (NYSE: BHI ) reported, yet again, the number of operating natural gas rigs nearly didn’t change and reached 223 by the end of last week – only 2 rigs higher than the previous week. Source of data taken from Baker Hughes Nonetheless, the U.S. natural gas production is still up for the year by nearly 5%, albeit it has slightly declined by 0.7% during last week, week over week. This year, the average output is still expected to rise by 4.2 Bcf per day, according to the latest EIA monthly report . This growth rate outlook, however, is lower by 0.3 Bcf per day than previously estimated. From the demand side, the EIA still expects the U.S. consumption will reach 76.7 Bcf per day or an increase of 4.3%, year over year. This gain will mostly be driven by higher consumption in the power and industrial sectors: The power sector’s natural gas consumption is estimated to rise by 13.7% compared to 2014 – this spike in demand is driven by low natural gas prices. In the industrial sector, the demand is projected to rise by 3.6% this year. Despite the higher demand for natural gas in the power sector, the storage is still expected to pick up at a faster pace than normal and pass the 3,900 Bcf – according to the EIA. So far during this injection season, the average injection was 32% higher than the 5-year average. If we were to assume the injections to remain 10% higher than normal for the rest of the season, the storage will pass 3,900 Bcf by the end of October. The higher storage by the end of the injection season is likely to keep pressuring down the price of natural gas. Over the short term, however, the ongoing hotter than normal weather mainly in the West is likely to augment the demand for electricity. Based on the latest cooling degree days projections, they are expected to remain higher than normal – another indication for higher demand in the power sector. Shares of UNG are expected to underperform the price of natural gas on account of the Contango in the future markets. Warmer weather could, over the short run, drive up the demand for natural gas. But over the coming months, higher production and rising storage levels are likely to keep UNG from recovering to former high levels. For more see: Has the Weakness in Oil Fueled the Decline of UNG? Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The production in natural gas is higher than last year, despite the drop in natural gas rigs. Warmer weather is projected to keep the consumption of natural gas in the power sector high. The Contango in the future markets is likely to keep UNG underperforming natural gas prices. Even though the demand for natural gas in the power sector continues to rise, the price of The United States Natural Gas ETF (NYSEARCA: UNG ) has only slightly increased during the past week. The recent natural gas storage report showed an 89 Bcf injection – a bit lower than expected. Looking forward, the Energy Information Administration still expects the storage to reach higher than normal levels by the end of the injection season on account of higher production. For UNG investors, the ongoing Contango in the future markets is likely to keep the price of UNG below the price of natural gas due to roll decay. But will natural gas pick up again? (click to enlarge) Source of data taken from EIA Over the short term, we could keep seeing modest gains in the price of UNG due to higher demand for natural gas in the power sector. Albeit the impact of the changes in the weather on the price of UNG and the injections to storage play a smaller role this time of the year relative to the winter time. Baker Hughes (NYSE: BHI ) reported, yet again, the number of operating natural gas rigs nearly didn’t change and reached 223 by the end of last week – only 2 rigs higher than the previous week. Source of data taken from Baker Hughes Nonetheless, the U.S. natural gas production is still up for the year by nearly 5%, albeit it has slightly declined by 0.7% during last week, week over week. This year, the average output is still expected to rise by 4.2 Bcf per day, according to the latest EIA monthly report . This growth rate outlook, however, is lower by 0.3 Bcf per day than previously estimated. From the demand side, the EIA still expects the U.S. consumption will reach 76.7 Bcf per day or an increase of 4.3%, year over year. This gain will mostly be driven by higher consumption in the power and industrial sectors: The power sector’s natural gas consumption is estimated to rise by 13.7% compared to 2014 – this spike in demand is driven by low natural gas prices. In the industrial sector, the demand is projected to rise by 3.6% this year. Despite the higher demand for natural gas in the power sector, the storage is still expected to pick up at a faster pace than normal and pass the 3,900 Bcf – according to the EIA. So far during this injection season, the average injection was 32% higher than the 5-year average. If we were to assume the injections to remain 10% higher than normal for the rest of the season, the storage will pass 3,900 Bcf by the end of October. The higher storage by the end of the injection season is likely to keep pressuring down the price of natural gas. Over the short term, however, the ongoing hotter than normal weather mainly in the West is likely to augment the demand for electricity. Based on the latest cooling degree days projections, they are expected to remain higher than normal – another indication for higher demand in the power sector. Shares of UNG are expected to underperform the price of natural gas on account of the Contango in the future markets. Warmer weather could, over the short run, drive up the demand for natural gas. But over the coming months, higher production and rising storage levels are likely to keep UNG from recovering to former high levels. For more see: Has the Weakness in Oil Fueled the Decline of UNG? Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News