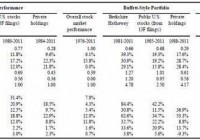

Summary This series offers an expansive look at the Low Volatility Anomaly, or why lower risk stocks have historically produced stronger risk-adjusted returns than higher risk stocks or the broader market. While low volatility strategies are often an appropriate long-term buy-and-hold strategy, this article offers a strategy that uses a momentum signal to tilt towards higher beta securities selectively. The alpha-generative strategy combines two market anomalies – Low Volatility and Momentum – to produce outsized returns. In recent articles, I have been authoring a fairly extensive examination of the Low Volatility Anomaly, the tendency for low volatility assets to outpeform high beta assets over long-time intervals. A Low Volatility strategy was one of five buy-and-hold factor tilts that I described in a previous series of articles. I believe that these buy-and-hold strategies to capture structural alpha are appropriate for many in the Seeking Alpha audience, but understand that some readers are looking for strategies that can generate even higher absolute returns. This article depicts one such strategy. Long-time readers know that two of favorite topics on which to author have been Low Volatility and Momentum strategies. This article combines these two strategies to produce a return profile that as the title of the article suggests has more than doubled the return of the S&P 500 over the past quarter-century. Before we delve into this strategy, we should first discuss the two components that drive this tremendous performance. Low Volatility Anomaly Regular readers know that I am currently authoring a multi-part series on the Low Volatility Anomaly. These articles include an introduction to the concept, a theoretical underpinning for the anomaly , cognitive and market structure factors that contribute to its long-run performance, and empirical evidence that demonstrates the outperformance of low volatility strategies across markets, geographies and long-time intervals. In past articles, I have depicted the relative outperformance of Low Volatility strategies using the graph below which shows the cumulative total return profile (including reinvested dividends) of the S&P 500 (NYSEARCA: SPY ), the S&P 500 Low Volatility Index (NYSEARCA: SPLV ), and the S&P 500 High Beta Index (NYSEARCA: SPHB ) over the past twenty-five years. The volatility-tilted indices are comprised of the one-hundred lowest (highest) volatility constituents of the S&P 500 based on daily price variability over the trailing one year, rebalanced quarterly, and weighted by inverse (direct) volatility. Source: Standard and Poor’s; Bloomberg The Low Volatility strategy contributes an important base component to this strategy that would have doubled the return of the market over the past twenty-five years, but we also need an element that pushes the strategy into riskier parts of the market when we can get paid for this tilt in the form of higher returns. Momentum Like the low volatility strategy, momentum strategies have been alpha-generative over long-time intervals and across markets. Consistent with Jegadeesh and Titman (1993), which documented momentum in stock prices that have outperformed in the recent past over short forward intervals, the efficacy of momentum strategies have been widely documented. Academic literature has described excess returns generated by momentum strategies in foreign stocks ( Fama and French 2011 ), multiple asset classes ( Schleifer and Summers 1990 ), commodities ( Gorton, Hayashi and Rouwenhorst 2008 ), and my own studies on momentum in fixed income strategies and more recently the oil market . Academic literature offers competing theories on why momentum has generated alpha over long-time intervals across markets and geographies. Proponents of market efficiency suggest that momentum is a unique risk premium, and the long-run profitability of these strategies is compensation for this unique systematic risk factor ( Carhart 1997 ). Behaviorists offer multiple competing explanations. In my previous series, I referenced both Lottery Preferences and Overconfidence as potential justifications. Studies contend that markets under-react to new information ( Hong and Stein 1999 ), which allows for the autocorrelations found in return series. Other behavioral economists contend that the disposition effect, or the tendency for investors to pocket gains and avoid losses, makes investors prone to sell winners early and hold onto losers too long ( Frazzini 2006 ), which could be further amplified by a “bandwagon effect” that leads investors to favor stocks with recent outperformance. Blitz, Falkenstein and Van Vliet (2013) offer an expansive summary of these explanations. The Strategy I am of the opinion that low volatility stocks should be a part of investors’ longer-term strategic asset allocation given that class of stocks’ historical higher average returns and lower variability of returns. In ” Making Buffett’s Alpha Your Own ,” I described academic research ( Frazzini, Kabiller, Pederson 2013 ) that broke down the Oracle of Omaha’s tremendous track record at Berkshire Hathaway ( BRK.A , BRK.B ) into two components – capturing the Low Volatility Anomaly and the application of leverage. If an allocation to low volatility stocks should be part of your long-term strategic asset allocation, then an allocation to high beta stocks must be done tactically with a short-term focus given that class of stocks’ lower long run average returns and higher variability of returns. This view is borne out of the data underpinning the chart above. However, a temporary allocation to the High Beta Index in sharply rising markets can further boost performance. The High Beta stock index has typically outperformed in post-recession recoveries. How do we combine Low Volatility and Momentum? A quarterly switching strategy between the Low Volatility Index and the High Beta Index, which buys the leg that has outperformed over the trailing quarter and holds that leg forward for the subsequent quarter, would have produced the return profile seen below since 1990, easily besting the S&P 500 with lower return volatility. For a pictorial demonstration of the leg that would be chosen by the Momentum strategy, please see the exhibit at the end of the article. It is a very simple heuristic. The Momentum strategy buys either Low Vol or High Beta stocks based on the index that outperformed in the trailing quarter and holds that index for the subsequent quarter before re-examining the allocation once again. The results are striking. (click to enlarge) From the cumulative return graph above, one can see that $1 invested in the S&P 500 would have produced $9.04 at the end of the period (including reinvested dividends) whereas $1 invested in the Momentum portfolio would have produced $19.90. These are gross index returns and do not consider taxes. Readers envisioning employing momentum strategies should utilize tax-deferred accounts. Summary statistics of the trade are captured below: (click to enlarge) The simple quarterly switching momentum strategy would have produced a 13% return per annum over the long sample period. This 3.6% outperformance relative to the S&P 500 led to the cumulative doubling of the market returns over time. Note that while the Momentum strategy is riskier than the broad market as measured by the variability of quarterly returns, practitioners of this strategy would have been rewarded with correspondingly higher returns for this incremental risk. While I contend that a long-run, buy-and-hold tilt towards lower volatility equity is probably appropriate for many Seeking Alpha readers, this article demonstrates a momentum-based switching strategy that can help inform investors when to pivot towards higher beta stocks when they offer returns commensurate with their higher risk. Disclaimer My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon. Exhibit: Returns of Low Vol, High Beta, Momentum, & Market (click to enlarge) Disclosure: I am/we are long SPLV, SPHB. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.