Reaves Utility Income Fund: What To Make Of The Rights Offering

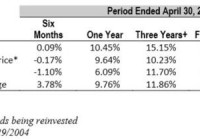

Reaves Utility Income Fund intends to do a rights offering. Forget about the minutia of the actual offering. Think – instead – about the reason for the offering. Reaves Utility Income Fund (NYSEMKT: UTG ) is one of my favorite closed-end funds, or CEFs, for those seeking utility exposure and dividend income. Its dividend history is nothing short of impressive and it has historically been a solid performer on a total return basis. That said, what should you make of the recent announcement of a rights offering? Impressive record One of the most notable aspects of UTG is its monthly distribution. Since the CEF first initiated a distribution in 2004, it has been increased eight times, most recently in December of last year. The distribution has never been cut, despite the fund living through the deep 2007 to 2009 recession. And, perhaps more impressive, the distribution has never included return of capital. Although the 6% or so distribution yield won’t excite those looking for 10% yields, it’s high enough to be meaningful and yet low enough to be sustainable. History has, so far, proven that out. Performance, meanwhile, is solid. The fund’s trailing 10-year return through September is an annualized 9% or so. That’s notably above Vanguard Utility ETF’s (NYSEARCA: VPU ) 6.6% annualized gain. Both numbers assume the reinvestment of distributions. To be fair, UTG’s mandate is broader than VPU’s, allowing it to invest in areas like oil, but the comparison provides at least a reasonable benchmark. That said, the more recent performance has been, well, not as good. UTG was down roughly 10% through September while VPU was down just 6.6% or so. It has been a bad year for utilities as well as some of the other areas in which UTG invests, so this doesn’t look like it’s an issue of management losing its way. Still, it’s not a good thing to see the value of an investment you own fall 10%. So why is UTG raising cash? Which might lead some investors to wonder why UTG recently announced a rights offering . Shareholders can get one right for every UTG share and buy a new share for every three rights they own. On the surface, this could look like a risky proposition since the fund is doing relatively poorly this year. If you are really cynical you might even suggest it’s a way to cover up a shortfall on the dividend front by spitting out the new cash as return of capital distributions. But step back and think bigger picture. Yes, UTG is doing poorly this year performance wise. Which, in turn, means its holdings aren’t doing so well, since UTG is nothing more than a pooled investment vehicle. If management believes this is an opportunity to buy good companies at depressed prices, its only option is to sell other holdings or raise more cash. But it can’t do that easily because it’s a closed-end fund. Thus, it has to go with a rights offering. In fact, the last time UTG did a rights offering was in 2012 . That was a relatively weak year for the fund, with a total return of around 5.8% compared to 2011’s over 14% gain (which was down from 2010’s 27% gain). In the CEF’s 2012 annual report it explained : “In August the Fund raised $144 million from a transferable rights offering. We view the rights transaction as a long‐term positive outcome for the Fund and its investors. The offering proceeds were invested principally in proven, current holdings of utility equities, increasing their portfolio weighting from just over 41% to 53%. The new investments enhanced the Fund’s current and potential future dividend yield. The outlook, after the offering, for Fund returns over the long term, gave us the confidence to announce in September the sixth increase in the monthly dividend rate since the Fund’s inception in 2004.” Essentially, the fund used the cash raised from the rights offering to buy more companies it knew well and believed were undervalued. It isn’t a stretch to think management is looking to do essentially the same thing this time around, too. If you are a Reaves shareholder this is probably a good deal for you. Will it be a good deal in the next six months? Maybe, maybe not. But longer term the CEF appears to be of the opinion that now is a good time to put money to work. And that should work out for you if you plan to stick around for some time.