Scalper1 News

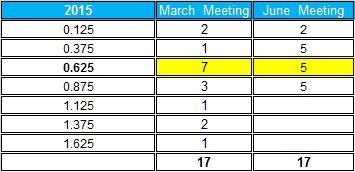

Summary The FOMC meeting concluded with a dovish statement and press conference. The silver market benefits from a dovish Federal Reserve. A potential rate hike could have a modest, negative impact on the price of SLV. The FOMC, as expected, didn’t raise rates and presented a dovish statement without dissenters. This news provided some backwind to the iShares Silver Trust ETF (NYSEARCA: SLV ) that came up in the last few days, albeit it’s still down by 8.5% over the past month. Let’s examine the recent FOMC meeting and its possible implications on SLV. Following the recent FOMC statement and press conference, the market revised down its outlook of the Fed’s rate “lift off”: The implied probabilities dropped to a 17% chance of a rate hike in September and 57% in December. In January 2016, the odds are 72% – nearly the same odds for a December rate hike only a week ago. The statement, which wasn’t changed much and didn’t offer any major headlines, still led to a modest rally in the price of SLV, as presented below. The dovish tone in the statement and Yellen’s press conference that followed suggested that even after the inaugural “lift off”, the FOMC will keep rates low – conditions that benefit the silver market. (click to enlarge) Source of data taken from FOMC and Google Finance The FOMC revised down its projections for the 2015 U.S. GDP growth rate from 2.5% in March to 1.9%. The rate of unemployment slightly increased to 5.25%. There weren’t any other major changes in the FOMC’s economic projections. Since Yellen reiterated that the first rate hike will still be data dependent, this means that if in the next few months the economic data show a stable recovery, e.g. NFP reports keep showing steady growth in jobs, lower unemployment, faster growth in wages, better GDP figures, higher inflation (just to name a few), the FOMC could decide to raise rates this year. As long as the FOMC keeps rates low, the silver market in general and SLV in particular benefit from it. Also, even if the FOMC were to start raising rates, the cash rate is likely to remain low, as Yellen suggested in the press conference, for a while. After all she tried, yet again, to diverge the attention from the historic first rate raise to the pace of subsequent rate hikes. She emphasized that rates will rise gradually; as such, this means the normalization policy is likely to have a modest adverse impact on SLV. In terms of the dot plots, FOMC members are still incline to raise rates this year, perhaps by September – this will allow for at least two rate hikes of 0.25% and bring the cash rate to 0.5% by the end of the year. For 2015, the median target range of the Federal Reserve hasn’t changed – it’s at 0.625% – albeit fewer FOMC members have picked higher rates and the projections are now more concentrated around lower interest rates, as you can see below: Source: FOMC’s website For 2016 and 2017, members slightly lowered their projections so that the median point declined by 0.25 percentage points for each year. This is another dovish indication that the trajectory of the future rate hikes could be more moderate than previously projected. Source: FOMC’s website In a CNBC interview, Richard Fisher, who is considered a hawk and was former president of the Federal Reserve Bank of Dallas and FOMC voting member, stated the dot plot outlook for the coming years is less relevant since the current members may not be there to make rate decisions in 2016-2017. This may be right, but since Yellen will remain at the Fed, we are still likely to see additional dovish FOMC decisions in the coming years. The market’s reaction to the dovish statement also included a depreciation of the U.S. dollar against leading currencies, which also contributed to the modest rise in shares of SLV. Nonetheless, the U.S. dollar could start to rise again especially against the euro – the ECB’s QE program and the ongoing Greek debt crisis are likely to drag down the currency – and yen. A stronger U.S. dollar could play against the price of SLV. The silver market isn’t out of the woods, but the FOMC provided a short-term boost to SLV. The market doesn’t seem convinced that the Fed will raise rates this year. As such, if and once it will occur, it could result in a modest drop in SLV prices. Until such time, as long as the FOMC produces dovish statements, silver will benefit over the short run. For more see: Will Higher Physical Demand for Silver Drive Up SLV? Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The FOMC meeting concluded with a dovish statement and press conference. The silver market benefits from a dovish Federal Reserve. A potential rate hike could have a modest, negative impact on the price of SLV. The FOMC, as expected, didn’t raise rates and presented a dovish statement without dissenters. This news provided some backwind to the iShares Silver Trust ETF (NYSEARCA: SLV ) that came up in the last few days, albeit it’s still down by 8.5% over the past month. Let’s examine the recent FOMC meeting and its possible implications on SLV. Following the recent FOMC statement and press conference, the market revised down its outlook of the Fed’s rate “lift off”: The implied probabilities dropped to a 17% chance of a rate hike in September and 57% in December. In January 2016, the odds are 72% – nearly the same odds for a December rate hike only a week ago. The statement, which wasn’t changed much and didn’t offer any major headlines, still led to a modest rally in the price of SLV, as presented below. The dovish tone in the statement and Yellen’s press conference that followed suggested that even after the inaugural “lift off”, the FOMC will keep rates low – conditions that benefit the silver market. (click to enlarge) Source of data taken from FOMC and Google Finance The FOMC revised down its projections for the 2015 U.S. GDP growth rate from 2.5% in March to 1.9%. The rate of unemployment slightly increased to 5.25%. There weren’t any other major changes in the FOMC’s economic projections. Since Yellen reiterated that the first rate hike will still be data dependent, this means that if in the next few months the economic data show a stable recovery, e.g. NFP reports keep showing steady growth in jobs, lower unemployment, faster growth in wages, better GDP figures, higher inflation (just to name a few), the FOMC could decide to raise rates this year. As long as the FOMC keeps rates low, the silver market in general and SLV in particular benefit from it. Also, even if the FOMC were to start raising rates, the cash rate is likely to remain low, as Yellen suggested in the press conference, for a while. After all she tried, yet again, to diverge the attention from the historic first rate raise to the pace of subsequent rate hikes. She emphasized that rates will rise gradually; as such, this means the normalization policy is likely to have a modest adverse impact on SLV. In terms of the dot plots, FOMC members are still incline to raise rates this year, perhaps by September – this will allow for at least two rate hikes of 0.25% and bring the cash rate to 0.5% by the end of the year. For 2015, the median target range of the Federal Reserve hasn’t changed – it’s at 0.625% – albeit fewer FOMC members have picked higher rates and the projections are now more concentrated around lower interest rates, as you can see below: Source: FOMC’s website For 2016 and 2017, members slightly lowered their projections so that the median point declined by 0.25 percentage points for each year. This is another dovish indication that the trajectory of the future rate hikes could be more moderate than previously projected. Source: FOMC’s website In a CNBC interview, Richard Fisher, who is considered a hawk and was former president of the Federal Reserve Bank of Dallas and FOMC voting member, stated the dot plot outlook for the coming years is less relevant since the current members may not be there to make rate decisions in 2016-2017. This may be right, but since Yellen will remain at the Fed, we are still likely to see additional dovish FOMC decisions in the coming years. The market’s reaction to the dovish statement also included a depreciation of the U.S. dollar against leading currencies, which also contributed to the modest rise in shares of SLV. Nonetheless, the U.S. dollar could start to rise again especially against the euro – the ECB’s QE program and the ongoing Greek debt crisis are likely to drag down the currency – and yen. A stronger U.S. dollar could play against the price of SLV. The silver market isn’t out of the woods, but the FOMC provided a short-term boost to SLV. The market doesn’t seem convinced that the Fed will raise rates this year. As such, if and once it will occur, it could result in a modest drop in SLV prices. Until such time, as long as the FOMC produces dovish statements, silver will benefit over the short run. For more see: Will Higher Physical Demand for Silver Drive Up SLV? Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News