Schwab Intelligent Portfolios: Intelligent Investing Or Marketing Hype?

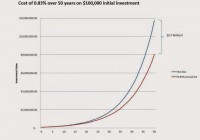

Summary Schwab has joined the rapidly growing robo-adviser market with its “Schwab Intelligent Portfolios.” Cash drag can dramatically diminish investor returns. Smart beta does not live up to its hype of superior returns. “No adviser fee” is just a marketing hype that can cost an investor millions of dollars when cash drag and ETF expenses are taken into account. Schwab Intelligent Portfolios won’t be a game changer for many reasons. Due to the increasing popularity of robo adviser investing, Charles Schwab (NYSE: SCHW ) has entered this market with its introduction of Schwab Intelligent Portfolios . For a minimum of $5,000 initial investment, Schwab sets an asset allocation using ETFs and rebalances the portfolio periodically. For a minimum of $50,000, a client may elect tax loss harvesting by the program. No adviser fees are charged on top of the fees charged by the ETFs. Is this a game changer? Should you enroll? How much will it cost? One major implicit cost is cash drag. Schwab Intelligent Portfolios hold 6-30% of assets in cash, allowing Schwab to earn the spread between the interest it pays on the cash deposits (currently around 0.12%) and investment income from such deposits. Assuming average stock market return of around 10%, a 6-30% cash allocation costs 0.6-3% annually ! That is at least twice as much as the 0.3% annual adviser fees charged by other similar robo adviser programs, as stated in Schwab’s disclosure . For comparison, neither Wealthfront nor Betterment mandate cash allocations. After all, if I want to hold cash, why do I need to give it to a robo adviser? While Schwab pays only 0.12% on cash deposits, you can earn over 8 times as much with a high yield savings account , which also allows you to withdraw money anytime. This implicit 0.6-3% annual fee from cash drag belies Schwab’s claim as a no-fee robo adviser. But that is not all. The ETFs selected have fees of their own. The asset allocation recommended is based on risk tolerance and investment horizon. The lowest cost asset allocation possible, recommended with the highest risk and return potential, and minimum 6% cash allocation, is shown below: Stocks 94% Probable ETF Expense U.S. Large Company Stocks 11% SCHX 0.04% U.S. Large Company Stocks – Fundamental 17% FNDX 0.32% U.S. Small Company Stocks 7% SCHA 0.08% U.S. Small Company Stocks – Fundamental 11% FNDA 0.32% International Developed Large Company Stocks 9% SCHF 0.08% International Developed Large Company Stocks – Fundamental 13% FNDF 0.32% International Developed Small Company Stocks 4% SCHC 0.18% International Developed Small Company Stocks – Fundamental 6% FNDC 0.48% International Emerging Market Stocks 4% SCHE 0.14% International Emerging Market Stocks – Fundamental 6% FNDE 0.47% U.S. Exchange-Traded REITs 4% SCHH 0.07% International Exchange-Traded REITs 2% VNQI 0.24% Cash 6% 0.00% Total 100% 0.23% Schwab will likely use its own funds whenever possible, but may switch to other funds under its program as part of tax loss harvesting. While the fees of traditional Schwab cap-weighted index funds are among the lowest in the mutual fund industry, the fees of fundamental index ETFs are much higher, as seen above. The net result is an additional 0.23% annual fee for the overall portfolio. In sum, Schwab Intelligent Portfolios cost at least 0.83% of assets annually . That does not account for costs associated with capital gains tax and bid-ask spread for periodic rebalancing. What is the effect of a 0.83% annual expense? Due to the effect of compounding, an investor will lose 14% of their assets in 20 years, 20% in 30 years, 26% in 40 years, and 32%, or almost a third of their potential wealth, in 50 years. As shown by the following graph, $100,000 invested over 50 years earning 10% return will grow to $11.7 million, but the investor paying 0.83% fee would end up with only $8.0 million, losing $3.7 million to fees over the years. (click to enlarge) Do fundamental index funds offer higher returns, thereby justifying their higher fees? The research suggests no. The table below shows that such so-called smart beta funds actually underperform the market: Smart beta funds vs. S&P 500 Name 3-year annualized total return 5-year annualized total return 10-year annualized total return Net expense ratio Strategic beta ETFs* 13.33% 12.5% 7.9% 0.48% Strategic beta mutual funds** 18.17% 13.69% 6.98% 1.17% S&P 500 index 20.42% 15.45% 7.67% Source: Morningstar. Returns are through Dec. 31, 2014. *Results from 394 strategic beta exchange-traded funds covered by Morningstar. **Results from 43 strategic beta open-end mutual funds covered by Morningstar. Fundamentally weighted indices have outperformed traditional capitalization-weighted indices by greater allocation to value stocks and small size stocks. ETFs and mutual funds constructed from fundamental indices, however, fail to live up to their promise of superior returns, mainly due to higher expense ratios and turnover costs. As John Bogle famously said about investing: You get what you don’t pay for. Impact on the Robo Advisor Industry Adam Nash, CEO of Wealthfront, wasted no time to attack Schwab’s new robo advisor program as a marketing gimmick by presenting something as no fee that was in fact high cost. Schwab was equally quick to issue a response , arguing that cash is actually an investment and the interest rate will eventually rise, that fundamentally weighted indices have historically delivered excess returns, and that the 0.25% advisor fee charged by Wealthfront is a real sunk cost. Betterment also wrote an article to attack Schwab’s program as costly due to cash drag . It is revealing that both Wealthfront and Betterment, the two leaders in the robo advisor industry, each with over one billion dollars in assets under management (AUM), felt compelled to respond with such rapidity. They clearly felt threatened. And rightly so. Most investors too lazy to manage their own investment portfolio and willing to pay 0.15-0.25% advisor fee that Betterment and Wealthfront charge will probably not look too closely at the real cost of cash drag, but rather be attracted by the superficial charm of Schwab posing as a “no fee” advisor. Robo advisor services, which are new technologies, mainly appeal to younger investors, who tend to like free things and new, fashionable things, such as smart beta, one of the latest financial innovations. It is probably inevitable that Schwab will take away some market share in the robo advisor industry. Nonetheless, the products offered by the three robo advisors are differentiated enough to have their own moats. Below are the highest risk and return portfolios from Wealthfront and Betterment: Wealthfront: Asset ETF Allocation Expense ratio U.S. Stocks VTI 35% 0.05% Foreign Stocks VEA 22% 0.09% Emerging Markets VWO 28% 0.15% Dividend Stocks VIG 5% 0.10% Natural Resources DJP 5% 0.75% Municipal Bonds MUB 5% 0.25% Total 100% 0.13% Betterment: Asset ETF Allocation Expense ratio U.S. Total Stock Market VTI 16.2% 0.05% U.S. Large-Cap Value VTV 16.2% 0.09% U.S. Mid-Cap Value VOE 5.2% 0.09% U.S. Small-Cap Value VBR 4.5% 0.09% Developed Markets VEA 37.5% 0.09% Emerging Markets VWO 10.5% 0.15% Municipal Bonds MUB 5.5% 0.25% U.S. Corporate Bonds LQD 0.6% 0.15% International Bonds BNDX 2.4% 0.19% Emerging Market Bonds VWOB 1.6% 0.34% Total 100.2% 0.11% For some reason, probably due to rounding error, the Betterment allocations don’t exactly add up to 100%. The table below summarizes the differences between the three portfolios. Schwab Wealthfront Betterment Stocks 92% 89% 89% Bonds 0% 5% 10% Cash 6% 1% 1% Alternatives 2% 5% 0% U.S. Stocks 52% 40% 41% Foreign Developed Market 33% 26% 38% Emerging Market 7% 23% 10% Value 58% 59% 58% Growth 42% 41% 42% Large Cap 59% 81% 76% Mid/Small Cap 41% 19% 24% Price/earnings 17.5 16.14 16.26 Price/book 1.81 1.94 1.79 Return on equity 14.61 18.21 16.61 Average Market Cap 16.0B 29.3B 29.0B Expense ratio 0.24% 0.13% 0.11% Number of Holdings 13 6 10 Overall stock allocation is similar, with Wealthfront and Betterment both at 89%, while Schwab is slightly higher at 93%. The rest is mostly in cash for Schwab, partly in bonds and partly in alternatives for Wealthfront, and mostly in bonds for Betterment. In terms of allocation to world regions, Schwab is U.S. centric. Wealthfront has a significantly higher allocation to emerging markets at 23%. All three are similar in value versus growth allocation. Schwab has significantly higher allocation to small cap stocks. The price ratios are similar for all three. Schwab has a significantly higher expense ratio, twice as much as its competitors; it also has the higher number of holdings in its portfolio. Wealthfront would appeal to investors who prefer simplicity (the portfolio has only 6 holdings), emerging markets, and alternative investments. Betterment would appeal to cost conscious investors. Schwab would appeal to investors who prefer complexity, small cap, smart beta, and tax loss harvesting (more holdings create more opportunities for tax loss harvesting). But the $64,000 question is, will this be a game changer? I doubt it, for several reasons. First, the robo advisor market is relatively small within the entire asset management business. Even if Schwab could reach $1 billion AUM, at 0.83% fee, that would still generate only a tenth of one percent of Schwab’s 2014 revenue of $6.157 billion, too small to move the needle. Second, Schwab Intelligent Porfolios might even eat into Schwab’s high margin core business, as it could cause Schwab clients using traditional advisor services and expensive actively managed mutual funds to switch over to Schwab’s robo advisor service, causing loss of revenue. Third, robo advisor service may not be a sustainable business model, as it has never been tested under bear market conditions. Young investors confident in a bull market may not feel so confident when the next bear market comes, especially without the hand-holding and long-term relationship of a personal investment advisor, causing funds to go out as fast as they had come into the robo advisor industry. Fourth, investors will probably come to the realization that cash drag is a significant hidden cost, and Schwab Intelligent Portfolios may end up being a total flop. Finally, even if Schwab does succeed in gaining market share and the industry continues to grow, the success itself will attract fierce competition from yet bigger firms, such as Merrill Lynch, ultimately driving profits down. Even though Schwab’s new robo advisor service would not alter Schwab’s fundamentals, robo advisor service is a Wall Street fad worth paying attention to for the enterprising investor. If Schwab succeeds in penetrating the market, it could generate undue optimism, creating good selling opportunities. Watch for its growth in AUM relative to the competitors, new market entrants, and how it handles a bear market. If the new robo advisor service fails, on the other hand, it could generate undue pessimism, leading to a selloff in Schwab’s stock, creating good buying opportunities. Conclusion Don’t fall prey for the marketing hype of Schwab’s “no fee” robo investing. One should hold enough cash as an emergency fund for 6 months worth of living expenses, but not in an investment portfolio meant to last 20 years or more. Put the cash in a high yield savings account, where you can earn over 8 times as much interest, and be able to withdraw anytime you want, rather than be forced to hold at least 6% cash at all times. Forget about smart beta. For higher returns, allocate more to value and small cap, and minimize costs. Schwab Intelligent Porfolios is good marketing, but it won’t be a game changer. Whether or not it succeeds, the potential market is too small to move the needle for Schwab; nonetheless, its success or failure may create price discrepancies for the enterprising investor to exploit. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.