5 Reasons Why It Is Still Not Too Late To Buy Chinese Stocks

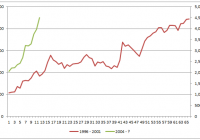

Summary Cheap valuations of heavyweight state-run companies. Market cap to GDP ratio still not overvalued. Potential new cash inflows from foreign investors. Chinese equivalent of “Don’t fight the Fed”. Bull market far from over. The Chinese market has been on fire, gaining over 110% since last July. Below are 5 reasons why it is still not too late to buy Chinese stocks: 1. Cheap Valuations Of Heavyweight State-Run Companies Chinese stocks are still not expensive. As of May 7, 2015, average P/E ratio for Shanghai Stock Exchange (SSE) Index is 19.7. The P/E for SSE 50 Index, which includes the biggest state-run companies, is less than 18. Many of them are also traded as H-share companies on the Hong Kong Stock Exchange. In the peak of the last bull market (which was Oct. 2007), the P/E for SSE Index was 69.6, according to the SSE monthly report . 2. Market Cap To GDP Ratio Still Not Overvalued Warren Buffett has often said that probably the best single measure of where valuations stand at any given moment is the ratio of the total market capitalization to the total dollar value of the GDP. Typically, a result of greater than 100% indicates that the market is overvalued. Total market capitalization for Shanghai and Shenzhen stock markets is 54.2 trillion RMB. With 2014 GDP of 62 trillion RMB, the market cap to GDP ratio is 87%. During 2007 bubble, that ratio was 178% in China, according to World Bank data . 3. Potential New Cash Inflows From Foreign Investors Last year, Chinese government electronically linked the Hong Kong and Shanghai exchanges, which essentially created a massive liquidity rally by opening up China’s markets to foreign investors. Also, China A-shares might be included in the MSCI Emerging Markets Index in the near future. 4. Chinese Equivalent Of “Don’t Fight The Fed” Chinese government is signaling that its priority has shifted from structural reform to stabilizing growth. In the meantime, China’s central bank has indicated it may be willing to cut interest rates to help prop up economic growth. In addition, there are trillions of capital in China that has to go somewhere now that the real-estate boom is over. 5. Bull Market Far From Over The historical pattern might hold true when considering the future prospects of China. In the last seven market cycles, on average, the Shanghai Index took 13 months to climb to its peak. The best comparison to this cycle might be January 1996 to June 2001 bull market, which lasted 65 months. In the first 11 months of that cycle, it also advanced over 100%, similar to this time. The following chart compares the 1996-2001 SSE Index vs. today’s. (click to enlarge) Top China ETFs Below are top 4 China ETFs with assets over $1 billion. Data are from iShares and CNN Money . Symbol Name Assets P/E (NYSEARCA: FXI ) iShares China Large-Cap ETF 7.4B 16.7 (NYSEARCA: MCHI ) iShares MSCI China ETF 2.4B 18.2 (NYSEARCA: GXC ) SPDR S&P China ETF 1.4B 13.5 (NYSEARCA: ASHR ) Deutsche X-trackers Harvest CSI 300 China A-Shares ETF 1.2B 16.9 The iShares China Large-Cap ETF is comprised of large-capitalization Chinese equities that trade on the Hong Kong Stock Exchange. It includes 50 of the largest Chinese stocks. With P/E of 16.7 and 12-month trailing yield of 2.4%, it is certainly more attractive than the A-shares traded on the Shanghai Stock Exchange. Conclusion Cheap valuation, sound economic fundamentals and central bank policies make the Chinese market, especially 50 large caps, look attractive in the next few years. With slowing economic growth rate, potential housing bubble, high level of local government debt, highly leveraged stock markets and an expected surge in new share offerings, the recent rally could be volatile for a while. However, any sizeable pullback (like last 3 days) should not be a surprise. Rather than being a signal to exit the Chinese market, such corrections could provide an opportunity for investors to add to positions. Disclosure: The author is long FXI, ASHR. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.