State Of Disunion: Safer Haven Investments Diverge From Stocks

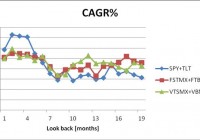

The appetite for risk has been changing before our eyes. Large-cap U.S. stocks in the S&P 500 still rocketed mightily. Safer haven assets were every bit as desirable as the Dow and the S&P 500 in 2014. Is that uncommon for a late-stage bull market? Not particularly. On the other hand, the landscape may be changing. The S&P 500 soared 29.6% and 11.4% in 2013 and 2014 respectively, pushing the broad market benchmark to unimaginable heights. Net inflows into U.S. stock funds, including ETFs, also set records. Unfortunately, that is not always a positive sign for the asset class. The increased participation by the world’s investors in U.S. stocks may not be inordinately alarming. What might be far more ominous? The remarkable performance of safer haven assets over “stuck-in-place” stock assets since the Federal Reserve ended its third round of quantitative easing (QE3) on October 31. Specifically, the 30-year treasury yield has plummeted from roughly 3.0% to 2.4%, sending a proxy like the PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF (NYSEARCA: ZROZ ) up more than 20%. Similarly, the iShares 20+ Year Treasury Bond ETF (NYSEARCA: TLT ) has pocketed nearly 14%, while the SPDR Gold Trust ETF (NYSEARCA: GLD ) has rallied about 10%. The appetite for risk has been changing before our eyes. Remember the success of riskier equities in 2013, as investors ran from treasury bonds and gold? Indeed, 2013 was only one of two negative years for total bond returns across two decades. Equally staggering, gold appeared to many as if it might collapse altogether. The nature of risk shifted in 2014. Large-cap U.S. stocks in the S&P 500 still rocketed mightily. Yet the clear preference of stocks over safer holdings evaporated; treasuries rallied throughout the year, in spite of the near-unanimous sentiment that interest rates would fall. (Note: I am not opposed to tooting my own horn on this one – I recommended pairing large-cap stock ETFs with long duration treasury ETFs like the Vanguard Extended Duration Treasury ETF (NYSEARCA: EDV ) and ZROZ 13 months earlier.) Safer haven assets were every bit as desirable as the Dow and the S&P 500 in 2014. Some of them like TLT and ZROZ were more desirable. At least for a calendar round-trip, the ownership of historically divergent asset classes produced harmony and indivisibility. Is that uncommon for a late-stage bull market? Not particularly. On the other hand, the landscape may be changing. The perceived need for safety has risen appreciably since the Federal Reserve ended its electronic money printing in October. For example, in 2015, each of the 10 components of the FTSE Custom Multi-Asset Stock Hedge Index has gained ground, whereas the S&P 500 has drifted lower. Those component assets include long-maturity treasuries, zero-coupon bonds, munis, inflation-protected securities, German bunds, Japanese government bonds, gold, the Swiss franc, the yen and the dollar. Granted, the European Central Bank (ECB) intention to create $50 billion euros monthly for a year could reward risk-taking in the same manner that the Federal Reserve’s $85 billion per month had. On the flip side, the $600 billion euro figure that is floating on newswires may come off as underwhelming, as the Fed’s QE3 had been open-ended upon its announcement. Moreover, the “stimulus” amount ran beyond the trillion-and-a-half level. Keep in mind, you do not need to run from stock risk if you have a plan to minimize the severe capital depreciation associated with bear markets. My approach in latter stage bull markets involves pairing lower volatility stock ETFs like the iShares MSCI USA Minimum Volatility ETF (NYSEARCA: USMV ) and the iShares S&P 100 ETF (NYSEARCA: OEF ) with safer haven ETFs like the Vanguard Long-Term Bond ETF (NYSEARCA: BLV ) and EDV. If popular stock benchmarks breach 200-day trendlines, I reduce equity exposure and/or employ multi-asset stock hedging by investing in those assets with a history of performing well in moderate-to-severe stock downturns. Click here for Gary’s latest podcast. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.