Tactical Asset Allocation – January 2015 Update

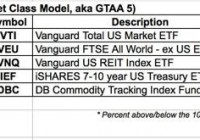

And so 2014 ends. What an interesting year from the investment performance side of things. Who would have thought long-term bonds and REITs would have led the performance rankings? I’ll have much to say about the 2014 performance of the various asset classes and portfolios throughout this month but first things first. Here is the January 2015 tactical asset allocation update. Starting with the most basic portfolios, below are the January updates for the GTAA5 and the Permanent Portfolio. There were no changes from the December update. I keep a spreadsheet online that is updated automatically. There were no changes from last month. Note: the Google sheets online are having issues updating. Seems to be an issue with Google sheets. Other bloggers are having the same problems. I did the update manually for this post. (click to enlarge) (click to enlarge) Now for the more broadly diversified GTAA13 portfolio and the aggressive versions. Online spreadsheet for this and the GTAA AGG3 and GTAA AGG6 portfolios. Same issue with this online spreadsheet as I noted above. (click to enlarge) One change this month for the GTAA13 portfolio. VWO, the emerging markets ETF went on a sell signal. Assets in that ETF should be moved to cash. The AGG3 and AGG6 updates are below – no changes for this month as well. (click to enlarge) These portfolios signals are valid for the whole month of January. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague