Scalper1 News

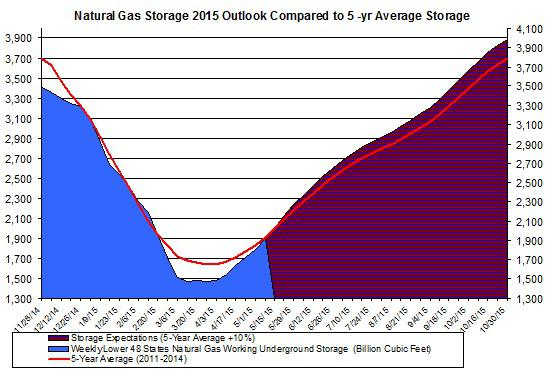

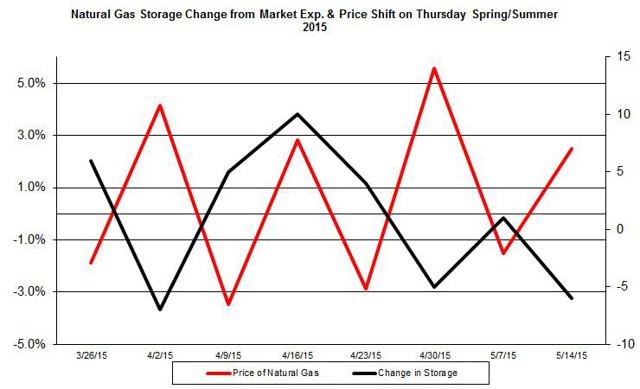

Summary The price of UNG rallied in recent weeks – it’s close to $15. The natural gas storage injection was 111 Bcf last week – below market expectations. Despite the recent recovery in natural gas market, the market still expects a high buildup in storage, which may indicate the price of UNG will remain low this year. The natural gas market continues to show signs of recovery, as the price of the Henry Hub increased by 9.6% since the beginning of the month. Moreover, the price of the United States Natural Gas ETF (NYSEARCA: UNG ) also rose by 10.5% during May. Despite the recovery in the natural gas market, it seems that the future progress of UNG isn’t too optimistic considering the latest Energy Information Administration report . The recent updated short-term outlook for the natural gas market still shows that the price of the Henry Hub is still expected to remain below $3 for the year. This is mostly related to the expected higher-than-normal storage buildup. According to the EIA, the current estimate is that the natural gas storage will rise to 3,890 Bcf by the end of the injection season in October, bringing the net injection to 2,420 Bcf, which will be the second highest injection season. Based on the current storage level, the injections to storage will need to be only, on average, 5% higher than the 5-year average for the storage to reach those levels by the end of October, as you can see in the chart below: Source of data taken from EIA The recent rally in the price of UNG and natural gas was partly driven by deviations between the storage buildup and the market expectations. The chart below shows the relationship between the percent change in the price of natural gas on Thursday – the day the EIA releases its weekly report – and the deviation in storage change from market estimates. (click to enlarge) Source of data: EIA The chart suggests a negative relation between the two data sets – the linear correlation is -0.59 – but since we have only a handful of data points for this injection season, this relation should be taken with a pinch of salt. In the past week, the demand for natural gas has picked up mostly due to higher consumption in the power sector. Considering the price of natural gas is low for the season, we could keep seeing higher demand for natural gas in the power sector. In the next couple of weeks, the weather is expected to be warmer than normal mainly in the East Coast. This could also drive the demand for natural gas in the power sector higher – after all, the cooling degree days are projected to be higher than normal this week. The supply didn’t move much, as the production remained nearly unchanged the past week. According to the latest update by Baker Hughes (NYSE: BHI ), the number of rigs rose again by 2 to 223 – which is still 32% below the level back in 2014. Last week’s injection to storage was 111 Bcf, which was 6 Bcf below market expectations. If the injections to storage were to remain lower than estimates, this could provide a short-term back-wind for UNG. But, over the coming months, the expected higher buildup could indicate the price of UNG isn’t going much higher than its current level. For more see: Natural Gas is Still Floating…Barely Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The price of UNG rallied in recent weeks – it’s close to $15. The natural gas storage injection was 111 Bcf last week – below market expectations. Despite the recent recovery in natural gas market, the market still expects a high buildup in storage, which may indicate the price of UNG will remain low this year. The natural gas market continues to show signs of recovery, as the price of the Henry Hub increased by 9.6% since the beginning of the month. Moreover, the price of the United States Natural Gas ETF (NYSEARCA: UNG ) also rose by 10.5% during May. Despite the recovery in the natural gas market, it seems that the future progress of UNG isn’t too optimistic considering the latest Energy Information Administration report . The recent updated short-term outlook for the natural gas market still shows that the price of the Henry Hub is still expected to remain below $3 for the year. This is mostly related to the expected higher-than-normal storage buildup. According to the EIA, the current estimate is that the natural gas storage will rise to 3,890 Bcf by the end of the injection season in October, bringing the net injection to 2,420 Bcf, which will be the second highest injection season. Based on the current storage level, the injections to storage will need to be only, on average, 5% higher than the 5-year average for the storage to reach those levels by the end of October, as you can see in the chart below: Source of data taken from EIA The recent rally in the price of UNG and natural gas was partly driven by deviations between the storage buildup and the market expectations. The chart below shows the relationship between the percent change in the price of natural gas on Thursday – the day the EIA releases its weekly report – and the deviation in storage change from market estimates. (click to enlarge) Source of data: EIA The chart suggests a negative relation between the two data sets – the linear correlation is -0.59 – but since we have only a handful of data points for this injection season, this relation should be taken with a pinch of salt. In the past week, the demand for natural gas has picked up mostly due to higher consumption in the power sector. Considering the price of natural gas is low for the season, we could keep seeing higher demand for natural gas in the power sector. In the next couple of weeks, the weather is expected to be warmer than normal mainly in the East Coast. This could also drive the demand for natural gas in the power sector higher – after all, the cooling degree days are projected to be higher than normal this week. The supply didn’t move much, as the production remained nearly unchanged the past week. According to the latest update by Baker Hughes (NYSE: BHI ), the number of rigs rose again by 2 to 223 – which is still 32% below the level back in 2014. Last week’s injection to storage was 111 Bcf, which was 6 Bcf below market expectations. If the injections to storage were to remain lower than estimates, this could provide a short-term back-wind for UNG. But, over the coming months, the expected higher buildup could indicate the price of UNG isn’t going much higher than its current level. For more see: Natural Gas is Still Floating…Barely Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News