Tag Archives: security

A New Exercise In Industry Rotation

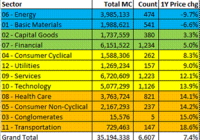

At Abnormal Returns, over the weekend , Tadas Viskanta featured a free article from Credit Suisse called the Credit Suisse Global Investment Returns Yearbook 2015 . It featured articles on whether the returns on industries as a whole mean-revert or have momentum, whether there is a valuation effect on industry returns, “social responsibility” in investing, and the existence of equity discount rate for the market as a whole. There are no surprises in the articles – it is all “dog bites man.” They find that: Industry returns exhibit momentum. There is a valuation component in industry returns. Socially responsible investing doesn’t necessarily produce or miss excess returns. There is an overall equity discount rate, which is levered about 20-25 times, i.e., a 1% increase in the rate lowers valuations by 20-25%. The first two are well known for individual stocks, so it isn’t surprising that it happens at the industry level. The third one has been written about ad nauseam, with many conflicting opinions, so that there is little effect is no big surprise. The last one resembles research I saw in the mid-90s, where the effect of changes in real interest rates has about that impact on stocks. Again, nothing new – which is as it should be. But now some more on industry returns. They found that industry return momentum was significant. Industries that did well one year were likely to do well in the next year. The second finding was that industries with cheap valuations also tended to do well, but it was a smaller effect. So, using one-year price returns as my momentum variable and book-to-market as a valuation variable (both suggested in the article), I divided industries for companies trading in the US into quintiles (also suggested in the article) for momentum and valuation. (Each quintile has roughly 20% of the total market cap.) Here is the result: (click to enlarge) Low valuations are at the right, high at the left. Low momentum at the top, high momentum at the bottom. Ideally, by this method, you would look for industries in the southeast corner. To me, Agriculture, Information Technology, Security, Waste, Some Retail, and Some Transportation look interesting. One in the far southeast that is not so interesting for me is P&C Insurance. Yes, it has done well, and compared to other industries, it is cheap. But industry surplus has grown significantly, leading to more competition, and sagging premium rates. Probably not a great time to make new commitments there. Anyway, the above table should print out nicely on two sheets of letter-sized paper. Not that it would be a substitute for your own due diligence, but perhaps it could start a few ideas going. All for now. Disclosure: None.

Get Him To The GREK

The Global X FTSE Greece 20 ETF is a great way to leverage a favorable resolution between Greece and the euro-zone. The GREK is far off its 52-week high of $25.76, largely due to the political developments that have led investors to speculate about Greece leaving the euro-zone. The security is up from its low of $10.44 recently because of an increasing understanding that a favorable resolution is likely. Opportunity exists for near-immediate appreciation on the announcement of a favorable resolution as early as next week. Over the course of this year, the GREK ETF should gain further as it reflects the benefits of ECB actions like Greece’s peer markets have. Investors interested in leveraging the prospect of a favorable Greece resolution, but hoping to limit risk to any one individual Greek security, can look to the Global X FTSE Greece 20 ETF (NYSEARCA: GREK ). The security has come off its highs on fear that Greece could leave the euro-zone. Though it has also come off its lows on the prospect of a favorable resolution, it still has a way to go higher because of the ongoing absence of that event. I think investors can buy it here for immediate upside to $15 on a quick fix and longer-term gain to $17 to $20 this year. 5-Year Chart of GREK at Seeking Alpha As you can see here in the long-term chart of the Global X FTSE Greece 20 ETF, it has recently fallen precipitously. The reason for the decline should be obvious to anyone who has not been on a deserted island for the last couple months, save for a Greek island. When the popular Syriza party was elected into power in Greece, and before that when the polls showed it could be, Greek securities started to sell off. That was because of the tough talk against austerity that emanated from the party and its leaders. Fear rose that Greece could leave the euro-zone or be ejected from it due to the change in political power. But as time has passed, investors have become aware of what I already knew. Tough-talking Greek leaders do not have the backing of the Greek people to leave the euro-zone, as polls show a great majority of Greeks would vote against it in a referendum. That was known even before the elections, and Syriza indicated it was not interested in leaving the euro-zone, ensuring its election. However, Syriza still wanted an alteration to the bailout deals Greece had previously agreed to, due to the great damage austerity has done to many Greeks. The medicine while beneficial for the long-term economy was administered too much too soon and it made a good deal of Greeks sick, if not, unemployed. Over recent weeks, the emergence of a somewhat free-speaking Finance Minister, and Greek Defense Minister’s demands for Nazi war reparations have only stirred up more concern among the global investment community. Greek demands were met with tough talk from the Germans and other EU partners, so it got scary for some investors, who then bid the GREK security down to $10 and change. When the fear was palpable, I went long National Bank of Greece (NYSE: NBG ) at approximately $1 using long-term call options. Thanks for telling us now Greek , is what you are saying, but for your information, I just went long GREK Friday and it’s not too late still. I never had concern about the future of Greece, and was long GREK a few months ago at around $17. If Greece agrees to continued currency relations with its euro-zone partners, however altered the structure of the deal could be, much fear currently priced into the security must go away. Greece said today it will do whatever it can to reach a deal to keep it in the euro-zone; it has until February 28, but there is talk that a deal could be consummated as early as Monday. And it is in Germany’s interest to keep Greece in the euro-zone, because the presence of weak partners limits the upside of the euro, which serves Germany’s exports. 1-Month Chart of GREK GREK currently trades at approximately $13.63, after rising about 5% Friday. It was up Thursday too, and as you can see here, it has come off its low of $10.44. But GREK has upside from here, because before Syriza was elected, the security traded upward of $15, and before it was a concern altogether, it traded even higher with a 52-week high of $25.76. Now some of the security’s decline has been due to the general weakness of the European economy and that of Greece over the last 12 months, but Greek stocks should be benefiting year to date from the actions of the ECB, like its peers are. The iShares Europe ETF (NYSEARCA: IEV ) is up 4.8% year to date while GREK is down 5.5%. The Global X FTSE Portugal 20 ETF (NYSEARCA: PGAL ) is up 2.2%; the iShares MSCI Spain Capped ETF (NYSEARCA: EWP ) is only down 2.8% year to date because of Greece and Spain’s own similar political issues. Thus, given European shares seem to be finding bids here, there appears to be room to grow for GREK beyond just the immediate gain that should occur once it is clear Greece will remain in the euro-zone. I’m not anticipating a quick recovery to the 52-week high, but an immediate move to above $15 on a positive resolution seems likely to me. From there, I see no reason why the security that marks the Greek market cannot approach $16 in short time and $17 to $20 before year-end. So I say, get him to the GREK. I have been following these Greek developments, so interested parties may find value in following my column . Disclosure: The author is long GREK, NBG. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.