Best And Worst Q3’15: Large Cap Growth ETFs, Mutual Funds And Key Holdings

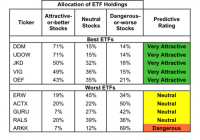

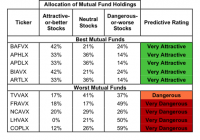

Summary The Large Cap Growth Style ranks fourth in Q3’15. Based on an aggregation of ratings of 24 ETFs and 622 mutual funds. QUAL is our top-rated Large Cap Growth ETF and FLGEX is our top-rated Large Cap Growth mutual fund. The Large Cap Growth style ranks fourth out of the 12 fund styles as detailed in our Q3’15 Style Ratings for ETFs and Mutual Funds report. It gets our Neutral rating, which is based on an aggregation of ratings of 24 ETFs and 622 mutual funds in the Large Cap Growth style. See a recap of our Q2’15 Style Ratings here. Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the style. Not all Large Cap Growth style ETFs and mutual funds are created the same. The number of holdings varies widely (from 21 to 683. This variation creates drastically different investment implications and, therefore, ratings. Investors seeking exposure to the Large Cap Growth style should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2. Figure 1: ETFs with the Best & Worst Ratings – Top 5 (click to enlarge) * Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity. Sources: New Constructs, LLC and company filings The State Street Systematic Growth Equity ETF (NYSEARCA: SYG ) and the Direxion iBillionaire Index ETF (NYSEARCA: IBLN ) were excluded from Figure 1 because its total net assets are below $100 million and do not meet our liquidity minimums. Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5 (click to enlarge) * Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity. Sources: New Constructs, LLC and company filings The iShares MSCI USA Quality Factor ETF (NYSEARCA: QUAL ) is the top-rated Large Cap Growth ETF and the Fidelity Large Cap Growth Enhanced Index Fund (MUTF: FLGEX ) is the top-rated Large Cap Growth mutual fund. Both earn a Very Attractive rating. The Columbia Select Large Cap Growth ETF (NYSEARCA: RWG ) is the worst-rated Large Cap Growth ETF and the Quaker Strategic Growth Fund (MUTF: QUAGX ) is the worst-rated Large Cap Growth mutual fund. RWG earns a Neutral rating and QUAGX earns a Very Dangerous rating. Verizon Communications, Inc. (NYSE: VZ ) is one of our favorite stocks held by Large Cap Growth funds and earns our Attractive rating. Since 2006, Verizon has grown after-tax profit ( NOPAT ) by 6% compounded annually. When including Verizon’s quarterly results this year, NOPAT is up an additional 8% on a trailing-twelve month basis. Verizon currently earns a return on invested capital ( ROIC ) of 8% and has increased its NOPAT margin to 16% from 13% in 2006. The market is not giving Verizon the credit it deserves for its consistent business operations, and the stock is undervalued. At its current price of $47/share, Verizon has a price to economic book value ( PEBV ) ratio of 0.8. This ratio implies that the market expects Verizon’s profits to decline permanently by 20%. If Verizon can grow NOPAT by 4% compounded annually for the next five years , the stock is worth $73/share – a 55% upside. Adobe Systems, Inc. (NASDAQ: ADBE ) is one of our least favorite stocks held by Large Cap Growth funds and earns our Dangerous rating. The company’s NOPAT has fallen by 28% compounded annually since 2011 and coincides with NOPAT margin falling to 10% from 29% over the same time frame. Adobe currently earns a 6% ROIC which is just a third of the 18% earned in 2011. However, the stock remains overvalued and does not reflect the company’s recent profit struggles. To justify the current price of ~$85/share, Adobe must grow NOPAT by 22% compounded annually for the next 20 years . Adobe has definitely seen better days, owning the stock and betting on such high growth for another two decades seems unrealistic. Figures 3 and 4 show the rating landscape of all Large Cap Growth ETFs and mutual funds. Figure 3: Separating the Best ETFs From the Worst Funds (click to enlarge) Sources: New Constructs, LLC and company filings Figure 4: Separating the Best Mutual Funds From the Worst Funds (click to enlarge) Sources: New Constructs, LLC and company filings D isclosure: David Trainer and Max Lee receive no compensation to write about any specific stock, style, style or theme. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.