Scalper1 News

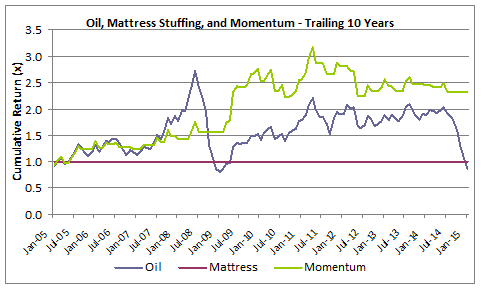

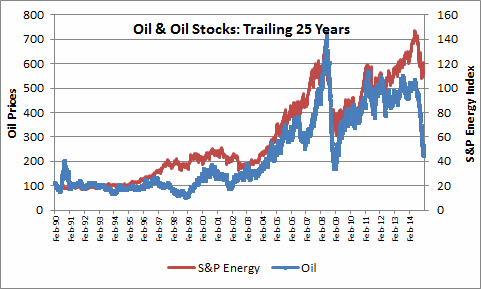

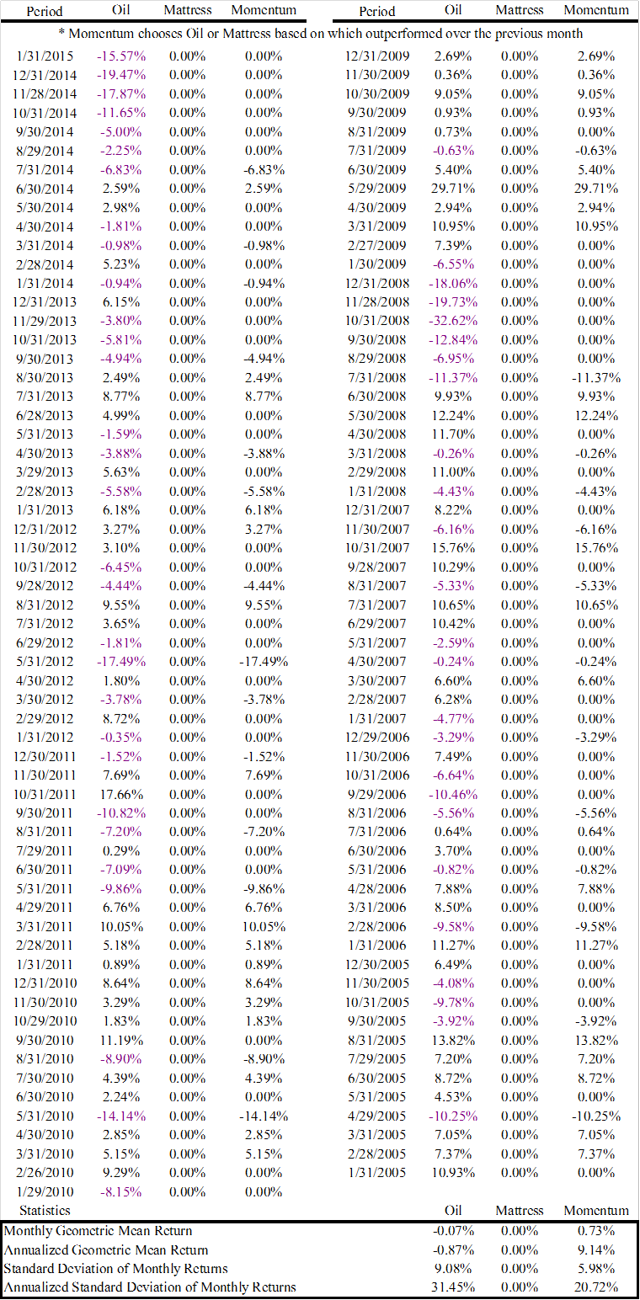

Like most risky asset classes, oil exhibits short-term momentum. Investors seeking short-term gains from timing a bounce in oil prices should understand this phenomenon, which could be reversing. After seven monthly losses for oil, momentum might finally have turned the corner, giving traders with a shorter-term horizon impetus to add positions. While evolving supply and demand factors impacting oil prices favor a longer-term value investing approach, a simple momentum heuristic could point to potential near-term gains. This is a re-purposed version of an earlier article that cautioned potential investors to take a long-term value approach to falling prices. As I have written previously, the performance of oil exhibits short-term momentum. What does that mean? On average, falling oil prices continue to fall in the short term. Conversely, rising oil prices continue to rise in the short term. Like I have done previously in articles about momentum’s impact on the returns stocks and bonds , I can demonstrate this phenomenon empirically. Understanding the power of short-term momentum can help Seeking Alpha readers more ably position oil-related exposures. Oil prices have been falling for several months, dragging down energy-related investments. With oil prices stabilizing and beginning to rebound, the negative trend from momentum could also be reversing. Imagine a world with just two asset classes – oil and your mattress. Knowing that oil exhibits short-term momentum, you invest in oil when it has produced a positive return over the trailing one month. If oil is falling, you stick your money in your mattress, earning zero. The cumulative return profile of oil, mattress savings, and a momentum strategy that toggles between oil and mattress stuffing based on which had outperformed for the trailing one month and holds that leg forward for one month is diagrammed below for the trailing ten-year period (see full results at the end of the article). Over the last ten years, if you had stuffed your money in the mattress, you would have of course earned zero. If you had purchased oil, this recent downturn would have taken you to a negative ten-year cumulative return. If you would have properly understood the momentum phenomenon, you would have more than doubled your money. (Source: Bloomberg WTI Crude) This simple heuristic to knowing when not to invest in oil based solely on trailing returns delivers tremendous outperformance. Even before the recent downdraft in oil prices, the oil/mattress momentum strategy outperformed a long-only oil strategy materially. Why? First, the countries, companies, and cartels that are major players in the global market are very large, and the forces that shape oil prices are slow-moving. Even absent the game theory inherent in supplying oil, reducing supply to the market takes time. Conversely, there is a lag effect from higher demand and prices manifesting into increased exploration via the drill bit. Secondly, short-term momentum is a powerful market anomaly present in many markets. (See Erb and Harvey (2006) on momentum impacts in commodity markets, or a litany of sourced articles I have written on the subject in other asset classes with performance proof). This does not mean that beaten-down energy stocks are a bad investment today, just that picking a short-term bottom in oil prices to generate short-term gains is a difficult proposition. If you are underweight energy stocks, then you should examine an increased allocation. As demonstrated pictorially in the chart below, buying energy stocks after a correction tends to generate very strong long-term performance. This graph shows the S&P Energy Index, replicated by the Energy Select Sector SPDR Fund (NYSEARCA: XLE ), over the trailing 25 years graphed against oil. (Source: Bloomberg, Standard and Poor’s) When I first wrote a version of this article in early December, short-term momentum suggested that oil prices and energy stocks could weaken further. Oil has fell an additional 32% over the next two months through the end of January. With oil again producing a negative return in January, the momentum strategy would again suggest that investors stay out of energy-related investments this month. My momentum strategy uses monthly calendar returns, in part because it is easier to find monthly return information historically. One-to-three month momentum with one to three month lookbacks have been shown to produce alpha across asset classes, markets, and time. Using a one-month lookback from today until mid-January and oil prices have risen by 13%. Perhaps this turnaround signals reversing momentum and further gains ahead. I have added to energy-related investments with an eye towards long-term value. Short-term momentum helped me to avoid the deepening correction. These investments have included a factor tilt towards low-cost energy focused exchange-traded funds. Given my traditional tilt towards low volatility investments (NYSEARCA: SPLV ), I was underexposed to energy pre-correction. I added broadly to closed-end high yield bonds funds, w hich were disproportionately negatively impacted by the oil drawdown . I have also added closed-end funds like Clearbridge American Energy MLP Fund (NYSE: CBA ), a pipeline focused MLP which was trading at nearly a ten percent discount to net asset value and generating a nearly eight percent yield at the time of purchase. The midstream sector is less exposed to commodity prices, and the selloff appeared to be overdone with investors selling energy-related funds indiscriminately early in the correction. A more speculative play was my add to Memorial Energy Production Partners (NASDAQ: MEMP ), an energy and production-related MLP that had strongly hedged several years of forward production as part of its business strategy, but suffered in the downturn like it was fully exposed to the commodity price drawdown. MEMP still offers nearly a 13% distribution rate even after the recent bounceback. Another long-term value play in the Energy space was my purchase of busted business development company, OHA Investment Corporation (NASDAQ: OHAI ). The company, formerly known as NGP Capital Resources is heavily exposed to the oil and gas industry with seventy percent of investments in those sectors. The company has recently brought in leading distressed debt manager Oak Hill Advisors to manage the fund. The company is trading at over a forty percent discount to net asset value. While I expect further impairments on its energy loans and a likely dividend cut, the combination of the deep discount, strong manager, inside management purchases, low leverage, and healthy liquidity all make a long-term rebound and strong forward risk-adjusted returns appear likely. Of my energy adds, this has been the worst performer thus far, but I believe downside is limited with the market capitalization trading roughly equal to the value of cash, Treasury bills, and non-Energy investments on the balance sheet. Do not be distracted by the potential for short-term losses and heightened volatility. Successful investing in oil and oil-related stocks is as simple as expanding your investment horizon. Even if you trade with a shorter-term focus, momentum could be reversing in oil given the positive trailing one-month return. Disclaimer: My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon. Appendix on Oil/Mattress Momentum: (click to enlarge) Disclosure: The author is long XLE, OHAI, MEMP, CBA, SPLV. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Like most risky asset classes, oil exhibits short-term momentum. Investors seeking short-term gains from timing a bounce in oil prices should understand this phenomenon, which could be reversing. After seven monthly losses for oil, momentum might finally have turned the corner, giving traders with a shorter-term horizon impetus to add positions. While evolving supply and demand factors impacting oil prices favor a longer-term value investing approach, a simple momentum heuristic could point to potential near-term gains. This is a re-purposed version of an earlier article that cautioned potential investors to take a long-term value approach to falling prices. As I have written previously, the performance of oil exhibits short-term momentum. What does that mean? On average, falling oil prices continue to fall in the short term. Conversely, rising oil prices continue to rise in the short term. Like I have done previously in articles about momentum’s impact on the returns stocks and bonds , I can demonstrate this phenomenon empirically. Understanding the power of short-term momentum can help Seeking Alpha readers more ably position oil-related exposures. Oil prices have been falling for several months, dragging down energy-related investments. With oil prices stabilizing and beginning to rebound, the negative trend from momentum could also be reversing. Imagine a world with just two asset classes – oil and your mattress. Knowing that oil exhibits short-term momentum, you invest in oil when it has produced a positive return over the trailing one month. If oil is falling, you stick your money in your mattress, earning zero. The cumulative return profile of oil, mattress savings, and a momentum strategy that toggles between oil and mattress stuffing based on which had outperformed for the trailing one month and holds that leg forward for one month is diagrammed below for the trailing ten-year period (see full results at the end of the article). Over the last ten years, if you had stuffed your money in the mattress, you would have of course earned zero. If you had purchased oil, this recent downturn would have taken you to a negative ten-year cumulative return. If you would have properly understood the momentum phenomenon, you would have more than doubled your money. (Source: Bloomberg WTI Crude) This simple heuristic to knowing when not to invest in oil based solely on trailing returns delivers tremendous outperformance. Even before the recent downdraft in oil prices, the oil/mattress momentum strategy outperformed a long-only oil strategy materially. Why? First, the countries, companies, and cartels that are major players in the global market are very large, and the forces that shape oil prices are slow-moving. Even absent the game theory inherent in supplying oil, reducing supply to the market takes time. Conversely, there is a lag effect from higher demand and prices manifesting into increased exploration via the drill bit. Secondly, short-term momentum is a powerful market anomaly present in many markets. (See Erb and Harvey (2006) on momentum impacts in commodity markets, or a litany of sourced articles I have written on the subject in other asset classes with performance proof). This does not mean that beaten-down energy stocks are a bad investment today, just that picking a short-term bottom in oil prices to generate short-term gains is a difficult proposition. If you are underweight energy stocks, then you should examine an increased allocation. As demonstrated pictorially in the chart below, buying energy stocks after a correction tends to generate very strong long-term performance. This graph shows the S&P Energy Index, replicated by the Energy Select Sector SPDR Fund (NYSEARCA: XLE ), over the trailing 25 years graphed against oil. (Source: Bloomberg, Standard and Poor’s) When I first wrote a version of this article in early December, short-term momentum suggested that oil prices and energy stocks could weaken further. Oil has fell an additional 32% over the next two months through the end of January. With oil again producing a negative return in January, the momentum strategy would again suggest that investors stay out of energy-related investments this month. My momentum strategy uses monthly calendar returns, in part because it is easier to find monthly return information historically. One-to-three month momentum with one to three month lookbacks have been shown to produce alpha across asset classes, markets, and time. Using a one-month lookback from today until mid-January and oil prices have risen by 13%. Perhaps this turnaround signals reversing momentum and further gains ahead. I have added to energy-related investments with an eye towards long-term value. Short-term momentum helped me to avoid the deepening correction. These investments have included a factor tilt towards low-cost energy focused exchange-traded funds. Given my traditional tilt towards low volatility investments (NYSEARCA: SPLV ), I was underexposed to energy pre-correction. I added broadly to closed-end high yield bonds funds, w hich were disproportionately negatively impacted by the oil drawdown . I have also added closed-end funds like Clearbridge American Energy MLP Fund (NYSE: CBA ), a pipeline focused MLP which was trading at nearly a ten percent discount to net asset value and generating a nearly eight percent yield at the time of purchase. The midstream sector is less exposed to commodity prices, and the selloff appeared to be overdone with investors selling energy-related funds indiscriminately early in the correction. A more speculative play was my add to Memorial Energy Production Partners (NASDAQ: MEMP ), an energy and production-related MLP that had strongly hedged several years of forward production as part of its business strategy, but suffered in the downturn like it was fully exposed to the commodity price drawdown. MEMP still offers nearly a 13% distribution rate even after the recent bounceback. Another long-term value play in the Energy space was my purchase of busted business development company, OHA Investment Corporation (NASDAQ: OHAI ). The company, formerly known as NGP Capital Resources is heavily exposed to the oil and gas industry with seventy percent of investments in those sectors. The company has recently brought in leading distressed debt manager Oak Hill Advisors to manage the fund. The company is trading at over a forty percent discount to net asset value. While I expect further impairments on its energy loans and a likely dividend cut, the combination of the deep discount, strong manager, inside management purchases, low leverage, and healthy liquidity all make a long-term rebound and strong forward risk-adjusted returns appear likely. Of my energy adds, this has been the worst performer thus far, but I believe downside is limited with the market capitalization trading roughly equal to the value of cash, Treasury bills, and non-Energy investments on the balance sheet. Do not be distracted by the potential for short-term losses and heightened volatility. Successful investing in oil and oil-related stocks is as simple as expanding your investment horizon. Even if you trade with a shorter-term focus, momentum could be reversing in oil given the positive trailing one-month return. Disclaimer: My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon. Appendix on Oil/Mattress Momentum: (click to enlarge) Disclosure: The author is long XLE, OHAI, MEMP, CBA, SPLV. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News