Scalper1 News

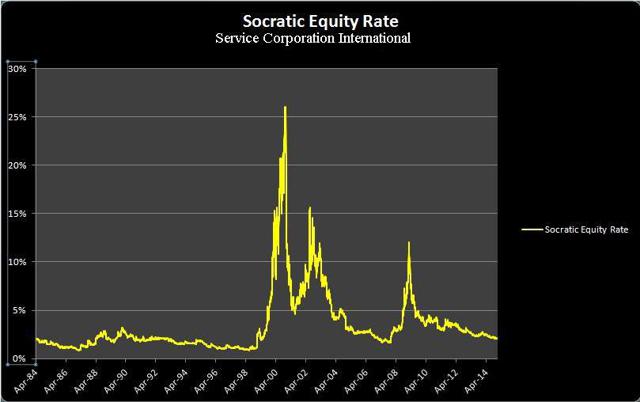

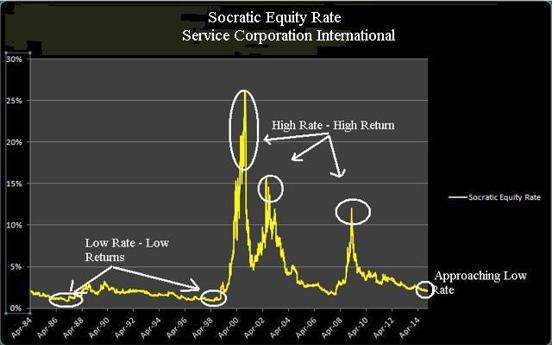

The Socratic Equity Rate is one tool investors can use to identify areas of value and over-value. Compared to past levels, a high yield might indicate areas of value. Compared to past rates, a low rate indicates investors might want to be cautious. If you ever owned a diversified mutual fund or ETF, chances are, at one time you were a part owner of a funeral services business. For those running the fund, and especially for owners of shares in a funeral services business such as Service Corporation International (NYSE: SCI ), it is essential to be familiar with the Socratic Equity Rate . Developed by The Socratic Investor, the Socratic Equity Rate was designed to assist in identifying opportunity and risk in investment securities. Intended for board of directors, company management, securities lawyers, fund managers and individual investors, this proprietary equity rate is a number to understand. The Trial of Socrates | The Death of Socrates movie trailer, by educationalmovies For an investment fund manager, the higher the current Socratic Equity Rate is compared to past readings, the more attractive an investment might be. The lower the reading, the more cautious an investor should be. For another professional, the readings will be the same but the takeaway will be different. The key is to know the historical range, be able to identify anomalies, and know what to do when those areas of value or overvalue appear again. Although the last part will be different depending on what role you play in the investment world, the concept is the same . Examine the performance of Service Corporation International after SCI’s Socratic Equity Rate reached 25% in 2000. From $1.75 to $13.81, SCI’s return was one of the best in the market. At a Socratic Equity Rate near the highest recordings ever seen in SCI’s history, Service Corporation International was a buy. For a board member, a lower number might indicate a time to incentivize management to issue equity . If private companies are cheap, management would be smart to pay using overvalued equity. A deal that won’t rest in peace, by TheDealVideo Take a look at the performance of investing in SCI when the Socratic Equity Rate was near its lowest levels ever. From $10.00 to $5.08, SCI investors experienced devastating returns. At a Socratic Equity Rate near the lowest readings ever, 1%, SCI’s overvalued equity presented management an opportunity to acquire another funeral company’s crown jewels without spending cash . On the other hand, if you are a private funeral home business owner looking to sell, and the acquiring company wants to pay in stock, you better know how overvalued the stock they want to pay with is. Knowing the Socratic Equity Rate can help protect your crown jewels from theft, as what happened to Time Warner when AOL paid using tech-bubble inflated AOL shares to merge. Ted Turner’s biggest regret, by CNNMoney From a securities law standpoint, an upstanding securities lawyer might consider using this rate as a tool to defend the innocent teacher’s pension fund or university endowment fund that lost money. By exhibiting a Socratic Equity Rate near the lowest levels ever, the lawyer could argue the fund manager breached their fiduciary duty by paying a premium substantially above historical norms. Examine what could happen to a fire-fighter pension’s investment when a supposed fiduciary buys SCI at a Socratic Equity Rate of 1%, a reading that is one of the lowest on record. If the supposed,”fiduciary” keeps ignoring the Socratic Equity Rate, one day there may not be a pension for retired fire-fighters. At a level near 2.1% today, SCI’s Socratic Equity Rate is approaching the lower end of its historical readings. Fund managers and individual investors should remain defensive. Be advised, this is not investment advice. The Socratic Equity Rate is one tool out of an entire tool box of equity valuation methods. Your decision to buy, sell or sue will depend on your profession and further research is always recommended. Thanks be to YCharts, who provides The Socratic Investor with Service Corporation International financial data. Scalper1 News

The Socratic Equity Rate is one tool investors can use to identify areas of value and over-value. Compared to past levels, a high yield might indicate areas of value. Compared to past rates, a low rate indicates investors might want to be cautious. If you ever owned a diversified mutual fund or ETF, chances are, at one time you were a part owner of a funeral services business. For those running the fund, and especially for owners of shares in a funeral services business such as Service Corporation International (NYSE: SCI ), it is essential to be familiar with the Socratic Equity Rate . Developed by The Socratic Investor, the Socratic Equity Rate was designed to assist in identifying opportunity and risk in investment securities. Intended for board of directors, company management, securities lawyers, fund managers and individual investors, this proprietary equity rate is a number to understand. The Trial of Socrates | The Death of Socrates movie trailer, by educationalmovies For an investment fund manager, the higher the current Socratic Equity Rate is compared to past readings, the more attractive an investment might be. The lower the reading, the more cautious an investor should be. For another professional, the readings will be the same but the takeaway will be different. The key is to know the historical range, be able to identify anomalies, and know what to do when those areas of value or overvalue appear again. Although the last part will be different depending on what role you play in the investment world, the concept is the same . Examine the performance of Service Corporation International after SCI’s Socratic Equity Rate reached 25% in 2000. From $1.75 to $13.81, SCI’s return was one of the best in the market. At a Socratic Equity Rate near the highest recordings ever seen in SCI’s history, Service Corporation International was a buy. For a board member, a lower number might indicate a time to incentivize management to issue equity . If private companies are cheap, management would be smart to pay using overvalued equity. A deal that won’t rest in peace, by TheDealVideo Take a look at the performance of investing in SCI when the Socratic Equity Rate was near its lowest levels ever. From $10.00 to $5.08, SCI investors experienced devastating returns. At a Socratic Equity Rate near the lowest readings ever, 1%, SCI’s overvalued equity presented management an opportunity to acquire another funeral company’s crown jewels without spending cash . On the other hand, if you are a private funeral home business owner looking to sell, and the acquiring company wants to pay in stock, you better know how overvalued the stock they want to pay with is. Knowing the Socratic Equity Rate can help protect your crown jewels from theft, as what happened to Time Warner when AOL paid using tech-bubble inflated AOL shares to merge. Ted Turner’s biggest regret, by CNNMoney From a securities law standpoint, an upstanding securities lawyer might consider using this rate as a tool to defend the innocent teacher’s pension fund or university endowment fund that lost money. By exhibiting a Socratic Equity Rate near the lowest levels ever, the lawyer could argue the fund manager breached their fiduciary duty by paying a premium substantially above historical norms. Examine what could happen to a fire-fighter pension’s investment when a supposed fiduciary buys SCI at a Socratic Equity Rate of 1%, a reading that is one of the lowest on record. If the supposed,”fiduciary” keeps ignoring the Socratic Equity Rate, one day there may not be a pension for retired fire-fighters. At a level near 2.1% today, SCI’s Socratic Equity Rate is approaching the lower end of its historical readings. Fund managers and individual investors should remain defensive. Be advised, this is not investment advice. The Socratic Equity Rate is one tool out of an entire tool box of equity valuation methods. Your decision to buy, sell or sue will depend on your profession and further research is always recommended. Thanks be to YCharts, who provides The Socratic Investor with Service Corporation International financial data. Scalper1 News

Scalper1 News