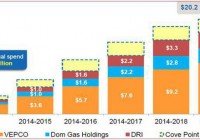

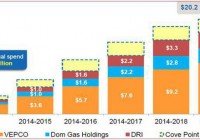

Summary Ongoing efforts to extend and improve operations will grow future top and bottom-line numbers. Company’s healthy earnings growth prospects will support cash flow base. D offers cheaper growth as compared to peers. Dominion Resources (NYSE: D ), one of the largest U.S. utility companies, has extended operations across the Mid-Atlantic region. D’s diversified electric and natural gas operations have been getting better revenue and earnings growth. As the company is increasing its growth capital expenditures to grow both electric and natural gas businesses, D’s long-term earnings growth outlook looks stable and attractive. And in fact, significant growth potential as a result of capital expenditures makes me believe the company will continue to grow its dividends at a healthy pace in the long term. The company’s earnings are expected to grow at an average rate of 6% in the next five years. Along with healthy growth prospects, the stock offers an attractive dividend yield of approximately 3%, which makes it an attractive pick for dividend-seeking investors. Elevated Growth Capital expenditure will guard D’s Long-Term Growth The U.S. utility sector has performed pretty well in 2014. And in the wake of improving economic conditions, future growth prospects of the industry also look bright. As far as D is concerned, with ongoing increases in its growth capital expenditures directed towards betterment and extension of its infrastructure and operations, the company has been strengthening its position among other utility sector giants. And in this regard, D has recently increased its long-term capital expenditure outlook from 2014-2019; the company will now spend $20.4 billion (guidance mid-point), higher than the previous forecast of $14 billion , on its various energy infrastructure projects. The value of these growth investments lies in strengthening the company’s current energy infrastructure in order to serve its customer base in a more competent and effective way. The following chart shows updated figures for the company’s increased capital expenditure on various growth projects. (click to enlarge) Source: Investor’s Meeting Presentation As natural gas production has significantly increased in the U.S., D is directing the major chunk of its capital expenditure to improve its natural gas infrastructure. As a matter of fact, one of the most important growth projects of the company is the Atlantic Coast Pipeline (NYSE: ACP ) project, which is a joint venture of D, Duke Energy (NYSE: DUK ), Piedmont Natural Gas Company (NYSE: PNY ) and AGL Resources Inc. (NYSE: GAS ). The ACP project’s pipelines, which have a capacity of 1.5Bcf/day, expandable to 2Bcf/Day, are waiting for FERC approval. The project’s construction is expected to begin in mid-2016, after which it will be made available for commercial operations by the end of 2018. D has the largest stake of 45% in the project, and I believe the company will benefit from this $5 billion project in the long run by meeting the increased natural gas transmission demand in Virginia and in North Carolina. Also, the company has invested $500 million towards its 1.0-1.5Bcf/day Supply Header Project (NYSE: SHP ). The timing to start SHP operations has been perfectly linked to the ACP project in order to support ACP by connecting its pipelines with five supply header reception points. With their operations scheduled to start in 2018, ACP and SHP will deliver natural gas to Virginia and North Carolina. In fact, these projects will allow D to increase its rates, which will portend well for its top and bottom-line growths in the long term. In addition to the ACP and SHP projects, the company has also agreed to acquire CGT for its subsidiary Dominion Midstream Partners, LP (NYSE: DM ). The addition of CGT offers an appealing opportunity to DM to raise rates in Virginia and Carolina, which will portend well to improve the company’s overall earnings base in the years ahead. Furthermore, the company is actively working to capitalize on the growth potentials of its Cove Point LNG export project, which has a capacity of 5.25 million tons/year . The Cove Point terminal facility is the first LNG export facility outside Louisiana and Texas to get government permission to export LNG. And it has created D’s monopoly, which will allow the company to enhance its bargaining power with suppliers. The company has already signed a 20-year LNG supply contract with Japan’s Sumitomo Corporation and Gail India. Owing to the longevity of these contracts, I believe D will have secure and strong top and bottom line bases for the years ahead. In addition to the abovementioned projects, the company is also making investments in renewable energy projects to strengthen its energy portfolio and comply with environmental regulations. In this regard, D has acquired the 28.4MW West Antelope Solar Park and the 50MW Pavant Solar Project . In its attempts to further capitalize on the growth prospects of renewable energy projects, the company has recently filed a request with VSCC to construct the first and largest solar facility in Virginia. By facilitating its customers to purchase electricity from its 2MW solar energy facility in Virginia, the company has created another important revenue generating source. Due to the impressive capital expenditure outlook and healthy growth prospects of the ongoing projects, I believe D is well-headed to delivering EPS growth in high-single digits. The company is scheduled for the 4Q’14 earnings call early next month, and during the earnings call, D will update its capital expenditure outlook and provide 2015 earnings guidance; any increase in capital expenditure outlook will portend well for its future growth and stock price. Hefty Dividends D’s healthy growth prospects have been fueling its earnings and cash flow growth, and helping it make attractive dividend payments to shareholders. Owing to its strong track record of making hefty dividend payments, the company is currently offering an attractive dividend yield of 3% . Since D is aggressively pursuing growth opportunities by making capital expenditures, I believe the company will attain more cash flow stability in the years ahead. Also, the company will continue to grow its dividends at a healthy pace in the years ahead; in the last five years, the company increased its dividends at an average rate of 7.3% . Risks The company’s efforts to expand its business operations, if not handled and executed effectively, could result in mismanagement and could weigh on its future performance. Moreover, regulatory restrictions and unfavorable movements in commodity prices are key risks to its future stock price performance. Conclusion The company’s ongoing efforts to extend and improve its operations are well-headed to grow its future top and bottom-line numbers. Moreover, the company’s healthy earnings growth prospects will support its cash flow base, which will allow it to consistently grow its dividends. The company currently has a higher forward P/E of 21.15x , as compared to Duke Energy’s and Southern’s forward P/E of 18.60x and 18.20x , respectively. I believe the higher forward P/E of D is justified due to its better growth prospects, as shown below in the table. Also, the company offers cheaper growth as compared to its peers, as it has a lower PEG of 2.9 , as compared to DUK’s PEG of 3.5 and SO’s PEG of 4.5 . The following table shows that D’s future earnings growth rate remains better than its peers. 2015 2016 2017 Long-Term 5-Year D 8.77% 4.80% 6.11% 6.05% DUK 3.97% 4.34% 5.27% 4.76% SO 2.13% 3.66% 4.31% 3.63% Source: Nasdaq.com