It’s A Risk Adverse World Out There

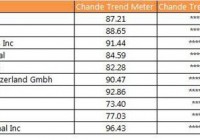

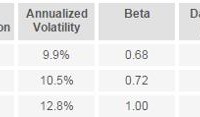

Summary Investors have been pulling back on the risk handle for some time now and shedding areas of their portfolio that may be susceptible to heightened volatility. The interesting thing about the high beta index is that it contains some very big winners this year. This has created a wide chasm between the so called “safe stocks” and “aggressive stocks”. Investors have been pulling back on the risk handle for some time now and shedding areas of their portfolio that may be susceptible to heightened volatility. Virtually anything connected to the energy or materials sectors has been torched this year. That extends to emerging market countries and high yield bonds , which have also felt the effects of the commodity crash. One of the more creative ways to view this trend is to look at the disconnect between high beta stocks and low volatility names. The PowerShares S&P 500 High Beta Portfolio (NYSEARCA: SPHB ) and PowerShares S&P 500 Low Volatility Portfolio (NYSEARCA: SPLV ) are two excellent indexes for this task. These two ETFs invest in a basket of 100 stocks within the S&P 500 universe that are showing the highest and lowest sensitivity to the benchmark over the last 12-months. Each stock within the portfolio is given an equal share (1%) of the asset allocation and the underlying holdings are evaluated and rebalanced on a quarterly basis. As you can see on the chart below, the divergence between the two has really accelerated over the last three months. SPLV is now trading within close proximity to all-time highs, while SPHB is quite near its 2015 lows. The interesting thing about the high beta index is that it contains some very big winners this year. Netflix Inc (NASDAQ: NFLX ) and Expedia Inc (NASDAQ: EXPE ) are both in the top 10 holdings of this fund and continue to show relative strength. Nevertheless, over one-third of the portfolio is made up of energy and industrial companies that have seen their share prices crater. Two of the worst have been Freeport-McMoRan Inc (NYSE: FCX ) and Chesapeake Energy Corp (NYSE: CHK ). By contrast, the low volatility sectors in SPLV are primarily geared towards financial and consumer staples names. Many of these stocks have either moved sideways in a plodding fashion or continued to buck the overall market malaise by heading higher. This has created a wide chasm between the so called “safe stocks” and “aggressive stocks”. On a year-to-date basis, SPHB is down -7.50% versus a 2.90% gain in SPLV. For comparison purposes, the benchmark SPDR S&P 500 ETF (NYSEARCA: SPY ) is up just 2.00% so far this year. While it’s easy to dismiss this divergence as simply a difference in index construction, I believe it also represents an excellent example of investor behavior and risk characteristics . High beta stocks are known to experience very rapid rallies during favorable market environments, but that also translates into quick breakdowns when the tide turns. Much of this fundamental risk versus reward has been forgotten or dismissed over the last several years as stocks march higher with very little in the way of volatility or fear. Earlier in the year, I transitioned a portion of the equity sleeve in my Strategic Income portfolio to the iShares MSCI U.S.A. Minimum Volatility ETF (NYSEARCA: USMV ). This fund takes a similar tact as SPLV by selecting a subset of stocks with lower overall price fluctuations than the broader market. These indexes are designed for more conservative investors that still want to participate in the upside of the market with less downside risk. One drawback to owning this fund in an income portfolio is that I am sacrificing some short-term yield by not owning a strict dividend-focused index. In addition, I could potentially miss out on a big rally in high yield or beaten down stocks. Yet based on the current market environment, I feel that this strategy is prudent to lower the beta of the portfolio and focus on total return. The Bottom Line In a true bear market or crisis situation, there is no such thing as a “safe stock”. Even low volatility indexes are going to experience sizeable declines as risk aversion sets in. However, that same risk is also rewarded during periods of cyclical strength in equities. By being proactive with your asset allocation and security selection, you can reduce your risk during unfavorable periods and take advantage of new opportunities when they fit your criteria. Disclosure: I am/we are long USMV. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: David Fabian, FMD Capital Management, and/or clients may hold positions in the ETFs and mutual funds mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell, or hold securities.