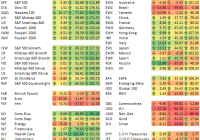

Valuation Dashboard: Healthcare – November 2015

Summary 4 key factors are reported across industries in the Healthcare sector. They give a valuation status of industries relative to their history. They give a reference for picking stocks in each industry. This article is part of a series giving a valuation dashboard by sector of companies in the S&P 500 index (NYSEARCA: SPY ). I follow up a certain number of fundamental factors for every sector, and compare them to historical averages. This article is going down at industry level in the GICS classification. It covers Healthcare. The choice of the fundamental ratios has been justified here and here . You can find in this article numbers that may be useful in a top-down approach. There is no analysis of individual stocks. A link to a list of individual stocks to consider is provided at the end. Methodology Four industry factors calculated by portfolio123 are extracted from the database: Price/Earnings (P/E), Price to sales (P/S), Price to free cash flow (P/FCF), Return on Equity (ROE). They are compared with their own historical averages “Avg”. The difference is measured in percentage for valuation ratios and in absolute for ROE, and named “D-xxx” if xxx is the factor’s name (for example D-P/E for price/earnings). The industry factors are proprietary data from the platform. The calculation aims at eliminating extreme values and size biases, which is necessary when going out of a large cap universe. These factors are not representative of capital-weighted indices. They are useful as reference values for picking stocks in an industry, not for ETF investors. Industry valuation table on 11/2/2015 The next table reports the 4 industry factors. For each factor, the next “Avg” column gives its average between January 1999 and October 2015, taken as an arbitrary reference of fair valuation. The next “D-xxx” column is the difference as explained above. So there are 3 columns for each ratio. P/E Avg D- P/E P/S Avg D- P/S P/FCF Avg D- P/FCF ROE Avg D-ROE HC Equipment&Supplies 34.5 27.18 -26.93% 4.12 3.18 -29.56% 45.64 30.51 -49.59% -20.09 -12.14 -7.95 HC Providers&Services 28.81 20.88 -37.98% 1.09 0.85 -28.24% 22.4 17.75 -26.20% 7.46 5.78 1.68 HC Technology* 56.41 56.13 -0.50% 4.11 3.39 -21.24% 32.35 35.77 9.56% -15.66 -6.2 -9.46 Biotechnology 47.8 39.78 -20.16% 50.92 29.01 -75.53% 41.33 43.74 5.51% -62.42 -64.42 2 Pharmaceuticals 32.96 26.26 -25.51% 12.28 8.25 -48.85% 29.82 32.55 8.39% -38.03 -30.3 -7.73 Life Sci. Tools&Services* 31.78 29.52 -7.66% 2.89 3.39 14.75% 32.39 27.28 -18.73% -8.87 -18.37 9.5 * Averages since 2006 Valuation The following charts give an idea of the current status of industries relative to their historical average. In all cases, the higher the better. Price/Earnings: Price/Sales: Price/Free Cash Flow: Quality Relative Momentum The next chart compares the price action of the SPDR Select Sector ETF (NYSEARCA: XLV ) with SPY (chart from freestockcharts.com). It also includes the iShares Nasdaq Biotechnology ETF (NASDAQ: IBB ) and the SPDR S&P Pharmaceuticals ETF (NYSEARCA: XPH ) as industry benchmarks. (click to enlarge) Conclusion The broad Healthcare ETF has almost the same return as SPY in the last 6 months, with large discrepancies between industries. The biotechnology index has underperformed by about 4%, the pharmaceutical index by about 14%. Two series of news have hit the latter: political announcements on overpriced legacy drugs initiated by Mrs Clinton, then suspicions of unduly inflated sales involving specialty pharmacies. Valeant Pharmaceuticals Intl (NYSE: VRX ) is at the core of both cases, but the market has punished most names linked to generic drugs and specialty pharmaceutical products. As it includes hedge fund darlings, an ETF replicating famous managers’ holdings has also suffered from this: the AlphaClone Alternative Alpha ETF ( ALFA). Taking into account valuation charts above, all healthcare industries look overpriced. There is no contradiction with the positive value score reported for Healthcare in my latest S&P 500 sector dashboard . Here, mid and small caps have been added in calculations. It is a clue of a significant discrepancy between market cap segments inside the sector. The most influential valuation factor from a statistical point of view is P/FCF, and it is more optimistic than other ratios. It points out to a slight under-pricing in 3 industries: Healthcare Technology, Biotechnology and Pharmaceuticals. However, there may be quality stocks at a reasonable price in any industry. To check them out, you can compare individual fundamental factors to the industry factors provided in the table. As an example, a list of stocks in Healthcare beating their industry factors is provided on this page . If you want to stay informed of my updates, click the “Follow” tab at the top of this article. You can choose the “real-time” option if you want to be instantly notified.