Scalper1 News

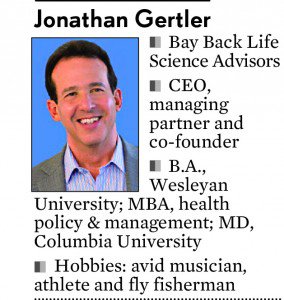

Before Valeant Pharmaceuticals recently cracked up over accounting and management issues, one of the most controversial aspects of its business model was its attitude toward research and development spending. Valeant ( VRX ) would typically pare to the bone the R&D operations of companies it acquired, and chided big pharmas for their allegedly wasteful spending on research. Historically its R&D spending was just 3% of sales. By contrast, the R&D budget of Bristol-Myers Squibb ( BMY ) last year totaled 36% of sales, Pfizer ‘s ( PFE ) was nearly 16% and big biotech Celgene ‘s ( CELG ) was a whopping 40%. But what is really the appropriate spending level for R&D — and how should it be spent? IBD recently asked Jonathan Gertler, a former biotech entrepreneur who advises companies on just this issue as managing partner of Back Bay Life Science Advisors. IBD: Looking over pharma in general, do you think they’re spending the right amount on R&D? Too much? Too little? Gertler: I tend to divide R&D into two categories broadly. There’s the R&D that really is focused on new technology, true biologically driven solutions for diseases. I think that level of spending is appropriate. I think increasingly, the collaborations between smaller and larger companies and the collaborations that are truly advancing between companies and academia really are focused on R&D that’s going to be meaningful in terms of overall national health and international health, and really driving significant solutions. There is still a tendency, in some companies, to look for follow-on commercial pharmaceutical solutions. You see that ranging from the private equity world all the way up through large pharma and specialty pharma, where it’s probably less innovation-driven. And although those dollars are still well spent in terms of the company’s viability, in terms of a primary research agenda they’re probably less important than the new biologically driven therapies. IBD: Another issue is whether companies want to do the R&D in-house or basically buy it by buying a company. Do you have any general guidelines on that? Gertler: In that I would categorize it into three main groups: the smaller companies that are innovation-driven and somewhat capital-constrained; the midcaps that have had success with aspects of their platform, that either have the chance to focus in on that platform alone, and start to diversify around the platform; and, of course, the global pharma companies. I think there was a lot of emphasis over the last number of years about outsourcing R&D entirely. Our system doesn’t work that way. Our system is, at this juncture, a very continuous ecosystem where you have many academics who have gone over to Big Pharma, driving significant R&D efforts; academics who are involved in early-stage companies; and seasoned executives from large companies moving into small companies. The lifeblood of small companies is identifying that which they can really develop, based on either platform or assets, within capital constraints. But then the relationships with the larger companies, where they become the outsourced R&D, is critical. The expertise within those large companies — which should not be eradicated — that has to do with R&D, and then ultimately commercial development, should influence the way those smaller companies act. The flip side of that is that large companies that have to focus — just by the way they’re judged by investors on the Street — on near-term commercial or commercial successes, still have to make sure that the pipeline is intact. If you eradicate R&D functionality from large companies, or significantly hamper it, you won’t have the proper means of identifying those smaller platforms that are going to be truly valuable five and 10 years down the line. And also, you won’t be able to help those smaller platforms both maintain their own organic growth while at the same time partnering out or licensing out to broaden the way the platform can have an impact. So I think the discussion of outsourced R&D vs. in-house R&D has become artificial. Our world at this juncture is too fluid and too sophisticated to justify that binary type of approach. IBD: There’s also been a lot of talk about R&D efficiency, and whether some companies are wasting their resources. What’s your impression on that? Gertler: First of all, I think that drug development is by nature a somewhat messy business. You can try to have an extremely strict, receptor-driven drug in development, but inevitably that will either have too small of an impact in terms of disease outcome, or will have too promiscuous effects on other systems, and then have too much collateral damage associated with its development. So inevitably, just by virtue of the biology, there’s going to be significant inefficiency in the process. I think that smaller companies sometimes do suffer from inefficiency. Their platforms can be very promising, but smaller companies sometimes lose sight of the best way to prove the concept of the platform, which may be economically smaller and tighter, and yet still really open up the platform once you’ve gone over that first inflection-point hurdle into larger things. From a large-company perspective, I think there are certainly many steps along the way, whether it’s in early-stage discovery or preclinical and early clinical development where many things will help us in the years to come — and those include biomarkers, and those include imaging processes for diseases and a greater understanding of selective biology for disease — that will, with the advance of knowledge, make our system more efficient. Doubtless there are inefficiencies in the systems that are due to bureaucracy, and the way things are judged. But I think the primary inefficiency is that drug discovery is, in and of itself, a messy business. IBD: What sort of advice would you give to the nonspecialist investor about judging a company’s R&D program? Gertler: If you’re looking at large companies, there are a lot of drivers of value for the public investor that probably go well beyond R&D. But I still think that using even a simple formula about percentage of R&D spend is probably not the way investors should look at those companies. I think that they should divide them into two areas. Those that are focused on R&D that’s really not primary pharmaceutical or biotech R&D — it has more to do with either me-too drugs or repurposed or reformulated drugs; I think those are less attractive investments. But if you look at larger companies that are really trying to fill the pipeline in a way that makes clinical sense — those are the ones (where), regardless of percentage of R&D spend, there is probably greater interest in having long-term support. The reason I say that is that as our health care system changes continually — and it inevitably will — we’ll have to have systems wherein drugs will have to have higher impact (and) better outcomes, and truly be differentiated to justify reimbursement and support. If you’re not a company that’s focused on that sort of targeted innovation, in the long run you’re not going to do as well. You also have to look at these companies and say, “What is coming out in terms of news in the near term? And is that news going be impactful to the sector it’s targeting?” Meaning: Is it a me-too drug, or is it a sixth-to-market drug that really is going to (have to) prove huge differentiation to make a difference? I think that would be less appealing. Or is it a drug that actually is addressing a significant unmet need, with a more-than-incremental mechanistic change, and where success there will also offer broader opportunity? Those are still the metrics that, even as as generalist investor in a public pharma company, I would bring to bear. For the midcap companies, I think the same principles apply. And the midcaps, which tend to have less-diversified portfolios, have to have that type of thinking applied to them even more stringently. Image provided by Shutterstock . Scalper1 News

Before Valeant Pharmaceuticals recently cracked up over accounting and management issues, one of the most controversial aspects of its business model was its attitude toward research and development spending. Valeant ( VRX ) would typically pare to the bone the R&D operations of companies it acquired, and chided big pharmas for their allegedly wasteful spending on research. Historically its R&D spending was just 3% of sales. By contrast, the R&D budget of Bristol-Myers Squibb ( BMY ) last year totaled 36% of sales, Pfizer ‘s ( PFE ) was nearly 16% and big biotech Celgene ‘s ( CELG ) was a whopping 40%. But what is really the appropriate spending level for R&D — and how should it be spent? IBD recently asked Jonathan Gertler, a former biotech entrepreneur who advises companies on just this issue as managing partner of Back Bay Life Science Advisors. IBD: Looking over pharma in general, do you think they’re spending the right amount on R&D? Too much? Too little? Gertler: I tend to divide R&D into two categories broadly. There’s the R&D that really is focused on new technology, true biologically driven solutions for diseases. I think that level of spending is appropriate. I think increasingly, the collaborations between smaller and larger companies and the collaborations that are truly advancing between companies and academia really are focused on R&D that’s going to be meaningful in terms of overall national health and international health, and really driving significant solutions. There is still a tendency, in some companies, to look for follow-on commercial pharmaceutical solutions. You see that ranging from the private equity world all the way up through large pharma and specialty pharma, where it’s probably less innovation-driven. And although those dollars are still well spent in terms of the company’s viability, in terms of a primary research agenda they’re probably less important than the new biologically driven therapies. IBD: Another issue is whether companies want to do the R&D in-house or basically buy it by buying a company. Do you have any general guidelines on that? Gertler: In that I would categorize it into three main groups: the smaller companies that are innovation-driven and somewhat capital-constrained; the midcaps that have had success with aspects of their platform, that either have the chance to focus in on that platform alone, and start to diversify around the platform; and, of course, the global pharma companies. I think there was a lot of emphasis over the last number of years about outsourcing R&D entirely. Our system doesn’t work that way. Our system is, at this juncture, a very continuous ecosystem where you have many academics who have gone over to Big Pharma, driving significant R&D efforts; academics who are involved in early-stage companies; and seasoned executives from large companies moving into small companies. The lifeblood of small companies is identifying that which they can really develop, based on either platform or assets, within capital constraints. But then the relationships with the larger companies, where they become the outsourced R&D, is critical. The expertise within those large companies — which should not be eradicated — that has to do with R&D, and then ultimately commercial development, should influence the way those smaller companies act. The flip side of that is that large companies that have to focus — just by the way they’re judged by investors on the Street — on near-term commercial or commercial successes, still have to make sure that the pipeline is intact. If you eradicate R&D functionality from large companies, or significantly hamper it, you won’t have the proper means of identifying those smaller platforms that are going to be truly valuable five and 10 years down the line. And also, you won’t be able to help those smaller platforms both maintain their own organic growth while at the same time partnering out or licensing out to broaden the way the platform can have an impact. So I think the discussion of outsourced R&D vs. in-house R&D has become artificial. Our world at this juncture is too fluid and too sophisticated to justify that binary type of approach. IBD: There’s also been a lot of talk about R&D efficiency, and whether some companies are wasting their resources. What’s your impression on that? Gertler: First of all, I think that drug development is by nature a somewhat messy business. You can try to have an extremely strict, receptor-driven drug in development, but inevitably that will either have too small of an impact in terms of disease outcome, or will have too promiscuous effects on other systems, and then have too much collateral damage associated with its development. So inevitably, just by virtue of the biology, there’s going to be significant inefficiency in the process. I think that smaller companies sometimes do suffer from inefficiency. Their platforms can be very promising, but smaller companies sometimes lose sight of the best way to prove the concept of the platform, which may be economically smaller and tighter, and yet still really open up the platform once you’ve gone over that first inflection-point hurdle into larger things. From a large-company perspective, I think there are certainly many steps along the way, whether it’s in early-stage discovery or preclinical and early clinical development where many things will help us in the years to come — and those include biomarkers, and those include imaging processes for diseases and a greater understanding of selective biology for disease — that will, with the advance of knowledge, make our system more efficient. Doubtless there are inefficiencies in the systems that are due to bureaucracy, and the way things are judged. But I think the primary inefficiency is that drug discovery is, in and of itself, a messy business. IBD: What sort of advice would you give to the nonspecialist investor about judging a company’s R&D program? Gertler: If you’re looking at large companies, there are a lot of drivers of value for the public investor that probably go well beyond R&D. But I still think that using even a simple formula about percentage of R&D spend is probably not the way investors should look at those companies. I think that they should divide them into two areas. Those that are focused on R&D that’s really not primary pharmaceutical or biotech R&D — it has more to do with either me-too drugs or repurposed or reformulated drugs; I think those are less attractive investments. But if you look at larger companies that are really trying to fill the pipeline in a way that makes clinical sense — those are the ones (where), regardless of percentage of R&D spend, there is probably greater interest in having long-term support. The reason I say that is that as our health care system changes continually — and it inevitably will — we’ll have to have systems wherein drugs will have to have higher impact (and) better outcomes, and truly be differentiated to justify reimbursement and support. If you’re not a company that’s focused on that sort of targeted innovation, in the long run you’re not going to do as well. You also have to look at these companies and say, “What is coming out in terms of news in the near term? And is that news going be impactful to the sector it’s targeting?” Meaning: Is it a me-too drug, or is it a sixth-to-market drug that really is going to (have to) prove huge differentiation to make a difference? I think that would be less appealing. Or is it a drug that actually is addressing a significant unmet need, with a more-than-incremental mechanistic change, and where success there will also offer broader opportunity? Those are still the metrics that, even as as generalist investor in a public pharma company, I would bring to bear. For the midcap companies, I think the same principles apply. And the midcaps, which tend to have less-diversified portfolios, have to have that type of thinking applied to them even more stringently. Image provided by Shutterstock . Scalper1 News

Scalper1 News