HEDJ: Is There Any More Upside In This Euro-Hedged ETF?

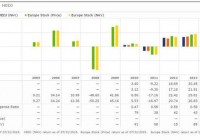

Summary The euro hit a 10-year low relative to the dollar and depreciated dramatically by 22% over a 12 month period leading into April of 2015. As the recent resistance and ostensible capitulation in the euro has taken hold investors may be better positioned in a long non-hedged European position. Since the sharp fall in the euro has subsided over the past four months, the two currencies appear to be normalizing against each other. Resistance has been seen at $1.05 (EU/USD) and the disparity between the two currencies has been retracing towards this level. Over the past 4 months a significant performance divergence exemplifies this phenomenon between hedged (HEDJ) and non-hedged (VGK) European ETFs. Introduction: In my previously published articles (on April 6th 2015: ” The Inevitable Capitulation Of The Euro Hedge ” and on May 20th 2015: ” The Inevitable Capitulation Of The Euro Hedge has begun “), I posited rotating money out of the WisdomTree Europe Hedged Equity (NYSEARCA: HEDJ ) ETF into a long non-hedged European equity position such as the Vanguard FTSE Europe ETF (NYSEARCA: VGK ). This thesis was rooted in three major pillars: 1) The Euro had depreciated relative to the dollar by more than 20% leading into April of 2015. 2) The currency disparity rendered a 10-year low for the euro relative to the dollar. 3) The Euro hedge within HEDJ had been largely attributable to this outperformance over an 18 month time period through April of 2015 relative its indices. Now four months later, two additional attributes may further support this thesis: 1) The Greece crisis is behind us and while this situation was not factored in to my previous articles as a potential event, this fiasco did not negatively impact the euro beyond the $1.05 resistance level. 2) As a looming interest rate increase by the Federal Reserve is on the horizon, this inevitable event may be priced in to some extent and thus the impact on the currency discrepancy may not be as dramatic as previously thought. This partial priced in event will mitigate the downside effect of the euro relative to the dollar when an interest rate increase takes place. Investors in the WisdomTree Europe Hedged Equity ETF have been rewarded handsomely over the past year leading into April of 2015 as the euro has depreciated relative to the dollar in spectacular fashion by more than 20% through March of 2015. HEDJ possess a hedge component exploiting this currency difference on the side of the US dollar, thus investors are rewarded as the euro weakens in relation to the dollar. I posited that this hedge may inevitably become a liability as the two currencies normalize against each other and thus back in April it was time to be in the sell camp of this hedged ETF prior to this hedge component working against investors in HEDJ. I suggested, as Europe continues to strengthen throughput 2015 and beyond, investors may be better positioned in a long European holding such as the Vanguard FTSE Europe ETF as opposed to the euro-hedged HEDJ. This article revisits this thesis four months removed to quantitatively assess the recent movement in the dollar and its impact on the performance of the hedged and non-hedged ETFs. The hedge: the depreciating euro relative to the US dollar HEDJ has outperformed its non-hedged index by a wide margin in 2014 and 2015 albeit through March. HEDJ outperformed the Morningstar non-hedged Europe Stock index on an annual basis by 11.3% and 11.9% in 2014 and 2015 (through March), respectively (Figure 1). However that outperformance of 11.9% through March has given up ground and has since fallen to an outperformance spread of 7.6% YTD (Figure 1). Per WisdomTree, HEDJ seeks to provide investors with exposure to European equities with a built-in hedge against the euro while focusing on companies that conduct a significant portion of their business overseas (non-euro exposure). “The Index and Fund are designed to have higher returns than an equivalent non-currency hedged investment when the value of the U.S. dollar is increasing relative to the value of the euro, and lower returns when the U.S. dollar declines against the euro.” This currency hedge has played out well for investors as the euro has slid against the dollar over the previous 12 months through March of 2015 (Figure 2). The euro sat at a 10-year low against the dollar with a sharp 22% depreciation seen over the previous 12 months heading into April of 2015 (Figures 2 and 3). A sharp divergence between the two currencies can be seen in figures 2 and 3, demonstrating this 20% slide. From these data, I stated that currency fluctuations are transient over the long-term, thus the euro hedge will likely capitulate in the near term. (click to enlarge) Figure 1 – Morningstar annual performance of HEDJ relative to a non-hedged Morningstar Europe Stock index (click to enlarge) Figure 2 – Google Finance graph showing the euro depreciation relative to the dollar over the previous 12 months leading into April of 2015 (click to enlarge) Figure 3 – Google Finance graph showing the euro depreciation relative to the dollar over the past 10 years heading into April of 2015. The capitulation of the euro hedge may be unfolding Recent data suggests that the perpetual falling of the euro may be coming to an end relative to the dollar (Figure 4). There also appears to be a firm resistance at ~$1.05. The euro touched down twice at or near $1.05 in Mach and April (Figure 4). Given the most bullish case for the dollar, some analysts are projecting the dollar to hit $0.95 by the end of the year. Assuming that the dollar hits that mark, this translates into another ~9% move after the already 22% move. Investors may be safe remaining in the hedge for now without much upside given the most bullish case. Given the most bullish estimates, I’d be content capturing over 70% of that spread and rotating money out of that position into a long European position such as VGK if investors would like to maintain exposure to European equities. (click to enlarge) Figure 4 – Google finance YTD performance of the euro relative to the dollar Hedge verses non-hedge performance: HEDJ and VGK Taking a close look at a long European ETF position via VGK (which I wrote about in detail here ) in comparison to the euro hedged HEDJ over the long-term exemplifies that currency fluctuations are transient over the long-term and this euro hedge will likely continue to capitulate in the near term. In 2012 and 2013 HEDJ underperformed VGK on an annual basis at times when the euro and dollar were mostly stable relative to each other (Figure 5). This hedge play has been highly favorable for investors over the most recent 12 month time period through March of 2015 however the currencies will inevitably start to trend to the inverse of this hedge as recent data suggests. At the point of initial reversion to the mean, this hedge will essentially be rendered useless and VGK will outperform as it did in 2012 and 2013. As the euro depreciation seems to have been arrested, HEDJ will likely continue its capitulation and underperform with any further uptick in the euro. This has been the case over the past four months, where VGK has outperformed HEDJ by 3.0% (Figure 6). These data suggest that VGK may be superior moving into the future and combined with the recovery in Europe, it may be time to abandon HEDJ and be long European equities without the euro hedge prior to the hedge working against the investor. (click to enlarge) Figure 5 – Morningstar annual return comparison between HEDJ and VGK through March of 2015 (click to enlarge) Figure 6 – Performance divergence between VGK and HEDJ over the previous four months since my initial article Conclusion: HEDJ has outperformed the non-hedged Morningstar Europe Stock index on an annual basis in 2014 by 11.3% and 11.9% through March in 2015. It is noteworthy to point out that this 11.9% outperformance has dwindled down to a 7.6% outperformance YTD. Specifically regarding HEDJ vs VGK, HEDJ maintains an outperformance of 11%, down from 14.3% since my last article in April. The hedge against the euro within HEDJ is largely attributable to this outperformance over the 12 month time period through March. Considering that the euro appears to have capitulated from its 10-year low preceded by a sharp depreciation by more than 20% indicates that this hedge may have played out. Continued exposure to this hedge may inevitably become more of a liability as the two currencies normalize against each other and thus it may be time to take profits. As Europe continues to strengthen throughput 2015 and beyond, investors may be better positioned in a long European ETF such as VGK. If the European economic strength is enough to mitigate the dollar rise after the Federal Reserve increases rates then there’s limited upside to remaining in this hedge. In terms of quality attributes, HEDJ lacks adequate diversification (by design) and provides a dividend yield inferior to that of VGK and the expense ratio is 6 times that of VGK (0.58%). Taken together, this euro hedge has provided investors with great returns however data suggest currency fluctuations are transient over the long-term and this euro hedge may not add any additional value to one’s portfolio moving into the future. Disclosure: The author currently holds shares of VGK and is long VGK. The author does not hold shares of HEDJ. The author has no business relationship with any companies mentioned in this article. I am not a professional financial advisor or tax professional. I am an individual investor who analyzes investment strategies and disseminates my analyses. I encourage all investors to conduct their own research and due diligence. Please feel free to comment and provide feedback. I value all responses. Disclosure: I am/we are long VGK. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.