Scalper1 News

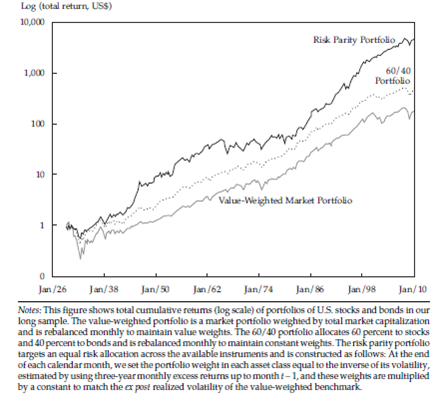

Summary This series offers an expansive look at the Low Volatility Anomaly, or why lower risk securities have historically produced stronger risk-adjusted returns than higher risk securities or the broader market. After examining the historical evidence of the outperformance of lower volatility stocks and bonds relative to their higher risk comps, this article examines a cross-market strategy. The long-run success of risk parity investing is closely linked to our previously discussed Leverage Aversion Hypothesis. In previous articles in this series, I have demonstrated the presence of the Low Volatility Anomaly in both the equity and fixed income markets. In the introductory article to this series , I demonstrated that a low volatility bent (NYSEARCA: SPLV ) to the broader equity market has outperformed both the broader market (NYSEARCA: SPY ) and high beta stocks (NYSEARCA: SPHB ) on both an absolute and risk-adjusted basis over the last quarter century. In the last article in this series , I demonstrated that lower levered BB rated bonds have produced higher absolute returns than higher levered single-B and CCC-rated bonds historically, as the higher yields on the lower rated securities failed to make up for their higher realized default rate. Our empirical evidence thus far has examined the Low Volatility Anomaly within distinct asset classes. This article examines a potential application across asset classes. Risk Parity A 2012 research paper by Clifford Asness, Andrea Frazzini, and Lasse H. Pedersen, ” Leverage Aversion and Risk Parity ” demonstrates that in an investment landscape characterized by, at a minimum, declining incremental returns for higher risk assets, then an approach to asset allocation, risk parity investing, that seeks to diversify in terms of risk and not dollars is preferable. To diversify by risk, more money is invested in low-risk/low volatility assets than in high risk/high beta assets, and leverage is applied to low risk assets to increase both expected returns and risk to its desired level. (If this sounds familiar to the aforementioned ” Betting Against Beta ” analysis, note the overlap in two of the authors.) In their study with data dating to 1926 (see below), the authors demonstrated that a portfolio that targets an equal risk allocation between bonds and stocks meaningfully outperforms 1) U.S. stocks and bonds weighted by total market capitalization, and 2) a portfolio rebalanced monthly to maintain a fixed 60%/40% stock/bond weighting. A preference for risk parity investing necessarily implies expected stock returns continue to produce an insufficiently high equity risk premium as was witnessed by the underperformance of the equity market relative to levered fixed income in the historical sample depicted above. The ballyhooed equity risk premium ( Mehra and Prescott 1985 ), like the risk premium attributable to high beta stocks, is negative in this data over this time horizon featuring multiple business cycles. This phenomenon has given rise to this notion of risk parity investing, a method of diversifying by risk rather than dollars in equities and bonds. This of course runs counter to the traditional notion of holding the market portfolio levered according to the investor’s risk profile instilled by the Capital Asset Pricing Model (CAPM), the model we have been exposing throughout this series. Our first hypothesis for the presence of the Low Volatility Anomaly detailed in this series was the Leverage Aversion Hypothesis . If higher risk-adjusted returns can be made through leveraged fixed income than holding un-levered equities, then risk parity can be viewed as another form of exploitation of the Low Volatility Anomaly. Disclaimer My articles may contain statements and projections that are forward-looking in nature, and therefore, inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon. Disclosure: I am/we are long SPLV, SPY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary This series offers an expansive look at the Low Volatility Anomaly, or why lower risk securities have historically produced stronger risk-adjusted returns than higher risk securities or the broader market. After examining the historical evidence of the outperformance of lower volatility stocks and bonds relative to their higher risk comps, this article examines a cross-market strategy. The long-run success of risk parity investing is closely linked to our previously discussed Leverage Aversion Hypothesis. In previous articles in this series, I have demonstrated the presence of the Low Volatility Anomaly in both the equity and fixed income markets. In the introductory article to this series , I demonstrated that a low volatility bent (NYSEARCA: SPLV ) to the broader equity market has outperformed both the broader market (NYSEARCA: SPY ) and high beta stocks (NYSEARCA: SPHB ) on both an absolute and risk-adjusted basis over the last quarter century. In the last article in this series , I demonstrated that lower levered BB rated bonds have produced higher absolute returns than higher levered single-B and CCC-rated bonds historically, as the higher yields on the lower rated securities failed to make up for their higher realized default rate. Our empirical evidence thus far has examined the Low Volatility Anomaly within distinct asset classes. This article examines a potential application across asset classes. Risk Parity A 2012 research paper by Clifford Asness, Andrea Frazzini, and Lasse H. Pedersen, ” Leverage Aversion and Risk Parity ” demonstrates that in an investment landscape characterized by, at a minimum, declining incremental returns for higher risk assets, then an approach to asset allocation, risk parity investing, that seeks to diversify in terms of risk and not dollars is preferable. To diversify by risk, more money is invested in low-risk/low volatility assets than in high risk/high beta assets, and leverage is applied to low risk assets to increase both expected returns and risk to its desired level. (If this sounds familiar to the aforementioned ” Betting Against Beta ” analysis, note the overlap in two of the authors.) In their study with data dating to 1926 (see below), the authors demonstrated that a portfolio that targets an equal risk allocation between bonds and stocks meaningfully outperforms 1) U.S. stocks and bonds weighted by total market capitalization, and 2) a portfolio rebalanced monthly to maintain a fixed 60%/40% stock/bond weighting. A preference for risk parity investing necessarily implies expected stock returns continue to produce an insufficiently high equity risk premium as was witnessed by the underperformance of the equity market relative to levered fixed income in the historical sample depicted above. The ballyhooed equity risk premium ( Mehra and Prescott 1985 ), like the risk premium attributable to high beta stocks, is negative in this data over this time horizon featuring multiple business cycles. This phenomenon has given rise to this notion of risk parity investing, a method of diversifying by risk rather than dollars in equities and bonds. This of course runs counter to the traditional notion of holding the market portfolio levered according to the investor’s risk profile instilled by the Capital Asset Pricing Model (CAPM), the model we have been exposing throughout this series. Our first hypothesis for the presence of the Low Volatility Anomaly detailed in this series was the Leverage Aversion Hypothesis . If higher risk-adjusted returns can be made through leveraged fixed income than holding un-levered equities, then risk parity can be viewed as another form of exploitation of the Low Volatility Anomaly. Disclaimer My articles may contain statements and projections that are forward-looking in nature, and therefore, inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon. Disclosure: I am/we are long SPLV, SPY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News