Scalper1 News

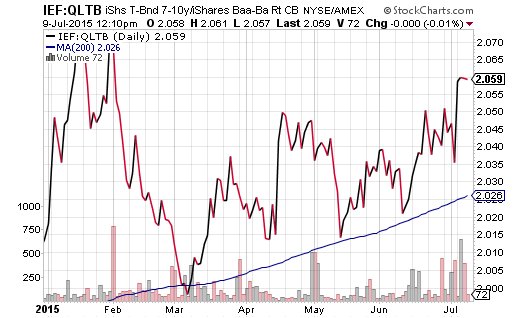

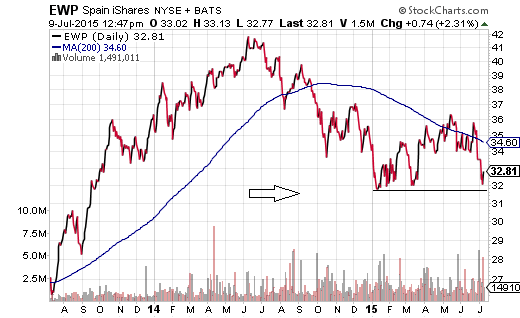

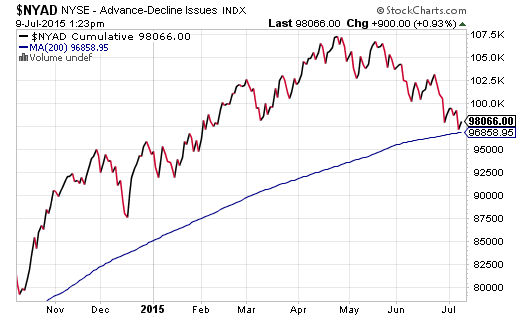

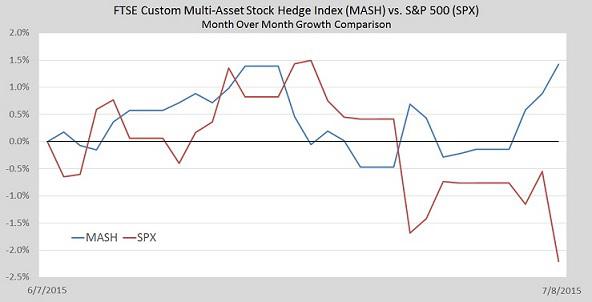

I have noticed a trend toward risk aversion that may adversely affect U.S. stocks. Investors may be in the process of adjusting their expectations for what central banks in Europe, Asia and the United States are capable of achieving. Sure, central banks may try to prevent recessions; they may attempt to inflate stock prices, decrease borrowing costs and/or depreciate currencies. In the end, though, their powers may extend no further than the collective confidence of market participants. Investors have seen a great deal of volatility in U.S. treasuries over the past six months. Early in the year, the combination of recessionary data stateside as well as quantitative easing (QE) measures in Europe helped propel demand for U.S. sovereign debt. Then came the massive unwind, alongside Fed hints at upcoming rate hikes; treasury yields spiked. More recently, the Greece default and the market meltdown in China gave treasuries their groove back. At present, the 10-year yield (2.25%) sits pretty darn close to where it sat at the start of 2015. If I had to project where that yield would be at the end of the year, I’d tell you that it might move up, down and around, but that it would ultimately be near where it is today. I feel the same way about the greenback. In essence, I anticipate that the U.S. dollar may jump around, but that it will not move substantially higher or lower over the next 6 months. In other words, irrespective of financial system shocks, geopolitical uncertainty or central banker gamesmanship, both the buck and the 10-year may be directionless. If I see little reason to invest in the greenback or bet against it, if I do not see value in adding meaningfully to treasuries in a portfolio or betting against them, why discuss U.S. sovereign debt or the U.S. currency at all? Primarily, I have noticed a trend toward risk aversion that may adversely affect U.S. stocks. Take a look at the price ratio between treasuries and crossover corporates – U.S. company bonds that span the lowest end of investment grade (Baa) universe through the highest-rated “junk” (Ba) arena. One can do this by comparing the iShares 7-10 Year Treasury Bond ETF (NYSEARCA: IEF ) with the iShares Baa-Ba Rated Corporate Bond ETF (BATS: QLTB ). In essence, since March, there have been higher lows in the price ratio and a consistent ability for IEF:QLTB to maintain above its long-term trendline. Moreover, the momentum in IEF:QLTB indicates a widening in credit spreads such that investors may be increasingly turning toward the return of capital over a return on capital. The credit spread evidence is hardly an indication of blood in the streets of Pamplona. Nevertheless, the iShares MSCI Spain Capped ETF (NYSEARCA: EWP ) sits near 2015 lows; its current price is well below a long-term 200-day moving average. Indeed, investors may be doubting the ability of the European Central Bank (ECB) to find a path forward. It is one thing to express a desire to “do whatever it takes” to preserve the euro-zone. It is another thing to keep debt-fueled excesses from fracturing alliances. Granted, the People’s Bank of China (PBOC) may eventually contain the fallout from the lightning quick collapse of Chinese equities in Shanghai. And central bankers may yet find a way to kick the toxic debt can down a European cobblestone path; that is, a disorderly “Grexit” for Greece is not an absolute certainty. Even the upswing in S&P 500 VIX Volatility (VIX) is merely a sign that folks are willing to pay a little bit more for index option protection than they were a few weeks earlier. On the other hand, the deterioration in U.S. stock market internals has been decidedly bearish. Both the NYSE Composite and the S&P 500 have significantly more 52-week lows than 52-week highs. Similarly, the number of advancing stocks relative to the number of declining stocks for both indexes has been steadily dropping since mid-May. What these breadth indicators tell you is that fewer and fewer stocks are carrying the entire ship. Like Atlas trying to hold the weight of the world on his shoulders, should he shrug, the benchmarks may buckle. If nothing else, we may be witnessing a “Great Recalibration.” (Did I just come up with a new term?) Investors may be in the process of adjusting their expectations for what central banks in Europe, Asia and the United States are capable of achieving. Sure, central banks may try to prevent recessions; they may attempt to inflate stock prices, decrease borrowing costs and/or depreciate currencies. In the end, though, their powers may extend no further than the collective confidence of market participants. Here’s a look at one last chart that supports the notion that the smarter money may be moving toward risk-off assets. On a month-over-month basis, the FTSE Multi-Asset Stock Hedge (MASH) Index is outperforming the S&P 500. The MASH Index is a collection of non-stock assets that tend to do well in bearish environments, including the yen, the franc, munis, long duration treasuries, inflation-protected securities, German bunds and gold. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. Scalper1 News

I have noticed a trend toward risk aversion that may adversely affect U.S. stocks. Investors may be in the process of adjusting their expectations for what central banks in Europe, Asia and the United States are capable of achieving. Sure, central banks may try to prevent recessions; they may attempt to inflate stock prices, decrease borrowing costs and/or depreciate currencies. In the end, though, their powers may extend no further than the collective confidence of market participants. Investors have seen a great deal of volatility in U.S. treasuries over the past six months. Early in the year, the combination of recessionary data stateside as well as quantitative easing (QE) measures in Europe helped propel demand for U.S. sovereign debt. Then came the massive unwind, alongside Fed hints at upcoming rate hikes; treasury yields spiked. More recently, the Greece default and the market meltdown in China gave treasuries their groove back. At present, the 10-year yield (2.25%) sits pretty darn close to where it sat at the start of 2015. If I had to project where that yield would be at the end of the year, I’d tell you that it might move up, down and around, but that it would ultimately be near where it is today. I feel the same way about the greenback. In essence, I anticipate that the U.S. dollar may jump around, but that it will not move substantially higher or lower over the next 6 months. In other words, irrespective of financial system shocks, geopolitical uncertainty or central banker gamesmanship, both the buck and the 10-year may be directionless. If I see little reason to invest in the greenback or bet against it, if I do not see value in adding meaningfully to treasuries in a portfolio or betting against them, why discuss U.S. sovereign debt or the U.S. currency at all? Primarily, I have noticed a trend toward risk aversion that may adversely affect U.S. stocks. Take a look at the price ratio between treasuries and crossover corporates – U.S. company bonds that span the lowest end of investment grade (Baa) universe through the highest-rated “junk” (Ba) arena. One can do this by comparing the iShares 7-10 Year Treasury Bond ETF (NYSEARCA: IEF ) with the iShares Baa-Ba Rated Corporate Bond ETF (BATS: QLTB ). In essence, since March, there have been higher lows in the price ratio and a consistent ability for IEF:QLTB to maintain above its long-term trendline. Moreover, the momentum in IEF:QLTB indicates a widening in credit spreads such that investors may be increasingly turning toward the return of capital over a return on capital. The credit spread evidence is hardly an indication of blood in the streets of Pamplona. Nevertheless, the iShares MSCI Spain Capped ETF (NYSEARCA: EWP ) sits near 2015 lows; its current price is well below a long-term 200-day moving average. Indeed, investors may be doubting the ability of the European Central Bank (ECB) to find a path forward. It is one thing to express a desire to “do whatever it takes” to preserve the euro-zone. It is another thing to keep debt-fueled excesses from fracturing alliances. Granted, the People’s Bank of China (PBOC) may eventually contain the fallout from the lightning quick collapse of Chinese equities in Shanghai. And central bankers may yet find a way to kick the toxic debt can down a European cobblestone path; that is, a disorderly “Grexit” for Greece is not an absolute certainty. Even the upswing in S&P 500 VIX Volatility (VIX) is merely a sign that folks are willing to pay a little bit more for index option protection than they were a few weeks earlier. On the other hand, the deterioration in U.S. stock market internals has been decidedly bearish. Both the NYSE Composite and the S&P 500 have significantly more 52-week lows than 52-week highs. Similarly, the number of advancing stocks relative to the number of declining stocks for both indexes has been steadily dropping since mid-May. What these breadth indicators tell you is that fewer and fewer stocks are carrying the entire ship. Like Atlas trying to hold the weight of the world on his shoulders, should he shrug, the benchmarks may buckle. If nothing else, we may be witnessing a “Great Recalibration.” (Did I just come up with a new term?) Investors may be in the process of adjusting their expectations for what central banks in Europe, Asia and the United States are capable of achieving. Sure, central banks may try to prevent recessions; they may attempt to inflate stock prices, decrease borrowing costs and/or depreciate currencies. In the end, though, their powers may extend no further than the collective confidence of market participants. Here’s a look at one last chart that supports the notion that the smarter money may be moving toward risk-off assets. On a month-over-month basis, the FTSE Multi-Asset Stock Hedge (MASH) Index is outperforming the S&P 500. The MASH Index is a collection of non-stock assets that tend to do well in bearish environments, including the yen, the franc, munis, long duration treasuries, inflation-protected securities, German bunds and gold. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. Scalper1 News

Scalper1 News