Scalper1 News

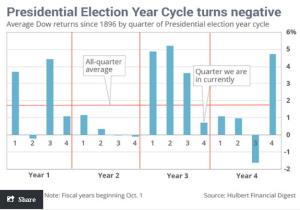

New technologies always excite the animal spirits. Take commercial drones, for instance. At first blush, these pilotless aircraft offer nothing but excitement and good news. Ah, but, there’s “the other side.” And the same is true of “robo-investing” … robo-anything! Amazon (NASDAQ: AMZN ) would be shipping goods to our doorstep via drones, people could watch sporting events up close and personal without having to buy a ticket, you could borrow a cup of sugar from your mom who lives a few miles away, and there would be fewer trucks and vans on our roadways. Sounds pretty good, doesn’t it? Well, put away your Jetsons fantasy for a moment, anyway. It could all happen but, along the way, we need to face the reality that any idiot can buy a drone and do any damn-fool thing they want. That includes voyeurs who want to peep into your private lives. Do you need to keep the curtains closed instead of enjoying a beautiful day or night? It includes pyro-voyeurs flying their drones into wildfire suppression areas, preventing retardant and water carrying aircraft from flying, and increasing the risk of death to firefighters. It includes flying their new toys higher than legally allowed, increasing the risk of mid-air collision with piloted aircraft. You think a bird strike is bad? Add the velocity and weight of even a small drone and imagine the results. Or consider a lone wolf terrorist who doesn’t care what the ultimate regulations might be for controlling drone traffic. What if he launches a few directly into the engine of an A-380 while its engines are running as it awaits its turn to take off on a crowded runway? Then there are the driverless cars being touted as the way to relieve urban traffic congestion; let you read, watch TV or play video games on your daily commute; reduce accidents; and clean up the environment. Let’s talk about vehicle safety. Have you seen the video where a Jeep driven by a human journalist has the systems overridden by faraway hackers and driven into a ditch? (Gently driven into a ditch; this was, after all, a controlled experiment.) Now imagine if a terror group or sovereign state like, say, Iran, Russia or China, with vast cyber-hacking armies under their command, decided to reverse the accident-avoidance systems of cars in the 25 largest American cities just before rush hour, sending vehicles with no allowance for human override careening into each other at high speeds. I love new technologies. But it bears pointing out that there are many sides to every innovation – and that human intervention should be part of any fail-safe robotic system. Otherwise we all become subjects of the old joke about the new pilotless commercial aircraft, where the announcement comes on after takeoff, “Ladies and gentlemen, welcome to USAmDeltaUnited flight # 65492 from Detroit to Puerto Rico. Embracing new technology, we are proud to announce there are no pilots aboard the aircraft and a cabin crew is not necessary since anything you need, our automated robotic attendants can provide. So relax, sit back and enjoy the flight. And remember, nothing can go wrong, hic!, nothing can go wrong, hic!, nothing can go wrong…” Remotely Piloted Aircraft – Test Flight with Passengers (and, for now, a human pilot on board to do the take-off and landing…) (click to enlarge) Like these two new technologies, a certain style of investment management and portfolio allocation has risen its head yet again – as it always does after a 5 or 6 year bull market. The benefit of these approaches is that they don’t require any decision-making. These are automated investment plans that take one of two typical variations: (1) The Bogle School, whose mantra is “Wall Street is a Random Walk so don’t try to beat the market. Just buy and hold a diversified ETF or mutual fund that mirrors a broad-based benchmark like the S&P 500. Never sell until you need to take some funds out for retirement, college or some other important life event.” (2) “Use a robot!” This will be either some quant black box approach that determines when to buy and sell or, better, rebalances a diversified portfolio tied to many different benchmarks like emerging markets, small cap US, large cap international, etc. The rebalancing forces you to buy low and sell high. When one part of the portfolio performs better than the others and another performs worse, the percent of each held will deviate from your chosen parameters, and you’ll rebalance. This approach assumes a steady reversion to the mean so you are, theoretically, selling a part of your winners and adding to your losers, which will revert to the mean and become winners. Our firm starts with something like #2 here but we then add enhancing strategies to tell us what and when to sell and what and when to buy. But for now let’s forget about adding the human element we use, and just take a look at these two very-popular-today “driverless investment vehicles.” Buy-and-hold is great. Until it isn’t. There are two problems with buy-and-hold. As sure as the sun will rise tomorrow, the market will at some point enter a bear market. If there were no bear markets, there’d be no risk and hence no reward. One of two things will happen to buy-and-hold investors during a bear market: either they will hold on or they won’t. Neither are attractive alternatives. In 2008, the S&P 500 lost 38.5% of its value. $100,000 became $61,500. If Mr. Buy-and-Hold held on, he was rewarded when, in 2009, the market rebounded 23.5%. (From March 9 forward, that is; he was down even further in Jan/Feb 2009.) Not too bad, right? Ummm… Not so fast. A 23.5% rise on $63,500 is not the same as a 23.5% rise on $100,000. That rebound in 2009 only took his portfolio back to $75,953. In 2010 a 12.8% rise in the S&P, however, got him back to $85,675! Regrettably, 2011 was exactly flat on the S&P so he spent another year underwater at $85,675. 2012 was a good year and his portfolio increased to $97,156. Then, finally, in early 2013, he broke even. So if Mr. Buy-and-Hold held on for 4 years (dividends would have reduced this holding period somewhat) he’d have suffered confidence, despair, hope, relief and, today, with the unusually strong bull of the last two years, perhaps a misplaced hubris. The alternative would have likely been worse. If Mr. Buy-and-Hold threw in the towel somewhere along the way, maybe in January 2009, he’d have lost 40% and would have gotten back in…when? After the market was up 10%? 20%? 30% ? At some point of emotional despair, Mr. Buy-and-Hold became Mr. Buy-and-Panic and might still not have recouped his losses. That brings us to the latest fad, “Do it Yourself on our Website!” These are the new “robo-investing” sites that tell you that you shouldn’t pay someone else when you could be paying the robo-site much less. I believe a robo-investing site that rebalances regularly but without any human understanding or input about market history, technical analysis, fundamental analysis as to the external economic environment, or behavioral analysis of investor and consumer sentiment is a dangerous place to be – a la the automated airplane. (“Nothing can go wrong, hic!, nothing can go wrong, hic!, nothing can go wrong…”) The problem with robo-investing is that one “might” never experience as serious a loss as Mr. Buy-and-Hold, but Ms. Rebalance-with-Regularity will also never hold on long enough to enjoy long-term sector outperformance. By selling on the basis of an arbitrarily-selected date and a graven-in-stone universe of geographic (US, international, emerging market, etc.) and/or capitalization-weighted (US large cap, foreign mid-cap, etc.) one decides, in advance, to leave much on the table in exchange for not losing big. How much is too much? Besides, if it isn’t possible to beat the benchmarks, then what accounts for the steady outperformance over many years of some of my colleagues with whom I exchange ideas every month? By coincidence the latest issue of Gray Cardiff’s Sound Investing just hit my inbox as I’m writing this. In it, Gray notes that The Hulbert Financial Digest verifies that Sound Advice has earned 11.3% annually since 3/31/2000 versus 2.2% for the S&P 500. And I should note, immodestly, that our own G&V Portfolio has returned 9.4% annually versus the S&P’s 5% over a slightly longer period from 1/1/1999. (My numbers include all S&P dividends.) Maybe Gray and I and all the other colleagues I credit in these pages from time to time have just been lucky for a decade or more. Or maybe it pays to have a human driver; it doesn’t have to be a registered investment advisor – it could be you, me, or someone else you trust, as long as they focus steadily on the road ahead and keep their hands firmly on the wheel. Here’s what I personally see as I look down that road… I expected great things from 2015 at the beginning of the year. It looked as if the economy was going to be able to stand on its own without Fed intervention; it was the third year of the presidential election cycle, a time when the party in power typically juices the economy and the markets; and it seemed as if China, India and Europe were all getting their act together. That’s what it still looks like – in the rear view mirror. Looking ahead, however, I see… The Hotel California in China “Relax” said the night man, “We are programmed to receive.” “You can check-out any time you like, but you can never leave!” These last words from the Eagles 1977 hit song ‘Hotel California’ pretty much sum up the state of things in China right now. You can buy all the stock you like; heck, they’ll even encourage you to buy it on margin. But sell it? How dare you? That would bring the whole Ponzi scheme down in days! (‘Hotel California’ is actually a doubly appropriate reference here; according to the Eagles, the song is about the phoniness and materialism they encountered in L.A. as they began to go from sort-of-known to hitting the big time. If the shoe fits…) At this point, the Chinese authorities have demanded internal records from Chinese and foreign brokerage firms who must prove they never helped fund or facilitate any short-selling; accused a US hedge fund of plotting to bring down prices; instructed the large Chinese state-owned companies with cash in the till to buy additional shares of Chinese companies; stopped all IPOs that may take funds away from current stock purchases; directed more state companies to invest in stocks rather than real estate; and (de facto) instructed Chinese pension funds and mutual funds to invest less in bonds and more in Chinese stocks. That’s a pretty Draconian reaction to a stock market correction that still leaves the Shanghai and Shenzhen exchanges solidly in the black for the year. Which leads me to wonder – what does the Chinese leadership know that we don’t know? My best guess is that they know that the productivity, GDP, real estate values, labor and other numbers being sent out for public consumption are less than wonderful. Basically, they don’t want anyone to look behind the curtain and see what Oz really looks like. We not only won’t be buying this correction, we are now shorting China. As Cnut (‘Canute’), king of Denmark, England and Norway, is alleged to have said to his courtiers and toadies back in the 1020s or so, when they told him he was so powerful he could stop the incoming tide, “No… I can’t.” (Okay, what Henry of Huntingdon reports Cnut really said was “Let all men know how empty and worthless is the power of kings, for there is none worthy of the name, but He whom heaven, earth and sea obey by eternal laws.” In other words, “No… I can’t.”) It seems the autocrats and oligarchs that constitute China’s elite Party members have yet to learn Cnut’s humility. It may take a while to work out, but when it comes to choice between the dictates of rulers and market forces, I’ll take market forces every time. The Presidential Election Cycle Typically, the year before a US Presidential election is a darn good one. And this may yet to prove to be, after we get through the dog days of summer. But for now things are not looking good. Indeed, unless we can mount a rally in the next six to eight weeks, it may be a long cold winter that follows this long hot summer before we can get back to moving forward. That’s because the markets hate uncertainty and the uncertainty markets hate most is which political scourge or savior will replace the current president and, by reflection, who he or she will select as their senior advisors and which representatives may be swept in on their coattails. The chart following is not graven in stone. The chart below is only the average of all years since 1896, and it is only on the Dow Industrials which may be disconnected from other benchmarks. Still, in the event this election cycle is somewhere near the average, it means we are in for a yawner for the next eight months or so, followed by a 2016 summer of discontent before we get the election uncertainty behind us and the market moves ahead smartly for a few months in the reflected glow of “Hope and Change” or whatever the next occupant at 1600 Pennsylvania has promised. Please note that the quarter that ended June 30 (bar 3 on “Year 3” above) was pretty much flat, not nearly as good as the “average.” One might interpret this as meaning there is pent-up demand, or that the handwriting is already on the wall for a queasy next few months, or that, pshaw, it’s just a bunch of numerology that don’t mean nuthin’. I lean toward door #2. As a rapt student of market history, I’ve lived through a lot of these, and that uncertainty thingy tends to get us every time. Not that there’s anything uncertain about 17 Republican presidential candidates and at least 3, maybe more, Democratic candidates, with a strong likelihood that, if not selected, Mr. Trump’s natural narcissism will cause him to run as an independent, continuing his clever way of telling us what we want to hear whether he believes it or not. Yes, 2016 could be complicated this time around. The Fed, Greece, ISIS, Ukraine, Iran, Russia, Etc. You don’t really need me to re-hash all these, do you? Any one of them could (continue to) create even more uncertainty. And, of course, there’s always some economic or political event over the horizon that we can’t see yet. So let’s just move on to… What Are We Doing About It? We’re reallocating our portfolio strategy to reflect what we believe to be the likelihood of a dull market that vacillates between heightened expectations and dashed expectations. That means lightening up on developing markets, energy, industrials, materials, utilities and even some technology firms. It means keeping our health care exposure and adding a bit to the consumer discretionary sector, one of the few bright spots we see as American consumers, tired of belt-tightening, loosen up a little and spend on something fun. It means looking for financials that will benefit as rates rise, which they inevitably will. We’ll leave it to others to benefit via shorting Treasuries and so on; we’ll instead buy insurers and regional banks that are already selling for single digit PEs. We’ll buy some defensive issues in the food and beverage area. And we will hedge our longs with a couple of good inverse ETFs. To wit… We will keep our Wisdom Tree Europe Hedged Equity (NYSEARCA: HEDJ ) because I see continued strength in the US $, making Euro exports relatively cheaper, but we will protect our gains with trailing stops. We’ll sell all shares of Guggenheim S&P 500 Pure Growth (NYSEARCA: RPG ) however. We’ll keep our shares of Royal Dutch Shell (NYSE: RDS.B ) and add to them if prices continue to decline, and we’ll trailing-stop some shares of Wisdom Tree Germany (NASDAQ: DXGE ). We’ll hold onto Marathon Petroleum (NYSE: MPC ) and BP (NYSE: BP ) — for now. At our cost basis and yield-to-cost, we’ll hold Royal Bank of Scotland (NYSE: RBS ) until they force redemption upon us, which they will some day. We feel strongly about the fine portfolio of Tekla Health (NYSE: THQ ), even though it has done nothing so far, so it’s a keeper. We’ll add a bit to our Franco Nevada (NYSE: FNV ). Even if the price of gold and silver don’t recover, FNV is so well-managed that I’m certain there are price-decline and bankruptcy provisions in the loans they make to smaller gold producers that will allow them to emerge from any gold price decline or range-bound trading with a greater share of the gold that is actually produced. Gold won’t stay down forever and it often does best in times of uncertainty. As an income play, I like the preferreds of Public Storage (NYSE: PSA ), particularly the A, T and V preferreds. A better jobs picture means lots more mobility and relocation. Relocation means more people put stuff in storage – as do empty-nesters downsizing and businesses that need a place to store inventory without taking on long-term leases for more space. PSA is the class act in this industry so I see their preferreds, all yielding around 5%, as a great way to invest for income without seeing anything more than a miniscule decline if US interest rates rise. Since we have no real hedge against a serious market decline in this portfolio, I’m also adding some shares of ProShares UltraShort S&P 500 (NYSEARCA: SDS ), which moves inverse to the S&P 500 at double the rate of movement, as well as shares of the iPath S&P 500 VIX (NYSEARCA: VXX ), which is a reflection of the volatility I imagine we’ll be seeing more of in the coming weeks and months. Also we’ll buy, not as a hedge for our long positions but as an outright short on hubris and autocracy, shares of Direxion CSI 300 China A Shares (NYSEARCA: CHAD ). CHAD is an unleveraged short on the 300 largest and most liquid Chinese A Share companies. The Chinese government will do their best to thwart this investment but I say free markets will triumph and we could see rather large profits from this ETF. Finally, we will buy one additional ETF: Fidelity MSCI Consumer Discretionary (NYSEARCA: FDIS ). While it is capitalization-weighted, it covers the entire MSCI (Morgan Stanley Capital International) index so it also includes some non-US firms that I believe will benefit from selling consumer discretionary goods and services to US consumers. As Registered Investment Advisors, we believe it is essential to advise that we do not know your personal financial situation, so the information contained in this communiqué represents the opinions of the staff of Stanford Wealth Management, and should not be construed as “personalized” investment advice. Past performance is no guarantee of future results, rather an obvious statement but clearly too often unheeded judging by the number of investors who buy the current #1 mutual fund one year only to watch it plummet the following year. We encourage you to do your own due diligence on issues we discuss to see if they might be of value in your own investing. We take our responsibility to offer intelligent commentary seriously, but it should not be assumed that investing in any securities we are investing in will always be profitable. We do our best to get it right, and we “eat our own cooking,” but we could be wrong, hence our full disclosure as to whether we own or are buying the investments we write about. Disclosure: I am/we are long FDIS, PSA-T, THQ, BP, FNV, RBS, VXX, CHAD, HEDJ, MPC, SDS. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

New technologies always excite the animal spirits. Take commercial drones, for instance. At first blush, these pilotless aircraft offer nothing but excitement and good news. Ah, but, there’s “the other side.” And the same is true of “robo-investing” … robo-anything! Amazon (NASDAQ: AMZN ) would be shipping goods to our doorstep via drones, people could watch sporting events up close and personal without having to buy a ticket, you could borrow a cup of sugar from your mom who lives a few miles away, and there would be fewer trucks and vans on our roadways. Sounds pretty good, doesn’t it? Well, put away your Jetsons fantasy for a moment, anyway. It could all happen but, along the way, we need to face the reality that any idiot can buy a drone and do any damn-fool thing they want. That includes voyeurs who want to peep into your private lives. Do you need to keep the curtains closed instead of enjoying a beautiful day or night? It includes pyro-voyeurs flying their drones into wildfire suppression areas, preventing retardant and water carrying aircraft from flying, and increasing the risk of death to firefighters. It includes flying their new toys higher than legally allowed, increasing the risk of mid-air collision with piloted aircraft. You think a bird strike is bad? Add the velocity and weight of even a small drone and imagine the results. Or consider a lone wolf terrorist who doesn’t care what the ultimate regulations might be for controlling drone traffic. What if he launches a few directly into the engine of an A-380 while its engines are running as it awaits its turn to take off on a crowded runway? Then there are the driverless cars being touted as the way to relieve urban traffic congestion; let you read, watch TV or play video games on your daily commute; reduce accidents; and clean up the environment. Let’s talk about vehicle safety. Have you seen the video where a Jeep driven by a human journalist has the systems overridden by faraway hackers and driven into a ditch? (Gently driven into a ditch; this was, after all, a controlled experiment.) Now imagine if a terror group or sovereign state like, say, Iran, Russia or China, with vast cyber-hacking armies under their command, decided to reverse the accident-avoidance systems of cars in the 25 largest American cities just before rush hour, sending vehicles with no allowance for human override careening into each other at high speeds. I love new technologies. But it bears pointing out that there are many sides to every innovation – and that human intervention should be part of any fail-safe robotic system. Otherwise we all become subjects of the old joke about the new pilotless commercial aircraft, where the announcement comes on after takeoff, “Ladies and gentlemen, welcome to USAmDeltaUnited flight # 65492 from Detroit to Puerto Rico. Embracing new technology, we are proud to announce there are no pilots aboard the aircraft and a cabin crew is not necessary since anything you need, our automated robotic attendants can provide. So relax, sit back and enjoy the flight. And remember, nothing can go wrong, hic!, nothing can go wrong, hic!, nothing can go wrong…” Remotely Piloted Aircraft – Test Flight with Passengers (and, for now, a human pilot on board to do the take-off and landing…) (click to enlarge) Like these two new technologies, a certain style of investment management and portfolio allocation has risen its head yet again – as it always does after a 5 or 6 year bull market. The benefit of these approaches is that they don’t require any decision-making. These are automated investment plans that take one of two typical variations: (1) The Bogle School, whose mantra is “Wall Street is a Random Walk so don’t try to beat the market. Just buy and hold a diversified ETF or mutual fund that mirrors a broad-based benchmark like the S&P 500. Never sell until you need to take some funds out for retirement, college or some other important life event.” (2) “Use a robot!” This will be either some quant black box approach that determines when to buy and sell or, better, rebalances a diversified portfolio tied to many different benchmarks like emerging markets, small cap US, large cap international, etc. The rebalancing forces you to buy low and sell high. When one part of the portfolio performs better than the others and another performs worse, the percent of each held will deviate from your chosen parameters, and you’ll rebalance. This approach assumes a steady reversion to the mean so you are, theoretically, selling a part of your winners and adding to your losers, which will revert to the mean and become winners. Our firm starts with something like #2 here but we then add enhancing strategies to tell us what and when to sell and what and when to buy. But for now let’s forget about adding the human element we use, and just take a look at these two very-popular-today “driverless investment vehicles.” Buy-and-hold is great. Until it isn’t. There are two problems with buy-and-hold. As sure as the sun will rise tomorrow, the market will at some point enter a bear market. If there were no bear markets, there’d be no risk and hence no reward. One of two things will happen to buy-and-hold investors during a bear market: either they will hold on or they won’t. Neither are attractive alternatives. In 2008, the S&P 500 lost 38.5% of its value. $100,000 became $61,500. If Mr. Buy-and-Hold held on, he was rewarded when, in 2009, the market rebounded 23.5%. (From March 9 forward, that is; he was down even further in Jan/Feb 2009.) Not too bad, right? Ummm… Not so fast. A 23.5% rise on $63,500 is not the same as a 23.5% rise on $100,000. That rebound in 2009 only took his portfolio back to $75,953. In 2010 a 12.8% rise in the S&P, however, got him back to $85,675! Regrettably, 2011 was exactly flat on the S&P so he spent another year underwater at $85,675. 2012 was a good year and his portfolio increased to $97,156. Then, finally, in early 2013, he broke even. So if Mr. Buy-and-Hold held on for 4 years (dividends would have reduced this holding period somewhat) he’d have suffered confidence, despair, hope, relief and, today, with the unusually strong bull of the last two years, perhaps a misplaced hubris. The alternative would have likely been worse. If Mr. Buy-and-Hold threw in the towel somewhere along the way, maybe in January 2009, he’d have lost 40% and would have gotten back in…when? After the market was up 10%? 20%? 30% ? At some point of emotional despair, Mr. Buy-and-Hold became Mr. Buy-and-Panic and might still not have recouped his losses. That brings us to the latest fad, “Do it Yourself on our Website!” These are the new “robo-investing” sites that tell you that you shouldn’t pay someone else when you could be paying the robo-site much less. I believe a robo-investing site that rebalances regularly but without any human understanding or input about market history, technical analysis, fundamental analysis as to the external economic environment, or behavioral analysis of investor and consumer sentiment is a dangerous place to be – a la the automated airplane. (“Nothing can go wrong, hic!, nothing can go wrong, hic!, nothing can go wrong…”) The problem with robo-investing is that one “might” never experience as serious a loss as Mr. Buy-and-Hold, but Ms. Rebalance-with-Regularity will also never hold on long enough to enjoy long-term sector outperformance. By selling on the basis of an arbitrarily-selected date and a graven-in-stone universe of geographic (US, international, emerging market, etc.) and/or capitalization-weighted (US large cap, foreign mid-cap, etc.) one decides, in advance, to leave much on the table in exchange for not losing big. How much is too much? Besides, if it isn’t possible to beat the benchmarks, then what accounts for the steady outperformance over many years of some of my colleagues with whom I exchange ideas every month? By coincidence the latest issue of Gray Cardiff’s Sound Investing just hit my inbox as I’m writing this. In it, Gray notes that The Hulbert Financial Digest verifies that Sound Advice has earned 11.3% annually since 3/31/2000 versus 2.2% for the S&P 500. And I should note, immodestly, that our own G&V Portfolio has returned 9.4% annually versus the S&P’s 5% over a slightly longer period from 1/1/1999. (My numbers include all S&P dividends.) Maybe Gray and I and all the other colleagues I credit in these pages from time to time have just been lucky for a decade or more. Or maybe it pays to have a human driver; it doesn’t have to be a registered investment advisor – it could be you, me, or someone else you trust, as long as they focus steadily on the road ahead and keep their hands firmly on the wheel. Here’s what I personally see as I look down that road… I expected great things from 2015 at the beginning of the year. It looked as if the economy was going to be able to stand on its own without Fed intervention; it was the third year of the presidential election cycle, a time when the party in power typically juices the economy and the markets; and it seemed as if China, India and Europe were all getting their act together. That’s what it still looks like – in the rear view mirror. Looking ahead, however, I see… The Hotel California in China “Relax” said the night man, “We are programmed to receive.” “You can check-out any time you like, but you can never leave!” These last words from the Eagles 1977 hit song ‘Hotel California’ pretty much sum up the state of things in China right now. You can buy all the stock you like; heck, they’ll even encourage you to buy it on margin. But sell it? How dare you? That would bring the whole Ponzi scheme down in days! (‘Hotel California’ is actually a doubly appropriate reference here; according to the Eagles, the song is about the phoniness and materialism they encountered in L.A. as they began to go from sort-of-known to hitting the big time. If the shoe fits…) At this point, the Chinese authorities have demanded internal records from Chinese and foreign brokerage firms who must prove they never helped fund or facilitate any short-selling; accused a US hedge fund of plotting to bring down prices; instructed the large Chinese state-owned companies with cash in the till to buy additional shares of Chinese companies; stopped all IPOs that may take funds away from current stock purchases; directed more state companies to invest in stocks rather than real estate; and (de facto) instructed Chinese pension funds and mutual funds to invest less in bonds and more in Chinese stocks. That’s a pretty Draconian reaction to a stock market correction that still leaves the Shanghai and Shenzhen exchanges solidly in the black for the year. Which leads me to wonder – what does the Chinese leadership know that we don’t know? My best guess is that they know that the productivity, GDP, real estate values, labor and other numbers being sent out for public consumption are less than wonderful. Basically, they don’t want anyone to look behind the curtain and see what Oz really looks like. We not only won’t be buying this correction, we are now shorting China. As Cnut (‘Canute’), king of Denmark, England and Norway, is alleged to have said to his courtiers and toadies back in the 1020s or so, when they told him he was so powerful he could stop the incoming tide, “No… I can’t.” (Okay, what Henry of Huntingdon reports Cnut really said was “Let all men know how empty and worthless is the power of kings, for there is none worthy of the name, but He whom heaven, earth and sea obey by eternal laws.” In other words, “No… I can’t.”) It seems the autocrats and oligarchs that constitute China’s elite Party members have yet to learn Cnut’s humility. It may take a while to work out, but when it comes to choice between the dictates of rulers and market forces, I’ll take market forces every time. The Presidential Election Cycle Typically, the year before a US Presidential election is a darn good one. And this may yet to prove to be, after we get through the dog days of summer. But for now things are not looking good. Indeed, unless we can mount a rally in the next six to eight weeks, it may be a long cold winter that follows this long hot summer before we can get back to moving forward. That’s because the markets hate uncertainty and the uncertainty markets hate most is which political scourge or savior will replace the current president and, by reflection, who he or she will select as their senior advisors and which representatives may be swept in on their coattails. The chart following is not graven in stone. The chart below is only the average of all years since 1896, and it is only on the Dow Industrials which may be disconnected from other benchmarks. Still, in the event this election cycle is somewhere near the average, it means we are in for a yawner for the next eight months or so, followed by a 2016 summer of discontent before we get the election uncertainty behind us and the market moves ahead smartly for a few months in the reflected glow of “Hope and Change” or whatever the next occupant at 1600 Pennsylvania has promised. Please note that the quarter that ended June 30 (bar 3 on “Year 3” above) was pretty much flat, not nearly as good as the “average.” One might interpret this as meaning there is pent-up demand, or that the handwriting is already on the wall for a queasy next few months, or that, pshaw, it’s just a bunch of numerology that don’t mean nuthin’. I lean toward door #2. As a rapt student of market history, I’ve lived through a lot of these, and that uncertainty thingy tends to get us every time. Not that there’s anything uncertain about 17 Republican presidential candidates and at least 3, maybe more, Democratic candidates, with a strong likelihood that, if not selected, Mr. Trump’s natural narcissism will cause him to run as an independent, continuing his clever way of telling us what we want to hear whether he believes it or not. Yes, 2016 could be complicated this time around. The Fed, Greece, ISIS, Ukraine, Iran, Russia, Etc. You don’t really need me to re-hash all these, do you? Any one of them could (continue to) create even more uncertainty. And, of course, there’s always some economic or political event over the horizon that we can’t see yet. So let’s just move on to… What Are We Doing About It? We’re reallocating our portfolio strategy to reflect what we believe to be the likelihood of a dull market that vacillates between heightened expectations and dashed expectations. That means lightening up on developing markets, energy, industrials, materials, utilities and even some technology firms. It means keeping our health care exposure and adding a bit to the consumer discretionary sector, one of the few bright spots we see as American consumers, tired of belt-tightening, loosen up a little and spend on something fun. It means looking for financials that will benefit as rates rise, which they inevitably will. We’ll leave it to others to benefit via shorting Treasuries and so on; we’ll instead buy insurers and regional banks that are already selling for single digit PEs. We’ll buy some defensive issues in the food and beverage area. And we will hedge our longs with a couple of good inverse ETFs. To wit… We will keep our Wisdom Tree Europe Hedged Equity (NYSEARCA: HEDJ ) because I see continued strength in the US $, making Euro exports relatively cheaper, but we will protect our gains with trailing stops. We’ll sell all shares of Guggenheim S&P 500 Pure Growth (NYSEARCA: RPG ) however. We’ll keep our shares of Royal Dutch Shell (NYSE: RDS.B ) and add to them if prices continue to decline, and we’ll trailing-stop some shares of Wisdom Tree Germany (NASDAQ: DXGE ). We’ll hold onto Marathon Petroleum (NYSE: MPC ) and BP (NYSE: BP ) — for now. At our cost basis and yield-to-cost, we’ll hold Royal Bank of Scotland (NYSE: RBS ) until they force redemption upon us, which they will some day. We feel strongly about the fine portfolio of Tekla Health (NYSE: THQ ), even though it has done nothing so far, so it’s a keeper. We’ll add a bit to our Franco Nevada (NYSE: FNV ). Even if the price of gold and silver don’t recover, FNV is so well-managed that I’m certain there are price-decline and bankruptcy provisions in the loans they make to smaller gold producers that will allow them to emerge from any gold price decline or range-bound trading with a greater share of the gold that is actually produced. Gold won’t stay down forever and it often does best in times of uncertainty. As an income play, I like the preferreds of Public Storage (NYSE: PSA ), particularly the A, T and V preferreds. A better jobs picture means lots more mobility and relocation. Relocation means more people put stuff in storage – as do empty-nesters downsizing and businesses that need a place to store inventory without taking on long-term leases for more space. PSA is the class act in this industry so I see their preferreds, all yielding around 5%, as a great way to invest for income without seeing anything more than a miniscule decline if US interest rates rise. Since we have no real hedge against a serious market decline in this portfolio, I’m also adding some shares of ProShares UltraShort S&P 500 (NYSEARCA: SDS ), which moves inverse to the S&P 500 at double the rate of movement, as well as shares of the iPath S&P 500 VIX (NYSEARCA: VXX ), which is a reflection of the volatility I imagine we’ll be seeing more of in the coming weeks and months. Also we’ll buy, not as a hedge for our long positions but as an outright short on hubris and autocracy, shares of Direxion CSI 300 China A Shares (NYSEARCA: CHAD ). CHAD is an unleveraged short on the 300 largest and most liquid Chinese A Share companies. The Chinese government will do their best to thwart this investment but I say free markets will triumph and we could see rather large profits from this ETF. Finally, we will buy one additional ETF: Fidelity MSCI Consumer Discretionary (NYSEARCA: FDIS ). While it is capitalization-weighted, it covers the entire MSCI (Morgan Stanley Capital International) index so it also includes some non-US firms that I believe will benefit from selling consumer discretionary goods and services to US consumers. As Registered Investment Advisors, we believe it is essential to advise that we do not know your personal financial situation, so the information contained in this communiqué represents the opinions of the staff of Stanford Wealth Management, and should not be construed as “personalized” investment advice. Past performance is no guarantee of future results, rather an obvious statement but clearly too often unheeded judging by the number of investors who buy the current #1 mutual fund one year only to watch it plummet the following year. We encourage you to do your own due diligence on issues we discuss to see if they might be of value in your own investing. We take our responsibility to offer intelligent commentary seriously, but it should not be assumed that investing in any securities we are investing in will always be profitable. We do our best to get it right, and we “eat our own cooking,” but we could be wrong, hence our full disclosure as to whether we own or are buying the investments we write about. Disclosure: I am/we are long FDIS, PSA-T, THQ, BP, FNV, RBS, VXX, CHAD, HEDJ, MPC, SDS. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News