Scalper1 News

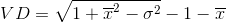

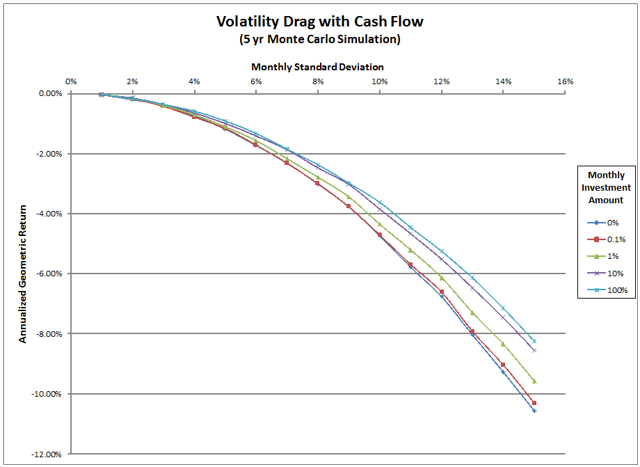

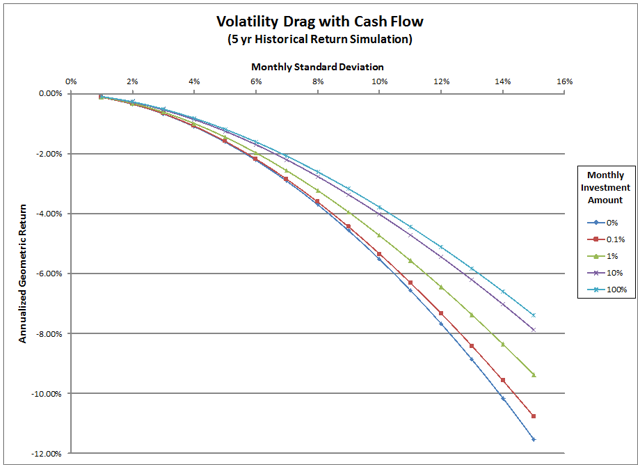

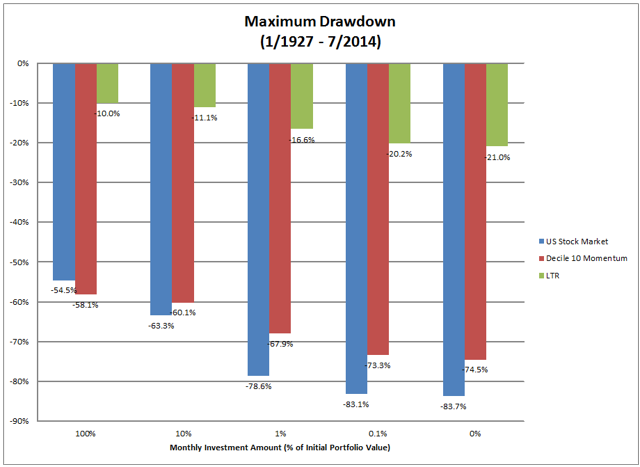

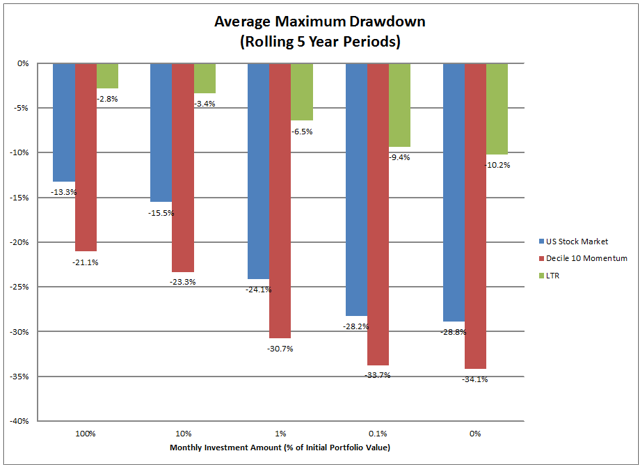

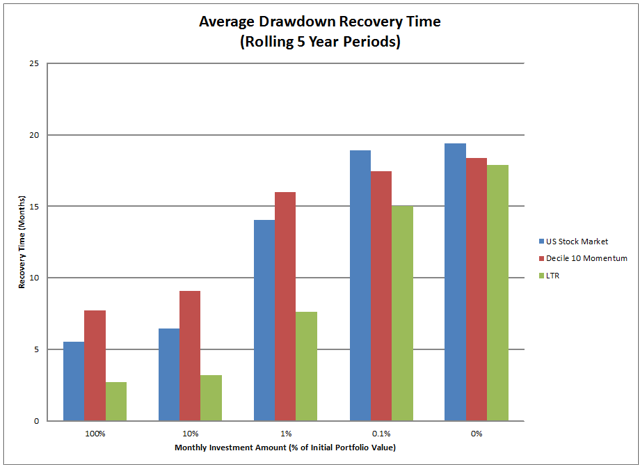

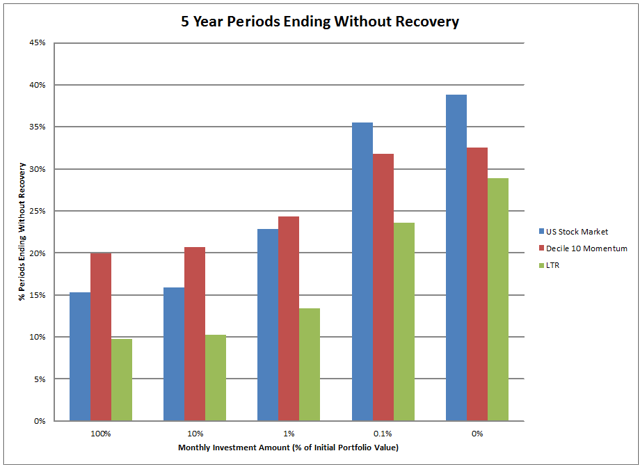

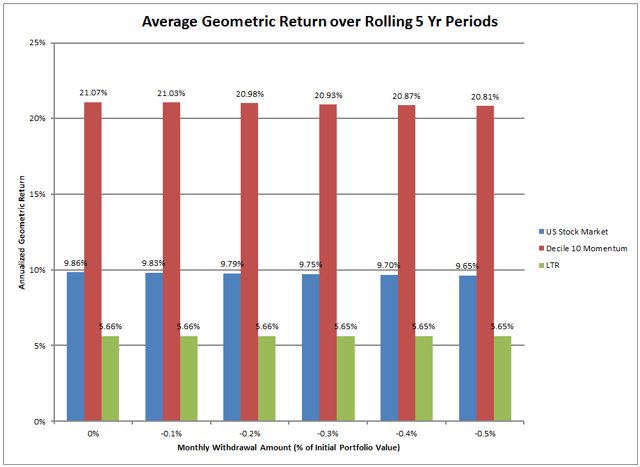

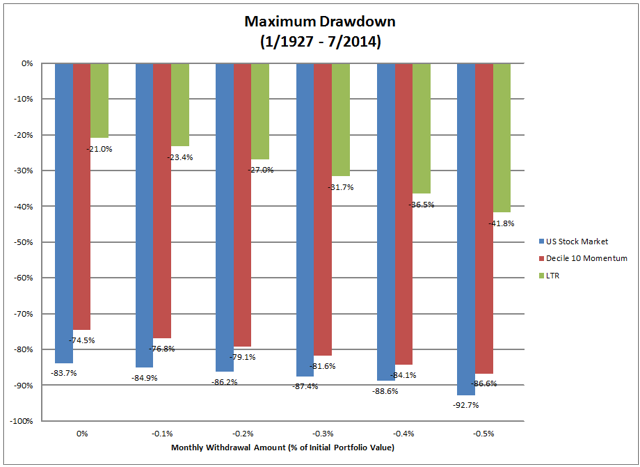

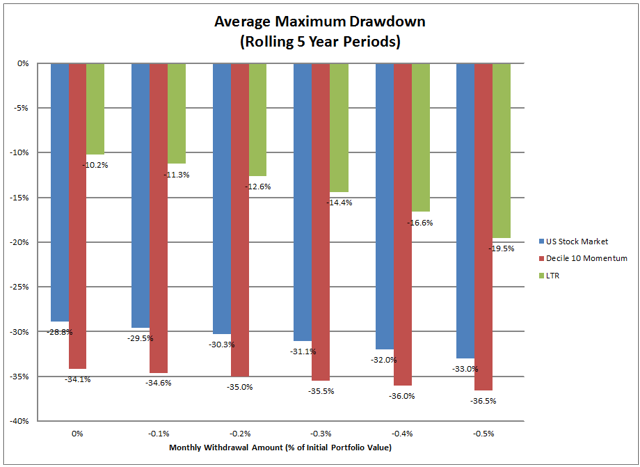

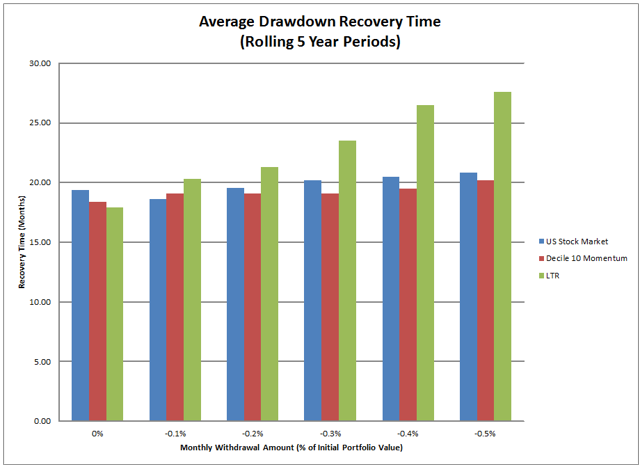

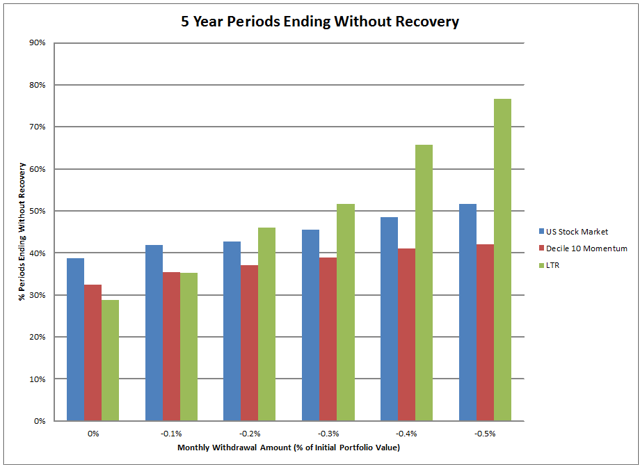

Guest Post: By Chris Scott Investors trying to make decisions on how to invest their savings face many complications that are frequently ignored in research papers on asset allocation. Often, it is assumed that a fixed lump sum of money is invested. But this is rarely the case in real-world investing for the individual investor. Typically, an investor will be either accumulating funds or drawing down funds, which results in regular cash flows into or out of investment accounts. These cash flows can have a significant impact on the investment results obtained, and therefore, should influence asset selection and asset allocation decisions. The objective of asset selection/asset allocation is to maximize return for a given amount of risk. When evaluating investment assets and making asset allocation decisions, asset volatility is a bad thing. Higher volatility typically means more risk. Higher volatility also reduces the geometric mean of returns (compound returns). When there are no cash flows into or out of an investment, this reduction in return from volatility drag (VD) can be estimated by: Or, to be more precise, we can calculate: VD is one of the reasons for generally trying to avoid or limit assets with high levels of volatility. However, periodic cash flow into an account changes the impact volatility can have on geometric returns. With regular contributions to an investment account, you are dollar-cost averaging into the investment. When the price of the investment increases, you purchase fewer shares. When the price of the investment decreases, you purchase more shares. To see how periodic cash flows into an account affect the geometric return of volatile investments, I ran a monte carlo simulation utilizing a normally distributed zero return investment with varying levels of volatility. Regular periodic cash flows of a fixed size were invested on a monthly basis. The size of the monthly cash flow tested ranged from 0.1% to 100% of the total initial account value. Each simulation trial was run for 60 months. After 100,000 trials for each set of parameters, the results of the trials were averaged. The graph below shows that even modest regular cash flows into an investment reduces the negative impact volatility drag can have on geometric returns. (click to enlarge) These are hypothetical results, and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. How do things change when using historical returns which exhibit serial auto-correlation, fat tails, and skewness? I repeated the simulation using monthly US stock market returns from 1926 to the present (returns are from the Ken French data library ). The returns were de-meaned and scaled to a desired standard deviation (average return is subtracted from each monthly return to produce a time series with an arithmetic average of zero, then multiplied by a scalar to increase/decrease the standard deviation). This results in 1000 5-year overlapping periods. The outcome shows that with actual returns, there is slightly more reduction in volatility drag compared to the monte carlo simulation. For reference, the monthly standard deviation for US stock market returns since 1926 has been 5.4%. (click to enlarge) These are hypothetical results, and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. So we can see that positive cash flow into an investment reduces the negative impact of volatility on returns, but that doesn’t mean an investor should blindly seek out volatility when there are significant positive cash flows into an account. Volatility hurts geometric returns. Ultimately, achieving good results is still about investing in assets with high expected returns. Typically, an investor will avoid or limit investments in high-volatility assets due to their risk. Positive cash flow into high expected return, high-volatility investments can reduce their perceived riskiness. To illustrate this, let’s consider the following assets: US cap-weighted stock market, US decile 10 momentum stocks – equal-weighted, and long-term US Treasury bonds (LTR). These three assets provide a set of risky assets with a range of returns and volatilities. Monthly Statistics LTR Mkt. Mom. Average Return 0.5% 0.9% 1.8% Standard Deviation 2.4% 5.4% 7.4% Using monthly returns from 1/1927 to 7/2014, rolling 5-year periods were simulated with varying levels of positive cash flow. (click to enlarge) These are hypothetical results, and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Historically, decile 10 momentum stocks produce fantastic returns, but with high volatility and drawdowns. Consistent with the previous simulations, average geometric returns improve with fixed regular monthly investments. With their lower volatility, long-term bonds show very little improvement, while decile 10 momentum stocks add 90 basis points of return for the high-cash flow scenario. The following charts represent drawdowns in a portfolio’s value, including the added funds invested. In other words, no adjustment is made for the increasing value of cash invested. So, if an investment experiences a decline of 10%, then additional cash of 5% is added to the portfolio that month, and it is treated as a 5% drawdown. (click to enlarge) These are hypothetical results, and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. (click to enlarge) These are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. (click to enlarge) These are hypothetical results, and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. (click to enlarge) The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. With funds being invested monthly, the depth and duration of drawdowns are significantly reduced. Of course, the investment risk hasn’t changed, and the improved drawdown metrics are mostly a function of adding funds. The investment still experiences severe drawdowns in market crashes and the returns during the crash are horrible, but the pain of the drawdowns is muted by the cash flows. While it seems easy to discount this effect, it can provide an important mental benefit to the investor. The illusion of a rapid recovery in value can make the high-return/high-volatility asset seem more tolerable, enabling the investor to allocate more to risky assets, and therefore improving long-term results. It should be obvious that the 100% cash flow scenario applies to a young investor with no savings who is starting to invest. However, long-time investors who have built up substantial portfolios may wonder if any of this is useful for an investor whose cash flow into their investments is now small relative to their total portfolio value. Even in the case where an investor’s additional contributions are small relative to the entire portfolio, there still can be high positive cash flow situations. Due to government tax rules, there are significant restrictions on moving funds between different classes of accounts (IRA, Roth IRA, 401k, etc.). For example, if you change jobs, you start over with a brand new 401k account. You can rollover your 401k from your previous employer to an IRA to take advantage of the better investment options available in a brokerage IRA. The new 401k account will start with a zero balance, with no opportunity for funding other than from monthly payroll contributions. The 100% cash flow scenario would also apply to this case, providing an opportunity to allocate more to higher-risk/higher-expected return assets in the new 401k than in the other accounts. Now let’s look at what happens when there are negative cash flows. As you would expect, negative cash flow from a volatile investment further reduces geometric returns. Using monthly returns from 1/1927 to 7/2014, rolling 5-year periods were simulated with varying levels of negative cash flow. (click to enlarge) Again, long-term treasuries show little impact to geometric returns, but the momentum stocks’ geometric returns were reduced by 26 basis points at the highest withdrawal rate. So, there’s an impact from negative cash flow, but at sane withdrawal rates, the return reduction is fairly small. The impact to the drawdown metrics is more dramatic, but not always in the way you would expect. (click to enlarge) Maximum drawdowns worsen with increasing negative cash flows. These Great Depression drawdowns illustrate the extreme case of things going bad for a retiree invested in equities! (click to enlarge) Long-term treasuries suffer from their low returns, showing significant average drawdowns as the withdrawal rate increases. (click to enlarge) While the withdrawals seem to have a minimal impact on the portfolio recovery time for equities, that’s not the case. This chart only represents the recovery time where the portfolio recovered by the end of a 5-year period. On the next chart, you can see the significant increase in periods that ended without recovering from the drawdown. (click to enlarge) In the end, even with negative cash flow, it’s still about investing in assets with high expected returns. One could argue that taking withdrawals would naturally result in a declining portfolio value, which is to be expected and okay as long as you don’t run out of money, and therefore the worsened drawdown statistics with withdrawals are not relevant. However, the mental impact to a newly retired investor of a portfolio that declines and doesn’t recover year after year after year can be significant. I’ve intentionally only used individual assets rather than diversified portfolios to illustrate the impact of cash flows on risk and returns. By combining uncorrelated assets into a diversified portfolio, the overall risk/return characteristics of the investment can be improved, while all the same principles and effects associated with cash flows still apply. Ultimately, it is up to each investor to determine how much risk they can take and still sleep at night. Having an understanding of how your portfolio – and the assets in it – behave when there are positive or negative cash flows is an important aspect of getting a good night’s sleep! Original Post Scalper1 News

Guest Post: By Chris Scott Investors trying to make decisions on how to invest their savings face many complications that are frequently ignored in research papers on asset allocation. Often, it is assumed that a fixed lump sum of money is invested. But this is rarely the case in real-world investing for the individual investor. Typically, an investor will be either accumulating funds or drawing down funds, which results in regular cash flows into or out of investment accounts. These cash flows can have a significant impact on the investment results obtained, and therefore, should influence asset selection and asset allocation decisions. The objective of asset selection/asset allocation is to maximize return for a given amount of risk. When evaluating investment assets and making asset allocation decisions, asset volatility is a bad thing. Higher volatility typically means more risk. Higher volatility also reduces the geometric mean of returns (compound returns). When there are no cash flows into or out of an investment, this reduction in return from volatility drag (VD) can be estimated by: Or, to be more precise, we can calculate: VD is one of the reasons for generally trying to avoid or limit assets with high levels of volatility. However, periodic cash flow into an account changes the impact volatility can have on geometric returns. With regular contributions to an investment account, you are dollar-cost averaging into the investment. When the price of the investment increases, you purchase fewer shares. When the price of the investment decreases, you purchase more shares. To see how periodic cash flows into an account affect the geometric return of volatile investments, I ran a monte carlo simulation utilizing a normally distributed zero return investment with varying levels of volatility. Regular periodic cash flows of a fixed size were invested on a monthly basis. The size of the monthly cash flow tested ranged from 0.1% to 100% of the total initial account value. Each simulation trial was run for 60 months. After 100,000 trials for each set of parameters, the results of the trials were averaged. The graph below shows that even modest regular cash flows into an investment reduces the negative impact volatility drag can have on geometric returns. (click to enlarge) These are hypothetical results, and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. How do things change when using historical returns which exhibit serial auto-correlation, fat tails, and skewness? I repeated the simulation using monthly US stock market returns from 1926 to the present (returns are from the Ken French data library ). The returns were de-meaned and scaled to a desired standard deviation (average return is subtracted from each monthly return to produce a time series with an arithmetic average of zero, then multiplied by a scalar to increase/decrease the standard deviation). This results in 1000 5-year overlapping periods. The outcome shows that with actual returns, there is slightly more reduction in volatility drag compared to the monte carlo simulation. For reference, the monthly standard deviation for US stock market returns since 1926 has been 5.4%. (click to enlarge) These are hypothetical results, and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. So we can see that positive cash flow into an investment reduces the negative impact of volatility on returns, but that doesn’t mean an investor should blindly seek out volatility when there are significant positive cash flows into an account. Volatility hurts geometric returns. Ultimately, achieving good results is still about investing in assets with high expected returns. Typically, an investor will avoid or limit investments in high-volatility assets due to their risk. Positive cash flow into high expected return, high-volatility investments can reduce their perceived riskiness. To illustrate this, let’s consider the following assets: US cap-weighted stock market, US decile 10 momentum stocks – equal-weighted, and long-term US Treasury bonds (LTR). These three assets provide a set of risky assets with a range of returns and volatilities. Monthly Statistics LTR Mkt. Mom. Average Return 0.5% 0.9% 1.8% Standard Deviation 2.4% 5.4% 7.4% Using monthly returns from 1/1927 to 7/2014, rolling 5-year periods were simulated with varying levels of positive cash flow. (click to enlarge) These are hypothetical results, and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Historically, decile 10 momentum stocks produce fantastic returns, but with high volatility and drawdowns. Consistent with the previous simulations, average geometric returns improve with fixed regular monthly investments. With their lower volatility, long-term bonds show very little improvement, while decile 10 momentum stocks add 90 basis points of return for the high-cash flow scenario. The following charts represent drawdowns in a portfolio’s value, including the added funds invested. In other words, no adjustment is made for the increasing value of cash invested. So, if an investment experiences a decline of 10%, then additional cash of 5% is added to the portfolio that month, and it is treated as a 5% drawdown. (click to enlarge) These are hypothetical results, and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. (click to enlarge) These are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. (click to enlarge) These are hypothetical results, and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. (click to enlarge) The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. With funds being invested monthly, the depth and duration of drawdowns are significantly reduced. Of course, the investment risk hasn’t changed, and the improved drawdown metrics are mostly a function of adding funds. The investment still experiences severe drawdowns in market crashes and the returns during the crash are horrible, but the pain of the drawdowns is muted by the cash flows. While it seems easy to discount this effect, it can provide an important mental benefit to the investor. The illusion of a rapid recovery in value can make the high-return/high-volatility asset seem more tolerable, enabling the investor to allocate more to risky assets, and therefore improving long-term results. It should be obvious that the 100% cash flow scenario applies to a young investor with no savings who is starting to invest. However, long-time investors who have built up substantial portfolios may wonder if any of this is useful for an investor whose cash flow into their investments is now small relative to their total portfolio value. Even in the case where an investor’s additional contributions are small relative to the entire portfolio, there still can be high positive cash flow situations. Due to government tax rules, there are significant restrictions on moving funds between different classes of accounts (IRA, Roth IRA, 401k, etc.). For example, if you change jobs, you start over with a brand new 401k account. You can rollover your 401k from your previous employer to an IRA to take advantage of the better investment options available in a brokerage IRA. The new 401k account will start with a zero balance, with no opportunity for funding other than from monthly payroll contributions. The 100% cash flow scenario would also apply to this case, providing an opportunity to allocate more to higher-risk/higher-expected return assets in the new 401k than in the other accounts. Now let’s look at what happens when there are negative cash flows. As you would expect, negative cash flow from a volatile investment further reduces geometric returns. Using monthly returns from 1/1927 to 7/2014, rolling 5-year periods were simulated with varying levels of negative cash flow. (click to enlarge) Again, long-term treasuries show little impact to geometric returns, but the momentum stocks’ geometric returns were reduced by 26 basis points at the highest withdrawal rate. So, there’s an impact from negative cash flow, but at sane withdrawal rates, the return reduction is fairly small. The impact to the drawdown metrics is more dramatic, but not always in the way you would expect. (click to enlarge) Maximum drawdowns worsen with increasing negative cash flows. These Great Depression drawdowns illustrate the extreme case of things going bad for a retiree invested in equities! (click to enlarge) Long-term treasuries suffer from their low returns, showing significant average drawdowns as the withdrawal rate increases. (click to enlarge) While the withdrawals seem to have a minimal impact on the portfolio recovery time for equities, that’s not the case. This chart only represents the recovery time where the portfolio recovered by the end of a 5-year period. On the next chart, you can see the significant increase in periods that ended without recovering from the drawdown. (click to enlarge) In the end, even with negative cash flow, it’s still about investing in assets with high expected returns. One could argue that taking withdrawals would naturally result in a declining portfolio value, which is to be expected and okay as long as you don’t run out of money, and therefore the worsened drawdown statistics with withdrawals are not relevant. However, the mental impact to a newly retired investor of a portfolio that declines and doesn’t recover year after year after year can be significant. I’ve intentionally only used individual assets rather than diversified portfolios to illustrate the impact of cash flows on risk and returns. By combining uncorrelated assets into a diversified portfolio, the overall risk/return characteristics of the investment can be improved, while all the same principles and effects associated with cash flows still apply. Ultimately, it is up to each investor to determine how much risk they can take and still sleep at night. Having an understanding of how your portfolio – and the assets in it – behave when there are positive or negative cash flows is an important aspect of getting a good night’s sleep! Original Post Scalper1 News

Scalper1 News