Scalper1 News

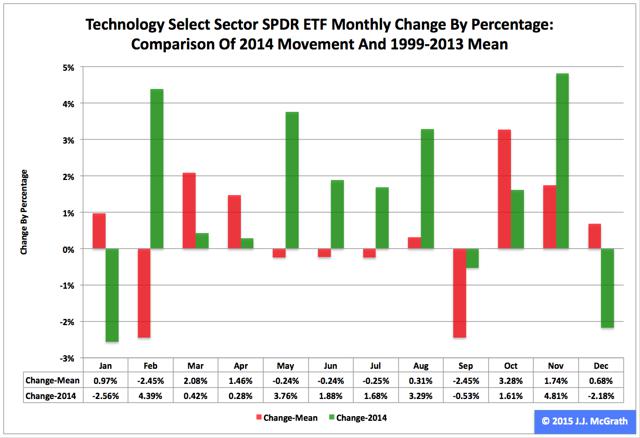

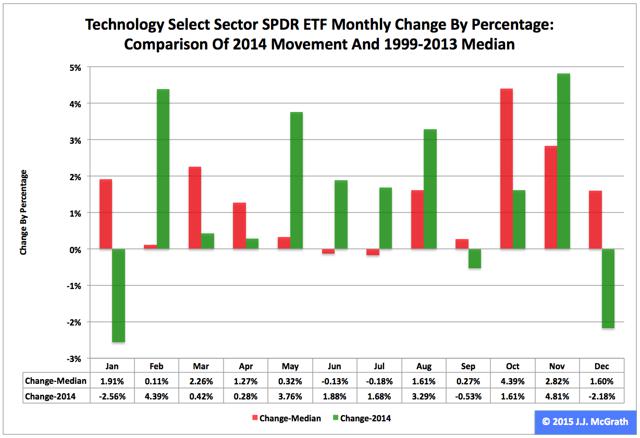

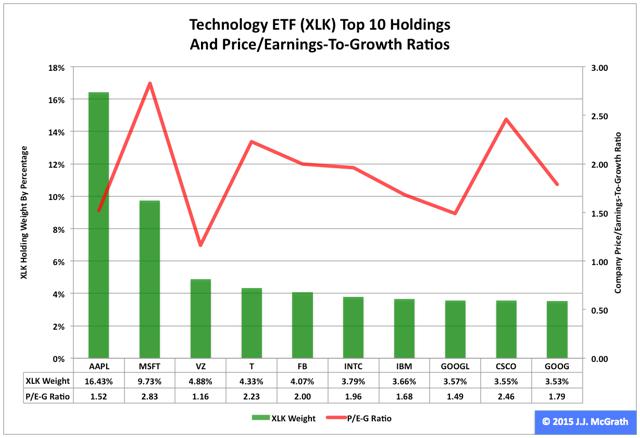

Summary The Technology exchange-traded fund finished third by return among the nine Select Sector SPDRs in 2014. As it did so, the ETF was weak at the beginning and the end of the year, while strong in the months in-between. Seasonality analysis of the first quarter is a mixed bag, but my data interpretation suggests a constrained return. The Technology Select Sector SPDR ETF (NYSEARCA: XLK ) in 2014 ranked No. 3 by return among the Select Sector SPDRs that cleave the S&P 500 into nine fragments. On an adjusted closing daily share-price basis, XLK climbed to $41.35 from $35.09, a hike of $6.26, or 17.84 percent. It thus behaved better than its parent proxy, the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) by 4.38 percentage points, but worse than its sibling, the Utilities Select Sector SPDR ETF (NYSEARCA: XLU ) by -10.90 points. (XLK closed at $41.25 Friday.) XLK ranked No. 7 among the sector SPDRs in the fourth quarter, when it lagged XLU and SPY by -9.00 and -0.72 percentage points, in that order. And XLK ranked No. 9 among the sector SPDRs in December, when it performed worse than XLU and SPY by -5.75 and -1.92 percentage points, respectively. Figure 1: XLK Monthly Change, 2014 Vs. 1999-2013 Mean (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing monthly share prices at Yahoo Finance . XLK behaved a lot better in 2014 than it did during its initial 15 full years of existence based on the monthly means calculated by employing data associated with that historical time frame (Figure 1). The same data set shows the average year’s weakest quarter was the third, with an absolutely large negative return, and its strongest quarter was the fourth, with an absolutely large positive return. Inconsistent with this pattern, the ETF had excellent gains each and every quarter last year. Figure 2: XLK Monthly Change, 2014 Versus 1999-2013 Median (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing monthly share prices at Yahoo Finance. XLK also performed a lot better in 2014 than it did during its initial 15 full years of existence based on the monthly medians calculated by using data associated with that historical time frame (Figure 2). The same data set shows the average year’s weakest quarter was the second, with a relatively small positive return, and its strongest quarter was the fourth, with an absolutely large positive return. Meanwhile, there is a big difference between the monthly mean and median performances of the ETF in Q1: Personally, I parse the relevant data more bearishly (consistent with the mean) and less bullishly (inconsistent with the median) in the current context. Figure 3: XLK’s Top 10 Holdings and P/E-G Ratios, Jan. 9 (click to enlarge) Note: The XLK holding-weight-by-percentage scale is on the left (green), and the company price/earnings-to-growth ratio scale is on the right (red). Source: This J.J.’s Risky Business chart is based on data at the XLK microsite and FinViz.com (both current as of Jan. 9). XLK appears poorly positioned to be a standout among the Select Sector SPDRs, either this quarter or this year, given factors discussed in “PowerShares QQQ’s 2014 And Fourth-Quarter Performance And Seasonality.” Basically, I anticipate one of the biggest headwinds buffeting the U.S. technology sector in general and XLK in particular over the foreseeable future may be the bias divergence in monetary policy at major central banks around the world. On the one hand, the U.S. Federal Reserve is oriented toward tightening; on the other hand, the Bank of Japan, European Central Bank and People’s Bank of China are oriented toward loosening. This divergence has had important effects on exchange rates, such as in the euro and U.S. dollar currency pair, or EUR/USD. It is worth mentioning in this context that the Fed announced the end of asset purchases under its latest quantitative-easing program, aka QE3+, Oct. 29 and may announce the beginning of interest-rate hikes April 29. Its conclusion of purchases under its first two formal QE programs this century is associated with both a correction and a bear market in large-capitalization equities, as evidenced by SPY’s declines of -17.19 percent in 2010 and -21.69 percent in 2011. The bias divergence at the major central banks has been reflected by action in the EUR/USD cross, which slipped from as high as $1.3992 May 8 to as low as $1.1753 Jan. 8, a slide of -$0.2239, or -16.00 percent, based on data at StockCharts.com. This change in EUR/USD and similar moves in other currency pairs indicate a strengthening greenback and a weakening everything else could pressure earnings of U.S. companies in sectors with substantial international businesses. And XLK encompasses many firms fitting this description, with its exposure to either the tech or the telecommunications sectors at about 100 percent, per its microsite. Meanwhile, the valuations of the ETF’s top 10 holdings seem unlikely to function as tailwinds for it this quarter (Figure 3). Nonetheless, the S&P 500 information-technology sector does not strike me as hideously overvalued, with S&P Senior Index Analyst Howard Silverblatt reporting Dec. 31 its P/E-G ratio was 1.20. Of course, it was a different story with the index’s telecommunications-services sector, with Silverblatt reporting at the same time its P/E-G ratio was 2.16. Disclaimer: The opinions expressed herein by the author do not constitute an investment recommendation, and they are unsuitable for employment in the making of investment decisions. The opinions expressed herein address only certain aspects of potential investment in any securities and cannot substitute for comprehensive investment analysis. The opinions expressed herein are based on an incomplete set of information, illustrative in nature, and limited in scope. In addition, the opinions expressed herein reflect the author’s best judgment as of the date of publication, and they are subject to change without notice. Scalper1 News

Summary The Technology exchange-traded fund finished third by return among the nine Select Sector SPDRs in 2014. As it did so, the ETF was weak at the beginning and the end of the year, while strong in the months in-between. Seasonality analysis of the first quarter is a mixed bag, but my data interpretation suggests a constrained return. The Technology Select Sector SPDR ETF (NYSEARCA: XLK ) in 2014 ranked No. 3 by return among the Select Sector SPDRs that cleave the S&P 500 into nine fragments. On an adjusted closing daily share-price basis, XLK climbed to $41.35 from $35.09, a hike of $6.26, or 17.84 percent. It thus behaved better than its parent proxy, the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) by 4.38 percentage points, but worse than its sibling, the Utilities Select Sector SPDR ETF (NYSEARCA: XLU ) by -10.90 points. (XLK closed at $41.25 Friday.) XLK ranked No. 7 among the sector SPDRs in the fourth quarter, when it lagged XLU and SPY by -9.00 and -0.72 percentage points, in that order. And XLK ranked No. 9 among the sector SPDRs in December, when it performed worse than XLU and SPY by -5.75 and -1.92 percentage points, respectively. Figure 1: XLK Monthly Change, 2014 Vs. 1999-2013 Mean (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing monthly share prices at Yahoo Finance . XLK behaved a lot better in 2014 than it did during its initial 15 full years of existence based on the monthly means calculated by employing data associated with that historical time frame (Figure 1). The same data set shows the average year’s weakest quarter was the third, with an absolutely large negative return, and its strongest quarter was the fourth, with an absolutely large positive return. Inconsistent with this pattern, the ETF had excellent gains each and every quarter last year. Figure 2: XLK Monthly Change, 2014 Versus 1999-2013 Median (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing monthly share prices at Yahoo Finance. XLK also performed a lot better in 2014 than it did during its initial 15 full years of existence based on the monthly medians calculated by using data associated with that historical time frame (Figure 2). The same data set shows the average year’s weakest quarter was the second, with a relatively small positive return, and its strongest quarter was the fourth, with an absolutely large positive return. Meanwhile, there is a big difference between the monthly mean and median performances of the ETF in Q1: Personally, I parse the relevant data more bearishly (consistent with the mean) and less bullishly (inconsistent with the median) in the current context. Figure 3: XLK’s Top 10 Holdings and P/E-G Ratios, Jan. 9 (click to enlarge) Note: The XLK holding-weight-by-percentage scale is on the left (green), and the company price/earnings-to-growth ratio scale is on the right (red). Source: This J.J.’s Risky Business chart is based on data at the XLK microsite and FinViz.com (both current as of Jan. 9). XLK appears poorly positioned to be a standout among the Select Sector SPDRs, either this quarter or this year, given factors discussed in “PowerShares QQQ’s 2014 And Fourth-Quarter Performance And Seasonality.” Basically, I anticipate one of the biggest headwinds buffeting the U.S. technology sector in general and XLK in particular over the foreseeable future may be the bias divergence in monetary policy at major central banks around the world. On the one hand, the U.S. Federal Reserve is oriented toward tightening; on the other hand, the Bank of Japan, European Central Bank and People’s Bank of China are oriented toward loosening. This divergence has had important effects on exchange rates, such as in the euro and U.S. dollar currency pair, or EUR/USD. It is worth mentioning in this context that the Fed announced the end of asset purchases under its latest quantitative-easing program, aka QE3+, Oct. 29 and may announce the beginning of interest-rate hikes April 29. Its conclusion of purchases under its first two formal QE programs this century is associated with both a correction and a bear market in large-capitalization equities, as evidenced by SPY’s declines of -17.19 percent in 2010 and -21.69 percent in 2011. The bias divergence at the major central banks has been reflected by action in the EUR/USD cross, which slipped from as high as $1.3992 May 8 to as low as $1.1753 Jan. 8, a slide of -$0.2239, or -16.00 percent, based on data at StockCharts.com. This change in EUR/USD and similar moves in other currency pairs indicate a strengthening greenback and a weakening everything else could pressure earnings of U.S. companies in sectors with substantial international businesses. And XLK encompasses many firms fitting this description, with its exposure to either the tech or the telecommunications sectors at about 100 percent, per its microsite. Meanwhile, the valuations of the ETF’s top 10 holdings seem unlikely to function as tailwinds for it this quarter (Figure 3). Nonetheless, the S&P 500 information-technology sector does not strike me as hideously overvalued, with S&P Senior Index Analyst Howard Silverblatt reporting Dec. 31 its P/E-G ratio was 1.20. Of course, it was a different story with the index’s telecommunications-services sector, with Silverblatt reporting at the same time its P/E-G ratio was 2.16. Disclaimer: The opinions expressed herein by the author do not constitute an investment recommendation, and they are unsuitable for employment in the making of investment decisions. The opinions expressed herein address only certain aspects of potential investment in any securities and cannot substitute for comprehensive investment analysis. The opinions expressed herein are based on an incomplete set of information, illustrative in nature, and limited in scope. In addition, the opinions expressed herein reflect the author’s best judgment as of the date of publication, and they are subject to change without notice. Scalper1 News

Scalper1 News