Scalper1 News

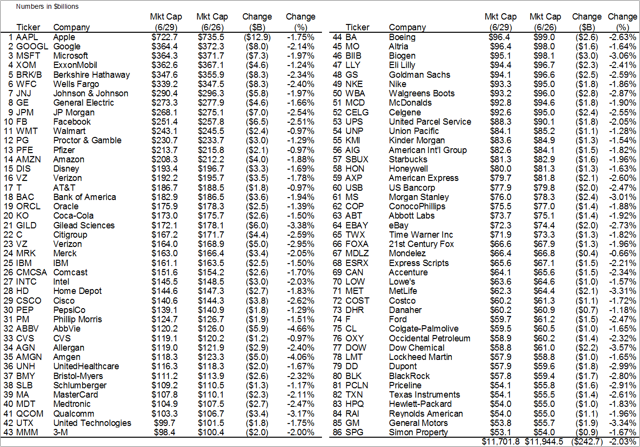

The article shows that the capitalization change of a small number of large-cap U.S. stocks equaled the entire annual output of the Greek economy. This effort is in part to frame the impact Greek turmoil is having on U.S. assets. A qualitative discussion of whether this capitalization change is warranted is included. The title of this article asks readers to guess the number of U.S. stocks whose reduction in market capitalization on Monday was equivalent to the size of annual Greek economic output. The answer: 86 To come up with the figure, I compared the gross domestic product of the Greek economy from the World Bank to the capitalization change of the largest components of the S&P 500 (NYSEARCA: SPY ) by market capitalization until the change in value equated to the Greek GDP of $242B. I had some notable takeaways from this data that I wanted to share with readers. The question for market participants is whether these moves are justified. If the value of an asset is its future cash flows discounted back to the present, then the reduction in domestic equity prices on Monday was either a function of an expectation of lower future cash flows and/or a higher discount rate. The former, lower future cash flows, seems unlikely to have had a large impact given the limited trade between the U.S. and Greece and the fact that the Greek economy is roughly the size of the Minneapolis-area economy. The negative translation effect of broader global cash flows earned by these U.S. companies from a strengthening U.S. dollar would have had a proportionately larger impact. That means that the re-pricing of risky assets is more likely a function of a higher discount rate. The interest rate component of the discount rate fell on Monday as U.S. rates rallied on a flight-to-quality bid signaling that an “equity risk premium” applied to U.S. equities increased to move the discount rate higher. While the outcomes from a potential “Grexit” remain uncertain and difficult to analyze, the transmission mechanism for broader global contagion seems equally uncertain. The potential financial sector link, which roiled equity markets in 2012 given the amount of Greek debt held by European banks at the time, appears to have been muted by a rotation of Greek debt from bank balance sheets to official creditors, enhanced stability mechanisms, European quantitative easing, and much lower yields in the periphery. While the odds of a disorderly outcome in Europe are certainly rising, investors must handicap how much of a risk premium on global assets is justified. While we are likely to continue to see heightened volatility in the near term, if the Greek drama was responsible for the entirety of the move on these 86 companies, I believe that the impact has been overstated already. Disclaimer : My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon. Disclosure: I am/we are long SPY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

The article shows that the capitalization change of a small number of large-cap U.S. stocks equaled the entire annual output of the Greek economy. This effort is in part to frame the impact Greek turmoil is having on U.S. assets. A qualitative discussion of whether this capitalization change is warranted is included. The title of this article asks readers to guess the number of U.S. stocks whose reduction in market capitalization on Monday was equivalent to the size of annual Greek economic output. The answer: 86 To come up with the figure, I compared the gross domestic product of the Greek economy from the World Bank to the capitalization change of the largest components of the S&P 500 (NYSEARCA: SPY ) by market capitalization until the change in value equated to the Greek GDP of $242B. I had some notable takeaways from this data that I wanted to share with readers. The question for market participants is whether these moves are justified. If the value of an asset is its future cash flows discounted back to the present, then the reduction in domestic equity prices on Monday was either a function of an expectation of lower future cash flows and/or a higher discount rate. The former, lower future cash flows, seems unlikely to have had a large impact given the limited trade between the U.S. and Greece and the fact that the Greek economy is roughly the size of the Minneapolis-area economy. The negative translation effect of broader global cash flows earned by these U.S. companies from a strengthening U.S. dollar would have had a proportionately larger impact. That means that the re-pricing of risky assets is more likely a function of a higher discount rate. The interest rate component of the discount rate fell on Monday as U.S. rates rallied on a flight-to-quality bid signaling that an “equity risk premium” applied to U.S. equities increased to move the discount rate higher. While the outcomes from a potential “Grexit” remain uncertain and difficult to analyze, the transmission mechanism for broader global contagion seems equally uncertain. The potential financial sector link, which roiled equity markets in 2012 given the amount of Greek debt held by European banks at the time, appears to have been muted by a rotation of Greek debt from bank balance sheets to official creditors, enhanced stability mechanisms, European quantitative easing, and much lower yields in the periphery. While the odds of a disorderly outcome in Europe are certainly rising, investors must handicap how much of a risk premium on global assets is justified. While we are likely to continue to see heightened volatility in the near term, if the Greek drama was responsible for the entirety of the move on these 86 companies, I believe that the impact has been overstated already. Disclaimer : My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon. Disclosure: I am/we are long SPY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News