Scalper1 News

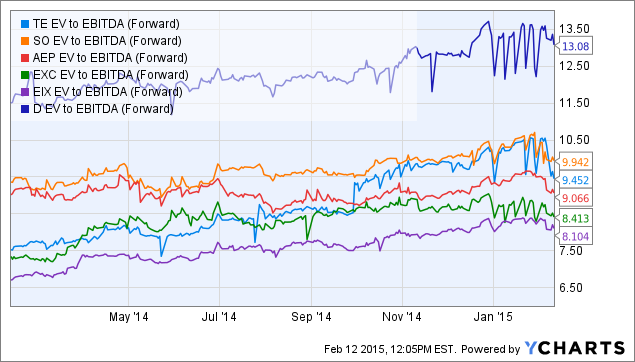

Summary TECO Energy is strategically exiting its TECO Coal business in order to boost earnings. We believe the stock should trade at a premium valuation compared to its peers post TECO Coal divestiture. Investors should buy the stock at the current price in order to maximize gains. The shares of TECO Energy (NYSE: TE ), an energy-related holding company with regulated electric and gas utilities in Florida and New Mexico, have fallen significantly post its unimpressive fourth-quarter 2014 earnings few days ago. Furthermore, reduction in sale price of its TECO Coal subsidiary to Cambrian Coal by $30 million was also responsible for the correction in the stock. However, we believe the correction offers a decent entry point to long-term investors as TECO Energy is expected to be an interesting growth story post the TECO Coal divestiture. TE data by YCharts Investment Thesis The investment thesis is primarily based on TECO Energy’s future growth in net income following the divestiture of TECO Coal that is seeing operating losses with coal markets continuing to weaken. The company’s other three subsidiaries, such as Tampa Electric, Peoples Gas System and New Mexico Gas Co. or NMGC, are growing impressively. Exiting TECO Coal will boost the company’s overall bottom-line significantly. TECO Energy’s electricity sales for 2015 by Tampa Electric, one of its key subsidiaries, should rise modestly as a result of thriving Florida economy, particularly the Hillsborough County, Tampa Electric’s primary service territory. The electricity sales pattern in the Tampa area is bouncing back to the pre-economic downturn level, which is positive for TECO shareholders since most of the company’s earnings come from Tampa Electric. In addition to the electricity business, the stronger Florida economy is also responsible for sales growth of TECO’s Peoples Gas System unit by around 2-3% yearly driven by stronger commercial and industrial customer growth. Further, TECO Energy’s acquisition of NMGC in September is also expected to drive earnings due to healthy customer growth supported by large presence of oil and gas industries in New Mexico. Fundamental Analysis We believe TECO should trade at a premium in terms of EV/EBITDA compared to its peers, such as Southern Company (NYSE: SO ), American Electric Power (NYSE: AEP ), Exelon (NYSE: EXC ), and Edison International (NYSE: EIX ) as a result of favorable economic conditions in the states it operates. Dominion Resources (NYSE: D ), which operates in Virginia and North Carolina, is trading at a significant premium compared to the peer group due to its favorable jurisdiction, and TECO can also trade closer to such valuation post its TECO Coal exit. TE EV to EBITDA (Forward) data by YCharts Assuming normal weather in 2015, TECO’s 2015 EBITDA is expected to see around 15% year-over-year growth, and should be around $1 billion. As a result, enterprise value should be around 13 billion at 13x forward EV/EBITDA, the valuation at which Dominion Resources is trading. However, 13x forward EV/EBITDA might be too optimistic and we feel 10x is a more reasonable valuation, at which TECO’s enterprise value should be around 10 billion, and market cap should be close to $6.5 billion. We believe the stock is heading toward $27.70 based on 10x forward EV/EBITDA. Potential Risks If Florida’s economic conditions and housing markets see any weakening going ahead, Tampa Electric’s or Peoples Gas System’s earnings could be negatively impacted, resulting in negative returns for TECO shareholders. Since Florida is exposed to extreme weather conditions including hurricanes, investors should be prepared for volatility in the share price due to temporary reduction in the company’s earnings as a result of any damage to the company’s facilities. Since the company operates in a highly regulated environment, if it earns return on equity above allowed ranges, earnings could be subject to regulatory review and eventually might be reduced. Conclusion The current year is going to be TECO’s first full-year of ownership of NMGC, and the company expects it to be EPS-accretive in the first full-year. However, we believe NMGC will be a sustainable growth driver for the company. NMGC’s bottom-line growth coupled with TECO’s strategic exiting of the TECO Coal business should be considered long-term positive for the stock. Investors are advised to buy the stock at the current price. Business relationship disclosure: The article has been written by a BB Research stock analyst. BB Research is not receiving compensation for it (other than from Seeking Alpha). BB Research has no business relationship with any company whose stock is mentioned in this article. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary TECO Energy is strategically exiting its TECO Coal business in order to boost earnings. We believe the stock should trade at a premium valuation compared to its peers post TECO Coal divestiture. Investors should buy the stock at the current price in order to maximize gains. The shares of TECO Energy (NYSE: TE ), an energy-related holding company with regulated electric and gas utilities in Florida and New Mexico, have fallen significantly post its unimpressive fourth-quarter 2014 earnings few days ago. Furthermore, reduction in sale price of its TECO Coal subsidiary to Cambrian Coal by $30 million was also responsible for the correction in the stock. However, we believe the correction offers a decent entry point to long-term investors as TECO Energy is expected to be an interesting growth story post the TECO Coal divestiture. TE data by YCharts Investment Thesis The investment thesis is primarily based on TECO Energy’s future growth in net income following the divestiture of TECO Coal that is seeing operating losses with coal markets continuing to weaken. The company’s other three subsidiaries, such as Tampa Electric, Peoples Gas System and New Mexico Gas Co. or NMGC, are growing impressively. Exiting TECO Coal will boost the company’s overall bottom-line significantly. TECO Energy’s electricity sales for 2015 by Tampa Electric, one of its key subsidiaries, should rise modestly as a result of thriving Florida economy, particularly the Hillsborough County, Tampa Electric’s primary service territory. The electricity sales pattern in the Tampa area is bouncing back to the pre-economic downturn level, which is positive for TECO shareholders since most of the company’s earnings come from Tampa Electric. In addition to the electricity business, the stronger Florida economy is also responsible for sales growth of TECO’s Peoples Gas System unit by around 2-3% yearly driven by stronger commercial and industrial customer growth. Further, TECO Energy’s acquisition of NMGC in September is also expected to drive earnings due to healthy customer growth supported by large presence of oil and gas industries in New Mexico. Fundamental Analysis We believe TECO should trade at a premium in terms of EV/EBITDA compared to its peers, such as Southern Company (NYSE: SO ), American Electric Power (NYSE: AEP ), Exelon (NYSE: EXC ), and Edison International (NYSE: EIX ) as a result of favorable economic conditions in the states it operates. Dominion Resources (NYSE: D ), which operates in Virginia and North Carolina, is trading at a significant premium compared to the peer group due to its favorable jurisdiction, and TECO can also trade closer to such valuation post its TECO Coal exit. TE EV to EBITDA (Forward) data by YCharts Assuming normal weather in 2015, TECO’s 2015 EBITDA is expected to see around 15% year-over-year growth, and should be around $1 billion. As a result, enterprise value should be around 13 billion at 13x forward EV/EBITDA, the valuation at which Dominion Resources is trading. However, 13x forward EV/EBITDA might be too optimistic and we feel 10x is a more reasonable valuation, at which TECO’s enterprise value should be around 10 billion, and market cap should be close to $6.5 billion. We believe the stock is heading toward $27.70 based on 10x forward EV/EBITDA. Potential Risks If Florida’s economic conditions and housing markets see any weakening going ahead, Tampa Electric’s or Peoples Gas System’s earnings could be negatively impacted, resulting in negative returns for TECO shareholders. Since Florida is exposed to extreme weather conditions including hurricanes, investors should be prepared for volatility in the share price due to temporary reduction in the company’s earnings as a result of any damage to the company’s facilities. Since the company operates in a highly regulated environment, if it earns return on equity above allowed ranges, earnings could be subject to regulatory review and eventually might be reduced. Conclusion The current year is going to be TECO’s first full-year of ownership of NMGC, and the company expects it to be EPS-accretive in the first full-year. However, we believe NMGC will be a sustainable growth driver for the company. NMGC’s bottom-line growth coupled with TECO’s strategic exiting of the TECO Coal business should be considered long-term positive for the stock. Investors are advised to buy the stock at the current price. Business relationship disclosure: The article has been written by a BB Research stock analyst. BB Research is not receiving compensation for it (other than from Seeking Alpha). BB Research has no business relationship with any company whose stock is mentioned in this article. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News