Scalper1 News

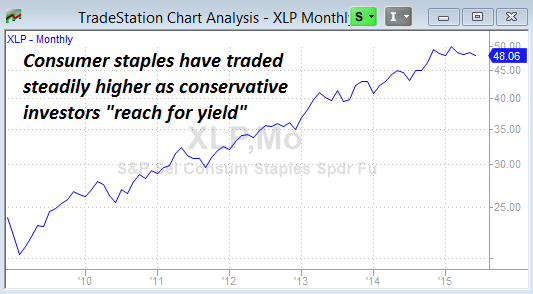

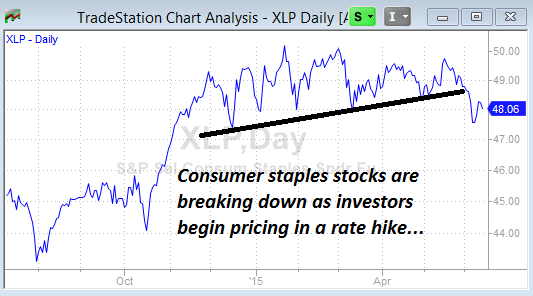

[ Editors Note: This is part one of our series on consumer staples stocks. Stay tuned for additional segments over the next few days.] Consumer staples stocks are considered some of the safest and most reliable equity investments available. Yet in today’s market, these stocks have hidden risks that could lead to serious losses for many conservative investors. Companies in the consumer staples category sell products that are used by consumers in both good times and bad. For example, shoppers aren’t likely to quit buying toothpaste, deodorant, and toilet paper just because their income dropped or they’re tightening the budget. Income investors love consumer staples stocks because the reliable businesses typically support robust dividend payments. In today’s low interest rate environment, these dividend payments are especially attractive to conservative investors who need income from their investment accounts. For the most part, consumer staples stocks are large blue-chip businesses with decades (if not centuries) of profitable operation. A long track record of profits make these stocks attractive for investors who want stability. In the investment business, professionals often overweight consumer staples stocks in the accounts of their most conservative investors. These “widow and orphan” stocks are supposed to be extremely safe for conservative customers. But today, these investments are likely to trade sharply lower. It’s a tragedy that the investors who can least afford to lose money will likely be the ones bearing the brunt of the losses over the next several months. While investors have been able to ignore these risks for quite some time now, the “monsters under the bed” are real (and very dangerous) when it comes to these traditionally safe investments. Two Major Risks For Consumer Staples Consumer staples stocks will likely trade sharply lower over the next few months because of two major factors: Extremely High Valuations Reach For Yield Unwind A stock’s earnings valuation tells us how much investors are willing to pay for a company, compared to how much profit that company will generate. According to Yardini Research Inc., the consumer staples sector is trading at a forward price/earnings (PE) ratio of 19.2. In other words, investors are paying $19.20 for every dollar that will be earned next year. This is the highest valuation seen in more than 15 years (since the dot-com bubble) . Part of the reason why consumer staples are trading at this high valuation is because income investors are reaching for yield . We all know that the Fed has kept interest rates at extremely low levels for years. While this may have helped to support the U.S. economy, an environment of low rates has hurt savers. Conservative investors who held money in CDs and other deposit accounts couldn’t generate as much income with rates lower. The only choice for many of these investors was to buy stocks that paid dividends. And since these investors were conservative by nature, the consumer staples sector was a natural place for them to invest their “safe” money into. The multi-year chart of the Consumer Staples Select Sector SPDR ETF (NYSEARCA: XLP ) below shows how this group of stocks has traded steadily higher over the period in which the Fed has kept rates at essentially zero. After a fantastic 6-year rally, the bullish trend for consumer staples is coming to an end. Valuations cannot be stretched much further, and a shift in the Fed’s interest rate policy spells trouble for this important group of income stocks. A New Era for Interest Rates During the financial crisis, the Federal Reserve lowered its federal funds target rate to a range between 0% and 0.25%. This target rate has significant influence over other interest rates including deposit accounts, mortgages and even bond yields. The Fed has kept the rate low in an effort to make cash cheap for financial institutions and to encourage lending. There’s also a strong argument that the Fed lowered rates in an attempt to inflate the stock market (making it easier for institutional investors to borrow cheaply and buy shares of stock – sending market prices higher). A discussion of Fed policy is outside the scope of this article. But suffice it to say that a period of low rates has helped to boost stock prices for consumer staples. And a reversal of that policy will likely have a very bearish effect on this sector. During the month of May, the U.S. economy added another 280,000 jobs. This figure came in well ahead of economists’ expectations. Meanwhile, the number of job openings in the U.S. rose to 5.4 million – the highest reading recorded since the Bureau of Labor Statistics started tracking the data in 2000. A strengthening labor market should lead to a Fed decision to raise rates this year. Already, traders are pricing in a probable rate hike when the Fed meets in September. Mortgage rates are already moving higher in anticipation of this hike, with the average rate on a new 30-year fixed mortgage now above 4%. Unwinding of the Reach For Yield When rates move higher, conservative investors will have more options for generating income. In particular, deposit accounts and treasury bonds will see their yields rise. When faced with a choice between stocks that pay a particular yield – and could lose value, and deposit accounts with a similar yield – which cannot lose value, the most conservative investors are likely to opt for the deposit accounts. As these conservative investors move cash out of dividend stocks like consumer staples, and into deposit accounts, the stock prices for this sector will likely decline sharply. We’ve been warning about this reach for yield unwind since our April alert, Don’t Touch That Blue Chip Dividend Stock! Looking at the daily chart for consumer staples below, we can see that the group has already started breaking down as investors anticipate higher interest rates. While consumer staples stocks have traditionally been a great source of stable income for investors, the current market environment makes this sector very dangerous. We’re encouraging investors to take profits in these stocks and avoid the area for the next several months. Once the sector trades lower and valuations are back to more attractive levels, it may be a great time to reinvest capital into this group. But for now, the “widow and orphan” stocks are some of the most dangerous investments in the market. Below is a list of the top stocks included in the consumer staples ETF as compiled by Morningstar. This is a good list to start with when reviewing your portfolio for exposure to consumer staples stocks. In addition to reducing exposure to consumer staples stocks, tactical traders may want to set up bearish trades to profit from a decline. Shorting shares of these stocks with a tight stop, or entering bearish spread trade with options are just two of the ways traders can profit from falling stock prices. In our next installment in this series, we’ll start looking at individual stocks in this group. In the meantime, we’d love to hear your thoughts on consumer staples. Please use the comment section below to let us know your thoughts on this group. Scalper1 News

[ Editors Note: This is part one of our series on consumer staples stocks. Stay tuned for additional segments over the next few days.] Consumer staples stocks are considered some of the safest and most reliable equity investments available. Yet in today’s market, these stocks have hidden risks that could lead to serious losses for many conservative investors. Companies in the consumer staples category sell products that are used by consumers in both good times and bad. For example, shoppers aren’t likely to quit buying toothpaste, deodorant, and toilet paper just because their income dropped or they’re tightening the budget. Income investors love consumer staples stocks because the reliable businesses typically support robust dividend payments. In today’s low interest rate environment, these dividend payments are especially attractive to conservative investors who need income from their investment accounts. For the most part, consumer staples stocks are large blue-chip businesses with decades (if not centuries) of profitable operation. A long track record of profits make these stocks attractive for investors who want stability. In the investment business, professionals often overweight consumer staples stocks in the accounts of their most conservative investors. These “widow and orphan” stocks are supposed to be extremely safe for conservative customers. But today, these investments are likely to trade sharply lower. It’s a tragedy that the investors who can least afford to lose money will likely be the ones bearing the brunt of the losses over the next several months. While investors have been able to ignore these risks for quite some time now, the “monsters under the bed” are real (and very dangerous) when it comes to these traditionally safe investments. Two Major Risks For Consumer Staples Consumer staples stocks will likely trade sharply lower over the next few months because of two major factors: Extremely High Valuations Reach For Yield Unwind A stock’s earnings valuation tells us how much investors are willing to pay for a company, compared to how much profit that company will generate. According to Yardini Research Inc., the consumer staples sector is trading at a forward price/earnings (PE) ratio of 19.2. In other words, investors are paying $19.20 for every dollar that will be earned next year. This is the highest valuation seen in more than 15 years (since the dot-com bubble) . Part of the reason why consumer staples are trading at this high valuation is because income investors are reaching for yield . We all know that the Fed has kept interest rates at extremely low levels for years. While this may have helped to support the U.S. economy, an environment of low rates has hurt savers. Conservative investors who held money in CDs and other deposit accounts couldn’t generate as much income with rates lower. The only choice for many of these investors was to buy stocks that paid dividends. And since these investors were conservative by nature, the consumer staples sector was a natural place for them to invest their “safe” money into. The multi-year chart of the Consumer Staples Select Sector SPDR ETF (NYSEARCA: XLP ) below shows how this group of stocks has traded steadily higher over the period in which the Fed has kept rates at essentially zero. After a fantastic 6-year rally, the bullish trend for consumer staples is coming to an end. Valuations cannot be stretched much further, and a shift in the Fed’s interest rate policy spells trouble for this important group of income stocks. A New Era for Interest Rates During the financial crisis, the Federal Reserve lowered its federal funds target rate to a range between 0% and 0.25%. This target rate has significant influence over other interest rates including deposit accounts, mortgages and even bond yields. The Fed has kept the rate low in an effort to make cash cheap for financial institutions and to encourage lending. There’s also a strong argument that the Fed lowered rates in an attempt to inflate the stock market (making it easier for institutional investors to borrow cheaply and buy shares of stock – sending market prices higher). A discussion of Fed policy is outside the scope of this article. But suffice it to say that a period of low rates has helped to boost stock prices for consumer staples. And a reversal of that policy will likely have a very bearish effect on this sector. During the month of May, the U.S. economy added another 280,000 jobs. This figure came in well ahead of economists’ expectations. Meanwhile, the number of job openings in the U.S. rose to 5.4 million – the highest reading recorded since the Bureau of Labor Statistics started tracking the data in 2000. A strengthening labor market should lead to a Fed decision to raise rates this year. Already, traders are pricing in a probable rate hike when the Fed meets in September. Mortgage rates are already moving higher in anticipation of this hike, with the average rate on a new 30-year fixed mortgage now above 4%. Unwinding of the Reach For Yield When rates move higher, conservative investors will have more options for generating income. In particular, deposit accounts and treasury bonds will see their yields rise. When faced with a choice between stocks that pay a particular yield – and could lose value, and deposit accounts with a similar yield – which cannot lose value, the most conservative investors are likely to opt for the deposit accounts. As these conservative investors move cash out of dividend stocks like consumer staples, and into deposit accounts, the stock prices for this sector will likely decline sharply. We’ve been warning about this reach for yield unwind since our April alert, Don’t Touch That Blue Chip Dividend Stock! Looking at the daily chart for consumer staples below, we can see that the group has already started breaking down as investors anticipate higher interest rates. While consumer staples stocks have traditionally been a great source of stable income for investors, the current market environment makes this sector very dangerous. We’re encouraging investors to take profits in these stocks and avoid the area for the next several months. Once the sector trades lower and valuations are back to more attractive levels, it may be a great time to reinvest capital into this group. But for now, the “widow and orphan” stocks are some of the most dangerous investments in the market. Below is a list of the top stocks included in the consumer staples ETF as compiled by Morningstar. This is a good list to start with when reviewing your portfolio for exposure to consumer staples stocks. In addition to reducing exposure to consumer staples stocks, tactical traders may want to set up bearish trades to profit from a decline. Shorting shares of these stocks with a tight stop, or entering bearish spread trade with options are just two of the ways traders can profit from falling stock prices. In our next installment in this series, we’ll start looking at individual stocks in this group. In the meantime, we’d love to hear your thoughts on consumer staples. Please use the comment section below to let us know your thoughts on this group. Scalper1 News

Scalper1 News