On Oct 4, 2016, Terex Corporation TEX was downgraded to a Zacks Rank #5 (Strong Sell). Going by the Zacks model, companies holding a Zacks Rank #5 are likely to underperform the broader market.

Why the Downgrade?

On Aug 1, 2016, Terex Corporation posted dismal results for the second quarter of 2016 wherein its top and bottom line numbers compared unfavourably with the year-ago quarter figures.

The company reported adjusted earnings per share of 64 cents and revenues of $ 1.3 billion. On a year-over-year basis too, the metrics registered steep declines of 18% and 10%, respectively.

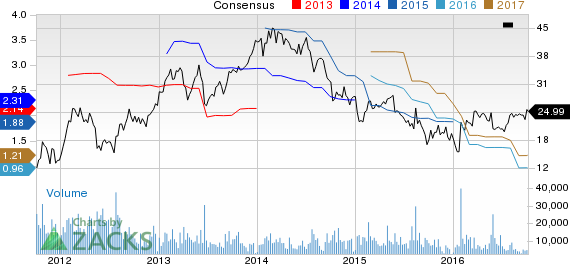

Terex now expects earnings per share from continuing operations to be between 85 cents and $ 1.15 in 2016, excluding restructuring and other unusual items. The Zacks Consensus Estimate stands at 96 cents. Additionally, the company provided guidance of net sales of $ 4.3 billion-$ 4.5 billion for full-year 2016. The Zacks Consensus Estimate is pegged at $ 4.44 billion. This reflects the removal of MHPS earnings from continuing operations and the effect of unabsorbed corporate management costs, but does not display any of the benefits of the MHPS sale which will be realized upon completion of the sale.

TEREX CORP Price and Consensus

TEREX CORP Price and Consensus | TEREX CORP Quote

Terex has witnessed substantial downward estimate revisions in the past 60 days. In fact, the Zacks Consensus Estimate for the current quarter plunged 57% to 21 cents over the last 60 days. For 2016, 10 out of 11 estimates were lowered over the same time frame, lowering the Zacks Consensus Estimate by approximately 29% to $ 1.35.

Furthermore, it is worth noting that out of the trailing four quarters, the company underperformed the Zacks Consensus Estimate in three, leading to a negative average earnings surprise of 34.89%.

Terex’s Aerial Work Platforms segment, sales will be hampered by the challenging market conditions, especially in North and South America, for the balance of 2016. Moreover, global pricing dynamics, geographical mix and production reductions will cause margin compression. The Material Processing segment will remain affected by the weak mining market. Further, soft market for Fuchs machines, driven by scrap metal prices remains a significant headwind for the segment. For the Cranes segment, pricing pressure, product mix and execution issues are to put pressure on margins.

Stocks to Consider

Brady Corp. BRC has a positive average earnings surprise of 31.49% over the last four quarters. The company sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Berry Plastics Group, Inc. BERY and Deere & Company DE also carry a Zacks Rank #1. While Berry Plastics generated a positive average earnings surprise of 13.97% over the trailing four quarters, Deere & Company reported a positive average earnings surprise of 32.16% in the trailing four quarters.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks’ best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TEREX CORP (TEX): Free Stock Analysis Report

DEERE & CO (DE): Free Stock Analysis Report

BRADY CORP CL A (BRC): Free Stock Analysis Report

BERRY PLASTICS (BERY): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International