4 ETFs For The Long Term Investor

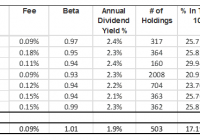

Summary A diversified portfolio can be replaced by an ETF investment strategy. Out of list of many dozens there are quick ways to filter out the best in class ETFs. Here is a list of my top 4 ETFs to choose from for the long term investor. A good friend came to me with a request. He has been managing his father’s investments for a while now and considers switching his strategy from a direct stocks picking investment to a ETF investment. He said that he would consider a shift only if the management fees will be very low and as long as the ETF would invest in big U.S. companies. I took on the challenge to find 3-5 ETFs for his consideration as replacement to a wide spread portfolio of big American corporations. He will probably choose only one or two. The first step was to create a list of Large Cap equities ETFs using ETFdb.com . The initial list included 66 Large Cap Value ETFs based on the proposal of the website. My benchmark is the S&P 500 index which is represented by the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ). The full list of ETFs can be found here . My first step was to find the ETFs that charge minimum fees. My benchmark ETF, SPY, carries 0.09% of fees therefore I filtered out all ETFs that held fees that are higher than 0.2% per year. This screening proved to be very productive, as out of initial list of 66 ETFs I was left with only 15. The next step was to look at the performance demonstrated by the ETFs. SPY delivered ~65% return during the last 3 years. I therefore filtered out the ETFs that delivered less than 60% in the last 3 years. This screening allowed to narrow the list from 15 to only 7 ETFs. The last 7 were: Vanguard Value ETF (NYSEARCA: VTV ) iShares S&P 500 Value ETF (NYSEARCA: IVE ) Vanguard Mega Cap Value ETF (NYSEARCA: MGV ) iShares Core U.S. Value ETF (NYSEARCA: IUSV ) Vanguard Russell 1000 Value ETF (NASDAQ: VONV ) Vanguard S&P 500 Value ETF (NYSEARCA: VOOV ) SPDR S&P 500 Value ETF (NYSEARCA: SPYV ) The next table captures the top seven information: All of the seven are following a similar group of big corporations, nevertheless I tried to narrow the list even further. I mapped the Top-10 holdings of the seven ETFs. The next table captures the percent of holding in each ETF of its highest ten holdings: This mapping allowed me to understand that the high similarity between these ETFs. For example, VTV and MGV had the same list of top holdings. VTV delivered 2.5% higher return in the last three years and charges a slightly lower management fees. I therefore prefer VTV over MGV. VTV delivered a 10% dividend growth rate in the last three year, going from $1.40 per share in 2011 to $1.87 per share in 2014. In 2015 the two paid dividends summed to $1.01 hence we can expect this year to demonstrate a growing dividend as well. IVE, VOOV and SPYV carries the list of Top-10 holdings as well. The internal holdings percentage allocation is also very similar between these three. SPYV is different from the other two in its high Beta to the market. IVE charges a higher management fee compared to the other two. The means that the best choice out of these three is VOOV . VOOV delivered a 17% dividend growth rate in the last three year, going from $1.10 per share in 2011 to $1.78 per share in 2014. In 2015 the two paid dividends summed to $0.94, hence we can expect this year to demonstrate a growing dividend as well, even though not in the same rate as in the past three years. IUSV and VONV also carries the same list of top 10 holdings. IUSV holds substantially higher number of stocks compared to the other ETFs. The total return of this fund was lower than VONV. Therefore, VONV is good even though it charges slightly higher management fees. VONV delivered a 16% dividend growth rate in the last two years, going from $1.43 in 2012 to $1.92 in 2014. In 2015 the two dividends totaled to $0.88, so there is no indication that the growth rate will continue as in the past two years. My benchmark, SPY, was found to be a pretty reasonable investment as well compared to the other ETFs in the list. The low fees and highest return are clearly better than the others but the dividend yield is slightly lower compared to VTV, VONV and VOOV. Yet, SPY invests in a more diversified type of companies and not only in large cap value stocks. Conclusions: Based on the request for a list of 3-5 ETFs to choose from that can replace a portfolio of big cap U.S. companies my picks are: VTV, which seeks to replicate the MSCI U.S. Prime Market Value Index. VOOV, which seeks to replicate the S&P 500 Value Index. VONV, which seeks to replicate the Russell 1000 Value Index. All three have delivered a dividend growth in the last two-three years and charge minimal management fees. If willing to expend the exposure to medium and smaller companies, SPY can also be considered as it seeks to replicate the S&P 500 Index. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: The opinions of the author are not recommendations to either buy or sell any security. Please do your own research prior to making any investment decision.