Scalper1 News

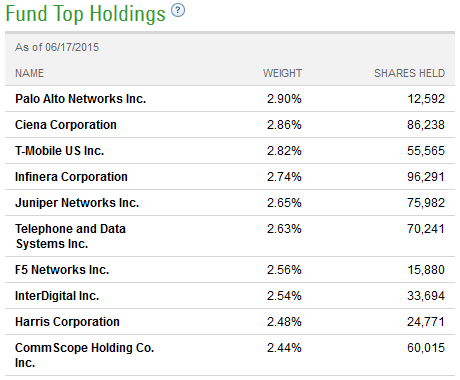

Summary Investors may find opportunities in the telecommunicationns sector. Closer look at the SPDR S&P Telecom ETF. Exposure to some other high-growth areas, like cyber security and cloud computing. By Todd Shriber & Tom Lydon Among sector exchange traded funds, telecom ETFs are usually the smallest and most overlooked – factors that belie occasional opportunity with this slow-growth group. The SPDR S&P Telecom ETF (NYSEArca: XTL ) is one telecom ETF that currently holds some allure and that allure is derived from a key advantage: XTL is not your run-of-the-mill telecom. Said another way, investors looking for an ETF heavy on telecom giants like AT&T (NYSE: T ) and Dow component Verizon (NYSE: VZ ) should look elsewhere. XTL, which turned four earlier this year, is an equal-weight fund where none of its 57 holdings account for more than 2.9% of its weight. Last year’s top-performing telecom ETF with a gain of just over 5.2%, XTL is up 5.6% this year and its technical condition is improving. “The recent move toward the upper resistance means that traders will want to watch for companies in this sector because they could be due for a surge in momentum. Based on the pattern, traders will look to enter positions in the ETF once the price closes above the upper trendline near $60.50,” according to Investopedia . XTL is arguably more of a tech fund with nearly two-thirds of its weight devoted to communications equipment makers, some of which have exposure to high-growth areas of the technology sector, such as cyber security and cloud computing. The ETF’s top 10 holdings include cyber security and communications equipment giants Palo Alto Networks (NASDAQGS: PANW ), Juniper Networks (NASDAQGS: JNPR ) and Harris (NYSE: HRS ) as well as Dow component Cisco (NASDAQGS: CSCO ). “Ken Leon, an equity analyst at S&P Capital IQ, thinks that while telecom service providers have been cautious over the past several years due to the economy, spending will likely begin to rebound in the second half of 2015, as new technologies gain broader market acceptance. For 2016, S&P Capital IQ expects accelerated equipment funding related to cloud computing and data centers from the enterprise and government markets,” said S&P Capital IQ . In addition to Cisco, Juniper and Palo Networks, XTL holds several other stocks that are also found in the PureFunds ISE Cyber Security ETF (NYSEArca: HACK ) and the First Trust ISE Cloud Computing Index Fund (NasdaqGM: SKYY ) – two of this year’s top-performing tech industry ETFs. S&P Capital IQ has a marketweight rating on XTL. The ETF charges 0.35% per year and has more than doubled in size this year to $78.6 million in assets under management. SPDR S&P Telecom ETF Top 10 Holdings Table Courtesy: State Street Global Advisors Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Investors may find opportunities in the telecommunicationns sector. Closer look at the SPDR S&P Telecom ETF. Exposure to some other high-growth areas, like cyber security and cloud computing. By Todd Shriber & Tom Lydon Among sector exchange traded funds, telecom ETFs are usually the smallest and most overlooked – factors that belie occasional opportunity with this slow-growth group. The SPDR S&P Telecom ETF (NYSEArca: XTL ) is one telecom ETF that currently holds some allure and that allure is derived from a key advantage: XTL is not your run-of-the-mill telecom. Said another way, investors looking for an ETF heavy on telecom giants like AT&T (NYSE: T ) and Dow component Verizon (NYSE: VZ ) should look elsewhere. XTL, which turned four earlier this year, is an equal-weight fund where none of its 57 holdings account for more than 2.9% of its weight. Last year’s top-performing telecom ETF with a gain of just over 5.2%, XTL is up 5.6% this year and its technical condition is improving. “The recent move toward the upper resistance means that traders will want to watch for companies in this sector because they could be due for a surge in momentum. Based on the pattern, traders will look to enter positions in the ETF once the price closes above the upper trendline near $60.50,” according to Investopedia . XTL is arguably more of a tech fund with nearly two-thirds of its weight devoted to communications equipment makers, some of which have exposure to high-growth areas of the technology sector, such as cyber security and cloud computing. The ETF’s top 10 holdings include cyber security and communications equipment giants Palo Alto Networks (NASDAQGS: PANW ), Juniper Networks (NASDAQGS: JNPR ) and Harris (NYSE: HRS ) as well as Dow component Cisco (NASDAQGS: CSCO ). “Ken Leon, an equity analyst at S&P Capital IQ, thinks that while telecom service providers have been cautious over the past several years due to the economy, spending will likely begin to rebound in the second half of 2015, as new technologies gain broader market acceptance. For 2016, S&P Capital IQ expects accelerated equipment funding related to cloud computing and data centers from the enterprise and government markets,” said S&P Capital IQ . In addition to Cisco, Juniper and Palo Networks, XTL holds several other stocks that are also found in the PureFunds ISE Cyber Security ETF (NYSEArca: HACK ) and the First Trust ISE Cloud Computing Index Fund (NasdaqGM: SKYY ) – two of this year’s top-performing tech industry ETFs. S&P Capital IQ has a marketweight rating on XTL. The ETF charges 0.35% per year and has more than doubled in size this year to $78.6 million in assets under management. SPDR S&P Telecom ETF Top 10 Holdings Table Courtesy: State Street Global Advisors Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News