Upcoming Political Risks For TransCanada Corp And The Keystone XL Pipeline

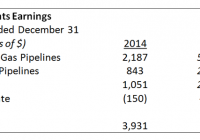

Summary Upcoming Canadian Federal Elections present significant risks for TransCanada Corp. The proposed Keystone XL and Energy East Pipeline projects will face strong headwinds if the NDP wins a minority. Expect increased short term volatility as these events unwind and the possible outcomes become more clear to investors. TransCanada Corporation (NYSE: TRP ) is a Canadian midstream oil and gas company operating in three main business segments: Natural Gas Pipelines, Liquids (crude) Pipelines and Energy. Its pipeline operations extend from Canada to the U.S and Mexico. Revenue breakdown for 2014 between these segments can be seen bellow: (click to enlarge) ( 2014 Annual Report ) TRP currently has two large proposed pipeline projects that have created a lot of public reaction recently and have become hot topic for the media and politicians from both the U.S and Canada. These projects are the Keystone XL and Energy East pipelines. With the Canadian Federal election to be held on October 19th, 2015, it is critical to evaluate each party’s stance on these two proposed projects. Keystone XL Pipeline Overview: The Keystone XL pipeline would transport crude oil for Alberta to Nebraska, expanding the current and operational Keystone Pipeline System. The proposed pipeline would measure 1,897 km long, possess a capacity of 830,000 barrels of oil per day and is estimated to cost $8 billion with $2.4 billion already invested. The pipeline faces a difficult regulatory environment. Since it crosses international borders between Canada and the United States, it is required to obtain a Presidential Permit from the Department of State. The Permit is awarded if the proposed Project serves the national interest, which is a very broad term and requires the consideration of many factors such as energy security, environmental, cultural and economic impacts. Energy East Pipeline Overview: The Energy East Pipeline would transport crude oil from Alberta and Saskatchewan to the eastern Canadian refineries as well as other export markets. In terms of length, this pipeline would span 4,600 km, have a capacity of 1.1 million barrels per day and is estimated to cost $12 billion. The regulatory environment for this project is administered by the NEB (National Energy Board) in Canada, which likely stands to approve the project providing the environmental requirements are met and political support remains. Upcoming Canadian Elections: The outcome of the upcoming Canadian Federal Elections slated for October 19th 2015 will have a significant impact on the likelihood of the Keystone XL and Energy East pipelines being completed. While both Harper’s Conservative party and Trudeau’s Liberals support both projects, the NDP led by Tom Mulcair is currently opposed. While the NDP has yet to win a federal election, this year may be its best chance yet. After a break through election in 2011 in which the NDP replaced the Liberals as the current opposition party. To add to the fact, the Alberta NDP recently won the Albertan provincial election, widely considered a Conservative stronghold and native land of Stephen Harper. The Tory’s have called an early election with the hopes of outspending their opponents. New rules introduced increase the spending limit for longer campaigns. The hope is that this will allow them to outspend the NDP and Liberals on advertising during the critical final weeks leading to the election. While still extremely early in the race, it is worth noting that the NDP currently holds a small but growing lead over the Tories. (click to enlarge) Source: CBC.ca . United States Political Front: As for the U.S political front, Obama has strongly opposed the Keystone XL project and it is extremely unlikely this position will change during the remainder of his term in office. TRP’s hopes lie with the next administration from which they can expect a better odds that they will receive support. Hillary Clinton recently refused to provide a direct answer to whether or not she supports the Project, stating that her current position and the potential for he involvement in a possible lawsuit prevents it. While she is unable to provide any comments at this time, her refusal to offer outright support for Obama on this issue signals that she may be more supportive of the project. As for the Republicans, Jeb Bush tweeted his support : “Keystone is a no-brainer. Moves us toward energy independence & creates jobs. President Obama must stop playing politics & sign the bill.” The economic benefits of the project throughout the U.S would make it difficult for any Republican candidate to oppose it. Conclusion: The impact of an NDP victory in the upcoming Canadian Federal Election presents a significant risk for TransCanada Corp. Two of TRP’s flagship pipeline projects, Keystone XL and Energy East, currently supported by the Tories, are strongly opposed by the NDP. While TRP appears to be a sound value play in the midstream O&G market, offering a juicy 4.31% yield and stable operating cash flows, the upcoming political risks should not be underestimated. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.