ProShares Doubles Dividend Growth ETF Lineup

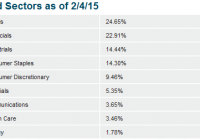

Summary ProShares recently launched two new dividend growth ETFs. A look at the methodology behind the underlying dividend indices. The ETFs include companies with a history of raising dividends. By Todd Shriber & Tom Lydon Looking to build on the success of the ProShares S&P 500 Aristocrats ETF (NYSEArca: NOBL ) , ProShares doubled the size of its dividend growth ETF suite today with the introduction of two new funds. Joining NOBL and the ProShares MSCI EAFE Dividend Growers ETF (NYSEArca: EFAD ) as ProShares dividend growth ETFs are the ProShares Russell 2000 Dividend Growers ETF (NYSEArca: SMDV ) and the ProShares S&P MidCap 400 Dividend Aristocrats ETF (NYSEArca: REGL ) . Like, NOBL, the ProShares S&P MidCap 400 Dividend Aristocrats ETF tracks a dividend aristocrats index. The midcap dividend aristocrats index requires 15 consecutive years of increased dividends for inclusion whereas NOBL’s underlying index requires a minimum dividend increase streak of 25 years. REGL’s index is equal-weighted. The new ETF allocates a combined 47.6% of its weight to the utilities and financial services sectors with industrials and consumer staples combining for another 28.7%, according to ProShares data . The ProShares Russell 2000 Dividend Growers ETF, a dividend spin on the Russell 2000, the benchmark U.S. small-cap index, tracks the Russell 2000 Dividend Growth Index. That index includes small-cap firms with dividend increase streaks of at least a decade. Index constituents are screened for liquidity and dividend status, then selected and equal weighted subject to a maximum sector weight of 30%, according to Russell Investments. SMDV allocates almost 30.2% of its weight to financial services stocks, an overweight of more than 600 basis points to that sector relative to the Russell 2000. The new ETF also features a combined 34.3% weight to materials and utilities stocks. Those sectors combine for just over 8% of the Russell 2000. “Over the past 28 years, U.S. equities that grew dividends year over year returned 13.9%, while those that paid them without growing them returned 10.1%, according to Ned Davis Research. The findings are based on an analysis of companies underlying the Russell 3000 Index, a measure of the broad U.S. equities market, from February 2, 1987 through December 31, 2014,” said ProShares in a statement. Investors have gravitated to dividend growth ETFs , including NOBL. NOBL is just 16 months old and is already home to over $600 million in assets. The ETF was named ETF Product of the Year at the William F. Sharpe Indexing Achievement Awards. REGL and SMDV, the new ProShares dividend ETFs, each charge 0.4% per year. ProShares Russell 2000 Dividend Growers ETF Sector Weights Table Courtesy: ProShares Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.