Virtus Global Multi-Sector Income Fund: Desperate For Attention?

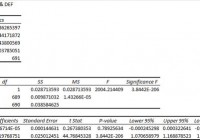

VGI is pretty much a go-anywhere bond fund. It’s focus is income and it uses leverage and options to get there. It’s relatively young, but so far I’m not overly impressed. I recently wrote about some closed-end funds, or CEFs, that invest in bonds. It’s not a topic I write about often because interest rates are near historic lows, which makes me worried about long-term capital risk here. However, a reader asked me to take a look at the Virtus Global Multi-Sector Income Fund (NYSE: VGI ), so I did. So far, I’m not overly impressed by this young fund. Too young to tell? To start off, it’s important to note that VGI is a young fund. It came public in early 2012 , meaning it doesn’t have a whole lot of history go off of. It also means VGI hasn’t really had to face too much adversity in its approximately three year life. So there’s a notable risk here that management fails to navigate the next big downturn well. For truly risk averse investors, that should be enough to lead you to examine a fund with a longer operating history. More aggressive investors, however, read on. VGI is pretty much a go anywhere bond fund. It’s prospectus gives it the leeway to invest in any country and pretty much any type of bond. The only notable mandate is that at least 40% of assets will normally be invested outside the U.S. market, with a maximum of 75%. After that, anything is fair game while the fund seeks to, “…maximize current income while preserving capital…” That said, the fund has a value orientation, looking to find opportunities in the, “…undervalued sectors of the global bond markets.” Good-old, hands-on credit research is the approach taken. Though VGI notes that sector rotation is a key part of its approach, so the makeup of the fund at any given moment likely won’t be indicative of the fund’s long-term approach to investing. The fund also uses leverage to enhance returns (to the tune of around 30% at the start of the year) and in mid-2014 it also initiated an option strategy. So VGI is far from a low risk offering. The question, then, is whether or not this CEF is worth the risk? I’m not convinced it is. How’s it done? Over the trailing three year period through May, VGI’s net asset value, or NAV, total return, which includes the reinvestment of distributions, was roughly 9%. That’s pretty good when compared to the Fidelity Global Bond Fund’s (MUTF: FGBFX ) loss of roughly 0.5% over the same span. And while VGI’s standard deviation, a measure of volatility, was 7 compared to FGBFX’s standard deviation of roughly 4.5, it was able to make money where a more conservative offering didn’t. VGI’s return was also more than double Morningstar’s World Bond benchmark over that span. So, performance wise, the fund has done well, including over shorter periods. That, of course, has come with increased volatility. But there’s a fly in the ointment here, the fund IPOed with an NAV of $19.10 a share. The NAV is more recently in the $18 a share range. So far, anyway, dividends look like they are doing more damage than good. And that fact makes it all the more interesting that the fund increased its distribution by 20% earlier in the year . According to the news release: “The fund is undertaking these actions to enhance shareholder value by both providing a more attractive distribution rate and furthering its efforts to reduce the current discount to which its shares trade relative to their net asset value (“NAV”).” In other words, VGI is looking to entice investors with a high yield. Which helps explain why the yield is nearly 12% of late. The discount, which started the year at around 10.5% narrowed briefly after the distribution news. However, it’s back to 11% again. The average discount over the trailing three years is around 8%, but that’s distorted by the premium at which all CEFs IPO. So based on total return, VGI is doing well. However, it’s effectively self liquidating right now. And it’s doing it purposefully to attract attention. That’s not a good story, in my book. And, worse, VGI also comes with notable costs, with the expense ratio at around 2.1% in each year of its existence. Although debt costs are a part of that, it’s still an expensive fee to pay for a fund that appears to be slowly liquidating. I’d wait At the end of the day, I think Virtus Global Multi-Sector Income Fund still needs to prove itself. For an aggressive investor it might be an interesting way to add flexibility to a more conservative portfolio if you use it in small doses. But for most others, this one is probably not worth the risk at this point in its life. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.