Scalper1 News

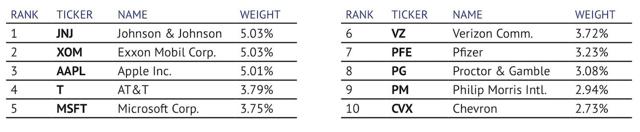

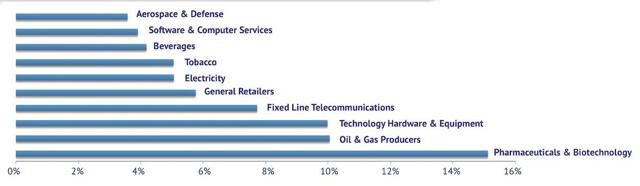

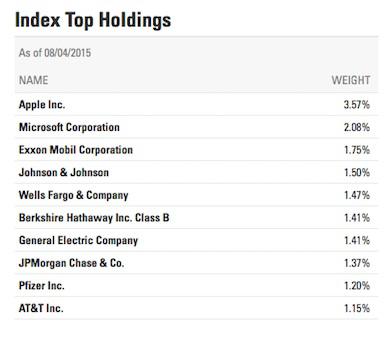

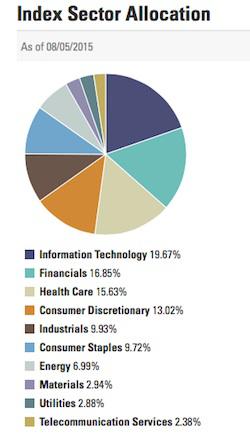

Summary Mr. Wonderful Kevin O’Leary recently launched a dividend focused ETF. OUSA is a smart beta ETF with screening parameters focused on Quality, Value, and Yield. Is there merit in this fund, or should Kevin go take a hike? As a frequent watcher of Shark Tank, I was intrigued to find out that dirty-rich Kevin O’Leary, self anointed “Mr. Wonderful,” had developed a dividend ETF, the O’Shares FTSE U.S. Quality Dividend ETF (NYSEARCA: OUSA ). The fund is less than a month old, with onset of trading July 14. I wanted to determine if there was merit to the fund, or whether O’Leary is just throwing chum into the water to attract some attention. Kevin O’Leary OUSA’s online materials state that the fund is correlated to the FTSE U.S. Qual/Vol/5% Capped Factor Index, which focuses on “Quality, Low Volatility, and Dividend Yield.” OUSA’s tearsheet refers us to the FTSE web site for additional information relative to how index constituent are selected and weighted within the portfolio. There one can read all about the ground rules as well as a methodology overview . There is also a fact sheet summary available, for those interested in statistical gibberish. I was unable to find a complete list of current constituents. Portfolio The fund (as of July 14) is invested in 142 companies, both large- and mid-cap, with weighted average market cap of $152 billion. The average dividend yield is 3.2 percent. Here is a list of top 10 holdings as disseminated on July 14, complete with the common misspelling of Proct”o”r and Gamble: (click to enlarge) Images sourced from Oshares.com There was also a breakdown of industry exposure: (click to enlarge) Let’s compare the holdings to the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) ….and sector weightings…. Source: spdrs.com OUSA vs. SPY The funds share 6 of their top 10 holdings with one another. The main difference is in concentration. OUSA concentrates 38% of assets in the top 10 while SPY has about 17% of assets in the top 10. O’Leary’s fund is considered “smart beta” since it screens on basis of “Quality, Value, & Yield.” SPY is a plain passive index that we generally know the constituents of at all times. And while there is sector diversification, I don’t think I would characterize OUSA’s as “index hugging” in nature. For instance, SPY contains 17% exposure to financials. Presumably, according to graphs above, OUSA has less than 4% exposure. Generally when ETFs have somewhat similar allocations, the trump card could be the fee. Currently SPY charges .0945% annually while OUSA’s net expense is .48%, with a waiver in place until July of 2018. Since O’Leary is advertising a 3.2% yield on the underlying holdings, we can probably guess that it will actually pay out somewhere between 2.5 and 2.7% on a full year run rate. SPY sits somewhere around 2.1 percent. Let’s Make A Deal! If I were able to switch positions and grill O’Leary like he does the entrepreneurs that stand in front of his majesty, I’d hit him hard on the fee, because like him, I’m not overpaying and want good ROI. I’d inquire as to what makes this FTSE methodology so superior to a passive index like SPY. He’d probably respond that investors should only own stocks that pay dividends, which his fund does. About 1 in 5 S&P 500 stocks don’t. He’d probably also bring up the point that his fund concentrates in quality and low volatility, providing opportunity to not only realize a yield in excess of SPY, but perhaps total return as well. Plus one could also sleep better at night with OUSA than SPY. Maybe he’d have a point. Since I wouldn’t characterize this fund as index hugging in nature, maybe it has a good shot of providing portfolio alpha. But I’d remind him 75% of active fund managers can’t beat an index. Further, OUSA has no track record of success and doesn’t appear to be pulling in assets by the boatload as of yet. Perusing the top 10 holdings once again, I’d remind him that many of them have really stunk up the joint ( Exxon Mobil Corporation (NYSE: XOM ), Chevron Corporation (NYSE: CVX ), The Procter & Gamble Company ( PG), Apple Inc. ( AAPL)) over the less than a month the fund has been public. Of course he’d then remind me that the fund hasn’t fared any worse than SPY over the same time – which is basically true. But, I tell him I’d want a better deal to be a buyer. “You’re no better than SPY,” I’d tell him. Then I’d tell Mr. Wonderful to drop his fee, at which point he’d say, “You’re no better than an Italian hit man, Aloisi” and turn down the offer. As he turns his back to me I’d utter, “O’Leary, you and your OUSA are dead to me!” Disclosure: I am/we are long AAPL,XOM. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Disclaimer: The above should not be considered or construed as individualized or specific investment advice. Do your own research and consult a professional, if necessary, before making investment decisions. Scalper1 News

Summary Mr. Wonderful Kevin O’Leary recently launched a dividend focused ETF. OUSA is a smart beta ETF with screening parameters focused on Quality, Value, and Yield. Is there merit in this fund, or should Kevin go take a hike? As a frequent watcher of Shark Tank, I was intrigued to find out that dirty-rich Kevin O’Leary, self anointed “Mr. Wonderful,” had developed a dividend ETF, the O’Shares FTSE U.S. Quality Dividend ETF (NYSEARCA: OUSA ). The fund is less than a month old, with onset of trading July 14. I wanted to determine if there was merit to the fund, or whether O’Leary is just throwing chum into the water to attract some attention. Kevin O’Leary OUSA’s online materials state that the fund is correlated to the FTSE U.S. Qual/Vol/5% Capped Factor Index, which focuses on “Quality, Low Volatility, and Dividend Yield.” OUSA’s tearsheet refers us to the FTSE web site for additional information relative to how index constituent are selected and weighted within the portfolio. There one can read all about the ground rules as well as a methodology overview . There is also a fact sheet summary available, for those interested in statistical gibberish. I was unable to find a complete list of current constituents. Portfolio The fund (as of July 14) is invested in 142 companies, both large- and mid-cap, with weighted average market cap of $152 billion. The average dividend yield is 3.2 percent. Here is a list of top 10 holdings as disseminated on July 14, complete with the common misspelling of Proct”o”r and Gamble: (click to enlarge) Images sourced from Oshares.com There was also a breakdown of industry exposure: (click to enlarge) Let’s compare the holdings to the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) ….and sector weightings…. Source: spdrs.com OUSA vs. SPY The funds share 6 of their top 10 holdings with one another. The main difference is in concentration. OUSA concentrates 38% of assets in the top 10 while SPY has about 17% of assets in the top 10. O’Leary’s fund is considered “smart beta” since it screens on basis of “Quality, Value, & Yield.” SPY is a plain passive index that we generally know the constituents of at all times. And while there is sector diversification, I don’t think I would characterize OUSA’s as “index hugging” in nature. For instance, SPY contains 17% exposure to financials. Presumably, according to graphs above, OUSA has less than 4% exposure. Generally when ETFs have somewhat similar allocations, the trump card could be the fee. Currently SPY charges .0945% annually while OUSA’s net expense is .48%, with a waiver in place until July of 2018. Since O’Leary is advertising a 3.2% yield on the underlying holdings, we can probably guess that it will actually pay out somewhere between 2.5 and 2.7% on a full year run rate. SPY sits somewhere around 2.1 percent. Let’s Make A Deal! If I were able to switch positions and grill O’Leary like he does the entrepreneurs that stand in front of his majesty, I’d hit him hard on the fee, because like him, I’m not overpaying and want good ROI. I’d inquire as to what makes this FTSE methodology so superior to a passive index like SPY. He’d probably respond that investors should only own stocks that pay dividends, which his fund does. About 1 in 5 S&P 500 stocks don’t. He’d probably also bring up the point that his fund concentrates in quality and low volatility, providing opportunity to not only realize a yield in excess of SPY, but perhaps total return as well. Plus one could also sleep better at night with OUSA than SPY. Maybe he’d have a point. Since I wouldn’t characterize this fund as index hugging in nature, maybe it has a good shot of providing portfolio alpha. But I’d remind him 75% of active fund managers can’t beat an index. Further, OUSA has no track record of success and doesn’t appear to be pulling in assets by the boatload as of yet. Perusing the top 10 holdings once again, I’d remind him that many of them have really stunk up the joint ( Exxon Mobil Corporation (NYSE: XOM ), Chevron Corporation (NYSE: CVX ), The Procter & Gamble Company ( PG), Apple Inc. ( AAPL)) over the less than a month the fund has been public. Of course he’d then remind me that the fund hasn’t fared any worse than SPY over the same time – which is basically true. But, I tell him I’d want a better deal to be a buyer. “You’re no better than SPY,” I’d tell him. Then I’d tell Mr. Wonderful to drop his fee, at which point he’d say, “You’re no better than an Italian hit man, Aloisi” and turn down the offer. As he turns his back to me I’d utter, “O’Leary, you and your OUSA are dead to me!” Disclosure: I am/we are long AAPL,XOM. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Disclaimer: The above should not be considered or construed as individualized or specific investment advice. Do your own research and consult a professional, if necessary, before making investment decisions. Scalper1 News

Scalper1 News