Scalper1 News

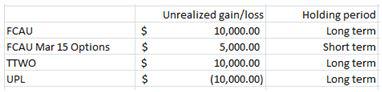

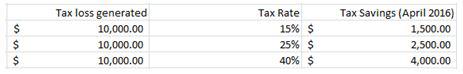

Summary In this article, we will discuss a popular tax strategy called a “loss-harvest swap”. This is effectively a legal version of the SEC-outlawed “wash-sale”. This is particularly relevant for investors with current unrealized losses in energy companies. A tax-loss harvest swap works well in times of indiscriminate selling within a sector, such as the recent selloff in oil. Whenever there are substantially alike securities to “swap” one position for another, this strategy can work well. The strategy also works well (better in fact) with ETFs. Loss-Harvest Swap Example Take this example portfolio. You’ll see we have some unrealized losses in Ultra Petroleum, a small-cap E&P company. Since the broad selloff in energy, many small-cap E&Ps have gone on sale. There are several which have fallen more than UPL and which we wouldn’t mind owning instead of it now. Say our swap of choice is SWN , a larger E&P trading at a similar valuation of 3.5x trailing cash flow, and more stable long-term Marcellus acreage. The stock has fallen 39% over the past year, compared to UPL’s 35%. A loss-harvest swap calls for a sale of UPL and a buy of SWN. From a portfolio standpoint, my risk / reward would be basically unchanged – I am still long a small-cap E&P company that is substanitally correlated to the sector. I might eventually end up with more gains from SWN than UPL, or less – that is a risk. But, I also generate some immediate & guarranteed tax benefits. Tax Savings The exact amount of the tax savings depends on your tax bracket: The savings vary, but the point is that these tax savings were obtained without much risk, and are essentially free money. If you have some short term capital gains, this is pure gold. Also, if your realized losses exceed your realized gains for the year, one can use $3000 of the losses to reduce one’s taxable income, and carry over the rest to next year. How Often to Harvest Losses Tax-loss harvesting is a strategy that can be used fairly often. Taking trading commissions into account as a cost, and leaving some margin for error for divergence between your swapped securities’ returns (don’t want inadvertently destroy alpha by buying an inferior name), you could easily make the case for an automatic swap at set thresholds (for example- harvest at every 5% loss). As such, you could benefit from even minor market volatility after you buy– and lock in a lower cost basis. However, swapping more often will generate trading costs, so I recommend using a discounted broker such as Interactive Brokers or Optionshouse (these are two I have used in the past). Also, keep in mind tax strategy is not a substitute for a good investment strategy – make sure you have the latter in place first. For a stock or sector that keeps falling, using 2 substantially-alike securites, one can swap one for the other once every 31 days and still remain in the clear with respect to the SEC’s wash sale rules. Using 3 alike securities, such as 3 ETFs which track the same index (yes, that is still allowable under SEC wash sale rules), one could swap more often than that, one just cannot swap the same security in 31 days. Scalper1 News

Summary In this article, we will discuss a popular tax strategy called a “loss-harvest swap”. This is effectively a legal version of the SEC-outlawed “wash-sale”. This is particularly relevant for investors with current unrealized losses in energy companies. A tax-loss harvest swap works well in times of indiscriminate selling within a sector, such as the recent selloff in oil. Whenever there are substantially alike securities to “swap” one position for another, this strategy can work well. The strategy also works well (better in fact) with ETFs. Loss-Harvest Swap Example Take this example portfolio. You’ll see we have some unrealized losses in Ultra Petroleum, a small-cap E&P company. Since the broad selloff in energy, many small-cap E&Ps have gone on sale. There are several which have fallen more than UPL and which we wouldn’t mind owning instead of it now. Say our swap of choice is SWN , a larger E&P trading at a similar valuation of 3.5x trailing cash flow, and more stable long-term Marcellus acreage. The stock has fallen 39% over the past year, compared to UPL’s 35%. A loss-harvest swap calls for a sale of UPL and a buy of SWN. From a portfolio standpoint, my risk / reward would be basically unchanged – I am still long a small-cap E&P company that is substanitally correlated to the sector. I might eventually end up with more gains from SWN than UPL, or less – that is a risk. But, I also generate some immediate & guarranteed tax benefits. Tax Savings The exact amount of the tax savings depends on your tax bracket: The savings vary, but the point is that these tax savings were obtained without much risk, and are essentially free money. If you have some short term capital gains, this is pure gold. Also, if your realized losses exceed your realized gains for the year, one can use $3000 of the losses to reduce one’s taxable income, and carry over the rest to next year. How Often to Harvest Losses Tax-loss harvesting is a strategy that can be used fairly often. Taking trading commissions into account as a cost, and leaving some margin for error for divergence between your swapped securities’ returns (don’t want inadvertently destroy alpha by buying an inferior name), you could easily make the case for an automatic swap at set thresholds (for example- harvest at every 5% loss). As such, you could benefit from even minor market volatility after you buy– and lock in a lower cost basis. However, swapping more often will generate trading costs, so I recommend using a discounted broker such as Interactive Brokers or Optionshouse (these are two I have used in the past). Also, keep in mind tax strategy is not a substitute for a good investment strategy – make sure you have the latter in place first. For a stock or sector that keeps falling, using 2 substantially-alike securites, one can swap one for the other once every 31 days and still remain in the clear with respect to the SEC’s wash sale rules. Using 3 alike securities, such as 3 ETFs which track the same index (yes, that is still allowable under SEC wash sale rules), one could swap more often than that, one just cannot swap the same security in 31 days. Scalper1 News

Scalper1 News