Scalper1 News

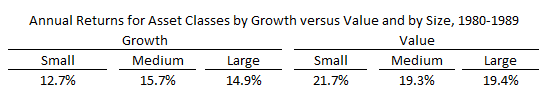

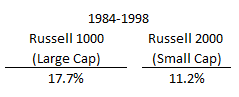

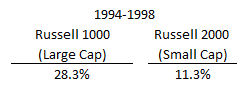

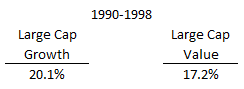

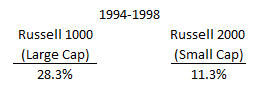

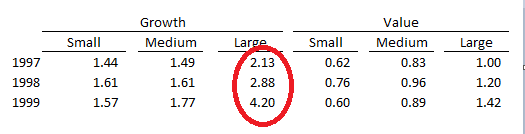

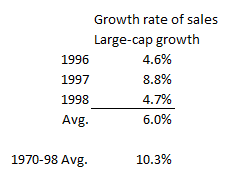

By David Foulke Every few years, people start to question whether value investing is dead. A recent Google search along these lines generated 3.1 million results: Likewise, people sometimes question whether the size effect is permanently going away. For instance, during the dotcom craze in the late 90s, large-cap growth investors made small-cap value investors look foolish. People jumped on the bandwagon, and embraced the “new paradigm” for investing. In “New Paradigm or Same Old Hype in Equity Investing?” Chan, Karceski, and Lakonishok (a copy is here ) examine equity returns across the growth/value and large-cap/small-cap spectrum during this era. I went ahead and cherry-picked some key data that illustrates the big picture trends explored by the authors. In the academic world, market returns during the 1970s and particularly in the 1980s were fertile grounds for researchers studying the cross-section of market returns, and variables that explained them. For instance, as can be seen from the panel below (from the paper, as are the other data below), during the 80s, value stocks earned more across the board than growth stocks, and small-cap value stocks beat small-cap growth stocks by 9% per year. The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. This 1980s sample period was influential in the establishment of the “size anomaly” and the “value premium.” The evidence seemed clear – you should go forth and buy small-cap value stocks. But then something strange happened – Both of these anomalies seemed to show elements of reversal! 1. First, large-cap began to outperform. Note below how from 1984 through 1998, large cap beats small cap: The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. And the large-cap trend only accelerated in the late 90s: The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. 2. Second, growth also seemed to outperform value, particularly for large-caps. From 1990-1998, large-cap growth beat large-cap value: And again, as with the large-cap outperformance above in #1, by the late 90s the trend in growth also appeared to accelerate: The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Indeed, in general, growth began to look like the better overall bet than value. Based on value weightings, growth stocks beat value stocks by 1.1% from 1990-1998 (although small and mid cap value still beat growth over the period). Particularly in the late 90s, large-cap growth just hammered small-cap value. In 1998, for example, large cap growth earned 41%, while small cap value earned -1.2% . Value investors began to look like idiots. During this period, even the king of value investors – Warren Buffett – began to feel the pain. In their paper, “Buffett’s Alpha,” (a copy is here ) Frazzini et al. observe that from June 30, 1998 to February 29, 2000, Berkshire Hathaway (NYSE: BRK.A ) (NYSE: BRK.B ) lost 44% of its value while the overall stock market gained 32%. Thus, over this ~1.5 year period, Warren Buffett underperformed the market by an astonishing 76% . At the tail end of this stretch, Barron’s published a piece entitled, “What’s Wrong, Warren?” From the article: After more than 30 years of unrivaled investment success, Warren Buffett may be losing his magic touch. Huh? What was going on here? Was Warren Buffett no longer a guru, was value investing dead, and had the small-cap premium disappeared forever? Some seemed to think so. Yet, if this were the case, how could you explain why these anomalies would do a 180 degree turn, and perform in a way that was the opposite of how they had performed previously? The paper examines three potential explanations for why this could be the case: Rational Asset Pricing Under this view, the outperformance of large-cap growth was driven by a series of unexpected positive shocks for large caps, and negative shocks for small caps, perhaps due to new technology, or investor expectations. If this were true, then the performance edge of small-cap value should reappear in the future. New Paradigm Popularized during the dotcom bubble, this view argues that technology and the dynamics of large companies have altered the investing landscape. Technology will allow huge long-run returns, with high growth rates persisting in the future, and large-caps have sustainable advantages based on their scale and international presence. Therefore, the old paradigm, in which firms were priced based on historical returns, no longer applies, and new valuations might be low given the new high expected growth rates under these new-paradigm conditions. If this is true, then small-cap value may continue to lag large-cap growth for a long time. Behavioral/Institutional This view argues that investors overreacted to the growth potential of technological innovation, and prices became disconnected from underlying fundamentals. Additionally, as markets continued to march higher, and large cap growth continued to outperform, the trend was self-reinforcing. If this view is right, then small-cap value will in the future exhibit return patterns consistent with its historical performance. We can test these explanations. Did large-caps experience excess profitability and small-caps experience depressed profitability? If this were true, that would support the rational pricing and new paradigm interpretations. If we failed to see this evidence, that might support the behavioral interpretation. So what does the evidence say? The authors examined performance data based on four accounting metrics: net sales revenue, operating income before depreciation, income, and cash dividends. We’re going focus on sales only since, as the authors point out, this data has no negative values, and is “smoother” (although you can read the paper to confirm that the other accounting metrics exhibited similar characteristics). The authors examined the price-to-sales ratio of the various asset classes and found something surprising: The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Note the extreme multiple expansion for price-to-sales that occurred for large-cap growth from 1997 through 1999. This expansion was obviously not duplicated by the other asset classes. Yet was this expanded multiple justified by the fundamentals? No. Note below how 1996-98 sales growth for large-cap growth was nothing special at 6%. In fact, growth badly lagged the 29 year average for large-cap sales growth of 10.3%. The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Meanwhile, sales growth for small-cap and mid-cap showed no particular weakness; in fact, small-cap sales growth from 96-98 was 12.7%, versus its long term (70-98) average of 8.1% – much stronger than historically! While we have only reviewed price-to-sales versus sales growth in detail here, again, the other profitability metrics reviewed in the paper are consistent with these observations. We therefore have a reasonable basis for rejecting the rational asset pricing argument, since we observed no unexpected fundamental shocks. Sales growth trends actually showed the opposite: it was weak for large-cap growth, and strong for small-cap value. Similarly, we can (mostly) reject the new paradigm argument, since we weren’t able to identify any emerging trends in sales growth that would justify higher valuations. It’s possible that these dramatically higher growth rates would show up farther in the future, but again, you would expect to see at least some evidence that this was occurring. Accordingly, it seems reasonable to embrace the third argument: behavioral/institutional. That is to say, the very high valuations of large-cap growth became disconnected from any reasonable assessment of future growth prospects, and this was driven by human bias, as investors overreacted to new technology and wild extrapolations of internet growth, and they chased anticipated returns. Taking a Step Back This observation is not especially revolutionary, in hindsight. By now, it’s obvious to everyone that during the dotcom years investors were caught up in “irrational exuberance” and bid up large-cap growth stocks to unsustainable highs. Yet it is still remarkable to see the actual fundamental data laid out so starkly and juxtaposed with equity prices. One observation that emerges from this analysis is how broader trends and market distortions can cause certain historical patterns and relationships, such as the size anomaly the value premium, to break down. Yet, once these behaviorally-driven market trends recede, and internet fever subsides, it seems reasonable to think longer-term value and small-cap effect will take hold once again. Of course, during this period in the 90s, people began to question value and size effects. As was demonstrated, Warren Buffett lagged the market by 76%! And people questioned him and his methods. Now that is the kind underperformance that can give you plenty of cover to argue that Buffett has lost his touch, that value investing is dead, and that only suckers believe in the size anomaly. Yet we have a long history of returns that gives us confidence that value and size effects are persistent. So we should be realistic and recognize too that they are not consistent. That is, there are prolonged periods, such as this stretch in the late 90s, when large-cap growth looks like the smart way to bet going forward. So when you see a broad reversal, say when large-cap growth has a stretch of outperformance, don’t be fooled. Consider that it’s pretty likely that you are getting fooled by “new paradigm” thinking that prevailed in the 90s. Original Post Scalper1 News

By David Foulke Every few years, people start to question whether value investing is dead. A recent Google search along these lines generated 3.1 million results: Likewise, people sometimes question whether the size effect is permanently going away. For instance, during the dotcom craze in the late 90s, large-cap growth investors made small-cap value investors look foolish. People jumped on the bandwagon, and embraced the “new paradigm” for investing. In “New Paradigm or Same Old Hype in Equity Investing?” Chan, Karceski, and Lakonishok (a copy is here ) examine equity returns across the growth/value and large-cap/small-cap spectrum during this era. I went ahead and cherry-picked some key data that illustrates the big picture trends explored by the authors. In the academic world, market returns during the 1970s and particularly in the 1980s were fertile grounds for researchers studying the cross-section of market returns, and variables that explained them. For instance, as can be seen from the panel below (from the paper, as are the other data below), during the 80s, value stocks earned more across the board than growth stocks, and small-cap value stocks beat small-cap growth stocks by 9% per year. The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. This 1980s sample period was influential in the establishment of the “size anomaly” and the “value premium.” The evidence seemed clear – you should go forth and buy small-cap value stocks. But then something strange happened – Both of these anomalies seemed to show elements of reversal! 1. First, large-cap began to outperform. Note below how from 1984 through 1998, large cap beats small cap: The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. And the large-cap trend only accelerated in the late 90s: The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. 2. Second, growth also seemed to outperform value, particularly for large-caps. From 1990-1998, large-cap growth beat large-cap value: And again, as with the large-cap outperformance above in #1, by the late 90s the trend in growth also appeared to accelerate: The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Indeed, in general, growth began to look like the better overall bet than value. Based on value weightings, growth stocks beat value stocks by 1.1% from 1990-1998 (although small and mid cap value still beat growth over the period). Particularly in the late 90s, large-cap growth just hammered small-cap value. In 1998, for example, large cap growth earned 41%, while small cap value earned -1.2% . Value investors began to look like idiots. During this period, even the king of value investors – Warren Buffett – began to feel the pain. In their paper, “Buffett’s Alpha,” (a copy is here ) Frazzini et al. observe that from June 30, 1998 to February 29, 2000, Berkshire Hathaway (NYSE: BRK.A ) (NYSE: BRK.B ) lost 44% of its value while the overall stock market gained 32%. Thus, over this ~1.5 year period, Warren Buffett underperformed the market by an astonishing 76% . At the tail end of this stretch, Barron’s published a piece entitled, “What’s Wrong, Warren?” From the article: After more than 30 years of unrivaled investment success, Warren Buffett may be losing his magic touch. Huh? What was going on here? Was Warren Buffett no longer a guru, was value investing dead, and had the small-cap premium disappeared forever? Some seemed to think so. Yet, if this were the case, how could you explain why these anomalies would do a 180 degree turn, and perform in a way that was the opposite of how they had performed previously? The paper examines three potential explanations for why this could be the case: Rational Asset Pricing Under this view, the outperformance of large-cap growth was driven by a series of unexpected positive shocks for large caps, and negative shocks for small caps, perhaps due to new technology, or investor expectations. If this were true, then the performance edge of small-cap value should reappear in the future. New Paradigm Popularized during the dotcom bubble, this view argues that technology and the dynamics of large companies have altered the investing landscape. Technology will allow huge long-run returns, with high growth rates persisting in the future, and large-caps have sustainable advantages based on their scale and international presence. Therefore, the old paradigm, in which firms were priced based on historical returns, no longer applies, and new valuations might be low given the new high expected growth rates under these new-paradigm conditions. If this is true, then small-cap value may continue to lag large-cap growth for a long time. Behavioral/Institutional This view argues that investors overreacted to the growth potential of technological innovation, and prices became disconnected from underlying fundamentals. Additionally, as markets continued to march higher, and large cap growth continued to outperform, the trend was self-reinforcing. If this view is right, then small-cap value will in the future exhibit return patterns consistent with its historical performance. We can test these explanations. Did large-caps experience excess profitability and small-caps experience depressed profitability? If this were true, that would support the rational pricing and new paradigm interpretations. If we failed to see this evidence, that might support the behavioral interpretation. So what does the evidence say? The authors examined performance data based on four accounting metrics: net sales revenue, operating income before depreciation, income, and cash dividends. We’re going focus on sales only since, as the authors point out, this data has no negative values, and is “smoother” (although you can read the paper to confirm that the other accounting metrics exhibited similar characteristics). The authors examined the price-to-sales ratio of the various asset classes and found something surprising: The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Note the extreme multiple expansion for price-to-sales that occurred for large-cap growth from 1997 through 1999. This expansion was obviously not duplicated by the other asset classes. Yet was this expanded multiple justified by the fundamentals? No. Note below how 1996-98 sales growth for large-cap growth was nothing special at 6%. In fact, growth badly lagged the 29 year average for large-cap sales growth of 10.3%. The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Meanwhile, sales growth for small-cap and mid-cap showed no particular weakness; in fact, small-cap sales growth from 96-98 was 12.7%, versus its long term (70-98) average of 8.1% – much stronger than historically! While we have only reviewed price-to-sales versus sales growth in detail here, again, the other profitability metrics reviewed in the paper are consistent with these observations. We therefore have a reasonable basis for rejecting the rational asset pricing argument, since we observed no unexpected fundamental shocks. Sales growth trends actually showed the opposite: it was weak for large-cap growth, and strong for small-cap value. Similarly, we can (mostly) reject the new paradigm argument, since we weren’t able to identify any emerging trends in sales growth that would justify higher valuations. It’s possible that these dramatically higher growth rates would show up farther in the future, but again, you would expect to see at least some evidence that this was occurring. Accordingly, it seems reasonable to embrace the third argument: behavioral/institutional. That is to say, the very high valuations of large-cap growth became disconnected from any reasonable assessment of future growth prospects, and this was driven by human bias, as investors overreacted to new technology and wild extrapolations of internet growth, and they chased anticipated returns. Taking a Step Back This observation is not especially revolutionary, in hindsight. By now, it’s obvious to everyone that during the dotcom years investors were caught up in “irrational exuberance” and bid up large-cap growth stocks to unsustainable highs. Yet it is still remarkable to see the actual fundamental data laid out so starkly and juxtaposed with equity prices. One observation that emerges from this analysis is how broader trends and market distortions can cause certain historical patterns and relationships, such as the size anomaly the value premium, to break down. Yet, once these behaviorally-driven market trends recede, and internet fever subsides, it seems reasonable to think longer-term value and small-cap effect will take hold once again. Of course, during this period in the 90s, people began to question value and size effects. As was demonstrated, Warren Buffett lagged the market by 76%! And people questioned him and his methods. Now that is the kind underperformance that can give you plenty of cover to argue that Buffett has lost his touch, that value investing is dead, and that only suckers believe in the size anomaly. Yet we have a long history of returns that gives us confidence that value and size effects are persistent. So we should be realistic and recognize too that they are not consistent. That is, there are prolonged periods, such as this stretch in the late 90s, when large-cap growth looks like the smart way to bet going forward. So when you see a broad reversal, say when large-cap growth has a stretch of outperformance, don’t be fooled. Consider that it’s pretty likely that you are getting fooled by “new paradigm” thinking that prevailed in the 90s. Original Post Scalper1 News

Scalper1 News