Start Living An Easier Life And Start Beating The Market Through Contrarian ETF Investments

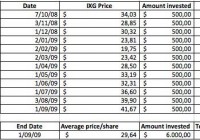

Summary Periodically buying the SPY all the time might be too boring for some people. Mixing things up with this new strategy might be more their cup of tea. As an example, John, our imaginary investor, will be using this new technique during the Financial Crisis of 2009 and during the GREXIT fears of 2012. With this new strategy, John doubled his performance. He gained 40% during 2008 – 2009 instead of 20%, and 22% during 2012 instead of 11%. So why even pick stocks if you can pick ETFs? It’s safer, easier and you’ll be able to beat the market. Discover 3 very interesting opportunities in the market right now, that might also lead to above average results. John might be getting a first position right now. In my previous article , we learned that life could be much easier and that perhaps joining them instead of trying to beat them might be the better option. However, in today’s article, I’ll dig deeper and see if simple investors like John can actually beat the market – by doing just one thing differently. Yes, there’s a way to still beat the market. And today, we’ll back-test that way 2 times + I’ll give you three possible opportunities that might lead to those same market-beating results. The portfolio strategy I’m going to describe to you during this article is all about two words: ‘Contrarian’ and ‘ETFs.’ It’s the Contrarian ETF Strategy. Let’s break down those words. A contrarian: A person who takes a contrary position or attitude; specifically: an investor who buys shares of stock when most others are selling and sells when others are buying. An ETF: A security that tracks an index, a commodity or a basket of assets like an index fund, but trades like a stock on an exchange. So the strategy goes as followed: Instead of picking individual shares of a company that is in trouble – which continues to be the more risky way of being a contrarian – we now decide to periodically buy an ETF related to an industry/commodity or country that is in trouble. You see, each year, there seems to be some sort of crisis going on somewhere in the world. Often does everyone think the world will end (for that particular industry that is in trouble) but in 99% of these cases, the world doesn’t end and these industries find ways to survive. Crises often are opportunities – when played right – and I bet you’re feeling the same thing. Are oil companies offering the opportunity of a lifetime right now? And how about oil suppliers and companies delivering services to oil companies? And what about Russia? Is Russia an opportunity or a value trap? Will the Ukraine – Russia war really last forever? Will oil remain below $100 during the next 10 years? Will Greece leave the EU? Well, I don’t know all the answers, but I do know that I’m very inclined to say “NO” to all of these questions. People love drama. And we all love doom-scenarios. But how often did any of them played out? Also, when you really think about it: Does oil really have to be at $100 before you – as an investor – can make a profit of certain oil related stocks? Hell no. Certain stocks would jump 20% if oil would make a 5% recovery, or would show signs of a simple stabilization. Does Russia really have to report a 2% GDP growth figure before you, as an investor, can make a decent profit? Hell no. Anything positive, anything that gives investors the outlook that “things will get normal again” will make Russian stocks go nuts (hence the 10% bounce in 4 days time that occurred last week). However, while most investors recognize these opportunities and see the possible value in these areas of the market right now, they often see things too pessimistic and are too uncertain. “I don’t know anything about Russian or Greek stocks. I know nothing about oil companies or their suppliers, I don’t know which ones are the good ones.” Well you don’t have to know which ones the good ones are. That’s what ETFs are for. John’s strategy during the financial crisis of 2009. Remember John from my previous article? Well, he’s back in town. John is still buying the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) each month, and just like he was in my previous article, he still is a pretty smart guy that loves to seize opportunities whenever they come along. Last time, he decided to double his investment efforts during the financial crisis. Instead of buying $500/month during 2009, he decided to buy $1000/month. This time, he’s about to do something even more smart. John figures that the industry that is being hurt most, will also have most upward potential. But instead of picking individual stocks and making risky/uncertain decisions that will make him sleep bad at night, he decides that now is the time to buy a financially related ETF. The iShares Global Financial ETF (NYSEARCA: IXG ) seems to be perfect, as it covers 240 banks. This way, he tries to profit – like a real contrarian – from an industry that is in serious trouble while not exposing himself to too much risk. John puts his monthly investments in the SPY on halt and puts his $500 in the IXG instead. However, like we mentioned, John is a very, very smart guy and he knows that a crash can go on for a long time, and thus that chances are real that he gets in too early. Therefore he has one rule when it comes to his contrarian plays: He will only get a first position after a 40% drop. On October 7, 2008, John finally gets what he wants. The IXG fell 40%. From $58 to $34, and John decides to make a first purchase. He then adds to this position the first of each of the following 11 months. After eleven months, and after investing his 6k, John possesses: 202 shares at an average price of $29.64. Which is far below his original entrance point. Thank god he didn’t went all in at once and stayed with the $500/month rule. (click to enlarge) With this strategy, John scored a ~40% return while not having to time the market, not having to take individual risky picks and while keeping it simple. If he had invested in the S&P 500 through the SPY this whole time, then he had gained 19%. So he doubled his return by making a simple shift in where he puts his assets. Of course, this is just one example where dollar cost averaging on an ETF of a sector in trouble turned out very nicely compared to the regular SPY and this is not a representation of any future scenario. So in order to make this theory a little more valid, let’s take a look at a second example. Same strategy, different scenario During the European Debt Crisis in 2012; everyone thought that Greece would be leaving the Eurozone and that the country would be doomed. On May 16, its main index (the ATHEX), had lost more than 40% compared to its year high in Feb., and was now quoting at 209 points. John didn’t belief that Greece would have to leave the Eurozone (damaging only itself and other members of Europe) and thus he decided to expose himself to the country as a whole. He again stops purchasing the SPY – and decides to buy the Global X FTSE Greece 20 ETF (NYSEARCA: GREK ) with his $500/month. After 11 months of dollar cost averaging, John held 625 shares of GREK at an average price of $14.12 while the index was now above $17. John was able to gain a nice 22% in a relatively safe way, while knowing nothing about Greek stocks. At a certain point, he was sitting on a 40% profit. More interesting though, is that John would have only gained 11% if he had continued to buy the SPY during the same period. So yet again John doubled his return. Conclusion Although periodically investing in the SPY should give one decent returns over time, it seems very likely that whenever a sector/industry/country appears to be in trouble, it might be a wise thing to shift your deposits from the SPY into an ETF related to this industry for the course of a year – after they’ve dropped ~40%. This could lead to market-beating results without much effort and without too much risk. Today, I’m seeing 3 great contrarian plays that fit John’s new strategy: Greece Greece is yet again being confronted with a “Grexit” and the ATHEX dropped more than -44% since January 2014. John would be getting his first position now, and this could lead to above average returns within a year from now. As Aristofanis explains here , a Grexit is very unlikely, just like last time. Russia The Russian index has fallen -48% since January 2014 and is also offering a high risk/reward. A first position of $500 now, could lead to market-beating results within a year from now, if you continue to dollar-cost average on the Market Vectors Russia ETF (NYSEARCA: RSX ) the following months. The fact that you’ll be dollar cost averaging + that you’re buying not a few specific Russian companies, is definitely lowering your overall risk. The Russian – Ukraine conflict can’t go on forever and the sanctions that Europe imposed on Russia could be relieved sooner than expected. Russia is in real trouble, now that the rouble and oil prices dropped so much: It’ll simply have no other choice than to retreat and to improve the situation with the Ukraine in order to save its economy. Oil Oil prices have taken a steep dive and thus it might be more than interesting to consider a position in the SPDR Oil & Gas Exploration & Production ETF (NYSEARCA: XOP ), as it is down more than -45% since its all-time-high of mid last year and holds ~83 holdings. However, further downside is definitely possible as oil hasn’t found its bottom yet. By Q3 of 2015 or early 2016 however, I belief that oil prices will start a sharp recovery. The commonly held belief is that Saudi Arabia is keeping prices so low by not lowering its production to put a stop to the rapid growth of production from the U.S. shale oil plays. Others believe it is their goal to crush the Russian and Iranian economies. If the oil price remains at the current level for a few months longer it will do all of the above and then it has succeeded. Also don’t forget that the low oil price will lead to an increased demand from all major economies who are thrilled to get themselves some cheap oil, if they all do this at the same time, there’s a possible shortage imbound which could lead to much higher prices in a short period of time. Mark Mobius, an economist and regular guest on Bloomberg TV recently said he sees Brent rebounding to $90/bbl by the end of 2015 and I agree with this vision. Although $70/bbl would also be good enough in order to make a profit of this ETF. Main source used for my oil prospects: Here . Read the full article, it is really interesting. Additional disclosure: All figures are coming from Yahoo Finance: I used ADJUSTED figures for dividends and splits for simplicity purposes. Returns are supposed to be accurate though.