U.S. REIT ETFs: Correlations

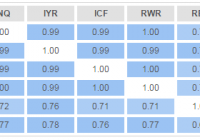

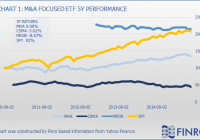

REIT ETFs appear to offer an improvement to the overall portfolio performance. Correlations to the S&P 500 were in the low to mid 0.50s in the last 12 months. The largest U.S. REIT ETFs are fairly homogeneous with correlation coefficients of 0.98-1.00 between themselves. Real estate is often mentioned as a stand-alone asset class next to equities, fixed income and commodities. This notion prompts investors to allocate a portion of their portfolios to the real estate investment trusts (“REITs”) in pursuit of diversification benefits. In this article, I review how the U.S. REIT ETFs fit into the overall portfolio and whether they help to improve the performance. The analysis focuses on the five largest U.S. REIT ETFs that have been around for at least 5 years and manage over $1 billion of assets each (in descending order by size): Vanguard REIT Index ETF (NYSEARCA: VNQ ), iShares U.S. Real Estate ETF (NYSEARCA: IYR ), iShares Cohen & Steers REIT ETF (NYSEARCA: ICF ), SPDR DJ Wilshire Global REIT ETF (NYSEARCA: RWR ), and iShares Mortgage Real Estate Capped ETF (NYSEARCA: REM ). All the calculations were carried out on the freely available investor resource InvestSpy. To start with, let’s look at the correlation matrix of these ETFs plus the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ), utilizing 5 years of historical data: The table above presents us with two important insights. Firstly, all REIT ETFs had a correlation coefficient with the broad equity market no higher than 0.78. Although such a reading indicates a relatively close co-movement, it is low enough to offer diversification benefits. Secondly, the four largest REIT ETFs (VNQ, IYR, ICF, and RWR) had almost perfect correlation of 0.99-1.00 between themselves. This means that from an investor’s standpoint, these are pretty much identical securities, thus it is worthwhile paying more attention to expense ratios and bid-ask spread when making a selection. The only standout is REM, which demonstrates a lower correlation both with SPY and with the remaining REIT ETFs. This is due to the fact that REM is a mortgage REIT, thus it behaves somewhat differently from equity REITs. Five years is fairly long period of time and it is useful to investigate correlations in the more recent past. Below is the same correlation matrix, utilizing daily data for the last 12 months only: It appears that the close co-movement between the four equity REIT ETFs persisted to the same degree whilst REM deviated even further from the traditional REIT class with its correlation coefficients no higher than 0.70. Interestingly, correlations with the broad U.S. equity market dropped across the board to as low as 0.49 in the case of ICF. As all of these ETFs except for REM posted positive total returns similar to the S&P 500 over the last year, it is clear that investors that had allocation to REITs in this period achieved an improved risk/reward performance. Just to illustrate the difference a 20% allocation to REIT ETFs would have made, consider a standard 60% equities/40% bonds portfolio where 20% of equity allocation is replaced with a REIT ETF. A portfolio with 60% invested in the Vanguard Total Stock Market ETF (NYSEARCA: VTI ) and 40% in the iShares Core Total U.S. Bond Market ETF (NYSEARCA: AGG ) would have brought the following results in the last year: (click to enlarge) Meanwhile, with 20% allocated to VNQ, the dynamics change a little bit: (click to enlarge) The key metric I am looking at here is the annualized volatility. Note that even though we have replaced VTI with a riskier VNQI (12.1% vs. 14.4% volatility), the overall portfolio volatility has decreased from 7.0% to 6.8%. This is the diversification benefit in its purest sense. In addition to that, the total return and maximum drawdown figures are the same for both portfolios whilst the second one is substantially less dependent on the broad equity market with a beta below 0.50. It is also clear that risk contributions are largely skewed away from fixed income, but this a classical case in most of traditional portfolios as I have covered here , and this topic requires a separate discussion. Summing up, U.S. REIT ETFs appear to offer an improvement to the overall portfolio performance. The largest ETFs in this space are extremely highly correlated, thus an investor needs to look more closely at ETF features such as expense ratio and bid-ask spread to identify the most efficient option. Finally, correlations change over time and so does the diversification benefit. Therefore, one has to monitor periodically if their asset class allocation is delivering performance as anticipated. Please share your thoughts and feedback on the insights above. In the next article later this week, I will present a similar analysis for international REITs. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.