Scalper1 News

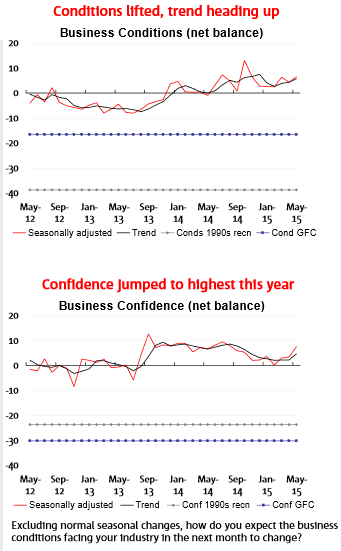

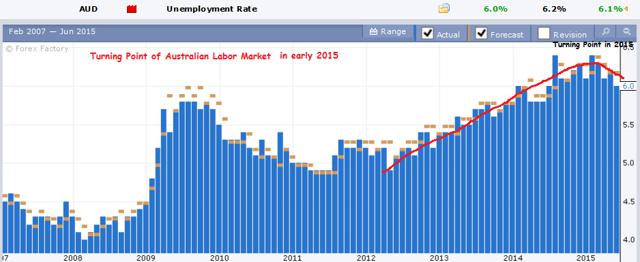

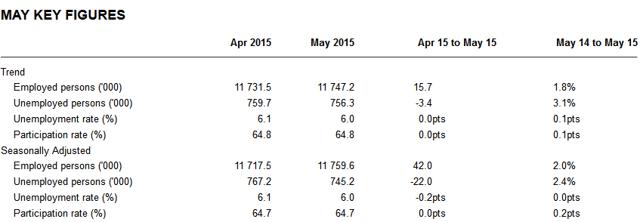

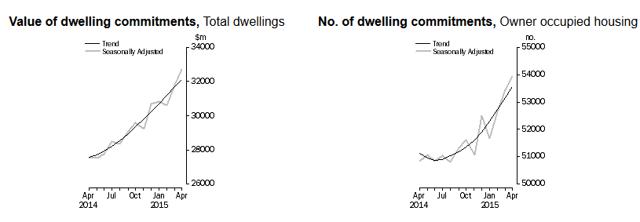

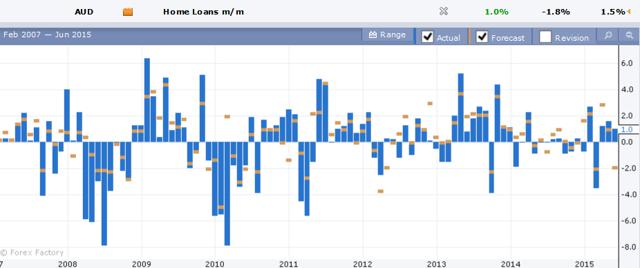

Summary Australia had record high business confidence on low AUD and consumption boost. Labor market continued to grow in a sustained manner along with the housing and credit markets. This might be the time to buy into Australian equities as both internal and external conditions merged to form bullish condition. Australia might be iconic to the average Americans as the land of the kangaroos but it has more to offer than tourism. The Australian economy is on the steady path of recovery as seen in the record high of business confidence, recovering labor market and better credit condition. This represents a great opportunity to gain exposure to the Australian market for this recovery had been ongoing since the beginning of this year. Australia had been blessed with its proximity to the emerging Asia, strong reserves of minerals and other raw materials and a dovish central bank that cut rate twice this year as a precaution. As a result, the recovery in Australia took hold and through months of consistent performance, it is now deeply rooted as the latest May data would show. However the Australian stock market remains discounted as market confidence was shaken by the weaker than expected US and Chinese economic data. This is now changing as the US and Chinese economies are on the mend as seen in recent articles. Record High Business Confidence We shall first delve into the May survey of business sentiment as conducted by the National Australia Bank (NAB). Business confidence went up from +3 in April sharply to +7 in May as all business sector (except mining) had a better outlook on business conditions. This +7 reading of business confidence is the record high this year. Source: NAB Business conditions were lifted by the twin effects of the lower AUD and supportive budget released this year. The recent low 2% interest rates by the Reserve Bank of Australia (NYSE: RBA ) also helped in the credit conditions for the housing market and business lending. Consumption and consumer confidence have also staged a steady recovery. These conditions had led non mining businesses as a whole to revisit their reluctance towards capital expenditure and to invest for the future. The manufacturing industry led the recovery on the tailwinds of the lower AUD while the mining industry continued to contract on reduced Chinese demand. Forward looking indicators such as new orders are also pointing towards the right direction for future growth. The overall trend is clear towards greater business confidence for Australia. Strengthening Australian Labor Market The next piece of good news for the Australian economy is the improving labor market as reported by the Australian Bureau of Statistics ( ABS ) for May 2015. The major good news is that the Australian economy had added 42,000 new jobs in May and this is resulted in the lowering of the unemployment rate from 6.1% to 6.0%. (click to enlarge) The reduction of the mining sector had resulted in the net increase in Australian unemployment rate as seen in the chart above. However this had been largely reversed since January 2015. The improving economy had been able to absorb the increasing workers made redundant as mining companies cut back on production. This improvement is all the more remarkable because this reduction is done without any corresponding reduction in the overall employment rate as seen in the table below. In other words, the unemployment rate came down not because of more discouraged workers as was the case in the US 5 years back in 2010. The unemployment came down because the labor pool expanded and more people are now working. (click to enlarge) Source: ABS In fact, the labor participation rate crept up by 0.2% over a 1 year period as the labor pool expanded to 11.75 million and 64.7% of Australians are gainfully employed. This means that Australian have greater income as a whole and would naturally consume more in the future. Housing And Credit Market Lastly we can look at the status of the Australian housing market. Bubbles are formed when housing are purchased for the purpose of speculation instead of dwelling. This, along with lax credit conditions, is the root cause of the US housing bubble, which burst in 2007. The Australian regulators are mindful of this painful episode and they had recently cracked down on runaway housing prices especially on foreign purchase of property for ‘investment’ purposes. This has resulted in the majority of purchase being used for residential purposes. In May, out of $32 billion worth of housing commitments, $19 billion is for owner occupation while $13 billion is for the purpose of investment. In other words, a good 59% of new housing being built in Australia will be occupied by owners and they are not likely to bid prices up to excessive levels in hopes of flipping it for profit as soon as regulation permits. (click to enlarge) Source: ABS The strength of the Australian housing market can also be seen in the upwards momentum of both the value and number of housing commitment. This is supported by modest and sustained increase in loans as seen in the chart below. (click to enlarge) The chart shows that the credit market in Australia had been rising for 3 consecutive months in a row. Conclusion If we were to put the recent domestic conditions of better business confidence, labor condition, housing and credit market in May together with the recovering economic conditions in the 2 largest economy in the world, this would signal the path towards a sustained economic recovery for Australia is now under way. This would mean this current price of $22 might the low price for the iShares MSCI Australia ETF (NYSEARCA: EWA ) which is the broad based representation of the best of Australian equity. The conditions are ripe for the bottoming out of Australian equities as both internal and external conditions coincide for a strong and sustained economic recovery. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Australia had record high business confidence on low AUD and consumption boost. Labor market continued to grow in a sustained manner along with the housing and credit markets. This might be the time to buy into Australian equities as both internal and external conditions merged to form bullish condition. Australia might be iconic to the average Americans as the land of the kangaroos but it has more to offer than tourism. The Australian economy is on the steady path of recovery as seen in the record high of business confidence, recovering labor market and better credit condition. This represents a great opportunity to gain exposure to the Australian market for this recovery had been ongoing since the beginning of this year. Australia had been blessed with its proximity to the emerging Asia, strong reserves of minerals and other raw materials and a dovish central bank that cut rate twice this year as a precaution. As a result, the recovery in Australia took hold and through months of consistent performance, it is now deeply rooted as the latest May data would show. However the Australian stock market remains discounted as market confidence was shaken by the weaker than expected US and Chinese economic data. This is now changing as the US and Chinese economies are on the mend as seen in recent articles. Record High Business Confidence We shall first delve into the May survey of business sentiment as conducted by the National Australia Bank (NAB). Business confidence went up from +3 in April sharply to +7 in May as all business sector (except mining) had a better outlook on business conditions. This +7 reading of business confidence is the record high this year. Source: NAB Business conditions were lifted by the twin effects of the lower AUD and supportive budget released this year. The recent low 2% interest rates by the Reserve Bank of Australia (NYSE: RBA ) also helped in the credit conditions for the housing market and business lending. Consumption and consumer confidence have also staged a steady recovery. These conditions had led non mining businesses as a whole to revisit their reluctance towards capital expenditure and to invest for the future. The manufacturing industry led the recovery on the tailwinds of the lower AUD while the mining industry continued to contract on reduced Chinese demand. Forward looking indicators such as new orders are also pointing towards the right direction for future growth. The overall trend is clear towards greater business confidence for Australia. Strengthening Australian Labor Market The next piece of good news for the Australian economy is the improving labor market as reported by the Australian Bureau of Statistics ( ABS ) for May 2015. The major good news is that the Australian economy had added 42,000 new jobs in May and this is resulted in the lowering of the unemployment rate from 6.1% to 6.0%. (click to enlarge) The reduction of the mining sector had resulted in the net increase in Australian unemployment rate as seen in the chart above. However this had been largely reversed since January 2015. The improving economy had been able to absorb the increasing workers made redundant as mining companies cut back on production. This improvement is all the more remarkable because this reduction is done without any corresponding reduction in the overall employment rate as seen in the table below. In other words, the unemployment rate came down not because of more discouraged workers as was the case in the US 5 years back in 2010. The unemployment came down because the labor pool expanded and more people are now working. (click to enlarge) Source: ABS In fact, the labor participation rate crept up by 0.2% over a 1 year period as the labor pool expanded to 11.75 million and 64.7% of Australians are gainfully employed. This means that Australian have greater income as a whole and would naturally consume more in the future. Housing And Credit Market Lastly we can look at the status of the Australian housing market. Bubbles are formed when housing are purchased for the purpose of speculation instead of dwelling. This, along with lax credit conditions, is the root cause of the US housing bubble, which burst in 2007. The Australian regulators are mindful of this painful episode and they had recently cracked down on runaway housing prices especially on foreign purchase of property for ‘investment’ purposes. This has resulted in the majority of purchase being used for residential purposes. In May, out of $32 billion worth of housing commitments, $19 billion is for owner occupation while $13 billion is for the purpose of investment. In other words, a good 59% of new housing being built in Australia will be occupied by owners and they are not likely to bid prices up to excessive levels in hopes of flipping it for profit as soon as regulation permits. (click to enlarge) Source: ABS The strength of the Australian housing market can also be seen in the upwards momentum of both the value and number of housing commitment. This is supported by modest and sustained increase in loans as seen in the chart below. (click to enlarge) The chart shows that the credit market in Australia had been rising for 3 consecutive months in a row. Conclusion If we were to put the recent domestic conditions of better business confidence, labor condition, housing and credit market in May together with the recovering economic conditions in the 2 largest economy in the world, this would signal the path towards a sustained economic recovery for Australia is now under way. This would mean this current price of $22 might the low price for the iShares MSCI Australia ETF (NYSEARCA: EWA ) which is the broad based representation of the best of Australian equity. The conditions are ripe for the bottoming out of Australian equities as both internal and external conditions coincide for a strong and sustained economic recovery. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News