Leveraged Oil ETPs: How To Lose Your Shirt Waiting For A Bounce

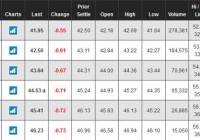

Summary Leveraged oil ETPs are for traders, not investors. There is a wealth destroyer in their rebalancing. And another one in their holdings. A reader wrote in a comment that he was long crude oil with leveraged ETPs : the VelocityShares 3x Long Crude Oil ETN ( UWTI) and the ProShares Ultra Bloomberg Crude Oil ETF ( UCO). I wrote a short answer, but I think a more detailed one to a broader audience may avoid significant wealth destruction to some Seeking Alpha members. This is also a way to give back to the investing online community. Many years ago, someone helped me understand one of the points below, resulting in closing a position with a loss that could have become much worse. This article is in no way an analysis or opinion on oil price. I have no idea if crude oil will bounce or fall lower. It aims at explaining that leveraged oil ETPs are a risky way to bet on a reversal. Indeed, they cumulate 2 wealth destroyers in their internal structure: beta-slippage and contango. 1st wealth destroyer: beta-slippage To understand what is beta-slippage, imagine a very volatile asset that goes up 25% one day and down 20% the day after. A perfect double leveraged ETP goes up 50% the first day and down 40% the second day. On the close of the second day, the underlying asset is back to its initial price: (1 + 0.25) x (1 – 0.2) = 1 And the perfect leveraged ETP? (1 + 0.5) x (1 – 0.4) = 0.9 Nothing has changed for the underlying, and 10% of your money has disappeared. Beta-slippage is not a scam. It is a mathematical property of a leveraged and rebalanced portfolio. Beta-slippage may be positive in a steady bull market, but the only sure thing is that you lose money when it is not. To learn more about beta-slippage, you can read this article . 2nd wealth destroyer: contango Contango happens when future contracts for an asset are at a higher price than the spot price. It means that buyers are ready to pay a premium for a later delivery. Just like a factory director anticipating higher raw material prices would try to buy stuff now, and rent a warehouse to store it. Contango can be assimilated to the warehousing cost. The opposite situation, called backwardation, can be interpreted as a premium for fast delivery. By extension, we also speak of contango when future contracts for a given month are more expensive than for the previous month (rolling cost is a more appropriate denomination in this case). It means that when you roll futures from one month to the next one, you get less stuff for the same money. This is what commodity ETPs do, leveraged or not. Here are crude oil futures quotes on 8/17/2015: (click to enlarge) (source: cmegroup.com) When rolling contracts from September to October, oil ETPs are losing 1.3%. It is an annualized loss of 14.6%. It is not so much if oil price surges in a near future, but it is an additional decay if it continues to the downside, or just stays in a range the next few months. Conclusion Leveraged oil ETPs are instruments for traders. They should not be held more than a few weeks unless oil enters a steady bullish trend. They are in no way designed for “buy-and-hold” and long-term investors. Holding them without an entry signal and an exit plan is a fool’s game. Leveraged oil ETPs shareholders are currently losing money to wait and see. There are better ways to bet on a bounce in oil price, like seeking undervalued and solid energy stocks with little debt. It is out of this article’s scope. Recommended reads on the cost of waiting: The Tartar Steppe by Dino Buzzati and Waiting for Godot by Samuel Beckett. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.