How To Invest As Fear Is Thrown Into The Market

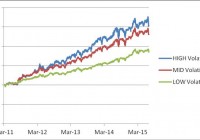

Summary As fear increases in the market, volatility has rapidly risen in one of the shortest timeframes on record. Traders betting on a normalization of expectations should position for an eventual decline in volatility. Investing alongside the impact of contango results in the best returns. Investments never consistently trade in a single direction forever. Over the past week, the crash of major stock indices has been a stark reminder that surprises to investors can happen very quickly and that fear itself can often prove to be a powerful force to be reckoned with. Yet potential opportunities exist in every situation. One such trade to now consider is the eventual suppression of uncertainty as the stock market once again normalizes and regains its composure. Over the last few days, volatility has very rapidly been increasing as a result of this uncertainty. This can be seen in the graph of the Volatility S&P 500 Index (VIX) found below as compared against the S&P 500 represented by the SPDR S&P 500 Trust ETF ( SPY ) . The VIX is quoted in percentage points and roughly equates to the expected movement in the S&P 500 index over the subsequent 30-day period when annualized. The index is a largely constructed by utilizing the implied volatilities of a wide range of S&P 500 index options. In general, the VIX represents the expected swing of the market in either direction as an expressed percentage over a given period of time. Since trading at a low of $13 on Monday, August 17, the Volatility S&P 500 Index soared to a closing price of $28 on August 21. This is greater than a 100% rise over the course of days, and therefore represents one of the most sudden movements recorded in the index’s history. It also reflects the high degree of uncertainty in the market as investors scrambled to buy options in order to gain protection for their investments. Yet as it often tends to be the case, fear and uncertainty naturally subside over a given course of time. Historically, this too can often unfold in a very rapid manner. As noted in the graph below, the VIX frequently spikes only to rapidly return back to a more sustained level in the mid-teen price range. Reasonably, this allows for a trader to predict and to invest into the normalization of market uncertainty by positioning for the eventual decline in the VIX. While investors can directly invest into the VIX through the utilization of call and put options, those unfamiliar with the use of these trading tools can still capitalize upon this predictable trend. One such investment method is to consider a short position in a related fund that is correlated to the VIX. For example, the iPath S&P 500 VIX Short-Term Futures ETN ( VXX ) is an exchange traded note that offers exposure to the daily rolling long position in the first and second month VIX futures contract. Yet as a consequence of contango, the VXX is almost inherently designed to decline in value. Contango occurs due to the perishable value of the premium attached to futures prices set before the expected delivery date. As a consequence of contango and the reliable trading action of the VIX itself, the long-term trend of the VXX is made abundantly clear in the graph shown below. Over the long-term, contango and the lack of a consistently fearful market typically dictate the downward trend of the investment. As seen in the graph below, such a trend has been well defined for many years. (click to enlarge) However, not everyone is capable of entering into a short position. There is also an inherent danger as the potential losses of a trend that backlashes against expectations are theoretically limitless. Therefore, investors could alternatively go long a VIX inverse investment such as the VelocityShares Daily Inverse VIX Short-Term ETN ( XIV ) in order to capture a similar trend. This investment seeks the inverse performance of the S&P 500 VIX Short-Term Futures Index. For those wanting to limit the volatile nature of the this long position, one can also consider the VelocityShares Daily Inverse VIX Medium-Term ETN ( ZIV ) . This investment seeks the inverse performance of the S&P 500 VIX Mid-Term Futures index. The difference between these two futures indices is that the short-term index utilizes the prices of the next two near-term futures contracts whereas the mid-term index utilizes the prices of the fourth, fifth, sixth, and seventh month future contracts. As a result of this, the mid-term index faces significantly less volatility and a reduced impact from contango. The resulting trends of each of these investments can be found in the comparison graph below. While both XIV and ZIV have historically trended higher, it is clear that traders seeking higher returns are more prone to invest into XIV following a deterioration of the upward trend, which occurs when increased fear returns to the market. Final Thoughts It is important to remember no one is capable of predicting the future with perfect accuracy. As such, both traders and investors should often consider utilizing multiple entry points in order to average down into a comfortable position. Just because fear and volatility have risen to a very high point in a limited amount of time, there is no reason to believe that it will not be able to continue to rise in the days and potential weeks to follow. Nevertheless, for the patient investor capable of identifying opportunity when it passes by, the potential return from a predictable trend found in volatility can often be quite rewarding. After all, the odds of a market that continues to consistently become ever more fearful is rather slim statistically. Disclosure: I am/we are long XIV, ZIV. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.