Scalper1 News

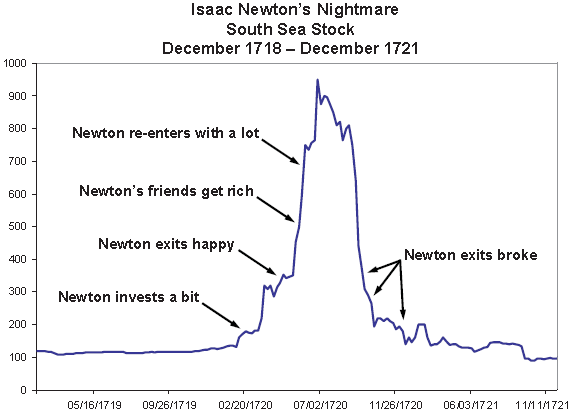

Summary Stay away from these 7 deadly words that we tell ourselves. See how investors can be classified into three types of lemmings. Discover a simple concept of what valuation really is to an investor. I’m a valuation nut. The methods I choose are not perfect because valuation involves art and science. But then again, what is the perfect valuation method? There’s no such thing. And that’s difficult for many people to grasp because we are taught to do things the “right” way, a “certain” way. One of the most difficult things with investing and any form of valuation is that there is no step by step guide. In any other industry there’s a clear process that you can follow from start to finish to accomplish a task Ikea furniture assembly instructions Photography tutorials How to tie a tie Learning to hang glide and so on But investing is like a choose your own adventure book that I loved to read growing up. A choose your own adventure book is one where you come to a section of the book and then get to choose which adventure you want to take. Depending on your choices, the ending is different. When it comes to investing, there is no clear single method of doing things and it can overwhelm, and frankly, freaks out some people. Instead of a straight path from A to B, the waves of decisions and new information you have to take in requires lots of work. And it’s too much for many people. That’s why you always see people asking strangers what their thoughts are on a stock they hold. But the truth is that people can invest successfully. People can value stocks properly. You’re just led to believe you can’t. It’s just that there are a ton of blogs, news and articles that discuss complex ideas, causing people to simply walk by obvious low risk ideas. I call these low hanging fruits. Bloggers, news reporters, financial analysts all want to write about the hard stuff to get recognized. The complex deals. Who wants to write about how a small, well run, industrial niche company in Nashville, with a 70 year long heritage that continues to gain business and generate cash when less than 400 people on the Internet will read it? Instead they could be writing about how Tesla (NASDAQ: TSLA ) is reinventing the auto industry and revolutionizing a new energy era, poring over PHD words and speculating about what the future could bring. It could go viral and look good on their writing stats. But… You’re led to believe that they must know something that you don’t. The 7 Most Deadly Words in Investing This is a video that I refer to now and then when I need to clear my head or when I start second guessing myself. I’ve marked the video to start from 1:57. Watch the next 2 minutes to around the 3:50 mark. Did you catch those 7 deadly words? They must know something that you don’t. If seasoned professionals fall into this trap, how much easier is it for regular investors to tell themselves the same thing? Especially when they read or hear people they regard as more intelligent as themselves disagreeing with their analysis and valuations. If you didn’t or can’t watch the video above, Prof Aswath Damodaran lays out a simple example that I certainly relate to. You value a company. Say you come up with a value of $50 per share. Let’s say the company is Amazon. Stock is trading at $278. One of the great stocks of the last decade. Your rational side is saying, “don’t buy that stock, it’s expensive”. But then you hear a voice at the back of your head. “They must know something that you don’t”. And when you hear that voice, magical things happen to your valuation. Your cash flows increase, your growth rates go up, your discount rates go down, $50 becomes $100, $100 becomes $150, and before you know it, guess what? You’re at $275, $300, justifying your need to buy. 3 Types of Lemmings Damodaran continues on to group investors into 3 groups of lemmings. After all, we are all lemmings to some degree. There is no such thing as a pure contrarian, because that just means you are a contrarian just for the sake of being a contrarian. Lemming #1: The Proud Lemming These are just momentum investors who are proud of following what’s hot. They don’t care what the company is or does. They look for a crowd and buy and sell whatever is being bought or sold. Lemming #2: The Yogi Bear Lemming Yogi Bear’s tagline is “smarter than the average bear” and it refers to the investors who like to think that they are able to pull out of a stock just before it crashes. The problem is that most people claim they are smarter than the average bear, but rarely are they able to jump ship of a momentum train before it crashes. If Isaac Newton, the father of advanced mathematics and mechanics couldn’t handle the charts, market and lemming fever, I have serious doubts about most of us. Isaac Newton Became a Lemming ( Photo Credit: Safal Niveshak ) Lemming #3: The Lemming with a Life Vest Valuation is simply a life vest. A compass. It’s something for you to hang onto when everyone else is doing something else. Buffett knew that dot com stocks were at stupid valuations in 2000 and held onto his life vest when Barron’s basically called him “old”. After more than 30 years of unrivaled investment success, Warren Buffett may be losing his magic touch. … To be blunt, Buffett, who turns 70 in 2000, is viewed by an increasing number of investors as too conservative, even passe. Buffett, Berkshire’s chairman and chief executive, may be the world’s greatest investor, but he hasn’t anticipated or capitalized on the boom in technology stocks in the past few years. Indeed, Buffett has even started taking flak on Internet message boards. One contributor called Berkshire a “middlebrow insurance company studded with a bizarre melange of assets, including candy stores, hamburger stands, jewelry shops, a shoemaker and a third-rate encyclopedia company [the World Book].” – Barrons I just love how Damodaran puts it because it’s exactly how I process it. Valuation slows the process down, gives your rational side a chance to mount an argument. Valuation is Simple. Don’t Complicate It. When you value stocks, you miss out on hundreds of opportunities. Most growth stocks go out the window. Forget about Tesla. Most investors don’t want to hear about valuation because it challenges their desire to hear what they want. But I love valuation and it’s the reason why the OSV Analyzer came to life in the first place. I love it and over 800 members have made great use of it because when facts and numbers over the past 5 years or 10 years are smack in front on your face, it’s difficult to trick yourself. Unless I can find a reason for why I have to increase my valuation from $50 to $300 without solid evidence, it’s easy to recognize I’m fooling myself. I could go into 101 reasons why everyone should use the analysis tool, but the more important thing is to start building a habit of valuing stocks. Investing is a game where you don’t win by making all the right calls. You can be right only 40% of the time. But if your conviction and position sizing is good, you can easily beat anyone out there. When I start chasing complicated stories, structures, deals, industries that I know nothing about, I’ve lost money every time. When I focus on valuation and follow it up with patiently waiting until the stock hits my margin of safety price, I’ve been rewarded more times than I’ve been wrong. You Can Win the Fight As a freebie, I have free valuation spreadsheets you can start with. It’s combined with an easy to digest mini valuation courses over email if you are a new subscriber. Just easy guides on how to value and analyze stocks using several different methods. Charlie Munger said that if he knew where he was going to die, he’d never go there. Well, you’ve just found the 7 deadliest words in investing. They must know something that you don’t. Let’s not go there. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Stay away from these 7 deadly words that we tell ourselves. See how investors can be classified into three types of lemmings. Discover a simple concept of what valuation really is to an investor. I’m a valuation nut. The methods I choose are not perfect because valuation involves art and science. But then again, what is the perfect valuation method? There’s no such thing. And that’s difficult for many people to grasp because we are taught to do things the “right” way, a “certain” way. One of the most difficult things with investing and any form of valuation is that there is no step by step guide. In any other industry there’s a clear process that you can follow from start to finish to accomplish a task Ikea furniture assembly instructions Photography tutorials How to tie a tie Learning to hang glide and so on But investing is like a choose your own adventure book that I loved to read growing up. A choose your own adventure book is one where you come to a section of the book and then get to choose which adventure you want to take. Depending on your choices, the ending is different. When it comes to investing, there is no clear single method of doing things and it can overwhelm, and frankly, freaks out some people. Instead of a straight path from A to B, the waves of decisions and new information you have to take in requires lots of work. And it’s too much for many people. That’s why you always see people asking strangers what their thoughts are on a stock they hold. But the truth is that people can invest successfully. People can value stocks properly. You’re just led to believe you can’t. It’s just that there are a ton of blogs, news and articles that discuss complex ideas, causing people to simply walk by obvious low risk ideas. I call these low hanging fruits. Bloggers, news reporters, financial analysts all want to write about the hard stuff to get recognized. The complex deals. Who wants to write about how a small, well run, industrial niche company in Nashville, with a 70 year long heritage that continues to gain business and generate cash when less than 400 people on the Internet will read it? Instead they could be writing about how Tesla (NASDAQ: TSLA ) is reinventing the auto industry and revolutionizing a new energy era, poring over PHD words and speculating about what the future could bring. It could go viral and look good on their writing stats. But… You’re led to believe that they must know something that you don’t. The 7 Most Deadly Words in Investing This is a video that I refer to now and then when I need to clear my head or when I start second guessing myself. I’ve marked the video to start from 1:57. Watch the next 2 minutes to around the 3:50 mark. Did you catch those 7 deadly words? They must know something that you don’t. If seasoned professionals fall into this trap, how much easier is it for regular investors to tell themselves the same thing? Especially when they read or hear people they regard as more intelligent as themselves disagreeing with their analysis and valuations. If you didn’t or can’t watch the video above, Prof Aswath Damodaran lays out a simple example that I certainly relate to. You value a company. Say you come up with a value of $50 per share. Let’s say the company is Amazon. Stock is trading at $278. One of the great stocks of the last decade. Your rational side is saying, “don’t buy that stock, it’s expensive”. But then you hear a voice at the back of your head. “They must know something that you don’t”. And when you hear that voice, magical things happen to your valuation. Your cash flows increase, your growth rates go up, your discount rates go down, $50 becomes $100, $100 becomes $150, and before you know it, guess what? You’re at $275, $300, justifying your need to buy. 3 Types of Lemmings Damodaran continues on to group investors into 3 groups of lemmings. After all, we are all lemmings to some degree. There is no such thing as a pure contrarian, because that just means you are a contrarian just for the sake of being a contrarian. Lemming #1: The Proud Lemming These are just momentum investors who are proud of following what’s hot. They don’t care what the company is or does. They look for a crowd and buy and sell whatever is being bought or sold. Lemming #2: The Yogi Bear Lemming Yogi Bear’s tagline is “smarter than the average bear” and it refers to the investors who like to think that they are able to pull out of a stock just before it crashes. The problem is that most people claim they are smarter than the average bear, but rarely are they able to jump ship of a momentum train before it crashes. If Isaac Newton, the father of advanced mathematics and mechanics couldn’t handle the charts, market and lemming fever, I have serious doubts about most of us. Isaac Newton Became a Lemming ( Photo Credit: Safal Niveshak ) Lemming #3: The Lemming with a Life Vest Valuation is simply a life vest. A compass. It’s something for you to hang onto when everyone else is doing something else. Buffett knew that dot com stocks were at stupid valuations in 2000 and held onto his life vest when Barron’s basically called him “old”. After more than 30 years of unrivaled investment success, Warren Buffett may be losing his magic touch. … To be blunt, Buffett, who turns 70 in 2000, is viewed by an increasing number of investors as too conservative, even passe. Buffett, Berkshire’s chairman and chief executive, may be the world’s greatest investor, but he hasn’t anticipated or capitalized on the boom in technology stocks in the past few years. Indeed, Buffett has even started taking flak on Internet message boards. One contributor called Berkshire a “middlebrow insurance company studded with a bizarre melange of assets, including candy stores, hamburger stands, jewelry shops, a shoemaker and a third-rate encyclopedia company [the World Book].” – Barrons I just love how Damodaran puts it because it’s exactly how I process it. Valuation slows the process down, gives your rational side a chance to mount an argument. Valuation is Simple. Don’t Complicate It. When you value stocks, you miss out on hundreds of opportunities. Most growth stocks go out the window. Forget about Tesla. Most investors don’t want to hear about valuation because it challenges their desire to hear what they want. But I love valuation and it’s the reason why the OSV Analyzer came to life in the first place. I love it and over 800 members have made great use of it because when facts and numbers over the past 5 years or 10 years are smack in front on your face, it’s difficult to trick yourself. Unless I can find a reason for why I have to increase my valuation from $50 to $300 without solid evidence, it’s easy to recognize I’m fooling myself. I could go into 101 reasons why everyone should use the analysis tool, but the more important thing is to start building a habit of valuing stocks. Investing is a game where you don’t win by making all the right calls. You can be right only 40% of the time. But if your conviction and position sizing is good, you can easily beat anyone out there. When I start chasing complicated stories, structures, deals, industries that I know nothing about, I’ve lost money every time. When I focus on valuation and follow it up with patiently waiting until the stock hits my margin of safety price, I’ve been rewarded more times than I’ve been wrong. You Can Win the Fight As a freebie, I have free valuation spreadsheets you can start with. It’s combined with an easy to digest mini valuation courses over email if you are a new subscriber. Just easy guides on how to value and analyze stocks using several different methods. Charlie Munger said that if he knew where he was going to die, he’d never go there. Well, you’ve just found the 7 deadliest words in investing. They must know something that you don’t. Let’s not go there. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News