Scalper1 News

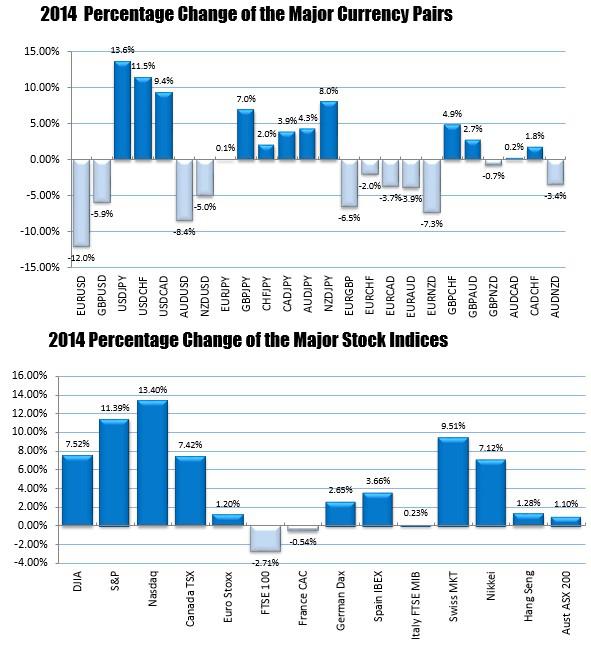

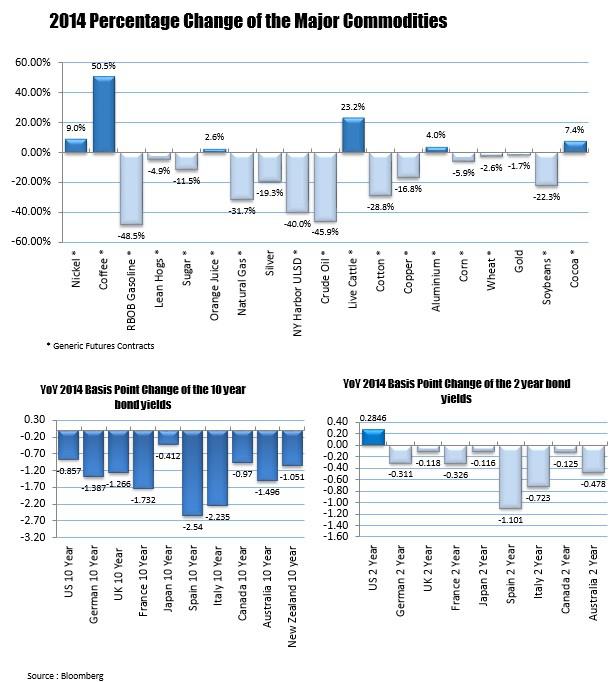

By Matt Rego With 2015 officially rung in and the first trading day of the New Year in progress, 2014 is fading off into the distance. But, before it goes, let’s take a look at some of the best and worst performing assets of 2014, which can help formulate an investment plan for the current year. Reviewing prior year is a good habit to get used to, as it can show what assets could outperform this year or which could underperform this year. Ultimately, it is good to close out a year with a review and a takeaway that will allow us to improve our analysis scope and where some investments made during the year went wrong or right. Best And Worst Performing Assets: Stocks US equities continued to march higher in 2014, as the bull market continued to show strength during the year. Dow Jones Industrial Average rose 8.4% in 2014, S&P 500 rose 12.39%, and the Nasdaq led the group of US indices with 14.31% gain for the year. Turning to European equities, the FTSE 100 (INDEXFTSE:UKX) lost -2.26% for the year, the CAC 40 rose 1.08%, and Euro Stoxx 50 saw a rise of 2.48% in 2014. The Shanghai Composite, Chinese equities, rose 53.94% in 2014 and Japan’s Nikkei 225 (INDEXNIKKEI:NI225) saw 2014 outcome of -1.93% ( Google Finance data) Best And Worst Performing Assets: Commodities Commodities had a good start in 2014, but as the US dollar continued to build strength in the latter half of the year, commodities began to suffer. The biggest and most memorable story of 2014 for commodities will be the collapse in oil prices, which fell -44.5% during the year. Natural gas lost -29% and heating oil was the second worst performing commodity at -39.6%. Gold ended the year down, but relatively flat overall with -2.9% 2014 performance. Silver fared much worse, which fell -20.7%. On the bright side, coffee was the overwhelming best performing commodity, which shot up 44.8%. Cattle prices had a huge run up in 2014, led by feeder cattle’s gains of 33.7%. Live cattle saw gains of 22.1% and lean hogs was worst performer of the livestock sector, down -6.6% for the year. The US dollar rose 12.9% during the year. Best And Worst Performing Assets: Bond Yields Bond yields across the board saw declines in 2014. Yields and bond prices work inversely, meaning bond prices rallied in 2014 as yields sank. The US 10 Year saw yields fall -0.857 basis points, Germany’s 10 year fell -1.387 bps, UK saw a drop of -1.266 bps, Japan’s 10 year saw the lowest fall in yield at -0.412 bps. Spain’s 10 year yields fell the most by -2.54 bps, followed by Italy’s 10 year yield declines of -2.235 bps. Overall, 2014 was a good year for US equities, the US dollar, cattle, coffee, and bond prices. Looking forward to 2015, analysts and economists are forecasting continued strength in the US dollar, which will mean lagging commodity prices. US equities have the general consensus of starting the year off strong and getting weaker as the year rolls on. Bonds are predicted to have a very rough year with the US Federal Reserve expected to raise rates at some point. Ultimately, we will have to wait and see what the New Year brings. Disclosure: None Scalper1 News

By Matt Rego With 2015 officially rung in and the first trading day of the New Year in progress, 2014 is fading off into the distance. But, before it goes, let’s take a look at some of the best and worst performing assets of 2014, which can help formulate an investment plan for the current year. Reviewing prior year is a good habit to get used to, as it can show what assets could outperform this year or which could underperform this year. Ultimately, it is good to close out a year with a review and a takeaway that will allow us to improve our analysis scope and where some investments made during the year went wrong or right. Best And Worst Performing Assets: Stocks US equities continued to march higher in 2014, as the bull market continued to show strength during the year. Dow Jones Industrial Average rose 8.4% in 2014, S&P 500 rose 12.39%, and the Nasdaq led the group of US indices with 14.31% gain for the year. Turning to European equities, the FTSE 100 (INDEXFTSE:UKX) lost -2.26% for the year, the CAC 40 rose 1.08%, and Euro Stoxx 50 saw a rise of 2.48% in 2014. The Shanghai Composite, Chinese equities, rose 53.94% in 2014 and Japan’s Nikkei 225 (INDEXNIKKEI:NI225) saw 2014 outcome of -1.93% ( Google Finance data) Best And Worst Performing Assets: Commodities Commodities had a good start in 2014, but as the US dollar continued to build strength in the latter half of the year, commodities began to suffer. The biggest and most memorable story of 2014 for commodities will be the collapse in oil prices, which fell -44.5% during the year. Natural gas lost -29% and heating oil was the second worst performing commodity at -39.6%. Gold ended the year down, but relatively flat overall with -2.9% 2014 performance. Silver fared much worse, which fell -20.7%. On the bright side, coffee was the overwhelming best performing commodity, which shot up 44.8%. Cattle prices had a huge run up in 2014, led by feeder cattle’s gains of 33.7%. Live cattle saw gains of 22.1% and lean hogs was worst performer of the livestock sector, down -6.6% for the year. The US dollar rose 12.9% during the year. Best And Worst Performing Assets: Bond Yields Bond yields across the board saw declines in 2014. Yields and bond prices work inversely, meaning bond prices rallied in 2014 as yields sank. The US 10 Year saw yields fall -0.857 basis points, Germany’s 10 year fell -1.387 bps, UK saw a drop of -1.266 bps, Japan’s 10 year saw the lowest fall in yield at -0.412 bps. Spain’s 10 year yields fell the most by -2.54 bps, followed by Italy’s 10 year yield declines of -2.235 bps. Overall, 2014 was a good year for US equities, the US dollar, cattle, coffee, and bond prices. Looking forward to 2015, analysts and economists are forecasting continued strength in the US dollar, which will mean lagging commodity prices. US equities have the general consensus of starting the year off strong and getting weaker as the year rolls on. Bonds are predicted to have a very rough year with the US Federal Reserve expected to raise rates at some point. Ultimately, we will have to wait and see what the New Year brings. Disclosure: None Scalper1 News

Scalper1 News