Scalper1 News

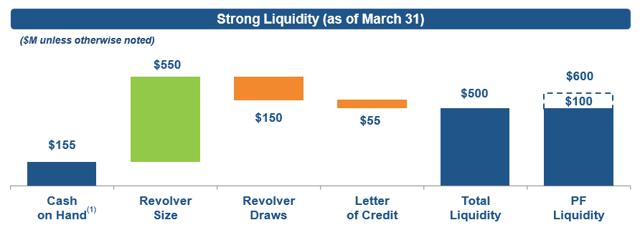

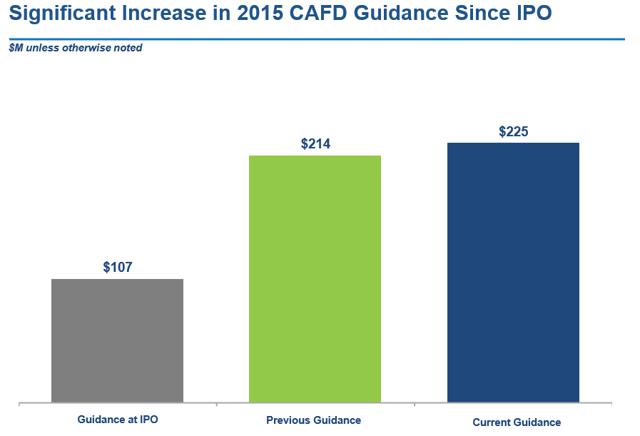

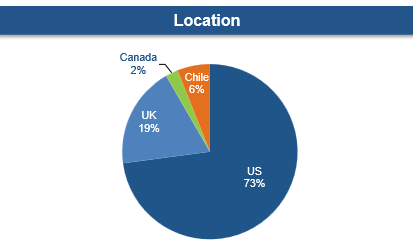

Summary Once again increased dividend guidance to $1.75 per share and $2.05 per share for 2016 and 2017. In a better position to support growth which is 24% CAGR currently. The recent acquisition of Vivint Solar will further strengthen TERP’s position in residential rooftop space. TerraForm Power Inc. (NASDAQ: TERP ), the yieldco formed by SunEdison (NYSE: SUNE ) should benefit from the leadership position of SunEdison in the industry today. SUNE is aggressively adding projects to its portfolio, which makes the investment case for TERP even stronger. TerraForm Power is in a good position to acquire projects from SunEdison. The recent acquisition of Vivint Solar (NYSE: VSLR ) will further strengthen the yieldco’s residential solar portfolio. TerraForm has been frequently increasing its dividend and CAFD guidance which is a good sign for the investors. I remain highly bullish on the stock, given the rate at which SunEdison is transferring quality projects to its yieldco. Why I like TerraForm Power 1) Strong Portfolio of projects – The inventory of project dropdowns have increased three times to 3.6 GW since the IPO, which is expected to grow by another 2.9 GW in 2016 and furthermore in the future. Not only there are transfers from its solar sponsor SunEdison, there have been acquisition from third parties as well amounting to ~1.4 GW since the IPO. The project conversions from SunEdison more than doubled from 6 GW to 14 GW in the last one year. TERP will leverage from the strong presence of SunEdison in the downstream project business. The portfolio of projects include utility projects in wind and solar energy and distributed generation projects. TerraForm currently has 17% of DG projects by installations, but they contribute to about 30% by cash flow. The recent announcement of Vivint Solar acquisition will further strengthen the yieldco’s residential portfolio, with TERP buying 523 MW of rooftop projects worth $922 million. The portfolio has expanded from 808 MW in the last year to almost 1.7 GW currently. The potential for growth in dividend per share also increases with increase in the dropdown inventory. 2) Diversifying into wind energy – As already mentioned, 30% of the assets in the total portfolio comprises of wind energy assets. This will help the yieldco benefit from the any slowdown in the solar markets. It acquired 521 MW of five wind farms from Atlantic Power, with an annual CAFD of ~$44 million. However, these assets are not dropped down in the vehicle immediately, but are stored in “warehouse”. 3) Q1 Performance was good – Revenue during the quarter was $75 million and adjusted EBITDA was $52 million. Cash available for distribution was $39 million as at the end of Q1 2015 as compared to $17 million as at the end of Q4 2014, which was in line with expectation. Drop downs from SunEdison were 167 MW in the first quarter, representing $17 million of CAFD opportunity in 2015. 4) Improved Credit & Liquidity – TerraForm Power increased the size of its revolver by $100 million to $650 million. There is sufficient liquidity in the form of cash and revolver credit to fund acquisitions. (click to enlarge) Source: TerraForm IR 5) Improved Dividend Guidance – TerraForm increased its dividend guidance to $1.35 per share from $0.90 per share at the time of its IPO and also provided a dividend growth target of 24% over the next five years. TerraForm achieved its full year DPS in the first quarter itself. The guidance has improved as a result of SunEdison accelerating the rate of dropdowns to TERP and effective conversion of the pipeline. The CAFD guidance has almost doubled since the time of the IPO. This is a very good sign of growth for TERP, since cash available for distribution is an important metric to measure the success of a yieldco. In addition, TERP has also increased its dividend per share guidance from $1.70 to $1.75 and from $2.00 to $2.05 for the years 2016 and 2017 respectively. (click to enlarge) Source: TerraForm IR Risks USA centric – Most of TERP projects are located in the USA which is increasingly moving towards solar energy. However, the recent rate of return in US projects are declining. Austin Energy in Texas got 1.2 GW of solar bids for just less than 4 cents . This might be a cause of concern for installers and developers. With improving technologies and declining cost, the prices are further expected to go down. Source: TerraForm IR Stock Performance & Valuation Currently the stock is trading at ~$31, which is very close to its 52 week low price. The market capitalization value is $3.8 billion . The P/B of 5.5x is lower than its peer 8point3 Energy Partners (NASDAQ: CAFD ) at 9.1x. TERP stock has come down due to the fall in oil prices. Most of the solar stock prices have come down due to this factor. However, falling oil prices are having absolutely no major fundamental effect on the growth of the solar energy markets worldwide. Note oil is mostly used for transportation and hardly anyone uses it for electricity power generation. Conclusion TerraForm is planning to expand into other geographies like Japan and Mexico and is also looking at new opportunities like the storage market. The company has a strong growth potential due to the aggressive expansion by its sponsor as well as from third-party M&A. The investors should like the translation of acquisitions into dividends and returns. TerraForm is also looking at expanding into the residential segment, where the dollar per megawatt is higher. I remain highly bullish on this stock and would recommend adding on dips. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Once again increased dividend guidance to $1.75 per share and $2.05 per share for 2016 and 2017. In a better position to support growth which is 24% CAGR currently. The recent acquisition of Vivint Solar will further strengthen TERP’s position in residential rooftop space. TerraForm Power Inc. (NASDAQ: TERP ), the yieldco formed by SunEdison (NYSE: SUNE ) should benefit from the leadership position of SunEdison in the industry today. SUNE is aggressively adding projects to its portfolio, which makes the investment case for TERP even stronger. TerraForm Power is in a good position to acquire projects from SunEdison. The recent acquisition of Vivint Solar (NYSE: VSLR ) will further strengthen the yieldco’s residential solar portfolio. TerraForm has been frequently increasing its dividend and CAFD guidance which is a good sign for the investors. I remain highly bullish on the stock, given the rate at which SunEdison is transferring quality projects to its yieldco. Why I like TerraForm Power 1) Strong Portfolio of projects – The inventory of project dropdowns have increased three times to 3.6 GW since the IPO, which is expected to grow by another 2.9 GW in 2016 and furthermore in the future. Not only there are transfers from its solar sponsor SunEdison, there have been acquisition from third parties as well amounting to ~1.4 GW since the IPO. The project conversions from SunEdison more than doubled from 6 GW to 14 GW in the last one year. TERP will leverage from the strong presence of SunEdison in the downstream project business. The portfolio of projects include utility projects in wind and solar energy and distributed generation projects. TerraForm currently has 17% of DG projects by installations, but they contribute to about 30% by cash flow. The recent announcement of Vivint Solar acquisition will further strengthen the yieldco’s residential portfolio, with TERP buying 523 MW of rooftop projects worth $922 million. The portfolio has expanded from 808 MW in the last year to almost 1.7 GW currently. The potential for growth in dividend per share also increases with increase in the dropdown inventory. 2) Diversifying into wind energy – As already mentioned, 30% of the assets in the total portfolio comprises of wind energy assets. This will help the yieldco benefit from the any slowdown in the solar markets. It acquired 521 MW of five wind farms from Atlantic Power, with an annual CAFD of ~$44 million. However, these assets are not dropped down in the vehicle immediately, but are stored in “warehouse”. 3) Q1 Performance was good – Revenue during the quarter was $75 million and adjusted EBITDA was $52 million. Cash available for distribution was $39 million as at the end of Q1 2015 as compared to $17 million as at the end of Q4 2014, which was in line with expectation. Drop downs from SunEdison were 167 MW in the first quarter, representing $17 million of CAFD opportunity in 2015. 4) Improved Credit & Liquidity – TerraForm Power increased the size of its revolver by $100 million to $650 million. There is sufficient liquidity in the form of cash and revolver credit to fund acquisitions. (click to enlarge) Source: TerraForm IR 5) Improved Dividend Guidance – TerraForm increased its dividend guidance to $1.35 per share from $0.90 per share at the time of its IPO and also provided a dividend growth target of 24% over the next five years. TerraForm achieved its full year DPS in the first quarter itself. The guidance has improved as a result of SunEdison accelerating the rate of dropdowns to TERP and effective conversion of the pipeline. The CAFD guidance has almost doubled since the time of the IPO. This is a very good sign of growth for TERP, since cash available for distribution is an important metric to measure the success of a yieldco. In addition, TERP has also increased its dividend per share guidance from $1.70 to $1.75 and from $2.00 to $2.05 for the years 2016 and 2017 respectively. (click to enlarge) Source: TerraForm IR Risks USA centric – Most of TERP projects are located in the USA which is increasingly moving towards solar energy. However, the recent rate of return in US projects are declining. Austin Energy in Texas got 1.2 GW of solar bids for just less than 4 cents . This might be a cause of concern for installers and developers. With improving technologies and declining cost, the prices are further expected to go down. Source: TerraForm IR Stock Performance & Valuation Currently the stock is trading at ~$31, which is very close to its 52 week low price. The market capitalization value is $3.8 billion . The P/B of 5.5x is lower than its peer 8point3 Energy Partners (NASDAQ: CAFD ) at 9.1x. TERP stock has come down due to the fall in oil prices. Most of the solar stock prices have come down due to this factor. However, falling oil prices are having absolutely no major fundamental effect on the growth of the solar energy markets worldwide. Note oil is mostly used for transportation and hardly anyone uses it for electricity power generation. Conclusion TerraForm is planning to expand into other geographies like Japan and Mexico and is also looking at new opportunities like the storage market. The company has a strong growth potential due to the aggressive expansion by its sponsor as well as from third-party M&A. The investors should like the translation of acquisitions into dividends and returns. TerraForm is also looking at expanding into the residential segment, where the dollar per megawatt is higher. I remain highly bullish on this stock and would recommend adding on dips. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News